On March 24 local time, the US White House announced that US President Trump had signed an executive order to impose "tariff sanctions" on countries importing oil from Venezuela. Starting from April 2, the United States might impose a 25% tariff on all goods imported from any country that directly or indirectly imports oil from Venezuela.

Notably, the United States remains a significant importer of Venezuelan oil. In 2024, the U.S. imported $5.6 billion worth of oil and gas from Venezuela, with companies like Chevron still holding extraction licenses in the country. This "double standard" highlights the contradictions in U.S. policy—relying on Venezuelan energy while attempting to suppress its international viability through tariff measures.

Venezuela was once China's second-largest crude oil import source in Latin America. According to the data from Zhuanshu Vision, in 2017, China's import of crude oil from Venezuela accounted for 5.19% of the total import volume, ranking it the eighth largest import source country that year; in 2018, it was 3.6%, and in the first half of 2019, it was 4.08%, both ranking it as the ninth largest import source country. However, due to Trump's "maximum pressure" sanctions against Venezuela during his previous term, China once suspended the import of crude oil from Venezuela. The specific data on crude oil imports from Venezuela after 2020 has not been clearly disclosed, but in 2024, the total export volume of crude oil from Latin America (including Venezuela) to China was 53.64 million tons, of which Brazil accounted for 68% (approximately 36.84 million tons), and Venezuela's proportion was significantly reduced due to the impact of sanctions. If estimated by the remaining share in Latin America, Venezuela's export volume to China may be less than 10 million tons.

Venezuela is also the country with the largest oil reserves in the world and one of the five founding members of the Organization of the Petroleum Exporting Countries (OPEC). However, affected by sanctions and other factors, Venezuela's oil production is not high. OPEC data shows that the country's production last year was 875,000 barrels per day, accounting for only 0.9% of global production.

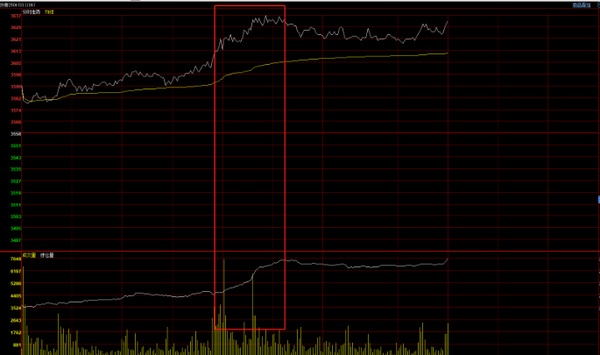

Due to the fact that Venezuelan crude oil (Merey crude) is mainly heavy oil, it is primarily used for refining specific finished products such as asphalt and lubricants. Some Chinese refineries, such as independent refineries in Shandong Province, rely on this type of crude oil. Trump's "secondary sanctions" policy may lead to a decrease in capacity utilization or regional supply tightness in the short term. As a result, the price of domestic asphalt increased by nearly 1% after the news was released, with an increase in open interest (as shown in the figure below).

In recent years, as the United States has increasingly pursued a policy of "decoupling and severing supply chains" with China, China has been diversifying its energy supply channels. In 2024, imports of crude oil from Russia and the Middle East accounted for 72%, with plans to increase Russian oil imports via the China-Russia oil pipeline (ESPO) to 80 million tons per year. Additionally, long-term agreements with Oman, the UAE, and other countries could cover an additional 50 million tons per year.

Furthermore, companies like Sinopec have increased their research and development efforts in heavy oil catalytic cracking technology, with the goal of reducing crude oil processing loss rate from 2.5% to 1.8%, thereby improving the utilization rate of low-quality crude oil.

In the long term, the RMB settlement mechanism has gained further opportunities for deepening in the energy sector. By settling in RMB, it reduces reliance on SWIFT and enhances resilience against sanction risks.

On the other hand, Venezuela may accelerate its accession to the BRICS to seek multilateral support. Cooperation between China and Russia in Venezuela's energy extraction and infrastructure fields will also be strengthened, forming a "sanctions buffer zone." In summary, through strategies such as diversified imports, deepening RMB settlement, and strengthening geopolitical cooperation, China is gradually reducing its dependence on a single energy channel and enhancing its initiative in global energy competition.

Author: Gao Xing, Senior Market Analysis Expert at ZhuanSu World