[this week's plastic market] continues to be bearish! most show narrow fluctuations, abs drops up to 230

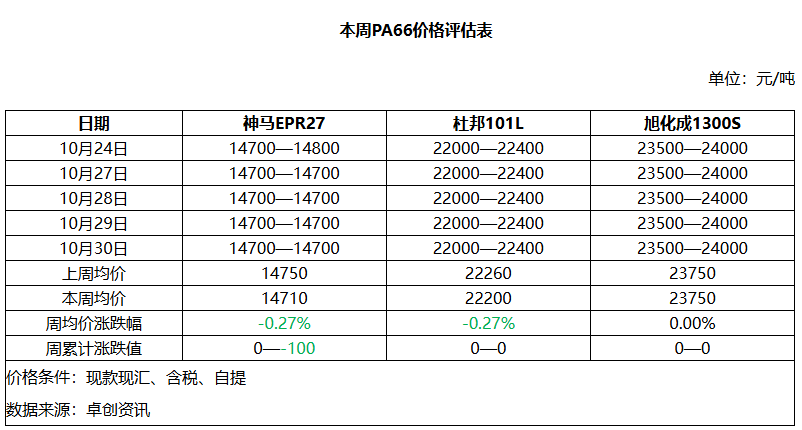

Summary: Weekly Market Review and Forecast for General Materials and Engineering Plastics from October 24-30! General materials fluctuated narrowly, with PP increasing then stabilizing this week, individual East China raffia grades up by 37; PE and EVA prices showed slight fluctuations; the PS industry focused on destocking, with some prices fluctuating by 100; ABS mostly declined with some grades up by 50-70 and most down by 50-230. Engineering plastics remained stable with minor movements, PC fluctuated narrowly by 50, PET slightly rose by 77; POM and PBT underwent narrow adjustments; some PA grades declined by 55-150; PA66 ran weakly, with individual grades down by 50.

General material

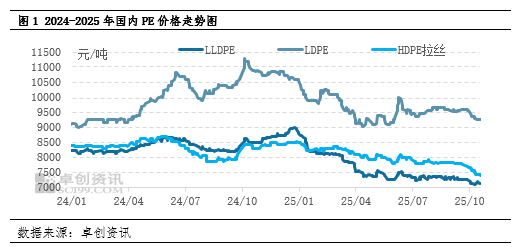

PE: Demand has slightly declined, and the volume of transactions is limited.

1Market Review: Prices Fluctuate Narrowly

This week, domestic PE market prices fluctuated slightly.Crude oil prices upstream fluctuated narrowly, and the China-U.S. trade teams held negotiations in Malaysia, reaching a "preliminary consensus," which somewhat bolstered overall market sentiment. During the week, Zhongyuan Petrochemical had a long-term shutdown, and facilities such as Sinochem Quanzhou and ExxonMobil Huizhou underwent planned minor maintenance, leading to an increase in maintenance-related losses compared to the previous period, slightly easing the pressure on domestic supply. On the demand side, the demand for greenhouse films and mulch films weakened, with other downstream sectors showing little to highlight. Factories' enthusiasm for purchasing raw materials appeared somewhat tepid, and overall transaction volumes were limited. Currently, the mainstream price for linear products ranges from 6,910 to 7,500 yuan/ton, with some minor increases, fluctuating between 10 to 80 yuan/ton. The mainstream price for high-pressure products is between 8,950 and 9,600 yuan/ton, with individual fluctuations ranging from 50 to 100 yuan/ton. Most low-pressure product prices remain stable, with individual fluctuations ranging from 20 to 100 yuan/ton.

2Future Market Outlook: Spot market prices remain stable.

Next week, domestic PE market prices are expected to remain stable, with mainstream LLDPE prices ranging from 6910 to 7500 yuan/ton.Next week, oil prices are expected to fluctuate within a narrow range, with the main impact on spot market prices being psychological. In terms of domestic supply, the planned maintenance loss for PE next week is expected to be 75,500 tons, a decrease of 44,300 tons compared to the previous week, with LLDPE maintenance losses at 30,400 tons, down by 19,300 tons. The reduction in domestic petrochemical maintenance units, combined with the commissioning of Guangxi Petrochemical and the release of production capacity, will lead to a continuous increase in domestic supply. On the demand side, the peak season for agricultural film production is ending next week, and some downstream factories may restock at lower prices in the early part of the month. However, overall, the operating rates of downstream industries are unlikely to improve significantly, and demand remains relatively weak. Factories show average enthusiasm for raw material procurement, providing limited support for LLDPE demand. In summary, supply pressure is increasing as demand gradually enters the off-season, but macroeconomic expectations are positive. It is expected that LLDPE prices will remain stable next week.

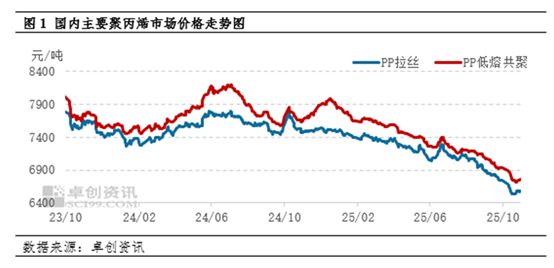

PP: The market consolidated after gains this week and is expected to adjust downward next week.

1The market review: This week, the domestic PP market rose and then consolidated, with the price focus slightly moving upward.

This week, the domestic PP market prices increased and then stabilized, with a slight upward shift in the price center.As of this Thursday, the average weekly price of East China raffia was 6,583 yuan/ton, an increase of 37 yuan/ton compared to the previous week, with a growth rate of 0.57%. The regional price spread for raffia slightly widened. In terms of product types, the price difference between raffia and low melting copolymer continued to narrow. During the week, the supply pressure of raffia in the spot market was limited, and with stable downstream demand, the price increase for raffia was greater than that of low melting copolymer.

2. Market Outlook: Positive Macro Environment & Weak Supply and Demand; Spot Market Mainly Adjusts Weakly

The PP market is expected to adjust weakly next week.Taking East China as an example, the expected price range for raffia next week is 6,500-6,650 RMB/ton, with an average price expected at 6,560 RMB/ton. The price range for low-melt copolymer is expected to be 6,650-6,850 RMB/ton, with an average price expected at 6,740 RMB/ton. On the cost side, crude oil is expected to fluctuate narrowly, providing little guidance for PP. On the supply side, new production capacity will impact next week, combined with reduced maintenance efforts, increasing supply pressure. On the demand side, although downstream operations remain stable and demand volume persists, limited downstream profitability leads to cautious purchasing, making it difficult for demand to continue releasing, which still suppresses the market. Overall, next week, the cost side offers little guidance, but supply and demand fundamentals remain weak, suggesting the market will primarily undergo weak adjustments. However, attention should be paid to the macro aspect, as the progress in US-China talks may have a phase-specific impact on the market.

PS: Industry De-stocking, Market Remains Stable with Minor Fluctuations

1. Weekly Market Review

Figure 1 PS for 2023-2025DailyEast China Market Price Trend Chart (Unit: Yuan/Ton)

![[PS周评]:成本支撑有所好转 市场先跌后涨(20251017-1023)](https://oss.plastmatch.com/zx/image/5b25dde8103945c68df4a0cd30fc5611.png)

During this cycle, the domestic PS market remained largely stable with minor fluctuations, with local changes within 100 yuan/ton, primarily supported by industry de-stocking. On the cost side, styrene experienced fluctuating declines, resulting in a lower cost focus. On the supply and demand side, industry production cuts and increases coexisted. The new plant in Guangxi Petrochemical was put into operation, leading to no significant change in the supply side. Recently, transactions have improved in stages, and the speed of downstream deliveries has accelerated, driving inventories to continue to decline. According to Longzhong Information data, on October 30, 2025, the East China market's general-purpose polystyrene (GPPS) remained stable at 6,950 yuan/ton, and high-impact polystyrene (HIPS) remained stable at 8,000 yuan/ton.

2. Market Forecast for Next Week

The PS market is expected to be narrowly weaker in the next period. On the cost side, OPEC's production increase is putting pressure on oil prices, the supply and demand forecast for pure benzene is not optimistic, and styrene is likely to show a weak performance mainly due to high inventory pressure. On the supply and demand side, the industry's supply is expected to recover, and with the release of new capacity, the supply-demand structure may become more relaxed, weakening the support for prices.

EVA: EVA prices initially rise then stabilize, confidence slightly recovers.

1. Market Review of the Week: EVA Market Prices Narrowly Adjusted

This week, EVA prices initially rose and then remained steady, with a flat trading atmosphere.Reference prices: Rigid foam materials at 9750-10600 RMB/ton, soft foam/cable materials at 9600-10300 RMB/ton, hot melt adhesives at 11000-11600 RMB/ton, and photovoltaic materials at 9700-10200 RMB/ton.

2. Market Outlook for Next Week:Short-term negative factors may have been fully reflected; pay attention to further guidance from news.

Overall, market confidence in EVA is relatively weak, and industry players have a pessimistic outlook for the future. However, the pressure on spot supply is not significant. On the demand side, there is an expectation of weakening. Accompanied by the recent rapid decline in EVA prices, downstream buyers' sentiment of "buying on rising prices and not on falling prices" has led to reduced buying intentions and continuous inventory depletion, with inventory gradually reaching low levels. On the supply side, as low-priced soft material sources are gradually cleared out, the market's negative factors have been temporarily exhausted. Next week, the EVA market is expected to undergo weak consolidation, with the decline continuing to moderate compared to earlier periods. It is preliminarily estimated that the price of foamed hard materials will be around 9,700-10,200 yuan/ton.

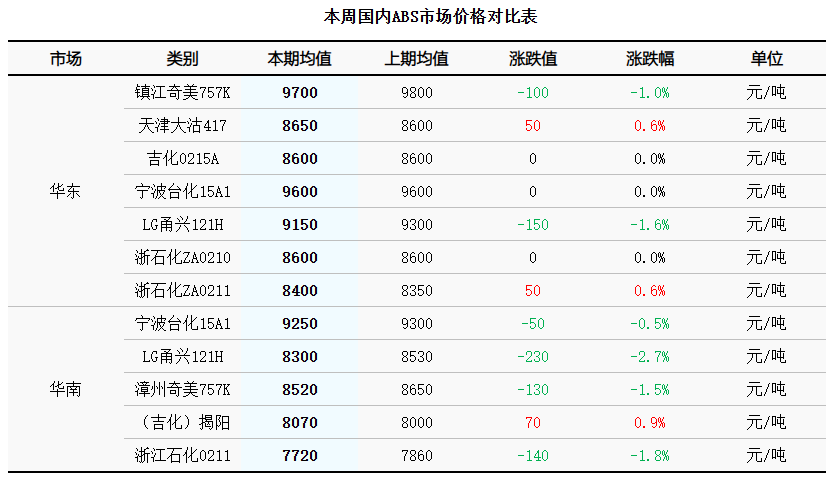

ABS: Prices Bottom Out Stimulating Purchasing Enthusiasm, This Week's Market Transactions Surge

1. This week's ABS market trend:

During this period (October 23, 2025 - October 30, 2025), ABS prices mostly fell with few increases. This week, ABS market prices hit bottom, sparking buying interest among market buyers, leading to increased purchasing enthusiasm among users. Prices for certain specific models rebounded slightly; however, prices of joint-venture products experienced fluctuations and declines due to the significant price difference with domestic materials. This week, market prices showed both rises and falls. From the raw material perspective, acrylonitrile hit bottom and rebounded, butadiene saw an increased decline, and styrene increased before adjusting and consolidating. Overall, costs continued to decrease. In terms of market prices, the range for domestic materials was 8,400-8,600 yuan/ton, while the range for joint-venture materials was 9,150-9,700 yuan/ton.

2. Market Outlook:The ABS market is expected to remain in oversupply in the next period, with overall transactions driven by just-in-time demand. Key points to focus on: 1. Supply side: The industry's overall supply is expected to remain high next week. 2. Demand side: ABS procurement demand remains weak. 3. Cost side: The trends of the three major raw materials are showing slight fluctuations, providing only moderate support to ABS costs. Sentiment: The high supply level is leading to a predominantly pessimistic sentiment among market participants, with a long-term bearish outlook for ABS expected to continue.

Engineering materials

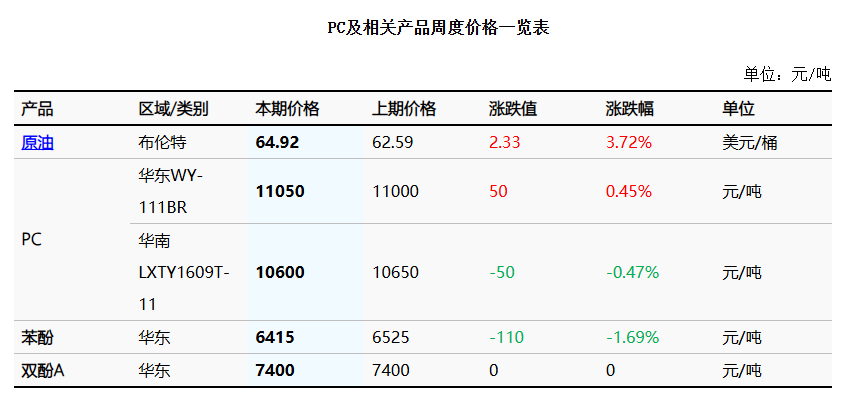

PC: This week, the domestic PC market fluctuates within a narrow range.

1. This week PC city Market analysis

During this period (October 24, 2025 - October 30, 2025), the PC market experienced a narrow range consolidation. As of the close on October 30, the price negotiation reference for domestic PC materials in the East China market was 10,400-11,550 yuan/ton, remaining roughly stable compared to the previous period, with individual prices rising by 50 yuan/ton, an increase of 0.45%. Against the backdrop of continued tight domestic PC supply, domestic PC factory spot quotations remained stable this week, but most involved pre-sale operations. On Tuesday, Zhejiang Petrochemical's PC auction opened low for four rounds, with transactions at 200 yuan/ton lower than last week. In the spot market, both the East and South China markets remained steady, with PC manufacturers maintaining stable pricing operations and overall low circulation of spot goods, prompting market participants to mostly observe and follow the stable market. However, terminal consumption remains sluggish, with no improvement in new PC downstream orders, leading to a slow procurement pace and mainly small transactions. Upstream raw materials showed a downward trend during the week, and PC-related materials also operated weakly, resulting in a cautious market outlook and the possibility of concessions in actual negotiations. 。

2. Market Forecast for Next Week

Next week marks the beginning of November, and the main PC factory in Shandong undergoing maintenance has not yet resumed operations. Domestic supply remains relatively limited for the time being, but given the sluggish spot trading and the overall upstream raw material context, the domestic PC market is expected to maintain a stalemate and consolidation trend. Key points to focus on include: 1. Supply side: The PC plant under maintenance in Shandong might restart in the first half of the month. Although it will not have a substantial impact on the market next week, the expectation of supply recovery is imminent, causing a cautious and slightly pressured market sentiment. The actual maintenance progress of PC production lines in Hubei, Ganning, and Zhejiang Petrochemical still needs to be monitored. 2. Demand side: At the end of the month, substantial progress has been made in China-US trade negotiations, and the additional tariffs imposed by the US on China will continue to be suspended for a year, boosting future demand expectations to some extent. However, it is unlikely to have an immediate effect on consumption; recent attention should still be given to the actual procurement demand for PC from downstream. 3. Cost side: Next week, bisphenol A is unlikely to escape its weak trend, and the price spread with PC remains large, resulting in weak cost pressure for PC. The possibility of proactive supply reduction in the industry in the short term is minimal.

PET: Industry News Boosts, Polyester Bottle Chip Market Edges Up

This week Market Focus:

Production: Capacity utilization rate is 73.37%.

Raw material: PTA industry opens78.38% of work.

2. Market Analysis

|

Figure Price Trend Chart of Polyester Bottle Chips in 2025 (CNY/ton) |

|

|

|

Data Source: Longzhong Information |

During the period from October 24, 2025, to October 30, 2025, the price of polyester bottle-grade chips increased. On Thursday, October 30, the average weekly spot price of polyester bottle-grade chips in the East China market was 5,732 yuan/ton, up by 77 yuan/ton from the previous week, with an increase of 1.36%. Specifically, the polyester bottle-grade chip market in East China showed a strong upward trend this period, with price fluctuations ranging from 5,600 to 5,800 yuan/ton. The anti-involution news boosted market sentiment, leading to a significant rise in polyester bottle-grade chip prices. Coupled with uncertainties in China-US economic and trade negotiations, downstream and traders were cautious in chasing the price increase, with a strong wait-and-see attitude. New installations are about to be launched, increasing supply pressure. Additionally, downstream pickup slowed, putting pressure on the polyester bottle-grade chip market, with the price increase not matching the raw material side, and the industry's processing fees rapidly compressed.

3. Future Forecast:

Crude oil has room for downward movement, and there are no signs of improvement in supply and demand. It is expected that the polyester bottle chip price in the East China market will fluctuate weakly next week.

POM: Cost Support Enhanced, Market Transacts as Needed

1. Market Analysis of the Week

|

2024-2025 Domestic POM Mainstream Market Price Trend Chart (Yuan/Ton) |

|

|

Data source: Longzhong Information

Domestic POM Market Price Weekly Fluctuation Table

Unit: yuan/ton

|

Market |

This week |

Last week |

Rise and fall |

|

East China Region |

10600 |

10600 |

0 |

|

Southern China |

9600 |

9600 |

0 |

Data Source: Longzhong Information

The POM market showed limited fluctuations this period. This week, the fundamentals have strengthened, with the temporary shutdown of the Hebi Longyu POM plant and low inventory levels at some manufacturers. The ex-factory prices of domestic materials collectively increased by 300 yuan/ton, providing some support to the supply side. Traders are more inclined to hold prices firm. However, given that end-user factories have not yet absorbed low-priced offers, short-term purchasing intentions remain relatively subdued. Some traders still face pressure to sell, so operations are mainly in line with market trends, and negotiation space is relatively flexible.

2. Next Week's Market Forecast

The next POM price is expected to rise slightly. Key points to focus on: 1. Supply side. The POM plant in Hebi Longyu is undergoing maintenance, while the POM plant in Kaifeng Longyu has resumed full production. The total supply is expected to tighten. Due to the price increase in domestic materials, manufacturers' inventories are expected to decrease. 2. Demand side. The operating load of end-user factories will remain low, and inventory digestion is relatively slow. Given the sufficient stock of low-priced raw materials, users are mostly adopting a cautious wait-and-see attitude, making future purchasing activity unlikely. 3. Cost side. Methanol prices upstream are providing support. The increase in POM prices will promote a continued rise in profit margins. 4. Macroeconomic side. Low-priced imported materials are moving slowly in the market, putting pressure on operators. Stimulated by macroeconomic benefits, POM exports will be encouraged.

PBT: Increased support from raw materials boosts market sentiment for PBT.

1. Review of Market Trends This Week

|

Figure 1 Price Chart of PBT in East China Region for 2024-2025 (Yuan/Ton) |

|

|

|

Data Source: Longzhong Information |

In detail, the East China PBT market saw narrow adjustments this period, with mainstream prices for low-viscosity PBT resin in the East China region closing at 7,400-7,700 yuan/ton. On the supply side, there were few changes in PBT facilities, and the supply volume remained stable compared to the previous period. On the raw material side, this week...BDO MarketRange fluctuationPTA MarketThe continuous strengthening. This week, the raw material PTA showed a strong trend under the guidance of crude oil and macro policies, boosting the sentiment in the PBT market. Some manufacturers issued price increase letters, and market offers were strong. However, the impact of the off-season on the demand side was evident, leading to a narrow fluctuation in actual negotiations and a strong sense of wait-and-see sentiment in the market.

2. Market Forecast for Next Week

The PBT market is expected to experience weak fluctuations in the next period, with demand significantly affected by the off-season. The fundamentals lack substantial support, posing a risk of decline in the PBT market focus. Key Focus: 1. Supply Side. There is an expectation of maintenance for the PBT unit at Yizheng Chemical Fiber, resulting in a slight decrease in supply volume. 2. Demand Side. The demand side is significantly affected by the off-season, with downstream and end-user purchasing intentions possibly delayed. 3. PTA The market is consolidating on a strong note; both supply and demand for BDO are shrinking, and negotiations are ongoing. The focus of market trading fluctuates limitedly, providing overall support for PBT market prices. Okay.

PA6: Limited Positive Support, PA6 Market Consolidates and Operates

1、 This Week's Market Analysis

During this cycle, the PA6 chip market price remained stable, with the mainstream price at 8,750 yuan/ton for cash payment with short delivery. Previously, driven by geopolitical factors, crude oil prices continued to rise, significantly boosting market sentiment. Additionally, with chip prices at a low level, traders and downstream companies were incentivized to replenish inventory, improving market transaction atmosphere. As polymerization companies tentatively raised their quotes, downstream purchasing sentiment turned cautious, overall transaction pace slowed, and the market showed a stable but slightly weaker trend.

During this period, the market price of PA6 high-speed spinning chips has declined, with mainstream prices at 9100-9150 yuan/ton delivered on acceptance. The raw material market is in a supply-demand stalemate and is consolidating at a low level. The cost pressure on chips remains, but downstream spinning companies maintain a cautious purchasing attitude, focusing mainly on just-in-time replenishment, leading to limited market transactions.

2. Next week's forecast:

The PA6 market is expected to remain stable in the next cycle, with the mainstream price of conventional spinning chips likely to remain in the range of 8,700-8,800 RMB/ton for cash short delivery. The mainstream price of high-speed spinning premium chips is expected to remain in the range of 9,000-9,200 RMB/ton for acceptance delivery. 。 Key Focus: 1. Supply Side. The supply volume for the next period is expected to decrease, mainly due to Fujian Zhongjin planning partial production line maintenance, leading to an overall reduction in supply for the next period. 2. Demand Side. Downstream activities are primarily focused on periodic low-price stocking for essential needs, with demand likely to be moderate. 3. Cost Side. The caprolactam market is expected to stabilize at a low level in the next period, with a small price difference between chips and raw materials, indicating continued cost pressure. Future attention should be given to the impact of cost, supply, and demand on market sentiment.

PA66: Market Operating Weakly

1. Market Review of the Week:

This week, the average price of the domestic PA66 market has declined. As of the close on October 30, the market price of Shenma EPR27 in the East China region was 14,700 yuan/ton in cash, down 50 yuan/ton compared to the closing price last Thursday. The average price this week was 14,710 yuan/ton, down 0.27% compared to last week's average price. Demand is weak, and the market is operating sluggishly.

2. Market Outlook for Next Week: Weak Demand, Prices May Still Fall

The PA66 market is expected to continue a slight downward trend next week. Downstream demand remains weak, with terminal orders possibly lacking follow-up, while market supply remains ample, resulting in a supply-demand pattern of oversupply. Coupled with the expected decline in raw material prices, cost support is weakening. Overall, the PA66 market prices are anticipated to be under downward pressure next week. The average market price for East China EPR27 is likely to be around 14,650 yuan/ton, with the price range expected to be between 14,600-14,700 yuan/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

-

Kingfa Sci & Tech Q3 Net Profit Attributable to Shareholders Rises 58.0% YoY to 479 Million Yuan

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

China-U.S. Summit in Busan Tomorrow! Syensqo Launches New PAEK Material; Ascend Debuts at Medical Summit

-

MOFCOM Spokesperson Answers Questions from Reporters on China-U.S. Kuala Lumpur Trade Consultations Joint Arrangement

![[PET瓶级周评]:聚酯瓶片市场持续下行(20251024-1030)](https://oss.plastmatch.com/zx/image/2d3687add1d94c5bb9a192bdf035c179.png)

![[POM周评]:成本支撑增强 市场按需成交(20251024-1030)](https://oss.plastmatch.com/zx/image/7f3d47633fda4bec9964ce20cfff7779.png)

![[PBT周评]:市场氛围偏空 PBT市场跌势延续(20251017-1023)](https://oss.plastmatch.com/zx/image/2b904004144d4d76b8124366ba4d232e.png)