【This Month's Plastics Market】The plastics market is in the red in March! PA6 drops nearly 1000 yuan, POM plummets 700 yuan, and PC hits an all-time low in average price.

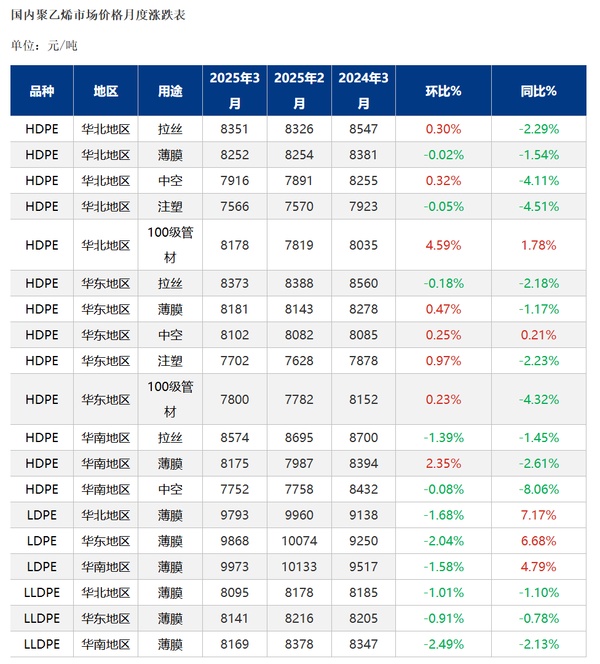

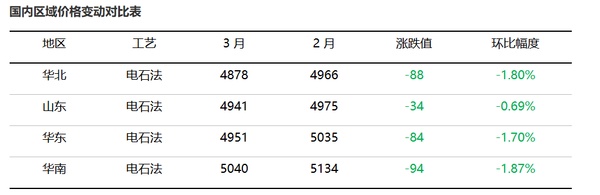

Summary: Price and market trend of plastics in March! Reviewing March, the plastic market collectively fell! General-purpose materials kept falling, with PE monthly change ranging from 2 to 287, and PVC monthly drop of 34-94; Engineering materials mainly fell, with PC monthly drop of 250, average price hitting a new low; PET monthly drop of 193, POM monthly drop of 500-750, PBT monthly drop of 150-300, PA6 monthly drop of 955, PA66 monthly drop of 239, is "Silver April" worth expecting?

General material

PE:

Hot Topics of the Month

1) In March, domestic polyethylene production increased by 7.12% to 2.7503 million tons;

2) China's PE social sample warehouse inventory decreased by 2.69% to 618,700 tons in March.

2. Market Analysis for This Month

In March, the price of polyethylene in China fell. With the production of two new facilities coming online, monthly production increased by 7.12% to reach 2.7503 million tons. Social sample inventory decreased slightly by 2.69% to 618,700 tons. Downstream industry operating rates rose by 14% to 37%, with the agricultural film and packaging film markets primarily focusing on essential orders and short-term agreements. With purchases made at lower prices, the support from demand was limited. In summary, the supply and demand situation was weak in March, leading to a decline in polyethylene prices. By the end of the month, the average price of mainstream LLDPE film in North China was 7,940 yuan per ton, a decrease of 1.08% compared to the previous month.

3.Next month's market forecast

The domestic PE market price in April is expected to fall. In April, Shandong New Era's 700,000-ton capacity is expected to come online, increasing the total domestic production by 0.29% to 2.7582 million tons. Imports are expected to decrease by 7.61% to 1.1467 million tons, easing the pressure on the supply side. However, on the demand side, the agricultural film industry is expected to decline by 9% month-on-month in April, while the packaging film industry is expected to increase by 4.85% month-on-month. Overall, downstream operating demand is somewhat suppressed and performing relatively average. In summary, although the supply side of the polyethylene market has some support in April, upward movement will be affected by resistance from the demand side. The average price for LLDPE in the North China market is expected to be 7,850 yuan/ton in April, 7,820 yuan/ton in May, and 7,800 yuan/ton in June.

PP:

1. This month's hot topics of interest

1. Downstream demand温和复苏as the season enters its peak period. (Note: It seems there might be a missing word in the original Chinese sentence, possibly "聚丙烯需求" should be directly translated as "polypropylene demand". The corrected translation would then be: 1. Polypropylene demand温和复苏as the season enters its peak period.) To better fit the context, the translation could be: 1. Polypropylene demand is experiencing a mild recovery as the market enters the peak season.

The loss data is high, and the increase in the polypropylene supply side is limited.

2. PolypropyleneMarket Review

This month, polypropylene prices showed weak fluctuations, with the price range for wire drawing operating between 7300-7400 yuan/ton, and the fluctuation range narrowed. The monthly average price decreased by 0.78% month-on-month. In March, the third line of Inner Mongolia Baofeng was successfully put into production. Demand benefited from the delivery of raw material export orders and the increase in downstream operations, showing a dual increase in supply and demand fundamentals. However, the growth rate of supply exceeded that of demand, leading to an accumulation of spot market contradictions and a fluctuating decline in prices. Overall, the decline in non-standard products this month was greater than that of standard products, especially the expanded decline in copolymer products. The main reason was that the high premium of copolymer products stimulated the production enthusiasm of upstream enterprises, and the rapid increase in supply outpaced market absorption, leading to an expanded decline in copolymer prices and a narrowing of the price difference between wire drawing and copolymer.

3. Next month's PP market outlook

The supply and demand drivers are in a deadlock, with the maintenance side providing some relief from the pressure of weak demand. However, the threat of overseas tariff hikes looms large, leading to a bearish outlook for the market valuation. From a cost perspective, the high cost of PDH production has temporarily locked in low market prices, limiting the potential for a significant price drop. The market will focus on export variables and national macro-policy stimulus in the future. It is expected that next month's market price will hover around 7280-7450 yuan/ton. Key factors to watch include the impact of overseas tariff hikes, new capacity expansions, inventory depletion across the supply chain, and changes in demand.

PVC:

1. Market Analysis for This Month

In March, the domestic PVC market showed a pattern of more declines than increases, with the price center of gravity shifting downward. Specifically, from early to mid-to-late March, PVC market prices fluctuated and declined. The supply of PVC continued to increase, while demand recovery was slow, constrained by high inventory pressure, sluggish terminal demand recovery, and poor order performance. Under the mismatch between supply and demand, the PVC market exhibited a weak and fluctuating downward trend. In late March, positive signals were released at the macro level, which positively influenced the commodity and stock index markets, boosting the trading atmosphere in the PVC spot market. Merchants actively followed the upward trend, and the price center of gravity in various regions shifted upward. Low-end prices saw decent transactions, but downstream resistance to high prices limited transactions at the high end, making it difficult to pass on the price increases downstream.

Two.Next Month's Market Forecast

In April, the number of PVC companies undergoing regular maintenance has increased, and production is expected to decline, easing the supply-side pressure. On the demand side, domestic downstream procurement of raw materials is based on just-in-time needs, and spring demand is still promising. Exports still have a price advantage in China, and short-term exports remain favorable. However, the biggest bearish factor in the market comes from the difficulty in inventory depletion. Overall, the increase in maintenance in April will provide some support for PVC prices, with demand maintaining a slow growth trend. It is expected that the price focus of PVC in April will oscillate upwards, but the overall supply still exceeds demand, limiting the price increase potential. The mainstream price of SG-5 in East China is expected to be at 5030 yuan/ton.

PS:

Market Review of PS This Month

Figure 1: PS Daily Price Trend in East China Market, 2023-2025

![[PS月评]:节后降价出货 市场高开低走(2025年3月) [PS月评]:节后降价出货 市场高开低走(2025年3月)](https://oss.plastmatch.com/zx/image/6eb46004946748d0a160813987133fac.png)

In March, the Chinese PS (polystyrene) market experienced a downward trend, driven by fluctuating and declining costs as well as market price reductions to destock. On the cost side, the weakening of pure benzene led to a slight downturn in styrene, failing to provide effective cost support. On the supply and demand front, integrated and non-integrated PS plants gradually resumed production, increasing industry supply pressure. However, the end of restocking in Europe and U.S. tariff hikes suppressed export orders for downstream companies. As a result, the PS market saw relatively loose supply-demand dynamics, with inventories accumulating against the trend, which to some extent "forced" the market to lower prices for sales.

2. Outlook for the Future Market

On the cost side, the expectation of a wide balance for pure benzene in April may lead to a higher probability of weak styrene prices. On the supply and demand side, the increase in U.S. tariff policies has posed challenges to downstream export profits, and the expected demand for downstream exports in April may be difficult to reverse. Against the backdrop of industry supply hitting a historical high, merely relying on domestic consumption stimulus policies may not effectively change the trend of supply and demand being loose, and the industry still faces high inventory pressure. It is expected that the PS market will show a weak trend in April.

Engineering materials

PC:

Hot Topics of the Month

This month's domestic PC production has significantly increased compared to last month.

2) The average price level of the domestic PC market this month decreased further compared to last month.

3) The loss in the PC industry increased further this month.

2. Market Trend Analysis This Month

In March, the domestic PC market hit a new low in average prices. By the end of March, the mainstream negotiated price for domestic injection-grade PC in East China was 12,000–12,500 yuan/ton, down about 250 yuan/ton from the end of the previous month, a decline of 1.96%–2.04%, and down 1,700–1,800 yuan/ton year-on-year, a drop of 11.97%–13.04%. On the supply side, domestic PC industry capacity utilization rates rose further this month compared to the previous month. Although Sichuan Tianhua, Dafeng Jiangning, and Luxi Chemical's PC units experienced phased production cuts, Hainan Huasheng's PC unit, which restarted in late February, maintained an overall operating rate above 80% this month. Yanhua Jutan's second PC line commenced operations mid-month, and Zhejiang Petrochemical's PC unit also saw improved operations compared to the previous month. As a result, domestic PC supply increased further in March, with monthly output exceeding 300,000 tons. On the pricing front, with domestic PC supply continuing to rise while downstream demand remained sluggish, the supply-demand gap widened, leading to rising inventory levels and significant pressure on market sentiment. PC prices broke through support levels and declined, with domestic prices falling to around 12,000 yuan/ton—a five-year historical low. Although news of some PC unit maintenance plans for April emerged late in the month, most were short-term and failed to provide effective support, leaving PC prices consolidating at low levels. On the demand side, overall PC downstream demand in March was significantly lower than historical levels, with most industries reporting weak new orders and sluggish rigid procurement of PC. Towards the end of the month, the改性 (modification) industry showed some recovery, but performance varied greatly among different types of factories. After moderate restocking of low-priced PC, buyers returned to a wait-and-see stance.

3.Market forecast for next month

In terms of costs, bisphenol A prices fluctuated within a narrow range in April, with minimal changes in the cost of PC compared to the previous month. On the supply side, four domestic PC units underwent maintenance shutdowns in April, leading to a significant increase in supply losses. However, the high supply levels from earlier periods have resulted in elevated industry inventory levels, and the gradual market release of products from the newly operational Fujian Zhangzhou Qimei PC unit will both act to limit price fluctuations. On the demand side, PC downstream demand in April continued to be influenced by factors such as import tariffs and domestic consumption. While there is an expectation of recovery in rigid demand for PC, its impact on industry inventory reduction is limited. Overall, changes in raw materials and demand in April are unlikely to boost the PC market. The reduction in supply will be the key driver for the market to bottom out and rebound. Additionally, against the backdrop of market overselling, industry participants have a strong desire for price increases. However, considering the high industry inventory levels and the short actual shutdown durations of most units, the upward potential for PC prices within the month is expected to be limited. The spot market price range for domestic PC materials in East China is projected to be between 12,100 and 12,500 yuan per ton.

PET:

1. Hotspot attention this month:

1) The United States plans to impose tariffs on multiple countries, reigniting the risk of trade disputes; the United States formally engages in consultations with Russia regarding the Russia-Ukraine peace talks, easing geopolitical tensions.

2) Polyester bottle flakes: The 500,000 tons/year unit of Yizheng Chemical Fiber has resumed operations, and the maintenance units of Hainan Yisheng (60+50) tons/year are gradually restarting.

2. Market Analysis of Polyester Bottle Chips This Month

![[PET瓶级月评]:聚酯瓶片市场价格下滑(2025年3月) [PET瓶级月评]:聚酯瓶片市场价格下滑(2025年3月)](https://oss.plastmatch.com/zx/image/3e9a0196e22d4f6a99b39593dde5f797.png) =

=

In March, the market price of polyester bottle chips plummeted significantly, with mainstream sources trading in the range of 6,000-6,280 yuan/ton. In early March, concerns over the U.S. imposing tariffs dragging down global demand led to a decline in high oil prices. The collapse of cost support caused a rapid drop in polyester bottle chip prices. Downstream buyers and traders took advantage of the low prices to replenish stocks, leading to increased trading volume. In the middle and late March, oil prices rose, but as end-users were mostly digesting their inventory, the polyester bottle chip market struggled to gain upward momentum and fluctuated within a range. As of March 31, the monthly average price was 6,101 yuan/ton, down 179 yuan/ton month-on-month, a decrease of 2.85%.

3. Market outlook for polyester bottle flakes next month:

Supply forecast: The Yisheng Dahuah 700,000 tons/year unit is expected to restart in early April, and there are expectations for a new unit in East China to be put into operation. There are currently no maintenance plans for any units, and it is expected that the production of polyester bottle flakes may increase to 1.47 million tons in April.

Demand Forecast: From the perspective of the downstream soft drink industry, the planned production for the first quarter has been completed. However, there is pressure on terminal warehouse inventory, coupled with weather impacts, it is expected that the production in April may slightly decrease to 65-85%. The PET sheet industry's production remains relatively low, expected to stay within the range of 45-80%. The oil industry's production is forecasted to be within the range of 38-56%.

Price Forecast: The PET chip market in April may remain weak. From the perspective of raw materials, PX's maintenance season provides strong support for prices, but TA and EG performance is average, lacking sufficient cost support. In terms of supply, previous units have been restarted and there are new units being commissioned, with no new maintenance units appearing, leading to expectations of a significant increase in supply. On the demand side, weather conditions have not changed much, downstream soft drink shipments have slowed compared to earlier periods, and after completing their first-quarter plans, industry operating rates have mostly declined. Under the situation of strong supply and weak demand, it is expected that the PET chip market in April will fluctuate slightly weaker. It is forecasted that the spot price for water bottle material in East China will be between 5,950-6,150 RMB/ton in April.

PMMA:

1. Market focus points this month

66% capacity utilization rate: Domestic facilities have increased their load, with an average monthly capacity utilization rate of 66%.

b) 42,800 tons: PMMA particle production in March was 42,800 tons.

c) 4137 CNY/ton: Theoretical profit value increased, with the average theoretical profit for PMMA particles in March at 41437 CNY/ton, up 18.56% month-on-month.

2. Market analysis for this month

In March, the particle market was relatively weak. The price of domestic particles was 17,021 yuan/ton, a decrease of 0.57% month-on-month. The price of imported particles was 16,968 yuan/ton, a decrease of 0.77% month-on-month. From the cost perspective, the average market price of raw material MMA fell in March, leading to a decrease in costs. The average prices in East China, Shandong, and South China markets were 11,080 yuan/ton, 11,068 yuan/ton, and 11,637 yuan/ton, respectively, with month-on-month changes of -7.13%, -7.25%, and -8.21%. From the supply perspective, factory operations remained stable with an increase in production days, resulting in higher output in March. From the demand perspective, downstream demand was poor, and coupled with the declining costs, the particle market experienced a downturn. Overall, the average price of the P MMA market in March was weak.

Table: PMMA Particle Market in East China This MonthPrice Statistics Table(Unit: yuan/ton)

3. Market Forecast for Next Month

On the raw material front, the average price of MMA is expected to fluctuate narrowly in April, with limited changes in costs, having little impact on the market. In terms of supply and demand, there are no planned maintenance operations at particle factories, and supply is sufficient. Downstream buyers continue to purchase based on刚需 (rigid demand), and amid trading negotiations, there is a possibility of a slight decline in the average price of PMMA particles in April. The short-term market price of PMMA particles in April is expected to range between 16,300-17,000 yuan/ton.

POM:

1. This Month's Hot Topics

1) The cumulative price reduction for domestic material manufacturers at the factory level is 300-800 yuan/ton.

Yankuang Luhua Phase II POM unit shutdown for maintenance.

The market is slow-moving, and the focus of market offers has shifted downward.

2. Market Analysis for This Month

In March, the domestic POM market trend declined. In the first half of the month, POM petrochemical plant inventories gradually accumulated, with the fundamentals lacking support, leading to a continuation of weak market sales. Traders operated with some room for concessions, and given the limited operating rates in downstream sectors, the focus remained on short-term inventory digestion, with actual transactions primarily based on just-in-time demand. In the middle of the month, some manufacturers raised their ex-factory prices, enhancing fundamental support; however, the weak demand continued to exert pressure, allowing traders to operate with relatively flexible margins. Some quotes saw slight increases, while individual businesses offered small concessions to stimulate transactions. Nevertheless, downstream purchasing enthusiasm remained low, with actual transactions leaning towards negotiation. In the latter part of the month, POM petrochemical plant inventories were high, and the fundamentals performed poorly. Domestic manufacturers collectively lowered their ex-factory prices, resulting in a pressured market sentiment. Traders continued to engage in low-price sales, with mainstream quotes slightly retreating. Downstream stockpiling remained cautious and observant, with transactions continuing to focus on negotiation.

3. Next Month's Market Forecast

In the first half of April, due to insufficient follow-up on demand orders, POM petrochemical plants face difficulties in releasing shipment pressure. Some manufacturers may continue to lower their ex-factory prices. Additionally, the trading atmosphere in various regions remains weak, which has dampened market sentiment. Traders are under pressure to sell, and operations will continue with a low-profile approach, causing the market's price focus to shift downward overall. In the second half of the month, the restart of Yankuang Luhua's Phase II POM facility will increase the total supply. However, there is no clear guidance in the market. As low-price offers gradually emerge, traders will likely maintain a cautious and观望 attitude. Mainstream quotations will see no significant fluctuations. Therefore, the market is expected to fall first and then stabilize in April.

PBT:

I. Hotspot Focus of the Month

In March, the domestic PBT industry saw a significant increase in production, with capacity utilization rising by 10.15% compared to the previous month.

2) In March, the average gross profit of the domestic PBT industry was -427 yuan/ton, a decrease of 2.15% compared to the previous month.

3) In March, the PBT market experienced a step-by-step mild decline, with a strong sense of观望 prevailing in the market.

II. Market Overview for This Month

In March, the PBT market showed a stepwise decline, with strong wait-and-see sentiment prevailing. As of the close on March 31, the mainstream negotiations for medium and low viscosity PBT slices in the Jiangsu market of East China were between 7,850-8,200 yuan/ton, down 150-300 yuan/ton compared to the previous month. On the supply side, there were fewer maintenance shutdowns for PBT facilities in March, leading to a noticeable increase in output during the month. On the cost side, the PTA market rebounded after a price drop, and processing fees were somewhat restored; the BDO market saw a narrow decline followed by a stalemate. The overall price trend in the PBT market in March was downward, but the decline was small and presented a stepwise downward movement. The support from the cost side was limited, as new BDO production capacity gradually came online, affecting the market sentiment for both BDO and PBT. Many PBT operators held a pessimistic outlook for the future, resulting in a strong wait-and-see atmosphere in the market. Although it entered the traditional peak season of "golden March and silver April," actual demand showed limited improvement, and overall trading remained focused on just-in-time needs. In the modified field, prices increased significantly, but this was primarily driven by the surge in antimony trioxide prices, which had not yet transmitted upward to the raw material PBT market. There were differing sentiments on the supply side, with some manufacturers offering discounts to stimulate sales, and there were occasional reports of low prices in the market. However, a stalemate remained between supply and demand, leading to an overall tense sentiment with the market weakly fluctuating downwards.

Three.Forecast for PBT in the future

In April, the PBT market price is expected to weaken and decline. On the supply side, PBT facilities are restarting and undergoing shutdowns and maintenance simultaneously, resulting in limited changes in supply volume. In terms of demand, there is not much optimism about the improvement in demand, and trading activities may continue to be driven by basic needs. From the cost perspective, PTA market prices are weak in the near term but strong in the long term, while the BDO market has fallen and stabilized. The PBT facility in Fujian Meizhou Bay (Fujian Haiquan) that was shut down in early April is expected to resume operations, while Kanghui New Materials and Zhejiang Meiyuan PBT facilities are expected to undergo maintenance, leading to a slight increase in production for April compared to the previous month, remaining at an annual high level. This further accumulates pressure on the supply side. Meanwhile, in March, PBT trading volumes revolved around basic needs, with few large orders being reported, increasing manufacturers' inventory pressure. In April, there might be an increase in price reductions to promote transactions. In terms of demand, although the spinning sector is in its peak season for the year, the actual increase in demand is not significant enough to support the PBT market. In the modification sector, the soaring prices of antimony trioxide could affect the PBT resin raw materials in the future, which still requires observation. Overall, the fundamental outlook for the PBT market in April remains bearish, making it easy for prices to fall and difficult for them to rise. Considering all factors, the domestic PBT market price in April is expected to fluctuate weakly, with the mainstream negotiated price for medium to low viscosity PBT chips in East China expected to be around 7,700-8,000 yuan/ton.

PA6:

1. This month's market focus points

1 Sinopec's high-end caprolactam settlement price for March 2025 is 10,790 yuan/ton (liquid superior grade, six-month acceptance for self-collection), a decrease of 715 yuan/ton compared to the February settlement price.

2 Sinopec pure benzene prices in East China and South China refineries were reduced by 350 yuan per ton, now at 6600 yuan per ton, effective from March 26.

3) In March, the production of polyamide 6 polymerization was 610,000 tons, a year-on-year increase of 133,800 tons and a month-on-month increase of 36,700 tons. The operating rate of polyamide 6 polymerization in March was 84.79%, a year-on-year increase of 1.78% and a month-on-month decrease of 3.82%.

2. Analysis of the Market Conditions for This Month

3. Market Forecast for Next Month

In April 2025, the market is expected to stabilize first and then experience volatile fluctuations. On the supply side, Yuehua.New MaterialsSome production lines of Jiangsu Hongsheng have started feeding materials, while Zhejiang Fangyuan and Fangming plan to undergo maintenance. Some polymerization plants plan to slightly reduce their load, leading to a decrease in the overall operating rate and production volume of polymerization. In terms of cost, the later maintenance of some enterprises will reduce the supply of caprolactam, supporting its price, and the cost support for chips may be slightly stronger. In terms of demand, general terminal orders have resulted in cautious procurement of raw materials. After consuming inventory raw materials, purchases will mainly be made on an as-needed basis, and demand is not expected to improve significantly. It is expected that the PA6 market will stabilize first and then follow the cost trend with a slight improvement. It is expected that the price of regular spinning ordinary chips in the East China market in April will be 10,400-11,200 yuan/ton in cash and short delivery, and the price of high-speed spinning chips will be 11,000-12,000 yuan/ton on acceptance and delivery.

PA66:

1. Key Focuses of the Market This Month

Invista (China) Investment Co., Ltd. announced that starting from 7:00 AM on March 1, 2025, the spot trading price of hexamethylenediamine will be set at 21,300 RMB/ton, an increase of 300 RMB/ton compared to the February price.

2) The average price of PA66 in March was 17,174 yuan per ton, a 1.37% decrease compared to the previous month.

In March, the domestic PA66 market experienced a narrow decline, with the average monthly price in East China at 17,174 yuan/ton, a decrease of 1.37% compared to the previous month. The demand in the terminal market was weak, with purchases made mainly based on needs, resulting in poor sales for polymer manufacturers and continuous accumulation of inventory pressure. Additionally, the price of raw material adipic acid fluctuated downward, lacking support from the cost side, leading to insufficient industry confidence and a decline in the transaction focus.

2. Next Month's Market Forecast

From the cost perspective, the raw material adipic acid market is experiencing low-level fluctuations. The April execution price of Invista's hexamethylenediamine remains stable, with little fluctuation in raw material prices, putting significant pressure on polymerization companies' cost ends. In terms of supply and demand, there is no significant recovery in terminal market demand, and downstream buyers are mainly purchasing based on their needs. As a result, polymerization companies are facing difficulties in selling at high prices. The overall inventory pressure in the industry is continuously increasing. However, some companies plan to cut production at the beginning of April, leading to expectations of a reduction in domestic PA66 spot supply in April. Under the expectations of cost pressures and reduced supply, the domestic PA66 market is likely to maintain narrow-range fluctuations in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track