The Surge of Used Power Batteries: How to Break Through the Trillion-Yuan Recycling Market?

In that distant memory, perhaps you have already heard such a story: an inconspicuous button battery is enough to deprive a clear little river of its former vitality. However, as the wheels of the times roll forward,Electric vehicleGradually becoming a common sight on the streets, have you ever thought about where the power batteries that drive these behemoths go after they are retired?

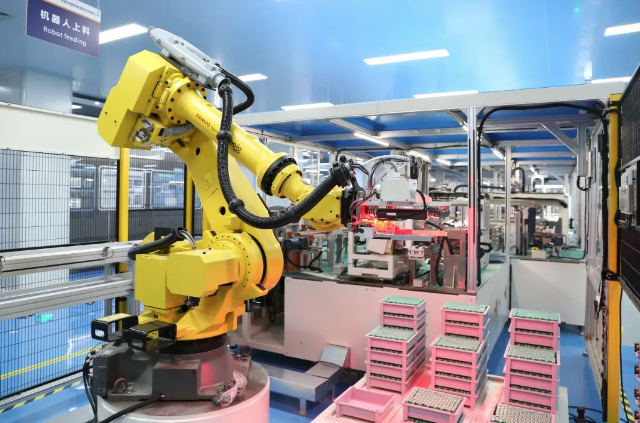

Entering 2023, China's automotive industry has迎来了 unprecedented辉煌时刻, with both production and sales surpassing the historical threshold of 30 million units. Amidst this prosperity,New Energy VehiclesLike a dazzling star, its penetration rate reaches 31.6%. Just one year later, in 2024, China's annual production of new energy vehicles will exceed ten million units. Those intelligent power battery production workshops are like a microcosm of the future world, telling the story of technological power.

However, in this waveNew energyBehind the wave, there lies a problem that cannot be ignored: the recycling and utilization of power batteries. According to predictions by the China Commercial Industry Research Institute, by 2025, the amount of retired power batteries in China will reach an astonishing 1.04 million tons, and by 2030, this figure may soar to 3.5 million tons. With such a massive amount of battery waste, how to effectively recycle and utilize them undoubtedly becomes a major issue that the entire industry urgently needs to address.

Reporters delved into the upstream and downstream of the power battery industry chain, visiting numerous business operators, technology planning experts, and technical service organizations. They found that the key to solving the challenges of power battery recycling lies in designing and popularizing a "digital ID" system. This system may become the key to unlocking the challenges of power battery recycling and lead the industry towards a more standardized and efficient development path.

Amid the surging wave of "scrapping tide," the management of the flow of power batteries has become a tricky issue. Data shows that by the end of 2024, the number of new energy vehicles in the country has reached 31.4 million, with the installation volume of power batteries ranking first in the world. As the "two new" policies continue to be implemented, which promote large-scale equipment updates and the exchange of old consumer goods for new ones, the retirement tide of power batteries is coming as expected.

Li Lin, a new energy vehicle owner living in Beijing, has owned his own electric vehicle since 2016. However, as the 8-year warranty period approaches, he finds that his beloved car seems to be "struggling" after charging. This anxiety about battery life has put him in a dilemma of whether to replace the battery or the car. In fact, many vehicle owners like Li Lin are facing the issue of battery scrapping. Wang Pan, the director of the Power Battery Department at the China Automotive Technology and Research Center, pointed out that the average lifespan of automotive power batteries is 5 to 8 years, which means that a large number of early purchasers of new energy vehicles have batteries that have already or are about to reach the end of their lifespan.

In the eyes of Zhang Tianren, the chairman of Tianneng Group, used power batteries are a huge "urban mine." However, if not disposed of properly, this "mine" could turn into a dangerous "volcano." To standardize the industry's development, the Ministry of Industry and Information Technology has released five batches of lists of enterprises that meet the "Comprehensive Utilization Industry Normative Conditions for Waste Power Batteries from New Energy Vehicles," involving a total of 148 enterprises. However, during his research, Zhang Tianren discovered that, according to Tianyancha data, there are more than 40,000 registered enterprises related to power battery recycling in China. This indicates that the management of the flow of discarded power batteries faces enormous challenges, with a large amount of battery recycling materials being diverted to the informal market and unable to be processed by compliant enterprises for recycling and reuse.

In Jieshou City, Anhui Province, the battery "circular economy" has already gained widespread fame. However, Cao Wei, the deputy director of the Jieshou High-tech Zone Management Committee, admits that the entry threshold for the circular economy industry is not high. In recent years, with the national encouragement for the development of related industries, Jieshou City has also seen a rush and disorderly development. Taking lead-acid batteries as an example, the annual scrap volume in the country is about 6 million tons, but the currently approved enterprises for recycling have a capacity that has reached 14 million tons, far exceeding the actual demand.

In this "battle" of battery recycling, non-compliant companies are taking advantage of low costs to acquire waste batteries on a large scale, leaving many compliant companies "starving" due to the lack of raw materials. This phenomenon of "the inferior driving out the superior" not only hinders the healthy development of the industry but also brings multiple hidden dangers. Ke Yanchun, director of the Science and Technology Innovation Department of China Resource Recycling Group, revealed that during their research, they found that a flexible disassembly production line invested in by a well-known automotive manufacturer has been idle for a long time due to a lack of supply. When the operating costs far exceed the benefits, these advanced production lines naturally become mere decorations.

If retired power batteries flow into the informal market, it not only easily causes environmental pollution and safety hazards but also goes against the original intention of developing new energy. Zhang Tianren is deeply worried about this. He pointed out that some non-compliant dismantling companies use rough methods to crush the batteries, which not only leads to environmental pollution but also severely disrupts the normal order of China's power battery recycling industry.

However, not all retired power batteries are destined for scrapping. In fact, after testing and repair, these batteries can still be utilized in energy storage systems, low-speed electric vehicles, and other fields, achieving "cascaded utilization." However, this requires more automated production lines for reverse manufacturing processes to carry out large-scale and refined dismantling. Ke Yanchun admits that the current low-level dismantling methods, which heavily rely on personal experience, make it difficult for the entire industry chain to achieve digital and technological upgrades. If it is not possible to coordinate nationwide efforts, organize high-quality recycling activities, and implement full-process management, then the proposition of efficient resource recycling will be difficult to resolve satisfactorily.

In this context, China Resource Recycling Group emerged as a "national team." Established in October 2024, this enterprise is tasked with the historical mission of finding a development path supported by technological innovation and guiding high-quality development across the entire recycling economy industry, including power batteries. They are committed to smoothing the resource recycling chain and creating a national, functional platform for resource recovery and reuse, injecting new vitality into the recycling and utilization of power batteries.

Around the world, waste batteries have become a "gold mine" that countries are eager to exploit. Ke Yanchun lamented, "For every new battery, there is an equal amount of old materials!" This year's government work report explicitly stated the need to strengthen the recycling of waste and vigorously promote the use of recycled materials. The mention of "recycled materials" for the first time has attracted widespread attention.

In the field of power batteries, the term "black powder," which has gained popularity with the rise of the lithium battery recycling industry, has become a focal point of public attention. It is composed of crushed waste battery materials and is a type of electronic waste, containing a mixture of metals such as lithium, manganese, cobalt, and nickel, which hold significant economic value. This "gold mine," which has yet to be fully developed, has attracted considerable attention from developed countries in Europe and America. They are strengthening the exploration and protection of this "gold mine" from a national strategic perspective.

The EU's "Critical Raw Materials Act" is a typical example. This act will officially take effect in 2024 and aims to meet 25% of the EU's strategic raw material needs through recycling, particularly in the area of electric vehicle battery materials. This initiative not only helps alleviate the EU's dependence on external resources but also provides strong policy support for the development of the power battery recycling industry. In China, a land full of vitality, the continuous advancement of technology and the ongoing improvement of policies suggest that the spring of power battery recycling and utilization may no longer be far away. In Germany, an ambitious "National Circular Economy Strategy" has been officially launched, with the core idea of building a closed-loop system for material recycling. Currently, Germany's secondary raw material utilization rate is only 13%, but this figure is expected to double by 2030, becoming the primary goal of this strategy. The vehicle and battery sector is a particularly shining gem in this strategic blueprint, attracting significant attention.

At the same time, across the Atlantic in the United States, the Infrastructure Act is injecting strong momentum into the battery industry. The funding of up to $6.36 billion acts like a spring of clear water, nourishing every aspect of battery manufacturing and recycling, as well as battery materials processing. This funding undoubtedly paves a broad road for the green transformation and sustainable development of the battery industry.

However, the global battery industry's direction is not set in stone. In October 2024, a significant revision by the European Union categorized lithium-containing components such as cathodes in lithium batteries as "hazardous waste," imposing strict restrictions on their export. This revision, like a large stone thrown into a calm lake, created ripples throughout the industry. Shortly after, on March 5, 2025, the European Commission took further action, releasing the latest revision of the "Waste List" concerning battery-related waste, tightening export policies on key materials such as black powder. This series of measures undoubtedly demonstrates the EU's firm determination to enhance its supply security for critical raw materials as a resource-scarce region.

Faced with this global trend, experts in China's battery industry have also sounded the alarm. Wang Pan pointed out that the EU's revisions are important measures taken after the "Critical Raw Materials Act" to address resource shortages. As a country highly dependent on imports of resources such as lithium, cobalt, and nickel, the standardized, scaled, and specialized recycling of retired power batteries in China is not only related to environmental safety but also a key step in alleviating resource dependence on foreign sources and promoting the healthy development of the new energy vehicle industry. Ke Yanchun further emphasized that China must strengthen the recycling of retired power batteries. This is not only a necessary means to eliminate safety hazards and solve environmental problems, but also an effective way to reduce the upstream resource dependence of the new energy vehicle industry on foreign sources.

On the production line of power batteries, intelligence has become an irreversible trend. From the perspective of national strategy, resource security has been elevated to an unprecedented level of importance. On December 23, 2024, China released the "Comprehensive Utilization Industry Norms for Waste Power Batteries from New Energy Vehicles (2024 Edition)," which clearly states that relevant enterprises should increase their research and development efforts and actively apply recycling technologies, equipment, and processes, focusing on the efficient recovery of key components such as positive and negative electrode materials, separators, and electrolytes. Among these, the lithium recovery rate during the smelting process must reach over 90%, which undoubtedly sets a new benchmark for the recycling of power batteries.

In this context, leading companies such as Tianneng Group are actively expanding their industrial chains, launching new production lines, and focusing on the extraction of rare and precious metals from lithium batteries. They are well aware that quickly establishing a path for "full lifecycle management" is key to achieving the recycling of power batteries and promoting the green transformation of the industry.

"From resource to resource, from material to material, this is the ideal realm pursued by the circular economy," Ke Yanchun sighed. However, there is often a long road between ideals and reality. In recent years, the concept of "digital product passports" has quietly emerged globally, and the power battery industry has actively responded, attempting to make strides in this field. In 2023, the European Union took the lead in launching the "Battery Passport" as a new tool to promote sustainable development management in the battery industry, creating a new chapter in the information traceability of the entire battery lifecycle. Subsequently, the South Korean government announced a national plan aimed at building a comprehensive information management system covering battery manufacturing, electric vehicle operation, disposal, post-use battery trading, circulation, and reuse.

The introduction of the "EU Battery and Waste Battery Regulation" has set strict carbon footprint declaration standards for the power battery industry. Starting from February 18, 2025, all power batteries must provide detailed information including product carbon footprint, battery manufacturer, model, raw materials (including renewable portions), total carbon footprint of the battery, and carbon footprint at different life cycle stages, and must meet relevant limit standards. This regulation undoubtedly presents new challenges and higher requirements for the development of China's new energy vehicle and battery industries.

Facing this challenge, our country has not backed down. On February 21, the State Council's executive meeting reviewed and approved the "Action Plan for Improving the Recycling and Utilization System of New Energy Vehicle Power Batteries," marking the official entry of China's power battery recycling industry into a new stage of standardized and large-scale development. This plan focuses on full-chain management and aims to promote the green closed-loop of the new energy vehicle industry. Additionally, the plan emphasizes the use of digital technology to strengthen the monitoring of the entire lifecycle flow of power batteries, ensuring traceability throughout production, sales, disassembly, and utilization. This means that the era of installing "digital IDs" for power batteries has arrived.

The introduction of the "digital ID card" will effectively manage the source, destination, and usage of batteries, thereby avoiding illegal recycling and resource waste. China Automotive Data is at the forefront in this field, jointly launching the "Battery ID Plan" with upstream and downstream players in the new energy vehicle industry, battery companies, and battery recycling enterprises. This plan is centered on the core idea of "centralized management and distributed storage," aiming to achieve hierarchical disclosure of information in the industry chain and efficient collaboration. Also released is the first "China Battery ID Indicator Manual," which covers six major dimensions, 93 result indicators, and 132 process indicators, as well as the first batch of pilot results for China's battery ID.

Wang Pan is full of confidence in the application prospects of the "digital ID." She believes that this initiative can not only establish a trustworthy and controllable digital security barrier for enterprises but also build an interconnected industrial digital space, providing effective regulatory tools for the government and enhancing the green competitiveness of China's battery products in the international digital arena. In the future, as the digital upgrade of the circular economy-related industries continues, the application scenarios of the "digital ID" will keep expanding, and its role in promoting the green transformation of the industry and enhancing the overall digital level will become increasingly prominent. Ke Yanchun revealed that China Resources Recycling Group is actively planning the "14th Five-Year" technology innovation plan in the resource recycling field, aiming to create a unified, efficient, and intelligent base and technological innovation platform, forming a comprehensive big data system for the entire industry and contributing to the sustainable development of the sector.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track