The stock price plummeted by 50%, and this medical device company has filed for bankruptcy.

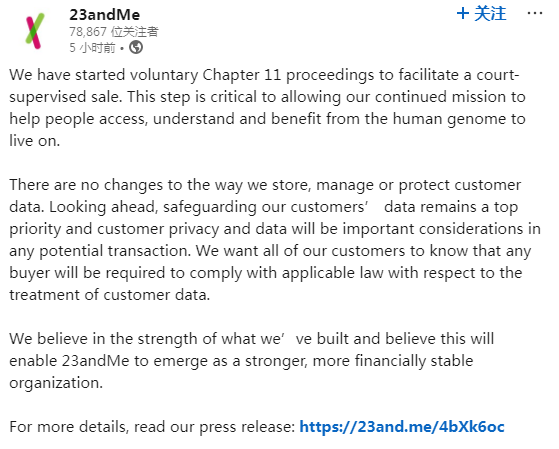

On March 23, local time, 23andMe, a major player in the U.S. gene testing industry, officially filed for bankruptcy protection with the U.S. Bankruptcy Court for the Eastern District of Missouri.

It is reported that the company's stock price plummeted more than 52% during Monday's trading session, with its total market capitalization shrinking from a peak of nearly $6 billion at the end of 2021 to approximately $24 million.

In addition, Anne Wojcicki, CEO and co-founder of 23andMe, resigned on Sunday but will remain on the board of directors. Joseph Selsavage, Chief Financial and Accounting Officer of 23andMe, has been appointed as the interim CEO.

This star company, which once had the vision of "changing lives with gene data," has reached a crossroads in its fate after nearly twenty years of highs and controversies, ultimately due to a broken funding chain, data security crises, and difficulties with its business model.

01

"23 pairs of chromosomes"

23andMe was founded in 2006 by Anne Wojcicki, former wife of Google co-founder Sergey Brin, and its name comes from the 23 pairs of chromosomes in human beings.

The company focuses on saliva testing and provides services such as ancestry tracing and health risk assessment by analyzing users' genetic data. In 2008, its product was even named "Invention of the Year" by Time magazine.

In 2013, 23andMe became the first direct-to-consumer genetic testing company to receive FDA approval, marking its official entry into the healthcare field.

Since then, the company's financing process has accelerated rapidly: from a $3.9 million seed round led by Google in 2007, to raising $3.5 billion through a SPAC listing in 2021, accumulating a total of 26 funding rounds with a total amount of $880 million.

At its peak, its valuation once exceeded $6 billion, with over 14 million users, and Wosky himself joined the "Silicon Valley Billionaire Club."

02

Strategic Defeat Chain Trap

However, the gears of fate began to turn quietly, and since 2023, 23andMe's decline gradually became apparent.

The financial report shows that the company's net loss for the first three quarters of fiscal year 2024 widened by 85% year-over-year to $458 million, with full-year revenue reaching only $191.8 million, a 28% decline compared to the previous year.

As of the end of 2024, the company's total assets were $277.4 million, while its total debt reached as high as $214.7 million.

The root cause is that the market has little room for growth left, and users' novelty with one-time genetic testing has faded, leading to a near-zero repurchase rate. Although subscription-based health services (such as annual blood testing) have been introduced, user stickiness remains insufficient to sustain continuous revenue.

Meanwhile, competitors represented by Ancestry continue to adopt a low-price strategy, further squeezing the market share.

In addition, the 7-million-user genetic data breach that occurred in 2023 became a turning point in the collapse of trust in the company.

Although a settlement of $30 million was ultimately reached, the five-month delay in disclosure completely destroyed the brand's reputation.

The comprehensive collapse of the pharmaceutical R&D front has further exacerbated the company's difficulties. All 50 drug projects in collaboration with GSK have yielded no results, and the self-developed anticancer drug has had its clinical trials halted due to a broken funding chain.

To alleviate financial pressure, 23andMe launched five rounds of layoffs in 2023, reducing its total employee count from 800 to 300; in November 2024, the company further cut its workforce by 40% and closed its drug development division.

The last straw that broke the camel's back was the failure of strategic transformation.

The high-priced acquisition of the telemedicine platform Lemonaid Health turned into a financial burden due to out-of-control operational costs, while the missed opportunity in medical-grade赛道布局 (track layout/field layout, likely referring to strategic market positioning or investment) in areas such as early cancer screening and genetic disease diagnosis caused it to miss the golden window for transitioning from a consumer-grade to a medical-grade market.

Although the board had attempted to自救 through a privatization scheme, it was ultimately forced to seek bankruptcy protection to facilitate a sale when the offer was deemed insufficient and was collectively opposed by independent directors. (Note: There seems to be an incomplete or out-of-place phrase "自救 through a privatization scheme" at the beginning which appears to be either a repetition or mistakenly included. The provided translation focuses on the main clause following this phrase.)

03

Less than 10 dollars

In October 2023, hackers exploited a system vulnerability to breach the 23andMe database, stealing the genetic information of nearly 6.9 million users, including a large number of data from users of Chinese and Ashkenazi Jewish descent.

These sensitive information packages were categorized and sold on the dark web at prices ranging from 1 to 10 dollars each. Hackers even listed a "special list" that included celebrities such as Meta CEO Mark Zuckerberg and Tesla CEO Elon Musk, causing a public uproar.

Following the incident's exposure, 23andMe was accused of "intentionally neglecting data security obligations" for failing to promptly notify users and regulatory authorities.

In January 2024, two user representatives filed a class-action lawsuit, accusing the company of failing to take reasonable measures to protect privacy, thereby exposing users to risks such as identity theft and genetic discrimination.

Additionally, some of the information in the 350,000 Chinese user profiles provided by hackers on the dark web has been confirmed to involve medical records and family medical history, further heightening public concerns about the misuse of genetic data.

Despite 23andMe’s bankruptcy filing pledging to continue ensuring data security, market doubts linger. Healthcare investors warn that the bankruptcy process might force the company to sell its data at a discount, and the “科研使用” (scientific research use) terms that users initially agreed to may not constrain the commercial intentions of new buyers.

The uniqueness of genetic data elevates it beyond ordinary personal information: it is linked to family medical history, ethnic characteristics, and even future disease risks. If it falls into the black market or is misused (such as in discriminatory insurance pricing), the consequences could be unimaginable.

However, there are no specific laws in the United States regulating the handling of genetic data from bankrupt companies, and regulatory loopholes exacerbate public concerns.

04

FDA halts.

The downfall of 23andMe is essentially a concentrated outbreak of defects in its business model.

In the early days, the company quickly captured the market through a low-price strategy (test prices dropped from $999 to $99), but the profit margin for consumer-grade genetic testing was limited.

The fees paid by users only cover the basic testing costs, while the company's commitment to "health risk prediction" has been controversial due to scientific limitations. For example, the disease risk reports it provided were halted by the FDA due to insufficient accuracy, leading to a decline in user trust.

In addition, 23andMe attempts to explore a new track through data monetization, cooperating with pharmaceutical enterprises such as GlaxoSmithKline to carry out drug research and development.

However, the commercial transformation cycle of genetic data is long and the investment is high, making it difficult to feed back to the main business in the short term.

Meanwhile, the company's reckless expansion led to uncontrolled operating costs: in 2024 alone, the losses from its drug R&D department accounted for over 40% of the total losses.

Ironically, the company was still in debt for genetic testing fees to partners like 23andMe before its bankruptcy, revealing a chaotic supply chain management.

At the industry level, the bursting of the bubble in the genetic testing market was also the backdrop to 23andMe's downfall.

As competitors涌入, the price war intensifies, and consumers' novelty with gene sequencing gradually fades. (Note: There appears to be a mix-up in the original sentence where "基因检测" (gene detection/sequencing) is followed by "涌入" (flood in), which is not typically used in the context of non-physical entities like services or technologies. The provided translation aims to convey the intended meaning as best as possible given the phrasing.)

According to statistics, the U.S. consumer genomics market size decreased by 32% year over year in 2024, while 23andMe’s market share fell from a peak of 45% to less than 15%.

The collapse of 23andMe is not only a commercial failure but also exposes deep contradictions within the genetic technology industry: consumer genetic testing needs to transition from a 'novelty gadget' to a health necessity, and the value of technology must align with users' real needs; ethical conflicts over data monetization highlight the lag in technological ethics; the mismatch between the drug development cycle and short-sighted capital has accelerated the bursting of the bubble. Although this company, which once revolutionized genetic understanding, awaits its fate, its data legacy continues to question the balance between technology and ethics, serving as a warning to the industry to build a framework of responsibility alongside technological innovation to avoid repeating past mistakes.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track