The growth rate of polypropylene capacity has slowed down; is there hope for easing the supply-demand contradiction?

Introduction: In February, market prices fell across the board, with a decline of 20-100 yuan/ton. During the first half and mid-month, inventory was actively consumed, easing spot contradictions, leading to a weak consolidation in prices. However, at the end of the month, poor trading combined with the return of supply intensified the contradiction for polypropylene, opening up a downward price channel. With the "Golden March, Silver April" period approaching, can PP prices see a breakthrough in March? Next, we will conduct an in-depth analysis from multiple dimensions such as current inventory status, supply changes, demand expectations, and policy impacts.

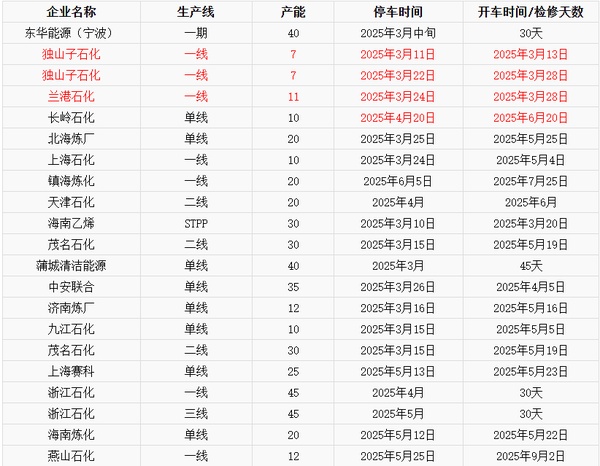

I. Inventory Depletion Delayed, Market Prices Decline

![[Longzhong Focus]: Delayed Inventory Depletion, Can PP Prices Break Through in March? [Longzhong Focus]: Delayed Inventory Depletion, Can PP Prices Break Through in March?](https://oss.plastmatch.com/zx/image/06bb0bdebea34dab9ff68a518951df89.png)

Source: Longzhong Information

Entering 2025, the problem of PP inventory depletion continues to trouble the market. After the Spring Festival holiday, petrochemical inventories were at high levels. Although downstream enterprises gradually resumed operations, the recovery in demand did not meet expectations. According to Longzhong's data, in February, there were relatively few maintenance shutdowns among domestic polypropylene producers, keeping the market supply at a high level. While downstream operating loads have increased, factories are cautious about purchasing, mainly focusing on consuming existing inventories, which has made it difficult for market transactions to expand.

Entering 2025, the issue of PP inventory reduction continues to trouble the market. After the Spring Festival holiday, petrochemical inventories are at a high level. Although downstream enterprises have gradually resumed operations, the recovery in demand has fallen short of expectations. According to Longzhong data, there were relatively few maintenance shutdowns of polypropylene production facilities in China in February, with market supply remaining at a high level. While the operating load of downstream factories has increased, procurement intentions from these factories remain cautious, mainly focusing on consuming existing inventories, which makes it difficult for market transactions to increase significantly.In this situation, the slow pace of inventory reduction by petrochemical companies and intermediaries is putting significant downward pressure on market prices. In February, the PP market price showed an overall trend of fluctuating downward. Although the price trends in the three major regions diverged, the overall price level decreased slightly compared to the previous month. For example, in the North China region, due to concentrated maintenance after the festival, price support was relatively strong, but over time, under the influence of the overall market atmosphere, prices also struggled to maintain an upward trend.

In this situation, the slow pace of inventory reduction by petrochemical companies and intermediaries is putting significant downward pressure on market prices. In February, the PP market price showed an overall trend of fluctuating downward. Although the price trends in the three major regions diverged, the overall price level decreased slightly compared to the previous month. For example, in the North China region, due to concentrated maintenance after the festival, price support was relatively strong, but over time, under the influence of the overall market atmosphere, prices also struggled to maintain an upward trend.II. Continuous Benefits from Maintenance, New Capacity Lower than Expected

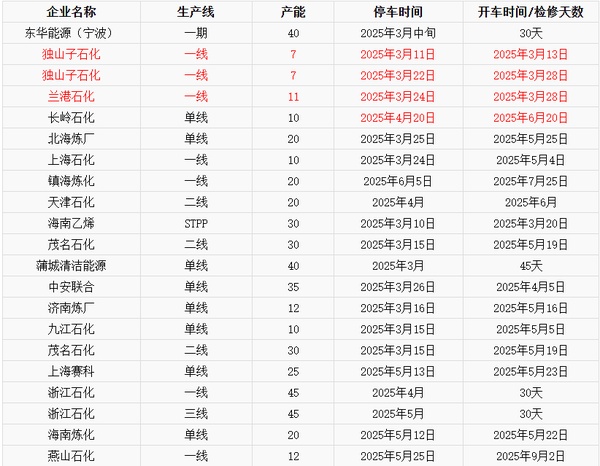

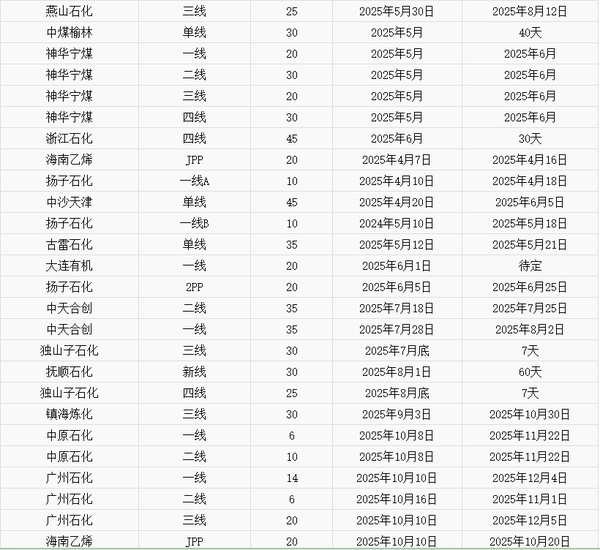

II. Continuous Benefits from Maintenance, New Capacity Lower than Expected II. Continuous Benefits from Maintenance, New Capacity Lower than ExpectedTable 2: Overview of 2025 PP Granule Plant Shutdown Plans

Table 2: Overview of 2025 PP Granule Plant Shutdown PlansTable 2: Overview of 2025 PP Granule Plant Shutdown PlansUnit: Ten Thousand Tons/Year

Unit: Ten Thousand Tons/YearUnit: Ten Thousand Tons/Year

On the supply side, maintenance plans have had a certain impact on the market. Since February, some facilities in North China, East China, and South China have undergone maintenance. Entering March, it is expected that the maintenance wave will further expand. According to Longzhong Information, the capacity affected by maintenance in March may be more concentrated in the East China and South China regions. The reduction in supply due to maintenance theoretically provides some support for prices.

Regarding new capacity, the large-scale new capacity planned for 2024-2025 has seen slower progress than expected. Some projects have been delayed for various reasons, which has somewhat alleviated market supply pressure. For example, some projects originally scheduled to start production at the beginning of the year are still in the construction or commissioning phase and have not yet made a substantial impact on the market.

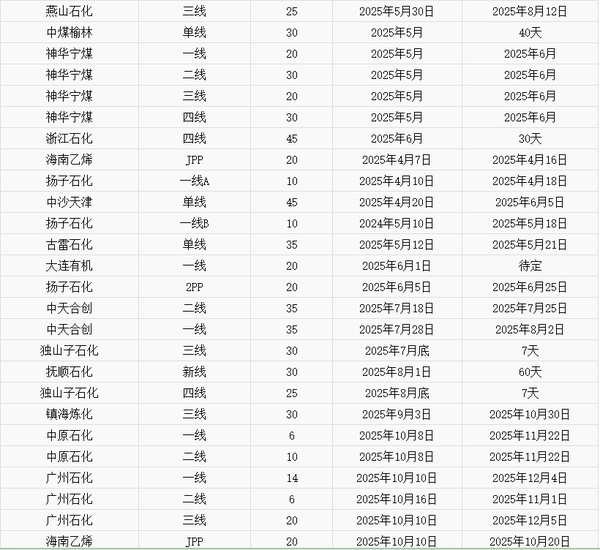

III. "Golden March" supports rigid demand, new policies from the Two Sessions are worth looking forward to

III. "Golden March" supports rigid demand, new policies from the Two Sessions are worth looking forward toIII. "Golden March" supports rigid demand, new policies from the Two Sessions are worth looking forward to![[Longzhong Focus]: Slow Inventory Depletion, Can PP Prices Break Through in March? [Longzhong Focus]: Slow Inventory Depletion, Can PP Prices Break Through in March?](https://oss.plastmatch.com/zx/image/424ad3e0724348b0a5da7f95adc970f9.png)

![[Longzhong Focus]: Slow Inventory Depletion, Can PP Prices Break Through in March? [Longzhong Focus]: Slow Inventory Depletion, Can PP Prices Break Through in March?](https://oss.plastmatch.com/zx/image/424ad3e0724348b0a5da7f95adc970f9.png)

From the demand side, March is traditionally seen as a "Golden March" for rigid demand, with downstream industry demand expected to see a seasonal rebound. The demand for PP from industries such as plastic weaving, injection molding, and BOPP will gradually increase. As the operating rates of downstream factories further improve, if order volumes can grow in tandem, it will provide strong support to the PP market.

In addition, the convening of the Two Sessions has brought policy expectations to the market. The government may introduce a series of policies to stimulate the economy and promote consumption, which will indirectly affect the demand of downstream industries for PP. For example, the strengthening of infrastructure construction may boost the demand for plastic products like pipes; consumption stimulus policies may enhance the production enthusiasm in the home appliance and daily necessities sectors, thereby increasing the procurement volume of PP.

IV. Future Forecast

IV. Future Forecast IV. Future ForecastConsidering multiple factors, the PP market will remain in a state of supply and demand competition in the short term. Although inventory reduction is slow, with the continuous release of maintenance benefits in March and the seasonal recovery of downstream demand, the market is expected to gradually improve. If the policies introduced during the Two Sessions can effectively stimulate downstream industry demand, and new production capacity remains relatively stable, PP prices are expected to see some breakthroughs in March.

However, there is still uncertainty in the market. If the recovery of downstream demand falls short of expectations, or if maintenance facilities resume production earlier than planned, it will hinder price increases. In addition, fluctuations in international crude oil prices will also affect PP costs, thereby impacting market price trends. Therefore, it is necessary to closely monitor policy developments, facility operations, and crude oil price fluctuations to accurately grasp the future direction of the PP market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track