The cigarette packaging market is stirring up again, with Yongji selling its Xiniu Wang equity and Jinjia getting embroiled in a lawsuit controversy!

The cigarette packaging market in China has been undergoing profound changes in recent years, with the role of private enterprises in this traditional industry quietly shifting. From once being the leaders of the industry to now gradually withdrawing, this change is driven by both the strategic adjustments of the companies themselves and the transformation of the market environment and policy orientation.

Aside from Jiajia Co., Ltd., Dongfeng Group, and Jiyou Co., Ltd., another company primarily engaged in cigarette packaging, Guizhou Yongji Printing Co., Ltd., announced on the evening of March 3rd about the sale of its equity in a subsidiary. The announcement stated that the company plans to transfer its 22.131% stake in Guizhou Xiniu Wang Printing Co., Ltd. to Guizhou Zhongxinhe Commercial Management Co., Ltd. for a price of 55.236 million yuan.

In the announcement, Yongji Co., Ltd. clearly stated that this transaction will help integrate and optimize the company's asset structure, improve the liquidity and efficiency of its assets, increase operating funds, provide financial support for the company's operations, optimize the company's strategic layout, and continuously enhance the company's core competitiveness. The company will use the funds obtained from the equity transfer to increase resource investment in its main business, seize opportunities, and further strengthen its main business.

Data shows that Xiniu Wang Printing has a strong profitability, with an estimated revenue of about 264 million yuan in 2024 and a net profit as high as 50.76 million yuan, with a net profit margin close to 20%. Despite this, Yongji Co., Ltd. still chose to sell its shares, clearly focusing on its core business.

Data shows that Xiniu Wang Printing has a strong profitability, with an estimated revenue of about 264 million yuan in 2024 and a net profit as high as 50.76 million yuan, with a net profit margin close to 20%. Despite this, Yongji Co., Ltd. still chose to sell its shares, clearly focusing on its core business.Previously, the 2024 annual performance forecast released by Yongji Co., Ltd. showed that the net profit attributable to the parent company's shareholders for 2024 is expected to be about 172 million yuan to 202 million yuan, an increase of 71.8476 million yuan to 101.8476 million yuan compared to the same period last year, representing a year-on-year increase of 71.74% to 101.69%. It is also expected that the net profit attributable to the parent company's shareholders after deducting non-recurring gains and losses for 2024 will be about 156 million yuan to 186 million yuan, an increase of 61.4249 million yuan to 91.4249 million yuan compared to the same period last year, representing a year-on-year increase of 64.95% to 96.67%.

Previously, the 2024 annual performance forecast released by Yongji Co., Ltd. showed that the net profit attributable to the parent company's shareholders for 2024 is expected to be about 172 million yuan to 202 million yuan, an increase of 71.8476 million yuan to 101.8476 million yuan compared to the same period last year, representing a year-on-year increase of 71.74% to 101.69%. It is also expected that the net profit attributable to the parent company's shareholders after deducting non-recurring gains and losses for 2024 will be about 156 million yuan to 186 million yuan, an increase of 61.4249 million yuan to 91.4249 million yuan compared to the same period last year, representing a year-on-year increase of 64.95% to 96.67%.In addition, coincidentally, just one day before Yongji Co., Ltd.'s announcement, Jiajia Co., Ltd., a leading company in the cigarette packaging industry, once again became the focus of market attention, as the company issued an announcement regarding litigation involving the company's controlling shareholder and actual controller. The announcement detailed two related cases: in Case One, the controlling shareholder and actual controller were listed as defendants; in Case Two, the controlling shareholder became the被执行人。案件一的涉案金额高达人民币4.51亿元,外加相关诉讼费用;案件二的涉案金额为人民币8400万元,另需承担相关执行费用。

In addition, coincidentally, just one day before Yongji Co., Ltd.'s announcement, Jiajia Co., Ltd., a leading company in the cigarette packaging industry, once again became the focus of market attention, as the company issued an announcement regarding litigation involving the company's controlling shareholder and actual controller. The announcement detailed two related cases: in Case One, the controlling shareholder and actual controller were listed as defendants; in Case Two, the controlling shareholder became the subject of enforcement. The amount involved in Case One was as high as 451 million yuan, plus related litigation costs; the amount involved in Case Two was 84 million yuan, along with the need to bear related enforcement costs.

In Case One, the equity in Jiajia shares held by the controlling shareholder and its concert parties may change, with the specific scope still uncertain. The announcement points out that if all the assets to be disposed of are Jiajia shares, based on a claim amount of 451 million RMB, and estimated at the closing price on February 28, 2025, it might involve approximately 7.66% of the company's total share capital.

Similar to Case One, the change in equity and scope of Jiajia shares held by the controlling shareholder in Case Two is also uncertain. Assuming all the assets to be disposed of are Jiajia shares, based on a claim amount of 84 million RMB, and estimated at the closing price on February 28, 2025, it might correspond to approximately 1.43% of the company's total share capital.

Overall, if calculated based on the maximum possible change in equity from the above cases, it could involve approximately 9.08% of Jiajia's total share capital. The announcement emphasizes that these cases are not expected to result in a change in the company's controlling shareholder or actual controller. As of the date of the announcement, the pledge ratio of the shares held by the controlling shareholder and its concert parties in the company is as high as 99.99%. Additionally, some of the company's shares pledged by Jiajia Venture Capital and Century Yuntong have been judicially refrozen, while the unpledged portion of the company's shares held by Century Yuntong has also been judicially frozen. The announcement finally states that if Jiajia shares need to be disposed of according to the final litigation results and rulings for Case One and Case Two, they will strictly follow the relevant legal procedures.

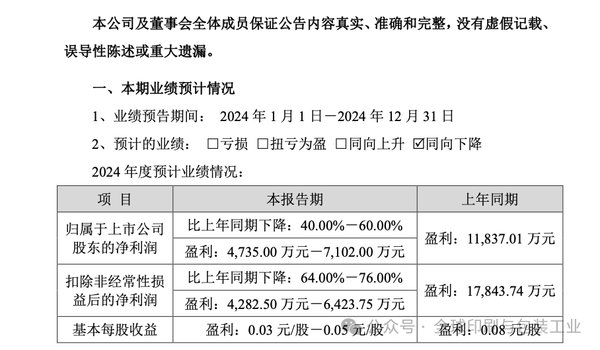

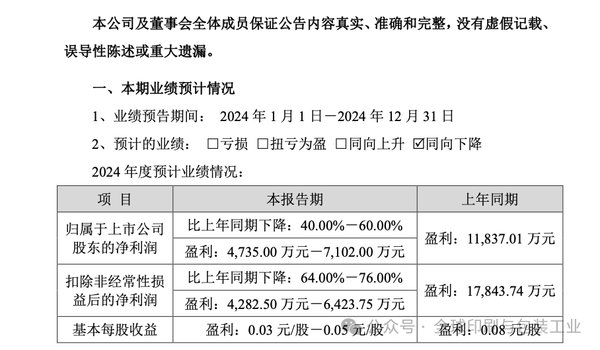

Overall, if the maximum possible changes in equity resulting from the aforementioned cases are combined, it could involve approximately 9.08% of Jifa's total share capital. The announcement stresses that these cases are not expected to result in a change in the company's controlling shareholder or actual controller. As of the date of the announcement, the pledge rate of the shares held by the controlling shareholder and parties acting in concert is as high as 99.99%. Additionally, some of the shares pledged by Jifa Venture Capital and Century Yuntong have been judicially re-frozen, and the unpledged portion of the shares held by Century Yuntong has also been judicially frozen. The announcement finally points out that if Case One and Case Two ultimately require the disposal of Jifa's shares based on the litigation results and rulings, the process will strictly follow relevant legal procedures.According to the 2024 annual earnings forecast released earlier, after continuously taking measures such as transferring the equity of Jixing Printing, Kunming Color Printing, and a targeted reduction in capital at Qingdao Jiaze in 2024, Jifa expects its net profit attributable to shareholders of the listed company for 2024 to be between 47.35 million yuan and 71.02 million yuan, a year-on-year decrease of 40% to 60%; the net profit after excluding non-recurring gains and losses is expected to be between 42.825 million yuan and 64.2375 million yuan, a year-on-year decrease of 64% to 76%. The basic earnings per share are expected to be 0.03 yuan per share to 0.05 yuan per share, a year-on-year decrease of 0.05 yuan per share. For comparison, the net profit attributable to shareholders of the listed company in the same period last year was 118.3701 million yuan, and the net profit after excluding non-recurring gains and losses was 178.4374 million yuan.

According to the 2024 annual earnings forecast released earlier, after continuously taking measures such as transferring the equity of Jixing Printing, Kunming Color Printing, and a targeted reduction in capital at Qingdao Jiaze in 2024, Jifa expects its net profit attributable to shareholders of the listed company for 2024 to be between 47.35 million yuan and 71.02 million yuan, a year-on-year decrease of 40% to 60%; the net profit after excluding non-recurring gains and losses is expected to be between 42.825 million yuan and 64.2375 million yuan, a year-on-year decrease of 64% to 76%. The basic earnings per share are expected to be 0.03 yuan per share to 0.05 yuan per share, a year-on-year decrease of 0.05 yuan per share. For comparison, the net profit attributable to shareholders of the listed company in the same period last year was 118.3701 million yuan, and the net profit after excluding non-recurring gains and losses was 178.4374 million yuan.The main reason for the decline in performance is that the scope of the consolidated financial statements has been reduced, and due to the uncertainty of the domestic and international macroeconomic environment and the intensification of market competition, there has been a certain degree of decline in both the sales volume and prices of the company's main products, leading to a decrease in the company's overall profit level. At the same time, considering the market competition landscape and the actual operating conditions, and adhering to the principle of prudence, the company has made provisions for impairment on goodwill, long-term equity investments, fixed assets, and accounts receivable, with the amount expected to be between 200 million yuan and 250 million yuan.

The main reason for the decline in performance is that the scope of the consolidated financial statements has been reduced, and due to the uncertainty of the domestic and international macroeconomic environment and the intensification of market competition, there has been a certain degree of decline in both the sales volume and prices of the company's main products, leading to a decrease in the company's overall profit level. At the same time, considering the market competition landscape and the actual operating conditions, and adhering to the principle of prudence, the company has made provisions for impairment on goodwill, long-term equity investments, fixed assets, and accounts receivable, with the amount expected to be between 200 million yuan and 250 million yuan.

Considering the divestiture of profitable assets by Yongji Co., Ltd. and the litigation storm surrounding Jiajia Co., Ltd., the transformation of private enterprises in China's tobacco packaging industry is no longer an isolated corporate action but more like a quietly unfolding industry migration. This cannot simply be summed up as "exiting"; it reflects the common challenges and strategic choices faced by traditional industry private enterprises under the wave of economic structural transformation and upgrading in China.

Once, private tobacco packaging companies, with their flexible mechanisms and keen market insight, held significant positions in the industry, even becoming leaders in their respective fields. However, as growth dividends gradually fade, market competition becomes increasingly fierce, coupled with policy orientation adjustments and the uncertainties of the macroeconomic environment, these companies' past advantages may instead become burdens. The sale of relatively profitable assets by Yongji Co., Ltd., which seems like "cutting off flesh," is actually aimed at focusing more on its core business and optimizing resource allocation. This is a typical defensive strategy of "contracting the front lines and concentrating superior forces." Meanwhile, Jiajia Co., Ltd. appears to be in the painful phase of industry transformation, where long-term accumulated risks are beginning to be released in a concentrated manner.

The cases of these two representative enterprises, like a mirror reflecting the changes in the industry, illustrate that China's cigarette packaging market and even broader traditional industries are undergoing a profound structural adjustment. The role played by private enterprises has gradually shifted from early pioneers and leaders to adapters and reformers. Their strategic choices involve both breaking through their own development bottlenecks and adapting to changes in the external environment. This transformation, while perhaps full of challenges and uncertainties, also signals that under a new economic cycle, Chinese private enterprises will explore new paths for high-quality development with a more cautious and pragmatic attitude.

The cases of these two representative enterprises, like a mirror reflecting the changes in the industry, illustrate that China's cigarette packaging market and even broader traditional industries are undergoing a profound structural adjustment. The role played by private enterprises has gradually shifted from early pioneers and leaders to adapters and reformers. Their strategic choices involve both breaking through their own development bottlenecks and adapting to changes in the external environment. This transformation, while perhaps full of challenges and uncertainties, also signals that under a new economic cycle, Chinese private enterprises will explore new paths for high-quality development with a more cautious and pragmatic attitude.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track