Stora Enso China's performance revealed: Revenue of 5.8 billion yuan, pre-tax loss of 2.9 billion yuan?!

Today, we will focus on its internal "engine" - various business units. Not only that, but the author will also delve into Stora Enso's business performance in the Chinese market, to understand its operations and production capacity. Next, the author will analyze the business scope, market position of these business units, as well as Stora Enso China's revenue performance in 2024, to gain a more comprehensive understanding of Stora Enso's operational status.

Stora Enso's five business divisions, with significant structural differentiation, continue to advance strategic adjustments

Packaging Materials Division, this division is a global leader and professional partner in the field of circular packaging, dedicated to providing high-quality packaging paperboard made from virgin and recycled fibers. Stora Enso helps customers reduce the use of fossil-based materials by offering renewable and recyclable products based on various substrates and barrier coatings. These products are widely used in food, beverage, and transport packaging.

In 2024, the revenue of the Packaging Materials Division reached 4.502 billion euros, making it the largest division under Stora Enso. In terms of market position, its liquid packaging board ranks first in the global market, while its virgin cardboard ranks first in the European market. Undoubtedly, its product innovation (such as renewable substrates and barrier coating technology) aligns deeply with the global trend of carbon reduction, becoming a key pillar of the group's sustainability strategy.

Packaging Solutions Division, this division, as a packaging processor, mainly produces various fiber-based packaging products for leading brands in multiple market sectors such as retail, e-commerce, and industrial applications. In addition, the division also provides services including design, packaging automation, and sustainability, aimed at helping customers optimize material usage efficiency, improve logistics operations, and ultimately reduce carbon dioxide emissions.

In 2024, the revenue of the Packaging Solutions Division was 987 million euros, with its EBIT even in a loss state, and the return on working capital was also negative, exposing the pain of the business transformation period. Despite this, the division is an important part of Stora Enso's future development focus, which is also one of the reasons why Stora Enso has sold several paper mills and acquired De Jong Packaging Group over the past few years. In terms of market position, its corrugated packaging business ranks third in the Nordic countries and second in the Benelux region.

Biomass Materials Division, this division takes pulp as its core business, aiming to become the preferred supplier for customers in specific grades of pulp products. To fully tap into the potential of trees, the division also utilizes all components of the tree to create innovative bio-based solutions as alternatives to traditional fossil-based and other non-renewable materials.

In 2024, the revenue of the Biomass Materials Division was 1.587 billion euros, with a return on operating capital as high as 9.3%, the highest among the five divisions. Currently, Stora Enso is the largest fluff pulp producer in Europe.

Wood Products Division, this division is currently the largest sawmill producer in Europe and is also a leading supplier of sustainable wood solutions for the global construction industry. The division provides renewable and low-carbon wood solutions to the construction industry, thereby helping to reduce carbon emissions in the built environment. In addition, the division also offers window and door components, as well as by-products such as pellets made from wood residues.

In 2024, the revenue of the wood products division was 1.522 billion euros, but its EBIT was also in a loss state, and it is currently the division with the most severe losses at Stora Enso, possibly related to fluctuations in global construction market demand and cost pressures, requiring further optimization of production capacity and product structure. In terms of market position, Stora Enso is currently the world's largest supplier of cross-laminated timber for construction and the largest supplier of traditional sawn timber in Europe.

Forest Business Unit, this business unit is mainly responsible for providing wood procurement services to Stora Enso's business units in Northern Europe and the Baltic region as well as external commercial customers (B2B customers). This business unit manages the group's forest assets in Sweden and a 41% stake in the Finnish company Tornator, whose forests are mainly distributed within Finland. The operations of this business unit are based on sustainable forest management, covering all aspects including forest planning, logistics and transportation, timber harvesting, and forest regeneration.

In 2024, the division's revenue was 2.827 billion euros, and its EBIT ranked first among all divisions, reaching 309 million euros. In terms of market position, Stora Enso is still one of the world's largest private forest owners.

Stora Enso China business, strategic stronghold and the challenge of turning losses around

From its sales regions, Europe is Stora Enso's largest market, contributing 69% of sales, followed by the Asia-Pacific region with 13%. North America and South America account for 4% and 1% respectively, while the remaining regions account for 13%. In terms of employee distribution, the Nordic region still has the highest number of employees, with Finland and Sweden accounting for 27% and 18% respectively. China ranks third, accounting for 12%, followed by Poland and the Czech Republic, which account for 10% and 6% respectively.

Regarding Stora Enso's situation in China, it has key capacities including consumer packaging paperboard (575,000 tons capacity at the Beihai plant), high-barrier coated paper (80,000 tons), and consumer packaging (annual capacity of 75 million square meters), as well as vast forest areas. Its main products cover consumer packaging paperboard, barrier paper, consumer packaging, and chemi-thermomechanical pulp, among others.

Currently, Stora Enso has 2340 employees in China (the total number of employees in 2023 was 2547), distributed across the following plants: Beihai plant with 430 people, Dongguan plant with 454 people, Qian'an plant with 459 people, and Wujin plant with 434 people.

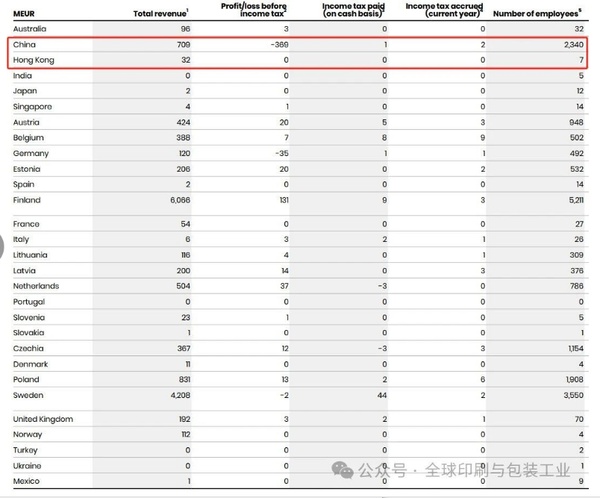

Adding Stora Enso's Hong Kong region, Stora Enso China generated a revenue of 741 million euros (approximately 5.83 billion yuan), ranking third among all countries. However, it is important to note that its pre-tax loss was as high as 369 million euros (approximately 2.9 billion yuan), making the China region the country with the highest losses under Stora Enso, which explains why the company had been considering selling its Beihai factory. In comparison, according to the 2023 annual report, Stora Enso China's revenue from non-related parties was 571 million euros, and the revenue from related parties in other tax jurisdictions was 31 million euros, with a pre-tax loss of 83 million euros.

Despite Stora Enso's revenue growth in China, its losses have increased significantly, and the number of employees has also declined. The impairment in the Packaging Materials division is mainly associated with the Beihai business, which directly reflects the challenges faced by operations in the Chinese market. The Chinese market continues to face a weak economic environment, which may be an important reason for Stora Enso's poor performance in China. Although there was previously an intention to sell the Beihai factory, Stora Enso ultimately decided to retain the business and forestry operations, believing that their internal use value exceeds the realizable transaction value. This decision indicates that Stora Enso may have confidence in the long-term potential of the Chinese market or believes that it can improve the profitability of its Chinese operations through internal optimization.

The top two in revenue are Finland and Sweden, at 6.066 billion euros and 4.208 billion euros, respectively. Finland's pre-tax profit is 131 million euros, while Sweden has a pre-tax loss of 2 million euros. In addition, the Netherlands also made a significant contribution to pre-tax profit, reaching 37 million euros. Geographically, Stora Enso's revenue and profits are mainly concentrated in the Nordic region, with Finland standing out in particular. Although the Chinese market contributes significantly to revenue, its massive losses have significantly weighed on the group's overall profitability.

It should be noted that the revenue referred to here is the total revenue obtained by entities within the jurisdiction from both domestic and foreign parties, excluding internal dividends. Pre-tax profit/loss is the total pre-tax profit or loss reported by group entities in the jurisdiction according to International Financial Reporting Standards. The reported amounts include temporary and permanent differences between accounting and taxation, such as tax-exempt dividends from other group companies, and therefore do not represent taxable income for tax calculations in the jurisdiction.

Stora Enso's production capacity for various products

Stora Enso's total production capacity for consumer packaging board is 3.57 million tons, including 0.575 million tons of annual production capacity from the Beihai factory in China. The Imatra factory has the highest capacity, reaching 1.23 million tons. The Skoghall factory's annual production capacity for consumer packaging board is 1 million tons. The Fors and Ingerois factories have capacities of 0.455 million tons and 0.31 million tons, respectively.

In addition, the newly built consumer packaging board production line at the Oulu mill has started to gradually increase its output. It is expected that the first batch of products will be delivered to customers in the second quarter of 2025. As early as 2022, Stora Enso had decided to convert the remaining idle paper machines at the Oulu mill into a highly flexible consumer packaging board production line. This production line will be used for producing folding boxboard and coated unbleached kraft, with an annual capacity of up to 750,000 tons.

The total capacity of corrugated board is 1.82 million tons, distributed in Heinola, Ostrów, Valkos, and Oulu, with capacities of 300,000 tons, 660,000 tons, 450,000 tons, and 410,000 tons, respectively.

The total production capacity of high-barrier coated paper is 655,000 tons, including 80,000 tons from the Beihai plant, 455,000 tons from the Imatra plant, and 120,000 tons from the Skoghall plant.

In China, Stora Enso's consumer packaging business is mainly distributed in Gaobu Town, Dongguan City, Qian'an City, Hebei Province, and Wujin District, Jiangsu Province, with annual capacities of 30 million square meters, 10 million square meters, and 35 million square meters, respectively, totaling an annual capacity of 75 million square meters.

The annual production capacity of the entire group's corrugated packaging business is 1.63 billion square meters. In comparison, the total output of corrugated boxes for Smurfit Kappa, the world's largest corrugated packaging giant, in 2024 is 18.99 billion square meters. The annual production capacity of 86 corrugated packaging plants under WestRock, the third-largest corrugated packaging company in the United States, is 6.224 billion square meters. The total designed annual production capacity of downstream corrugated packaging for Nine Dragons Paper is 2.86 billion square meters.

The biomass material division's chemical pulp capacity is 2.5 million tons, and the packaging material division's annual chemical pulp capacity is 2.71 million tons, with a total chemical pulp capacity reaching 5.21 million tons.

The annual production capacity of chemical thermomechanical pulp under the Packaging Materials Division is 960,000 tons, including 210,000 tons from the Beihai plant, and 220,000 tons, 220,000 tons, and 310,000 tons from the Fors plants, Kokkola plants, and Skoghall plants, respectively.

Overall, Stora Enso's performance in 2024 showed a clear polarization. The packaging materials and forest divisions performed strongly, contributing the main revenue and profits to the group. However, the packaging solutions and wood products divisions faced severe profitability challenges, with significant losses and asset impairments. It is particularly noteworthy that although Stora Enso's business in China generated considerable revenue, it suffered huge losses, becoming the weakest link in terms of profitability within the group. Despite this, Stora Enso did not abandon the Chinese market but instead chose to retain the Beihai factory, which may indicate an adjustment in its strategy for the Chinese market.

The group's strategic investment in the renewable packaging sector, such as the transformation of the Oulu mill and the acquisition of De Jong Packaging Group, is a key driver for its future growth. These initiatives align with the growing market demand for sustainable packaging solutions and are expected to bring new growth opportunities for Stora Enso in the future. However, the group also needs to address and resolve profitability issues in certain business units and specific regions (such as China) and effectively respond to challenges brought by the external market environment, such as demand fluctuations, economic downturns, and rising raw material costs. Overall, Stora Enso has demonstrated its strength in core business areas and strategic determination towards future sustainability in 2024, but improving overall profitability remains an important issue.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track