Shenma's Net Profit Plummets 78%! Due to This Material Not Selling

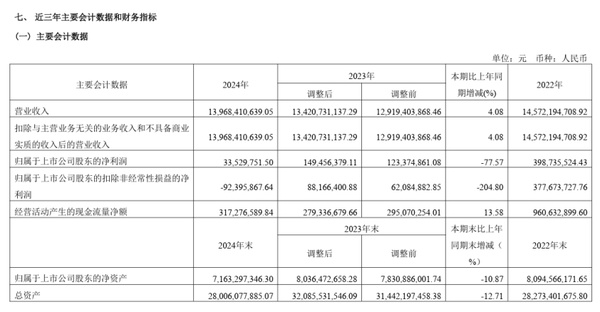

Recently, Shenma Co., Ltd. released its 2024 annual report, achieving a revenue of 13.968 billion yuan in 2024, with a year-on-year increase of 4.08%;Net profit attributable to parent company shareholders of 33.53 million yuan, a year-on-year decrease of 77.57%non-recurring net profit loss of 92.4 million yuan, turning from profit to loss year-on-year.

The annual report shows that the revenue of nylon 66 industrial yarn was 1.54 billion yuan (+3.45%), and the revenue of nylon 66 chip was 2.788 billion yuan (+4.70%), both maintaining growth, but the income of the chemical fiber weaving industry was 3.947 billion yuan (-5.18%).PC chemical industry revenue 4.93 billion yuan (-61.17%) significantly shrank, with bisphenol A revenue plummeting 95.65% to 0.31 billion yuan.

The financial report of Shenma revealed that the PC chemical industry is the main reason for its profit plunge. Bisphenol A, as an upstream raw material for producing PC, why did Shenma's bisphenol A revenue plummet? Is PC really unsalable? Next, Zhuan Su Shi Jie will analyze the current market situation of PC.

I. Shenma Group's PC Project Updates

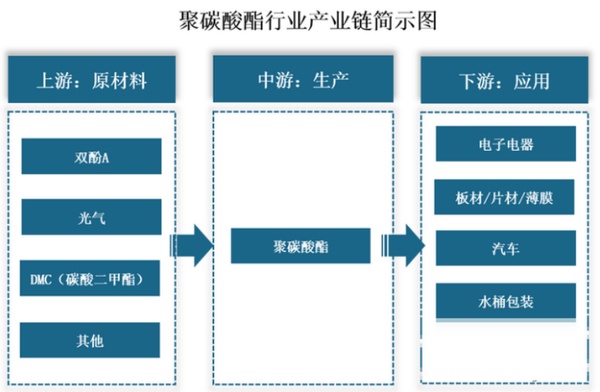

Shenma Group's polycarbonate material company PC project adopts the phosgene interfacial polycondensation process technology of the US KBR company, with a planned total production capacity of 400,000 tons. Among them, the first phase is a 100,000 tons/year PC project, accompanied by a 130,000 tons/year bisphenol A project. The total investment in the first phase of the project is 3.95 billion yuan, and it is a key provincial project. Construction began in March 2020, and in October 2021, the PC production line started debugging. On April 23, 2022, the first phase project completed all the process flows, taking a significant step towards stable production and quality improvement.

On June 12, 2024, Shenma Co., Ltd. held a board meeting and deliberated and approved numerous proposals, including the "Proposal on the Termination of Some Fund-Raising Investment Projects" and the "Proposal on the Capital Increase and Share Expansion of Subsidiaries and Related Party Transactions."

The name of the proposed fundraising project to be terminated is "240,000 tons/year Bisphenol A Project (Phase II)". The "240,000 tons/year Bisphenol A Project (Phase II)" plans to use ion exchange resin technology, with phenol and acetone as raw materials for catalytic condensation reaction to produce bisphenol A. After the completion of the project, it will add an annual production capacity of 240,000 tons of bisphenol A. Shenma currently has a Phase I Polycarbonate (PC) project and a matching Phase I Bisphenol A. Simply put, in 2024, the Shenma Group will terminate further investment in the PC project.

II. How will the PC supply and demand relationship be in 2024

In 2024, the global PC market supply and demand relationship is severely imbalanced, with prices fluctuating significantly. There is a serious oversupply in the global market, with a global production capacity of 8.24 million tons, while consumption is only 6.5 million tons, resulting in an overcapacity of 1.74 million tons.

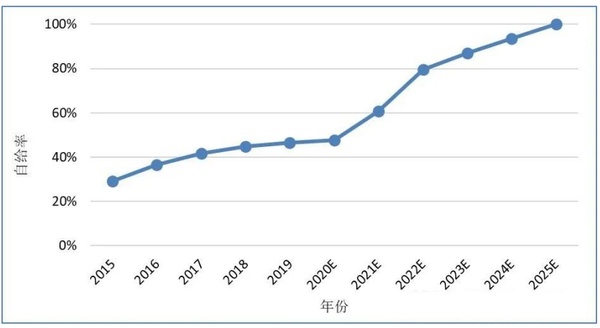

Domestic production capacity accounts for about 3.43 million tons, or 50% of global capacity, while domestic consumption is only around 3.35 million tons. The self-sufficiency rate for mid-to-low-end products exceeds 100%, leading to a relatively severe structural imbalance between supply and demand. In order to actively sell their products, major manufacturers have begun to export in large quantities to alleviate the current situation of domestic overcapacity.

However, the export data is not ideal, with a total of 354,200 tons exported from January to September, a year-on-year increase of 29.74%. The main export destinations are Southeast Asia, where the market competition is also very intense, leading to exports at low prices, further compressing our profit margins.

The PC market price in 2024 is "first rising then falling", from January to May due to the increase in the cost of raw material bisphenol A, the downstream market actively stocked up after the Spring Festival to welcome the peak season. The price of Lotte's 1100 grade product in East China rose from 14,300 yuan/ton in January to a high of 16,000 yuan/ton in May, an increase of 11.9%.

After the peak season from June to December, downstream demand decreased, and the industry's average operating rate continued to decline, reaching only 76%. In December, the price fell to its lowest in nearly four years, at 13,800 yuan/ton. The average price for the entire year of 24 was 14,932 yuan/ton, a year-on-year decrease of 4.05%.

The price of raw material bisphenol A gradually increased in the first half of the year (reaching 10,100 yuan/ton in April), and in the second half, there was a severe overcapacity of bisphenol A, leading to a significant drop in prices. This is because domestic PC facilities are equipped with bisphenol A facilities, resulting in a substantial dilution of profits along the industrial chain.

III. PC Industry Competitive Landscape and Profit Differentiation

In 2024-2025, China's new PC capacity is expected to be about 440,000 tons (Wanhua, Hengli, Zhangzhou Chi Mei, etc.), and the global capacity in 2025 is estimated to be 8.5 million tons, exacerbating the overcapacity rate.

Domestic production capacity accounts for over 50%, and many new projects are fully integrated with the entire industry chain (such as phenol ketone, BPA), with production costs as low as 11,000-12,000 yuan/ton, which theoretically should be lower than those of enterprises without raw material integration (costs 12,000-13,000 yuan/ton).

Under the premise that the price of bisphenol A does not significantly invert, companies with a complete industrial chain, such as Hengli, Zhejiang Petrochemical, and Shenma Group, can reduce costs to 11,000-12,000 yuan per ton by relying on self-sufficiency in raw materials like benzene and propylene.

Enterprises without supporting industrial chains will have slightly higher production costs, approximately 12,000-13,000 yuan/ton, with profit margins being squeezed, and some may be forced to reduce production or exit.

Compared to Europe and America, domestic gasoline has a full industrial chain advantage, with a clear cost advantage from pure benzene to the complete layout of PC, while European and American companies mostly only have bisphenol A facilities, showing a significant cost disadvantage.

end of the article

Although China's PC production capacity self-sufficiency rate is relatively high, it mainly focuses on the mid-to-low end market, where competition is extremely fierce, a red ocean within a red ocean. Whether in 2024 or 2025, the capacity for general-grade PCs will be in a state of severe oversupply, with prices approaching the cost line. In terms of high-end products, China still relies heavily on imports, especially for optical and medical-grade PCs, which are almost entirely supplied from abroad. Therefore, domestic companies must accelerate their technological breakthroughs, such as the mass production of optical-grade PCs by companies like Wanhua, to expand the space for future import substitution. Breaking the dependence on imported high-end products will become the key for domestic PC companies to break through in the coming years.

Source: Shenhua Group Official Website, Chemical Industry Association, Chemical New Materials

Editor: Shi Shenbing

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track