Selling 3 billion in a year, soaring 120% at the opening, supplying to Luckin Coffee, HEYTEA, and Mixue Ice City

In today's market, new coffee and tea beverage brands are fiercely competing in the 9.9 yuan low-price competition, while behind this, related suppliers are quietly welcoming development opportunities and have successfully gone public one after another. Just like during the gold rush, the people selling shovels eventually became beneficiaries, and even joined the gold mining themselves.

On March 19, "Hengxin Life", which focuses on the research and development and production of paper and plastic tableware, made its initial public offering (IPO) on the Shenzhen Stock Exchange's ChiNext board. After the opening, its stock price once soared by over 120%, reaching 88 yuan. However, as of the time of publication, the stock price had fallen back to 74.02 yuan, with a total market value of 7.55 billion yuan.

From the prospectus, it is known that the core business of Hengxin Life is the research, production, and sales of paper and plastic tableware, mainly using raw paper, PLA particles, traditional plastic particles, etc., as raw materials. In the field of biodegradable tableware, the company holds a significant advantage and has been rated as a national specialized, refined, unique, and new "little giant" enterprise.

Looking at the customer list of Hengxin Life is like being in an afternoon tea ordering scene: Luckin Coffee, Heytea, Starbucks, Yihetang, McDonald's, Dicos, Mixue Bingcheng, Manner Coffee, Burger King, Coco, Guming, DQ, and many other well-known brands are all included.

For a long time, Hengxin Life has supplied packaging products such as cups, lids, and straws to the giants in the tea, coffee, and fast-food industries. According to the prospectus data, it can sell nearly 3 billion paper cups and over 2.2 billion cup lids in a year, with annual revenue reaching 1.4 billion yuan and net profit exceeding 200 million yuan.

The rapid development of the new tea beverage industry has prompted a batch of supply chain companies to thrive. Areas that were once overlooked have now gathered many industry "giants." In addition to Hengxin Life, Jialian Technology, which provides cups for IKEA and Mixue Bingcheng, successfully went public in 2021; Nanwang Technology, a supplier for Hualaishi, entered the capital market in June 2023; Fuling Shares, which supplies paper cups to KFC and Chabaibao, also listed on the Shenzhen Stock Exchange on January 23, 2025.

With the rise of new tea beverages, a new era of consumption has arrived. Supply chain companies have achieved survival of the fittest through continuous iteration, gradually transforming from past workshop-style operations to modern business models, and optimizing production processes according to the needs of industry upgrades. However, as the tide rises, it also means a dependence on the "water" (i.e., the industry environment).

As early as 2022, Hengxin Life submitted its prospectus for the first time. During the long wait, the Shenzhen Stock Exchange had paid particular attention to its customer-related issues. In recent years, the growth rate of the new-style tea beverage industry has gradually slowed down, with Luckin Coffee and Nayuki both experiencing losses. The Shenzhen Stock Exchange asked Hengxin Life to analyze and explain, in conjunction with the operating conditions of its customers and the prosperity of downstream sub-industries, whether the growth in domestic sales revenue is sustainable.

For Hengxin Life, to reduce its dependence on major clients, it needs to adjust the proportion of customer structure while expanding revenue scale. The most direct way is undoubtedly to expand more customer resources, but the highly competitive coffee and tea beverage market is not friendly to new brands. In this track characterized by "high volume, low margin", what advantages should Hengxin Life rely on to achieve further development?

Vocational school teacher entrepreneurship, riding the two major trends

In 1997, at the age of 34, Yan Deping stood at a crossroads in his career and began to redraw the blueprint for his future.

At that time, as a teacher at Hefei Forestry Vocational and Technical School, he had been silently dedicating himself to this honorable position for 11 years after obtaining the enviable "iron rice bowl" upon graduating from his undergraduate studies at the age of 23. Facing piles of papers and endless grading every day, his life was uneventful, and the focus in his eyes gradually became lax towards these papers. At that time, the "business tide" in society was surging, and Huizhou merchants once again stood bravely at the forefront of the times. Influenced by the surrounding environment, Yan Deping developed a strong impulse within him; he yearned to bid farewell to the stable campus life and embrace new challenges.

Once determined, Yan Deping acted swiftly. He and his wife Fan Yanru embarked on an entrepreneurial journey together, founding a family business called Hengxin Printing. The inspiration for entrepreneurship often stems from fleeting moments in past experiences. Due to his long-term involvement in education, Yan Deping was most familiar with paper, and he keenly observed that paper could not only be used for printing test papers but also for various other materials. In the wave of the market economy, every startup is a significant force in stirring up ripples. At the time, the demand for commercial printing surged like bamboo shoots after rain, and Yan Deping decisively seized this business opportunity, focusing on the printing of corporate promotional brochures and other materials, much like opening a B2B print shop before printers became standard equipment in companies.

Hengxin Printing adheres to the business strategy of earning slim profits in others' large businesses and driving revenue growth through the continuous accumulation of order quantities. This model has not only become the consistent business approach for Hengxin as it moved from the printing field to the tableware industry, but it is also a common "business wisdom" for many entrepreneurs starting from scratch and venturing into the business world.

However, the path of entrepreneurship is fraught with thorns, and its difficulty far exceeds imagination. In the early stages of starting a business, Yan Deping and Fan Yanru took on multiple roles; they were both the CEOs overseeing the overall situation and the CFOs controlling finances; they had to undertake the creative work of designers as well as serve as frontline printing workers, and even had to run around to expand their business, truly embodying the standard "slash youth." To save money, they could only purchase second-hand equipment and then invested a great deal of effort in debugging and maintaining it, all just to ensure that the printing quality met the standards. At the same time, they tirelessly traveled to various places to actively develop corporate customer resources. Fortunately, through relentless efforts, corporate customers helped Hengxin Printing accumulate its first pot of gold in the fiercely competitive printing market.

After gradually establishing a foothold in the printing market, Yan Deping, with his keen business acumen, noticed many drawbacks in the printing service industry, such as low entry barriers, exceptionally fierce competition, and high market saturation. Thus, he began to deeply contemplate the future transformation direction of the enterprise, with the diverse uses of paper still being the key starting point for exploring the path of transformation.

In 2000, Yan Deping accurately captured the potential opportunities brought about by the booming catering market. At that time, the disposable tableware model introduced by foreign fast-food brands was rapidly spreading from small restaurants to street food stalls, and the takeout industry was just beginning to emerge. The market demand for paper products used in catering, such as paper cups, cup lids, food trays, and meal boxes, surged sharply. Seizing this opportunity, Hengxin decisively adjusted its main business direction, shifting from pure printing services to the production of paper cups, and specially set up a paper cup production line, becoming one of the earlier domestic companies to apply flexographic printing technology to paper cup production. Flexographic printing uses non-toxic and harmless water-based inks and is known as "the most environmentally friendly printing process," also called "green printing." Moreover, this technology excels in medium adaptability and application scope, covering almost all paper and plastic packaging products, in addition to traditional newspaper, book, and magazine printing fields.

The path of enterprise transformation is by no means smooth, involving multiple complex aspects such as updating production equipment, upgrading technical processes, and adjusting the employee structure. However, efforts eventually pay off. The successful commissioning of the paper cup production line not only allowed Hengxin to lay out its environmental protection track in advance but also helped it successfully achieve a splendid transformation from the printing service industry to product manufacturing.

On June 1, 2008, the highly anticipated "plastic restriction order" was officially implemented, clearly stipulating that all shopping malls, supermarkets, and other retail venues are prohibited from providing plastic shopping bags for free. Thereafter, various plastic alternatives welcomed development opportunities, and Hengxin Printing also followed the trend, consciously exploring and advancing in the new direction of biodegradable plastics. However, it should be noted that at the time, the domestic plastic restriction order focused only on the category of "plastic shopping bags," while Hengxin Life's main business was eco-friendly tableware, and did not gain significant "industry benefits" from this policy. For a considerable period, the company's revenue mainly relied on export business, with customers mostly being well-known international brands such as Starbucks, McDonald's, Dicos, Burger King, and DQ.

Until 2019, the domestic new tea and coffee industry experienced explosive growth, and Hengxin's customer structure underwent a significant transformation. In that year, Luckin Coffee became its new customer. In 2020, Luckin Coffee contributed 26.5 million yuan in sales to Hengxin, and by 2021, this figure soared to 83.19 million yuan, making it Hengxin's largest customer. Meanwhile, starting from 2020, many well-known domestic tea and coffee brands such as Heytea, Manner Coffee, Yihetang, Guming, Mixue Bingcheng, and Coco Cola Tea also gradually established partnerships with Hengxin.

In January 2020, our country further upgraded its plastic control policies, shifting from "restricting plastics" to a full "plastic ban." The policy clearly requires that by 2020, some regions and fields should take the lead in banning and restricting the production, sale, and use of certain plastic products; by 2025, the consumption intensity of non-degradable disposable plastic tableware in the catering takeaway sector in cities above the prefecture level needs to decrease by 30%. Since the implementation of the "plastic restriction order" in 2008, the model of charging for plastic bags at retail locations has been widely accepted by consumers, which presents new challenges for the advancement of environmental protection efforts and also prompts the extension of the plastic restriction order's control scope to the use of tableware. For a time, the demand for PLA material tableware from catering enterprises surged dramatically.

In 2021, Hengxin Printing officially changed its name to Hengxin Life, focusing entirely on the biodegradable plastic products sector, with its product range expanding to include cup lids, cup sleeves, cutlery, straws, stirrers, and various dining utensils. In that year, Hengxin Life sold 1.88 billion paper cups, 1.22 billion cup lids, and nearly 230 million plastic cups. Notably, in 2021, the company's domestic sales revenue increased by 171.1% year-over-year, significantly outpacing the 25.1% growth in overseas sales revenue, and the proportion of domestic sales revenue rose rapidly from 21.1% in 2019 to 47.2%.

This enterprise, founded in 1997, after more than 20 years of arduous exploration and relentless efforts, finally ushered in a period of accelerated development in 2019. Riding the strong winds of new consumption and green economy, it has been racing all the way to the doorstep of the Shenzhen Stock Exchange, about to open a brand new chapter of development.

However, Hengxin Life's path to listing was not smooth.

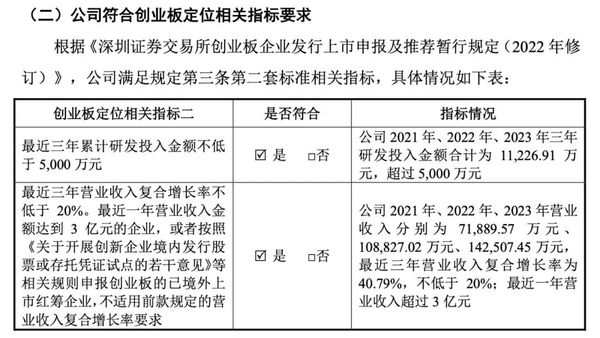

In May 2022, Hengxin Life first submitted its prospectus, and it has been nearly three years since then for a smooth IPO. In two rounds of inquiries, the Shenzhen Stock Exchange expressed concern about Hengxin Life's ChiNext positioning, industry and policy impact, revenue and customers, share payments, period expenses, and inventory issues.

Especially for the first question, the Shenzhen Stock Exchange requires Hengxin Life to explain, in combination with the innovativeness and advancement of technology as well as the growth potential of biodegradable products, whether the company meets the positioning of the Growth Enterprise Market.

In the latest prospectus, Hengxin Life emphasizes its innovative attributes, level of intelligence, environmental positioning, and the degree of alignment with the Growth Enterprise Market positioning over a large portion, with terms such as "innovation," "creation," and "creativity" appearing much more frequently than "client daddies."

Image source: Hengxin Life prospectus

The first-mover advantage of Hengxin Life can be summarized as one point: mastery of the modification, coating, and molding technology of PLA-based biodegradable materials, with strong R&D capabilities for new biodegradable tableware products, enabling effective application of low-carbon materials in the disposable tableware market.

PLA, or polylactic acid, is a polymer with lactic acid as the main raw material, and its most significant feature is biodegradability.

Hengxin Life mentioned that in 2008, it independently completed the research and development and production of PLA-coated paper cups, becoming one of the earliest companies in China to produce and sell PLA-coated paper cups on a large scale. Since then, the production and sales of biodegradable PLA-coated paper cups have gradually increased, becoming the company's flagship product.

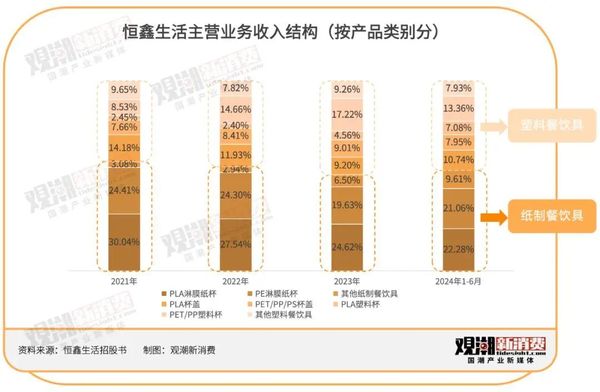

The prospectus shows that, classified by biodegradability, Hengxin Life's products are divided into biodegradable tableware and non-biodegradable tableware. In 2021, 2022, 2023, and the first half of 2024 (hereinafter referred to as the "reporting period"), the revenue share of biodegradable products was 59.2%, 52.6%, 54.0%, and 57.6%, respectively.

In other words, Hengxin Life had a very early first-mover advantage in the industry, but looking at the revenue composition, the revenue share of biodegradable tableware has never exceeded 60%.

By product category, Hengxin Life's products are mainly divided into paper tableware and plastic tableware, with the current revenue share of both being equal.

From the perspective of sales regions, Hengxin Life's product sales cover two major segments: domestic sales and overseas sales. During the reporting period, the proportion of Hengxin Life's domestic sales business showed a year-on-year increasing trend, rising steadily from an initial 47% to 59%. This significant change is mainly attributed to the rapid development of the domestic new-style tea beverage industry, with the market size continuously expanding, creating a broad domestic sales market space for Hengxin Life.

In detail, during the period from 2021 to 2023, Hengxin Life's sales revenue from freshly ground coffee and new-style tea beverage customers achieved a compound growth rate as high as 81%, with an extremely strong growth momentum. However, entering 2024, there were signs of a slowdown in the overall income growth rate of the national catering industry. Affected by this macro environment, Hengxin Life's year-on-year sales revenue growth from freshly ground coffee and new-style tea beverage customers was only 15%, a significant slowdown, clearly reflecting the impact of the overall industry trend on the company's sales performance.

As the number of domestic customers continues to grow, and the scale of customer businesses keeps expanding, Hengxin Life's revenue has also steadily increased. It is noteworthy that Hengxin Life's own gross profit margin is quite considerable, even surpassing that of many customer enterprises.

Looking back at 2021-2023, Hengxin Life's comprehensive gross profit margin was 27.21%, 28.12%, 28.63%, and 27.27% respectively. If transportation and packaging costs are excluded from the cost of main business, its gross profit margin reached 36.17%, 36.48%, 36.35%, and 35.09% respectively. During the same period, Mixue Bingcheng's gross profit margin was 31.3%, 28.3%, and 29.5% respectively. In comparison, Fuling Shares, a peer that went public slightly earlier than Hengxin Life, had a comprehensive gross profit margin of 18.07%, 22.30%, and 24.92% during the same period. It can be seen that Hengxin Life has a significant advantage in terms of gross profit margin.

However, as the competition in the new-style tea and coffee industry becomes increasingly fierce, although there is a certain lag, it gradually affects the supply chain companies. Starting from 2024, Hengxin Life's gross profit margin has experienced a certain degree of decline. Regarding this phenomenon, Hengxin Life explained that the main reason is that since the second half of 2023, after negotiations with major customers, they unanimously agreed to lower the unit sales price of the products.

Despite the immense pressure from price wars and the challenging business environment for leading brands, Hengxin Life's cup sales business has maintained a steady and profitable trend.

While the product unit price is declining, the pace of customer growth for Hengxin Life is also gradually slowing down. Hengxin Life pointed out in its prospectus that since 2024, the overall growth rate of national catering industry revenue has slowed down, and the growth rate of new store numbers and sales scale for some of the company's major customers has also decreased. As a result, the company's sales revenue from freshly ground coffee and new-style tea beverage customers has only increased by 15.36% compared to the same period last year, indicating a significant slowdown in the growth trend.

During the reporting period, the sales revenue from freshly ground coffee and new-style tea beverage customers of Hengxin Life totaled 198 million yuan, 352 million yuan, 651 million yuan, and 323 million yuan, respectively, accounting for 28.45%, 33.41%, 46.65%, and 45.04% of the main business income in sequence.

Among them, Luckin Coffee has consistently held the position of Hengxin Life's largest customer, and the revenue amount from Luckin Coffee and its proportion have shown an increasing trend year by year. During the reporting period, the revenues from Luckin Coffee were 83.193 million yuan, 148 million yuan, 227 million yuan, and 121 million yuan, accounting for 11.57%, 13.61%, 15.59%, and 16.49% respectively.

Hengxin Life's product pricing is relatively low. According to the prospectus data, in the first half of 2024, the wholesale price range for its main products such as cup lids and cups was between 0.08 yuan and 0.57 yuan.

Even though the product price is only a few cents or even a few fractions of a cent, with a massive sales volume, Hengxin Life successfully built a large-scale business. For the entire year of 2023, Hengxin Life sold 2.97 billion paper cups, 2.22 billion cup lids, and 950 million plastic cups.

Hengxin Life expects that in 2024, the company's revenue and profit will reach a new level. Revenue is expected to reach 1.52 billion to 1.6 billion yuan, an increase of 6.66% to 12.27% compared to the same period last year; net profit is expected to be 213 million to 220 million yuan, an increase of 0.63% to 3.93% compared to the same period last year.

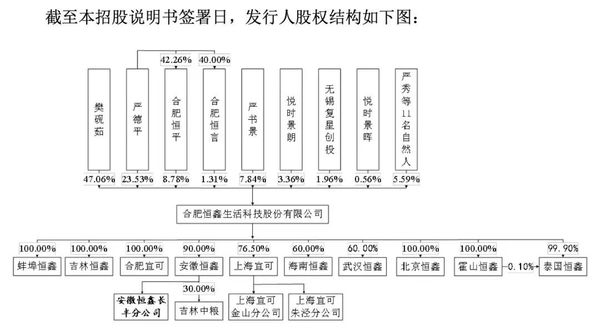

Although there are many large clients, the equity structure of Hengxin Life is relatively concentrated, making it a typical family business.

Image source: Hengxin Life prospectus

Before the IPO, the actual controllers of Hengxin Life were Fan Yanru, Yan Deping, and their daughter Yan Shujing. The three held 47.06%, 23.53%, and 7.84% of the shares respectively, collectively holding 78.43% of the company's shares directly and controlling 88.52% of the voting rights.

if the customer becomes a peer

Low unit price, high sales volume, high revenue, high gross profit, the key to the smooth operation of this chain is the mothership that connects customers, capturing their needs.

Since 2021, Luckin has been the largest customer of Hengxin Life. Xicha rose to the second place from the third in 2022 and has maintained that position since then. In the first half of 2024, the top five customers of Hengxin Life were Luckin Coffee, Xingmi Technology (a wholly-owned subsidiary of Xicha), Biopak Pty, Staples, and Sichuan Chaji (Bawang Chaji). These top five customers together accounted for over 40% of Hengxin Life's revenue.

From another perspective, on the list of new-style tea and coffee brands that consistently rank at the top in terms of sales volume, Luckin, Mixue Ice City, Gu Ming, and Ba Wang Tea Ji are all clients of Hengxin Life.

When it comes to the ability to match customer needs, it has to circle back to "innovation".

In fact, not all paper tableware are environmentally friendly products. For example, paper cups, their waterproof coating materials are mainly PE (polyethylene) and PP (polypropylene), and both are difficult to degrade, causing harm to the environment.

As a pioneer in paper tableware, Hengxin Life independently developed and customized a degradable PLA coating production line after the "plastic restriction order," becoming one of the earlier companies in China with the capability to produce PLA paper cups. In its prospectus, Hengxin Life summarizes these advantages into three points — technical barriers, customer barriers, and financial barriers, with technology placed at the top.

A description of innovation capabilities over 3,000 characters long is like a thematic essay, with only one core idea: due to the special nature of the material, the biodegradable material PLA has extremely high requirements for processing precision, and there is a technological gap between PLA material and PLA products.

Capital barriers refer to the need for tableware suppliers to have substantial financial support in terms of asset acquisition and technology research and development, which is still a specific manifestation of first-mover advantage.

Customer barriers are more direct, referring to when customers propose procurement needs, they will prioritize proposing procurement needs to suppliers within the list of qualified suppliers. Generally, a relatively stable cooperative relationship is formed between both parties, with strong customer stickiness.

However, another important meaning of customer advantage is that it only counts as an advantage if the customer has the upper hand, with the customer steering the direction of this fleet.

Despite Hengxin Life explicitly stating that "there is no severe dependence on a few customers," it also frankly admits that if future competition in the downstream freshly ground coffee and new-style tea beverage industries intensifies, and growth further slows down, leading to a decrease in demand from the company's main customers, and if the company fails to timely develop new customers or products, this could result in a decline in sales revenue from freshly ground coffee and new-style tea beverages, thereby adversely affecting the company's operating performance.

The prospectus shows that from 2021 to 2023, benefiting from the rapid development of industries such as freshly ground coffee and new-style tea drinks, the demand for orders of Hengxin Life's cups and straws increased, with a compound growth rate of 81.30% in related product sales, and the capacity utilization rate increased from 77.64% to 98.46%.

Since 2024, the domestic new-style tea and coffee industry has entered a stage of inventory competition. The strategy of densely opening stores has begun to reflect on the books, which is not a good omen for this industry that is stepping towards the capital market. Thus, the entire industry has entered a track of low-speed growth, demand segmentation, and supply differentiation. The changes in the tea and coffee market and the supply chain are merely misaligned rather than disconnected. Ultimately, any fluctuations in front-end brands will still be reflected in the supply chain market.

As the growth rate of new store openings and sales scale for major customers slowed down, the year-on-year growth in related product sales revenue for Hengxin Life also slowed to 15.36%, with capacity utilization falling back to 92.19%. From July to September 2024, the company's comprehensive gross profit margin decreased by 1.32% compared to the same period last year.

At the same time, the fierce competition in the new tea and coffee market is also driving another change, with brands beginning to secretly lay out plans upstream, snatching the "rice bowls" of suppliers.

For example, Mixue Bingcheng is positioning itself as a "super supplier," having established a "super supply chain" in China consisting of 5 production bases and a warehousing and logistics system, with 66% of its IPO funds allocated to supply chain construction. In contrast, Mixue Bingcheng, which was the fourth largest customer of Hengxin Life in 2023, no longer appears in the latter's top five customer list for 2024.

For supply chain companies, technology is the link between customers and capital, and it is also the key factor to escape the quagmire of price wars. The accumulation of technological barriers requires many years, and the demand for modern development has led supply chain companies to come to the door of the capital market. This includes upgrading capacity, production, and technology to form a moat of scale effect.

As more and more customers become competitors, the final battle in the new-style tea and coffee market will be a war of supply chains. The focus of competition has shifted forward, and various supply chain companies are rushing towards IPOs, all shouting the same slogan—capacity, capacity, and more capacity.

The total amount of funds planned to be raised by Hengxin Life this time is 828 million yuan, and most of the funds will be invested in projects related to expanding production capacity, including the construction of a smart factory for the annual production of 30,000 tons of PLA compostable green and environmentally friendly bioproducts, upgrading the existing production and warehousing logistics systems, and improving the processes and recycling methods of PLA products.

concluding remarks

"New consumption" has become a topic that more and more industries are reluctant to mention, but the dividends generated by the transformation of the consumer industry have finally, albeit belatedly, been distributed among a batch of industries. From scattered and poorly managed small workshops to modern listed companies, the green transformation of the supply chain is the foundation for growth at the brand level. The "friend circle" of new tea beverages has added a listed company, and its impact will also be fed back to the consumer side through a long chain from the supply end.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track