Sanctions Lift Shockwave: Lifting the Ban on Russian Crude Oil Could Trigger a Global Oil Price Plunge of $15

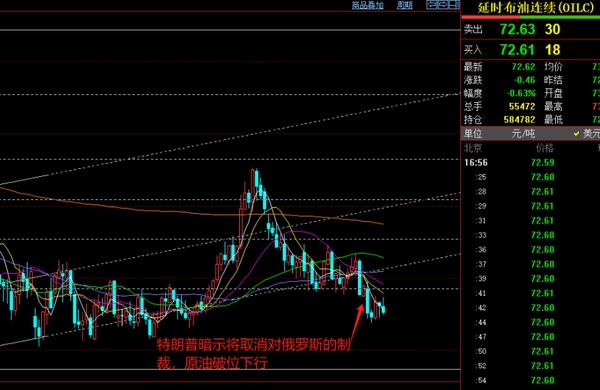

On February 26, US President Trump pointed out to reporters in the Oval Office when asked whether Washington would lift anti-Russian sanctions:

As a result, Brent crude broke through its support level, completely breaking the bottom of the range it had been operating in since the end of last year.

So, if the Western allies led by the United States fully lift the oil sanctions on Russia, what impact would this have on the international crude oil market? In March 2024, the Federal Reserve Bank of Dallas published a report - "The Impact of the 2022 Oil Embargo and Price Cap on Russian Oil Prices," which mentioned that the oil embargo forced Russia to accept a $32 per barrel discount in March 2023, with nearly half due to increased transportation costs, and the other half attributed to enhanced bargaining power from India and China. The impact of the price cap on Russian oil export prices was minimal, especially after allowing the use of Western shipping services.

Under the current comprehensive sanctions imposed by Western allies on Russian crude: Russia's crude exports still remain at a high level of about 5 million barrels per day, but are sold to the Asian market at a deep discount (Ural crude is priced $8-12 per barrel lower than Brent). Meanwhile, the global crude oil market is in a state of tight supply-demand balance, with Brent oil prices fluctuating around a central point of $80 per barrel, within a range of ±$5 per barrel.

Once the EU, G7, and other Western allies fully lift the oil embargo and price cap policies on Russia, restoring free access for Russian crude to the international market, the international crude oil market will first be hit by a supply-side shock: Russia could quickly resume crude exports to Europe (before the sanctions, Europe imported about 2.5 million barrels per day), and combined with existing exports from the Middle East, the daily global crude supply could increase by 1-1.5 million barrels.

If OPEC+ does not take measures to cut production, international oil prices could fall by $10-15 per barrel. For example, the central price of Brent crude might drop to $70, with a fluctuation range of ±$5 per barrel.

The regional markets would then undergo a rebalancing process: during this phase, European demand would first shift, as European refineries would repurchase Russian Ural crude, reducing their dependence on the Middle East (such as Saudi Arabia and Iraq) and U.S. shale oil.

At the same time, Asian oil prices would face a narrowing discount: the bargaining power of buyers like India and China would weaken, and the discount on Russian crude could narrow from $8-12 to $3-5, with ESPO crude prices approaching international levels.

In addition, energy logistics and costs would also be restructured: once European ports reopen to Russia and routes are restored, the average transport distance for Russian crude would be significantly shortened, such as from the Baltic Sea to Europe taking only 3-5 days, compared to 20 days to India; transport costs would decrease by about $5-8 per barrel, greatly improving efficiency.

Moreover, the "shadow tanker fleet" that relies 70% on non-Western insurance might return to the regular market, increasing nominal capacity and lowering the cost of trade friction.

If Russia can maintain an export volume above 5 million barrels per day, it may again become the largest crude supplier to Europe (accounting for over 30%), while squeezing out North Sea and West African crude.

The greatest impact might be an intensification of internal competition within OPEC+—to protect market share, Saudi Arabia might be forced to further cut production to stabilize oil prices or adopt more aggressive measures—restarting a price war with Russia. Regardless of the approach, the cooperation agreement between Russia and OPEC would face pressure for renegotiation.

In summary, the return of Russian crude to the mainstream market would help stabilize the global crude supply chain, reduce geopolitical risk premiums, and lower the volatility of international oil prices from the current 20% to the historical average of 12-15%.

For the plastics industry, if Russian crude returns to the international market, Brent crude prices might fall by $10-15 per barrel (in the short term), and naphtha prices would decline in tandem (by about $80-120 per ton). Using PE (polyethylene) as an example to calculate costs (assuming crude accounts for 50% of costs, and a 15% drop in oil prices): PE production costs could decrease by 7.5%, expanding corporate profit margins.

For intercontinental trade:

Europe: With the resumption of direct Russian oil supplies, the landed price of naphtha could decrease by 10%-15%, stimulating the restart of old cracking units in Europe (such as BASF and INEOS plants). Ethylene capacity utilization could rise from 70% to over 85%, increasing PE/PP supply and creating a more relaxed supply-demand situation in the region.

Asia: As the discount on Russian oil narrows (from $8-12 to $3-5), the cost of naphtha in Asia might slightly increase, but the overall decrease in global oil prices would still bring net benefits. However, large private refining projects in China (such as Hengli Petrochemical and Rongsheng Petrochemical), which rely on cheap Russian oil, would see their cost advantage diminish, narrowing the price gap with imports from the Middle East (Saudi Aramco) and North America (Dow Chemical).

North America: Ethane prices, which are decoupled from crude, would see a relatively weakened low-cost advantage, though the impact would be limited. The competitiveness of North American ethane derivatives (such as LLDPE) in the European export market would decrease.

Changes in trade flows: Europe would reduce imports of ethylene monomers from the Middle East, and Asian exporters (such as Lotte Chemical) might turn to Southeast Asian markets.

In terms of prices, the transmission of falling crude prices to the end prices of plastic products generally lags by 3-6 months. Therefore, intermediaries (traders, processors) might stockpile low-cost raw materials in the short term, leading to longer inventory cycles. If the market expects further declines in oil prices, midstream dealers might delay purchases, causing "inventory reduction" pressure and exacerbating short-term price volatility.

The decrease in raw material costs would significantly benefit integrated leaders (such as SABIC and Sinopec), while smaller companies relying on spot purchases might face pressure due to increased price volatility.

In summary, after lifting sanctions on Russian energy, the market would benefit from lower raw material costs in the short term, improving the profitability of plastics companies. However, in the long term, the recovery of European capacity would lead to increased competition with Asian petrochemical products, and the industry should be wary of the risk of structural oversupply.

Author: Gao Xing, Senior Market Analysis Expert at Plastics Vision

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track