Regenerated Plastic vs. Bioplastic: Which Will Dominate the Sustainable Automotive Future?

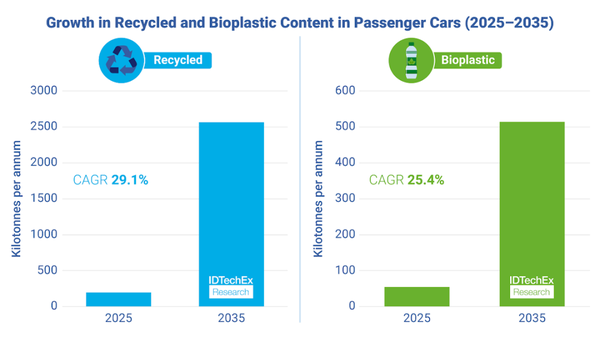

By 2035, the amount of recycled plastic used in cars reached 2.567 million tons, and the amount of bioplastic reached 513,000 tons.

In the global wave of sustainable transformation in the automotive industry, the environmental friendliness of plastic materials has become a key challenge. The high carbon emissions, resource dependency, and recycling difficulties of traditional fossil-based plastics are prompting automakers to seek alternatives. The latest report from IDTechEx, "Sustainable Plastics in Automotive 2025-2035: Markets, Players, and Forecasts," indicates that recycled plastics and bioplastics will become the two core directions in the next decade, but their development paths and market potentials show significant differences.

I. Sustainability Challenges of Automotive Plastics

The automotive industry consumes over 14 million tons of plastics annually, primarily derived from fossil fuels, leading to a high carbon footprint and dependence on the volatility of the oil market. Mandatory policies in regions like the EU, such as the requirement for vehicles to contain 25% recycled plastics by 2025, along with carbon tax pressures, are compelling automakers to accelerate the transition to sustainable materials.

However, the promotion of sustainable plastics faces multiple obstacles:

Material Performance and Cost: The recycling of complex polymers and composites is difficult, and the supply chain for bioplastics is immature and costly.

Application Scenario Differences: Single materials (such as polypropylene interiors) are relatively easy to recycle, while the recycling of special components (such as composite materials) still faces technical bottlenecks.

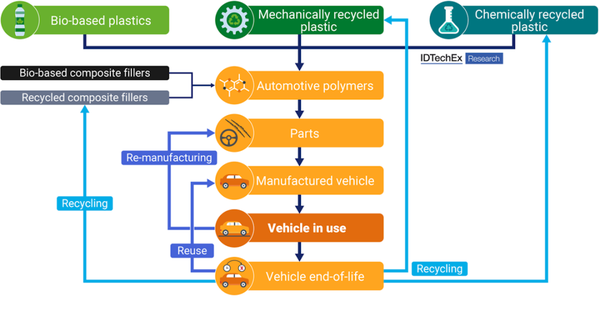

Automotive Plastic Circular Economy

Growth in Recycled and Bioplastic Content in Passenger Vehicles (2025-2035)

II. Recycled Plastics: The "Practical Choice" Dominating in the Short Term

Mechanical recycling is currently the most mature solution, achieving plastic circularity through crushing, melting, and remolding without altering the chemical structure. Its advantages include:

Policy-driven: EU regulations directly promote the application of mechanically recycled plastics.

Cost and Infrastructure: The existing recycling system supports its rapid implementation, and some automakers have already adopted recycled polypropylene in components such as seats and dashboards.

Chemical recycling breaks down plastics into monomers or raw materials, restoring material properties, but the technology is still in its early stages, with high costs and limited scalability. The report predicts that the global use of recycled plastics in automobiles will grow at a compound annual growth rate (CAGR) of 29.1% from 2025 to 2035, reaching 2.567 million tons by 2035, making it the short-term mainstream solution.

III. Bioplastics: Potential and Challenges Coexist

Bioplastics, made from renewable biomass such as plants and algae, theoretically reduce fossil fuel dependence. However, their development is currently limited by:

Supply chain bottlenecks: Limited production of bio-based polymers (such as bio-polypropylene and bio-polyamides), potential land competition arising from dependence on agricultural resources.

Cost disadvantage: The production cost of bioplastics is 30%-50% higher than that of conventional plastics, and they are only used in small quantities in high-end interiors (such as bio-based leather).

The report predicts that the global use of bioplastics in automobiles will grow at a CAGR of 25.1%, but by 2035, it will only account for 18% of the total automotive plastics, with usage reaching 513,000 tons, far below the sustainability targets set by automakers.

Four, industry pain points and breakthrough directions

Although the prospects for recycled plastics and bioplastics are promising, the industry still needs to address the following issues:

Technological Innovation: Develop recycling technologies suitable for complex components to enhance the durability and cost competitiveness of bioplastics.

Policy coordination: Strengthen global regulatory consistency and promote investment in circular economy infrastructure (such as chemical recycling plants).

Supply chain collaboration: automobile companies need to work with material suppliers and recycling companies to optimize the full lifecycle management from production to disposal.

Five, Future Outlook

IDTechEx predicts that by 2035, sustainable plastics will account for only 18% of the total automotive plastics, indicating that the industry needs to accelerate its transformation. In the short term, recycled plastics will dominate the market due to policy support and mature technology; in the long term, bioplastics, if they overcome technical and cost barriers, may complement recycled materials. Additionally, sustainable composite materials, tire innovations (such as bio-based elastomers, self-healing materials), and circular economy models (such as mono-material design) will also become important directions.

Conclusion

Regenerative plastics are a "must-have" for achieving sustainability goals today, while bioplastics are the "promising contenders" for a long-term low-carbon vision. Automakers need to take a multi-pronged approach by complying with policies, innovating technologically, and integrating supply chains, while also exploring diverse solutions (such as recyclable composites and bio-based alternatives) to achieve deeper sustainable transformation by the 2030s.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track