【PP Weekly Review】The market showed slight recovery this week, and a warm consolidation is expected next week.

1、Market Review: This week the market saw a slight recovery, with prices moving up slightly.

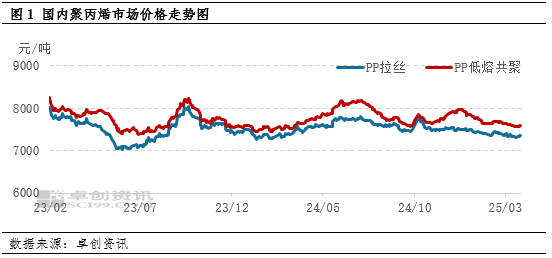

The domestic PP market showed a slight rebound this week, with prices edging slightly higher.As of this Thursday, the weekly average price of华东拉丝 (East China drawing wire) was 7351 yuan per ton, an increase of 28 yuan per ton compared to the previous week, with a growth rate of 0.38%. It has turned from a decline to an increase compared to the previous week. The regional price spread of the drawing wire has not changed much. In terms of product types, the price difference between drawing wire and low-melt copolymer has narrowed slightly. High inventory pressure at the front end of the low-melt copolymer market exerts some downward pressure on its price, resulting in a smaller increase compared to the drawing wire this week, thus narrowing the price difference between the two.

Table 1: This Week's Domestic Market Price Assessment for Polypropylene

Unit: yuan/ton

This week, the PP USD market experienced limited fluctuations, with on-site trading facing pressure.In the import market, futures fluctuated during the week without providing clear guidance to market sentiment. Crude oil prices rose slightly, maintaining cost support. The fluctuation in the USD to RMB exchange rate widened the price difference between domestic and international markets, making it difficult to attract foreign offers. Additionally, the maintenance of South Korean facilities in April still limited the relief in front-end supply, resulting in few new offers at the end of the month. Traders mostly followed market trends, while downstream end-users maintained a hand-to-mouth purchasing approach with low willingness to enter the market, mostly opting for low-priced, moderate, and just-needed purchases. In the domestic market, the mainstream offers for March-April shipment of raffia in USD were at $900-910 per ton, and for homopolymer injection molding, the mainstream offers were also at $900-910 per ton. For copolymer transparent products, the mainstream price range for March-April shipment was $920-950 per ton. In the export market, the indicative FOB offers for homopolymer raffia were in the range of $905-925 per ton, with tepid trading activity during the week. Overseas demand varied, but there was a significant gap in the intended transaction prices. Orders from nearby regions remained relatively stable, while orders from distant regions were affected by freight fluctuations, leading to increased观望情绪 for orders with long delivery times. Export performance was flat during the week, with negotiations dominating the transactions.

Table 2 Domestic PP USD Market Price Statistics

Unit: USD/ton

2Driving Factors: Cost and Fundamental Supply-Demand Weakness Lead to a Decline in Market Focus

This week, downstream factories showed no significant improvement in new orders, with some plants yet to fully destock raw material inventories, leading to subdued spot procurement activity and limited support for the PP market. However, a notable rally in futures at the start of the week provided strong momentum to the spot market. Meanwhile, supply-side and cost-side drivers gained strength. On the supply side, delays in new capacity launches and concentrated maintenance of existing units kept overall market supply pressure manageable, sustaining support for the PP market. On the cost side, the recent uptick in international oil prices bolstered PP cost support. Overall, with manageable supply-demand fundamentals, stronger cost support, and a boost from futures, the domestic PP market halted its decline and turned upward during the week, though the upside remained limited.

3Next week's outlook: Weak supply-demand contradiction, expected to consolidate in a slightly positive manner.

The PP market is expected to be slightly bullish next week.Taking East China as an example, the wire drawing price is expected to range between 7250-7450 yuan/ton next week, with an average price projected at 7370 yuan/ton. The low-melt copolymer price is anticipated to range between 7400-7800 yuan/ton, with an average price expected at 7600 yuan/ton. Crude oil is predicted to fluctuate weakly next week, which is likely to reduce cost support for PP. On the supply side, PP maintenance units are currently concentrated, and the intensity of unit maintenance is strong, providing short-term support for the supply side. On the demand side, downstream operations are gradually increasing, but procurement remains cautious, and short-term demand is expected to be released steadily. Overall, although short-term cost support for PP has weakened, there is no significant contradiction in the market's supply and demand fundamentals in the near term. Additionally, the concentration of maintenance units on the supply side is expected to provide periodic support to the market. Based on this, the PP market is forecasted to experience a slightly positive consolidation next week.

Supply: Concentrated maintenance operations, still supported by the supply side.Next week, there will be no new capacity impact temporarily. Recently, the maintenance of equipment has been relatively concentrated. Some equipment is planned to be shut down for maintenance today, and the overall maintenance intensity of the equipment is relatively strong. It is expected that the loss of equipment maintenance next week will be 154,400 tons, increasing by 0.06% from the previous week. Overall, the supply-side pressure next week will not be significant, providing support to the market. In terms of production enterprise inventory, the recent destocking has been quite evident. The short-term supply-side pressure is not substantial, and demand is steadily being released. It is expected that the inventory of production enterprises will hover around the medium level next week, offering support to the market. Regarding trader inventory, traders have recently aimed to maintain low inventory operations. It is anticipated that traders will primarily follow the market for shipments in the short term, with stable demand release, and the overall trader inventory level remains controllable. In terms of port inventory, the domestic supply has been sufficient recently, and the inverted price difference between domestic and foreign markets has persisted, leading to a slight reduction in imports. The export window is expected to remain open in the short term, with export volumes remaining relatively stable. Overall, it is expected that port inventory may slightly decline next week, estimated to be around 42,000-44,000 tons.

Demand: Downstream rigid procurement with steady demand release.Recent downstream operations have maintained a stable and positive trend. However, influenced by new order follow-ups and profit levels, downstream procurement remains cautious. In the short term, it is expected to continue with selective, low-level, and essential purchasing. Demand is steadily releasing, providing relatively limited support to the market.

Cost: Looking ahead to next week, oil prices are expected to fluctuate with a weak trend, with the average WTI crude oil price at $68 per barrel and a fluctuation range between $66 and $70 per barrel.From the market performance, the risks associated with the Middle East situation are basically controllable, and the issues in Central and South America continue to lack the momentum to push oil prices higher. On the contrary, the market is paying more attention to the negotiation issues in Europe, and the cooling down of these issues has prompted a downward adjustment in crude oil prices. Additionally, the implementation of reciprocal tariff policies starting next month is causing overall market concerns. Apart from the cooling of geopolitical tensions and weak macroeconomic expectations, Saudi Arabia will also gradually increase production, adding downward pressure on the fundamentals. Therefore, market news is mainly bearish, and oil prices are likely to maintain a weak and volatile trend. In terms of risks, the first is the U.S. crude oil inventory drawdown, and the second is the disturbance from the European situation. Crude oil is expected to remain weak and volatile, and the cost support for PP will weaken.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track