Polypropylene: Short-term bottom support exists, but medium to long-term pressure remains

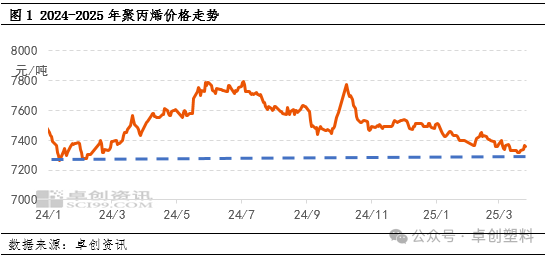

In March, insufficient cost support and weak supply and demand continued to pressure the market, leading to a weak performance in the domestic PP market. However, as multiple facilities entered maintenance in the second half of the month, the pressure on the supply side was being alleviated, coupled with seasonal rigid demand support, strengthening short-term market support. In the long term, however, the pressure from new capacity additions and expectations of seasonal weakening in demand weighed on the market, leaving market operation pressure unabated.

March: Insufficient cost support combined with weak supply and demand leads to a downward shift in the price center.

In the first half of March, the international crude oil market showed weakness, weakening cost support. At the same time, some facilities that had been under maintenance gradually resumed production, increasing market supply pressure and dampening market sentiment, leading to a continuous softening of PP prices. In the second half of the month, in order to meet monthly sales targets, traders adopted aggressive price-cutting strategies, keeping the market under pressure. Additionally, weak overseas demand coupled with expectations of rising shipping costs weakened the trading atmosphere in the export market, further undermining market confidence. However, as several domestic facilities entered maintenance, production volumes decreased significantly month-on-month, with operating rates for major categories such as homopolymer injection molding, and low melt fiber reaching relatively low levels, easing market supply pressure. Moreover, as prices reached the lowest levels of the year, downside support began to strengthen, leading to a slightly warming price trend by the end of the month.

Market Outlook: Short-term may be relatively strong with fluctuations, long-term operating pressure still exists.

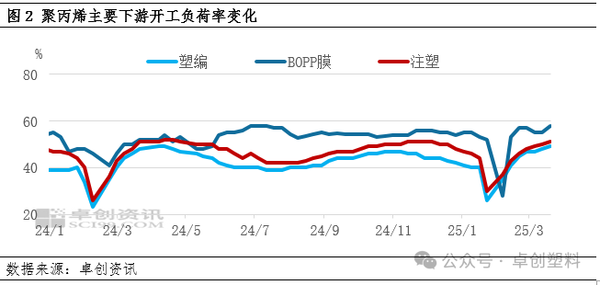

For the short-term outlook, analysts believe that the PP market will have strong bottom support and may remain in a relatively oscillating situation. On one hand, the market is gradually entering the spring maintenance season, and as maintenance work progresses steadily, it will help alleviate supply pressure in the market. On the other hand, the current operating load of downstream industries is at a relatively high level for the first half of the year, and seasonal rigid demand will continue to provide support for the market.

Supply: Continuous Increase in Maintenance Facilities to Help Alleviate Supply Pressure

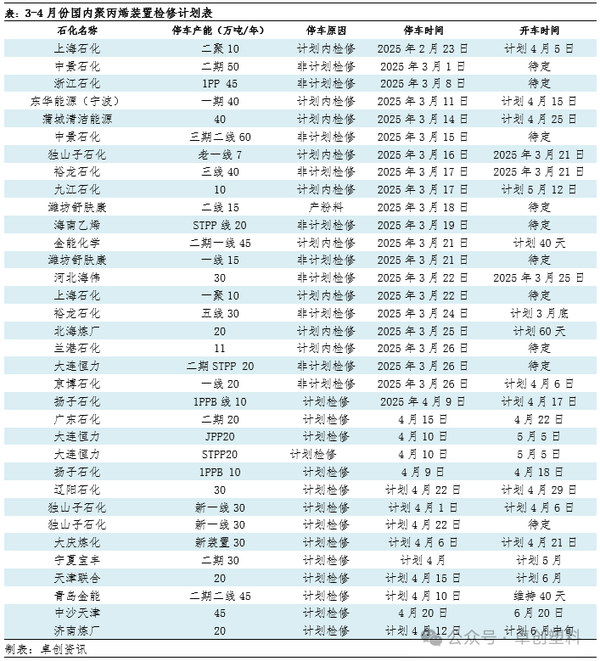

Since mid-March, the number of polypropylene plant maintenance shutdowns has significantly increased, leading to a continuous reduction in market supply. According to data statistics, due to the rise in maintenance shutdowns, domestic polypropylene production last week decreased by 6.44% compared to the previous week, and it is expected that production will continue to decline this week. Looking at April, the maintenance situation in the polypropylene market has not eased. In addition to the existing maintenance shutdowns, multiple plants such as Yangzi Petrochemical, Sinopec SABIC Tianjin, and the second phase of Jinneng Chemical will also join the maintenance lineup. Therefore, it is anticipated that the production loss caused by maintenance in April will continue to increase, potentially further alleviating market supply pressure.

Requirement: Downstream long-term orders are weak, but currently in a seasonally strong demand period.

Since the Spring Festival, the trend in new orders for major downstream sectors of polypropylene (PP) has been relatively weak, especially long-term orders have not performed well. Coupled with poor profit conditions for downstream businesses and the gradual arrival of pre-hedged resources before the festival, there is insufficient motivation for enterprises to replenish stocks. However, as operating rates gradually rise to relatively high levels, demand for polypropylene has entered a seasonally favorable period in the first half of the year. It is expected that by late April to mid-May, seasonal basic demand will continue to provide support. Additionally, polypropylene prices have fallen back to the low point in early February last year, and the relatively low absolute price will also provide some bottom-level support for the market.

Overall, the short-term supply and demand contradiction for polypropylene is unlikely to significantly widen, and given that prices are not excessively high, there is support at the lower end. It is expected that the market may remain in a moderately strong oscillation in the near term.

From a medium-term perspective, the polypropylene market will still face pressure from supply and demand. On one hand, there are multiple new capacity addition plans in the second quarter, such as Inner Mongolia Baofeng (500,000 tons/year), ExxonMobil PP facility (955,000 tons/year), and Zhenhai Refining and Chemical PP facility (500,000 tons/year). The addition of these new capacities is expected to increase year-over-year production, intensifying supply pressure. On the other hand, considering seasonal factors, demand from some downstream industries may weaken after April, and it is necessary to closely monitor the new order conditions of downstream enterprises. Additionally, based on the seasonal performance of polypropylene exports, exports are expected to decline in April-June, especially in May and June. Moreover, weak overseas demand and the instability of freight costs will also reduce the support for the export market.

Overall, in the short term, the fundamental pressure in the polypropylene market is not significant, and the price still has certain bottom support. However, from a long-term perspective, fundamental pressure still exists. If planned new capacity is released as scheduled, the supply pressure will increase; coupled with the possible seasonal weakening of downstream demand and limited export support, these factors will jointly exert pressure on the market. Therefore, in the long run, the polypropylene market will still face pressure.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics