【Polyolefins】Impact of US Tariffs and Vessel Costs on Polyolefins

I. The US tariff policy is gradually being implemented

In the article "The Impact of Trump's Victory on Polyolefins" on November 9, 2024, I summarized three main impacts after Trump took office: including the uncertainty of international energy price fluctuations, stricter tariff policies, and the acceleration of de-globalization. At that time, it was pointed out that after taking office, Trump would most likely fulfill his campaign promise to impose tariffs on China and other countries. Now, it has been nearly 60 days since Trump took office. During his campaign, Trump planned to impose a 60% tariff on China and a 20% base tariff on global goods. As expected, he is gradually fulfilling his tariff promises.

U.S. Tariff Policy on China: On February 4, 2025 (Eastern Time), the U.S. government announced a 10% tariff increase on all imports originating from mainland China and Hong Kong, with the tariff rate for goods previously subject to a 25% tariff being raised to 35%. On March 3, 2025, Trump signed an executive order revising the previously issued executive order, increasing the additional tariffs on China from 10% to 20%. The scope of application covers almost all Chinese exports to the U.S., classified under HTS 9903.01.20. The de minimis exemption policy (value ≤ $800) has been canceled, requiring all Chinese goods to be formally declared and fully taxed. (Humanitarian supplies, informational materials, and goods shipped before February 1, 2025, and arriving in the U.S. by March 7, 2025, may apply for exemptions.)

According to the plan mentioned in the bill, a 10% tariff is imposed on all imports originating from mainland China and Hong Kong, which was then increased to 20% on March 3. This also indicates that the tariffs on polyolefins have changed to some extent. Previously, the U.S. imported Chinese polyolefins at the most-favored-nation tariff rate, but with an additional 20% now, the average tariff rate will rise to around 26.5%. Downstream plastic products are even more affected, as many plastic products were already subject to an additional 25% tariff under the "Section 301" tariffs; now, the average tariff for some downstream plastic products will reach 35%-45%. And this is only about 60 days after Trump took office, we can anticipate that the previous goal of 60% set by Trump is not far off.

Based on the situation of exporting polyolefin, a type of plastic raw material, to the United States, the impact of imposing additional tariffs on polyolefins is much less than that on plastic products. This is because the window for exporting polyolefin raw materials to the United States was originally very small.

China's counter-tariffs on the US: In February 2025, in response to the US imposing additional tariffs, China announced a 15% tariff on US coal and liquefied natural gas, a 10% tariff on crude oil, agricultural machinery, large-displacement vehicles, and other items, and a 10% tariff on agricultural products such as sorghum, soybeans, pork, and beef. In March 2025, the measures were further escalated with a 15% tariff imposed on chicken, wheat, corn, and cotton, and a 10% tariff on fruits, vegetables, dairy products, and other items. This is to safeguard national interests and fairness in international trade.

In China's tariff increase measures, polyolefin products were not mentioned, so the tariffs on importing polyolefins from the United States have not changed for the time being. After Trump's election, Chinese polyolefin traders tried to avoid the risk of fluctuations in international trade policies by avoiding imports of polyolefin goods from the United States as much as possible.

Currently, for polyolefins, the US has imposed additional tariffs on China, while China has not yet imposed additional tariffs on polyolefins exported to the US. Therefore, we focus on the situation of polyolefins exported from China to the US to understand the basic situation of China's polyolefin exports to the US.

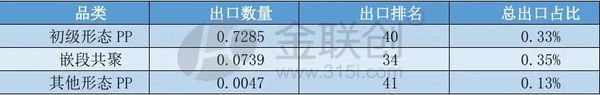

2024 Year 1-12 Month China Export to US Polypropylene Overview

unit: ten thousand tons

Data source: General Administration of Customs

China exported a total of 0.8071 million tons of polypropylene to the United States in 2024, with primary form PP, block copolymers, and other forms of PP accounting for 0.33%, 0.35%, and 0.13% of China's total exports to the United States, respectively.

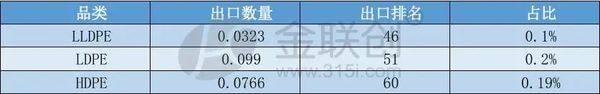

2024 January-December China Exports to the US Polyethylene Overview

unit: ten thousand tons

Data source: General Administration of Customs

China exported a total of 0.2079 million tons of polyethylene to the United States in 2024, with LLDPE, LDPE, and HDPE accounting for 0.1%, 0.2%, and 0.19% of the total volume from China to the United States, respectively.

As can be seen, the amount of polyolefins exported from our country to the US market is extremely small, accounting for only 0.016% of China's domestic polyolefin production in 2024. Based on the export base, it can be determined that the impact of the US raising tariffs on polyolefins is not widespread.

China-US polyolefins arbitrage space

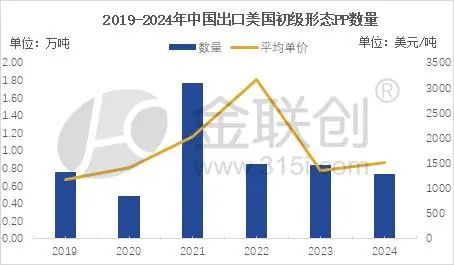

Data source: General Administration of Customs

The quantity of primary form PP exported from our country to the US reached its peak in 2021, while the export price peaked in 2022. From 2021 to 2022, China was the first to recover from the pandemic and resume production, while overseas markets became more dependent on the Chinese market due to supply chain disruptions. This larger context provided an opportunity for rapid growth in Chinese exports. However, with the global victory over the pandemic, Chinese exports then declined. Taking primary form PP as an example among the polyolefin products China exports to the US, it can be seen that in 2021, primary form PP reached a six-year peak in exports following the international trend. It then rapidly declined after the end of the pandemic.

From the above analysis, it can be concluded that the amount of polyolefins exported from China to the United States is minimal. Taking PP fiber as an example, the export window for CFR Far East and FAS Houston does exist. During 2021-2022, influenced by the supply in the United States, which is the mismatch between supply and demand under the pandemic background mentioned earlier, the arbitrage window between CFR Far East and FAS Houston widened during this period, confirming the surge in the export volume of primary form PP at this stage. However, for most of the time between 2020 and 2025, although the window existed, it did not have much advantage.

Data source: Jinlianchuang

In the absence of special background support, the price difference between CFR Far East and FAS Houston is limited, and this price difference can basically be covered by freight and other miscellaneous fees. In addition, the self-sufficiency rate of polyolefins in the United States is relatively high, and it has raw material advantages such as ethane and propane, which not only meet domestic demand but also allow exports to reach South America and Eurasia.

II. Layout Shipping Revitalize Shipbuilding

At the beginning of the article, I mentioned that in the previous article "The Impact of Trump's Victory on Polyolefins," three main impacts were summarized. Apart from energy and tariffs, the third point, which is the acceleration of deglobalization, cannot be ignored. The United States has shown its intervention in the global shipping supply chain, attempting to reconstruct the global supply chain and strengthen its discourse power over shipping.

December 19, 2024, a federal legislator in the United States proposed a bill, the "American Shipbuilding and Port Prosperity and Security Infrastructure Act" (SHIPS for America Act). The bill aims to support the development of the U.S. maritime industry, enhance the competitiveness of vessels flying the U.S. flag, support investment in shipyards, and intensify recruitment and improvement of maritime workers' skills. The U.S. intends to strengthen the supply chain, reduce dependence on foreign ships, and revitalize the shipbuilding industry by supporting shipbuilding, shipping, and workforce development. This marks the beginning of the U.S. challenging China's position in global shipping, attempting to curb our country's growing influence in the maritime industry.

Trump not only used tariffs as a sword to provoke trade frictions in an attempt to collect more fees for the United States, to curb imports, protect domestic industries, and reduce national debt. After he took office, we saw him play new cards. In his inaugural address, he claimed that he would change the name of the Gulf of Mexico and intended to regain control of the Panama Canal, as well as his later covetous intentions towards Greenland, all of which demonstrated his "America First" principle of action, the impact on global trade goes without saying.

Two months after the inaugural address, on March 4, 2025, the American consortium BlackRock acquired 43 overseas ports outside of China and Hong Kong from CK Hutchison Holdings for $22.8 billion. These include the Balboa and Cristobal ports on the Panama Canal.

Image source: Internet

The Panama Canal is one of the most important shipping waterways in the world, linking the Atlantic and Pacific Oceans, and is a key point for shipping trade between Asia and the United States. Approximately 6% of global trade passes through this canal each year.

The United States has increased its control over the Panama Canal, which means that the United States will intensify its intervention in global maritime pricing power.

Apart from control over the Panama Canal, the Trump administration plans to impose high fees on Chinese shipping companies and any Chinese-made vessels entering U.S. ports. The proposal mainly includes: 1, for vessels made in China: a fee of up to $1 million per port call; 2, for vessels ordered from China: an additional service fee based on the proportion of vessels ordered from Chinese shipyards within the next 24 months, with a maximum of $1 million; 3, for vessel operators: a service fee levied upon entry into U.S. ports, based on the proportion of Chinese vessels in their fleet, with a maximum of $1.5 million; 4, for vessels made in the U.S.: if the operator uses U.S.-made vessels for transportation, the service fee can be refunded on a fiscal year basis, with a maximum refund of $1 million per U.S. vessel per port entry.

Three, Through Thorns to Greet the Spring Mountains, Another Journey Tempered by Wind and Frost

Our country, under the "Belt and Road" initiative, has cooperated with Peru to build the Chancay Port, which connects South America and China. The port officially opened on November 14, 2024, with an annual throughput capacity of up to 1 million standard containers. It is connected to Lima via the Pan-American Highway and tunnels, radiating to countries such as Brazil and Chile, thereby strengthening ties with various South American nations. This layout enhances trade influence in South America and reduces reliance on the Panama Canal. Although the current throughput scale has not reached a very large size, it mainly focuses on transporting agricultural products. However, Chancay Port still has enormous growth potential and can become a key node in the trade pattern between South America and Asia.

For polyolefins, the main export destinations of our country are not the United States, so the additional fees for ships docking in the US have a minor impact on polyolefins. However, for downstream products, due to the large volume of exports, caution is needed, and if conditions are met, the cost of叠加关税和船舶额外费用 needs to be calculated. But for polyolefin trade, the main focus should be on the extensive port operating rights that the US has in other regions globally, such as acquiring shares in 43 ports from CK Hutchison. The true long-term concern for polyolefin trade is whether the scope of the ports covered by this proposal will be expanded globally in the future. Note: "叠加关税和船舶额外费用" was left untranslated as it seems to be a specific term or phrase that requires context for accurate translation. If you can provide more details or an exact term, I can translate it accordingly.

Currently, apart from China, the list of additional tariffs announced by the United States includes Canada, Mexico, and the European Union, which also indicates that Trump is gradually fulfilling his promise to impose tariffs on global goods. The European Union and Canada, among others, have also responded and retaliated. The global trade landscape will change, and in a complex international trade environment, we still have different opportunities in the global market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track