PA6 | Supply and Demand, as well as Costs, Both Negative; Prices Hit a Five-Year Low

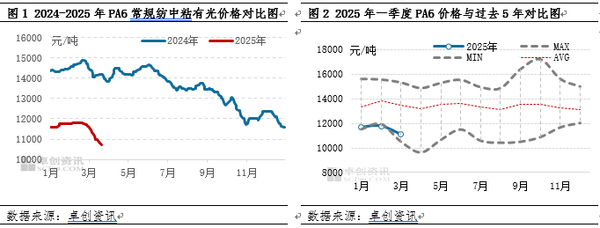

In the first quarter of 2025, the domestic PA6 market experienced an overall fluctuating decline. As of March 21st, the average price of regular spinning medium viscosity bright in the first quarter was 11,558 yuan/ton, a month-on-month decrease of 5.17% and a year-on-year decrease of 19.79%. The monthly average prices within the quarter were at relatively low levels compared to the past five years. In January, raw material prices increased slightly, providing a small boost to the cost side of PA6, and pre-Chinese New Year stocking sentiment from downstream was somewhat better, leading to a rebound in PA6 prices in mid-January. However, as the downstream began to take holidays in late January, market transactions gradually became quieter, restraining the increase in PA6 prices. After the holiday in February, PA6 manufacturers mainly focused on delivery, but the resumption of work by downstream enterprises was not ideal, and support from the cost side weakened. In March, with continuous declines in raw material prices and sluggish downstream demand, PA6 manufacturer inventories increased, and prices continued to fall. Within the quarter, raw material prices hit a new low over the past five years, coupled with PA6 inventory reaching its highest level in recent years, causing PA6 prices to drop to a lower level. As of March 21st, the highest daily average price for regular spinning medium viscosity bright in the first quarter appeared on February 2nd at 11,825 yuan/ton, and the lowest on March 21st at 10,725 yuan/ton.

PA6 production continues to grow, with a significant increase in corporate inventory, which is bearish for price trends.

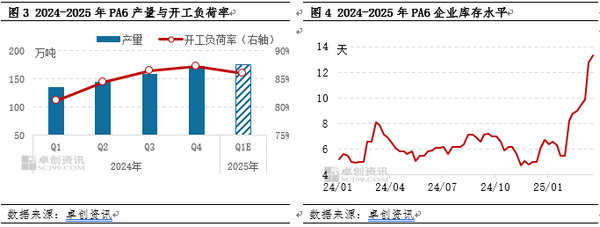

In the first quarter, the PA6 industry added 145,000 tons of new capacity, bringing the total capacity to 8,003,000 tons, an increase of 1.85% from the end of last year. The first quarter coincided with the Spring Festival holiday, and before the festival, downstream customers stocked up, resulting in more orders for PA6 manufacturers, with facilities operating at high loads. After the holiday, PA6 manufacturers continued to deliver, maintaining a high level of operation. It is estimated that the average operating load rate of PA6 in the first quarter was 86%, a decrease of 1 percentage point from the previous quarter. However, with the expansion of industry capacity, it is expected that the production of PA6 will be about 1,759,000 tons, an increase of 2.09% from the previous quarter, with supply continuing to grow.

After the holiday, the PA6 industry's production remains at a high level, with manufacturers mainly focusing on delivery. The resumption of work at downstream factories is relatively late and not optimistic. PA6 manufacturers are gradually completing deliveries, while new orders are fewer, leading to a continuous increase in inventory levels. The end-of-month inventories for January, February, and March (up to the 21st) were 5.5, 9.4, and 13.3 days, respectively, showing a continuous upward trend and reaching the highest level since 2018. The inventory pressure on PA6 manufacturers has increased, and they are reducing prices to accept orders and decrease inventory.

Downstream demand is sluggish, PA6 supply exceeds demand, the contradiction between supply and demand intensifies, dragging down prices

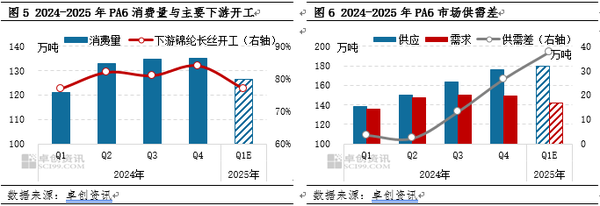

It is estimated that the downstream consumption of PA6 in the first quarter will be about 1.264 million tons, a decrease of 6.37% quarter-on-quarter. The maximum downstream industry, nylon filament, has an average quarterly operating load rate of 77%, a decrease of 7 percentage points quarter-on-quarter, indicating weaker demand for PA6. Affected by the reduction in terminal demand during the Spring Festival holiday, since January 2025, the operating level of the nylon filament industry has gradually declined, dropping to around 64% during the Spring Festival holiday. Although the operating level after the holiday has recovered, the pace is slow, and it is difficult to further improve after reaching around 85%, still lower compared to the end of the previous quarter. In addition, the operating level of the downstream modified industry in the first quarter was not as good as the previous quarter, with general demand.

Comparing supply and demand, it is estimated that the PA6 supply (production + imports) in the first quarter will be about 1.759 million tons, while the demand (consumption + exports) will be about 1.419 million tons. The supply-demand gap is 0.376 million tons, an increase of 41.89% quarter-over-quarter. Additionally, since the second quarter of last year, the quarterly supply-demand gap for PA6 has shown a continuous trend of expansion. Overall, the PA6 market is oversupplied, dragging prices down continuously.

Costs fluctuate downward, PA6 price trend lacks positive support

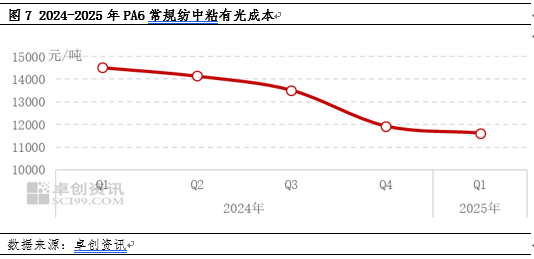

In the first quarter, the caprolactam market showed a strong start followed by weakness. As of March 21, the average cost of regular-spun semi-dull PA6 was 11,620 yuan/ton, down 2.61% from the fourth quarter of last year. The price of caprolactam in the first quarter showed a trend of rising first and then falling. Before the Spring Festival, the price of pure benzene increased, boosting the cost side of caprolactam, and the sentiment for PA6 factories to purchase caprolactam was still positive, which was favorable for the upward trend of caprolactam prices and also boosted the cost end of PA6. On January 1, the daily average price of liquid caprolactam in East China was 10,400 yuan/ton, and on February 18, it was 11,225 yuan/ton, with a cumulative increase of 825 yuan/ton. However, as the price of pure benzene declined, the cost support for caprolactam weakened, and after the Spring Festival, the trading in the PA6 market was light, leading to a gradual decrease in the consumption of caprolactam by PA6. In late February, the caprolactam market entered a downward channel, continuously having a negative impact on the cost end of PA6. As of March 21, the daily average price of liquid caprolactam in East China fell to 9,800 yuan/ton, with a cumulative decrease of 1,425 yuan/ton. In summary, the decline in raw material prices in the first quarter led to a reduction in PA6 costs, which had a negative effect on the price trend of PA6.

In the second quarter, PA6 supply still exceeds demand, with social inventory to be consumed, raw material prices are low, and PA6 prices fluctuate at a low level.

The narrowing of the supply-demand gap is unlikely to change the situation of oversupply, with active inventory reduction in the second quarter.

In the second quarter, the supply of PA6 is expected to decrease due to sluggish market transactions, high enterprise inventories, and some facilities undergoing maintenance or operating at reduced capacity. The estimated production of PA6 in the second quarter is about 1.64 million tons, a decrease of 6.77% quarter-on-quarter. Demand is expected to pick up, with the downstream nylon industry planning to add 200,000 tons of new capacity, leading to a PA6 consumption of approximately 1.376 million tons, an increase of 8.86% quarter-on-quarter. Despite the reduction in supply and the increase in demand, the gap between supply and demand will narrow. However, considering the still prominent contradiction in market supply and demand, and the relatively high social inventory of PA6, the focus in the second quarter may be on destocking. The price of PA6 may see a phased rebound due to the narrowing of the supply-demand gap, but the magnitude will be quite limited, and prices will remain at low levels.

In the second quarter, raw material prices were low, and the cost side of PA6 lacked favorable support.

The supply and demand contradiction of pure benzene will continue in the second quarter, making it difficult for high prices to sustain. It is expected that if there is no clear supportive policy from the macro perspective, the price of pure benzene may continue to decline, which will still have a negative impact on the cost side of caprolactam. Although there are maintenance activities in the caprolactam market, they are not enough to boost prices upward; instead, prices may follow the downward trend of pure benzene, but with limited downward space due to pressure on the profit margin of caprolactam. Overall, the lack of positive support for the cost side of PA6 in the second quarter remains a negative factor for price trends.

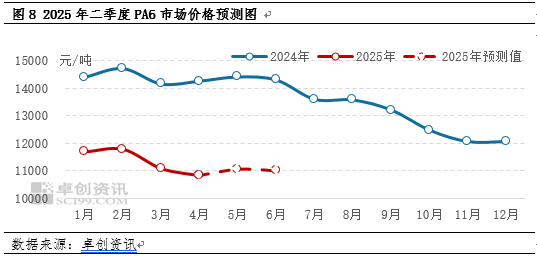

In summary, the supply and demand contradiction of PA6 in the second quarter needs to be alleviated, and the cost side lacks support. It is expected that there may still be room for price declines in the second quarter, followed by a phased rebound as the supply and demand gap narrows. The average prices for April, May, and June may be 10,850 yuan/ton, 11,050 yuan/ton, and 11,000 yuan/ton, respectively. The high point of the second quarter is more likely to appear in May, with the low point possibly occurring in April, and overall, the prices will remain at a low level with fluctuations.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track