Never expected that the collapse of plastic prices would be even more dramatic than that of packaging paper.

After the collapse of packaging paper prices, plastic raw material prices have also crashed!

From the "6" mark straight down to the "4" mark, PVC plummeted by 1360 yuan in less than a year!

The entire market is collapsing, and the PE market can't hold on either! Making ten thousand yuan from three truckloads of waste plastic, now it's all for nothing!

Plastic manufacturers secretly resumed production during the Spring Festival, Trump wielded tariff sanctions, India aggressively blocked BIS certifications, international crude oil prices crashed... Faced with overflowing inventory, dealers had no choice but to sell at a loss and exit the market.

Now that crude oil is plummeting with new materials, it's squeezing the price of regenerated materials, causing the price of regenerated materials to crash, which directly affects the price of recycled raw materials! Everything is falling apart!

Plastic prices plummet

The price of PVC has accelerated in the afternoon, dropping from the "6" range last May to the "5" range, and now it has even reached the "4" range. In less than a year, it has decreased by 1360 yuan!

Currently, the global PVC market is in a race to see who is worse off, with China’s main port FOB prices plummeting like a roller coaster. Manufacturers are struggling with excess inventory, and they can only cut their losses through massive discounts.

In the PE market, both imported and domestic materials continued to decline across the board, with a slightly larger drop in imported materials. In the Shanghai market, LDPE/Iran/2119 fell by 200 yuan/ton in a single day, while in the Dongguan market, domestic LDPE/Maoming Petrochemical/951-050 dropped by 150 yuan/ton daily.

March 21 Shanghai Import PE Market Price

March 21 Dongguan PE Market Price

Multiple adversities intertwined in a predicament

The direct cause of this price reduction in the short term is the result of the resonance between oversupply and suppressed demand.

In the first quarter, it was expected to be the maintenance season for global PVC, but in reality, manufacturers were secretly operating, putting on a farce of trying to cover up but making it more obvious.

On the demand side, market activity has been sluggish due to the impact of Trump's tariff policies and India's BIS certification restrictions.

In the long run, China's crazy production capacity may have a profound impact on the global plastic industry. We have to say that we projected the country's crazy infrastructure construction onto the global manufacturing sector, and the mad expansion of production capacity has led to an imbalance between global supply and demand.

Crazy capacity expansion

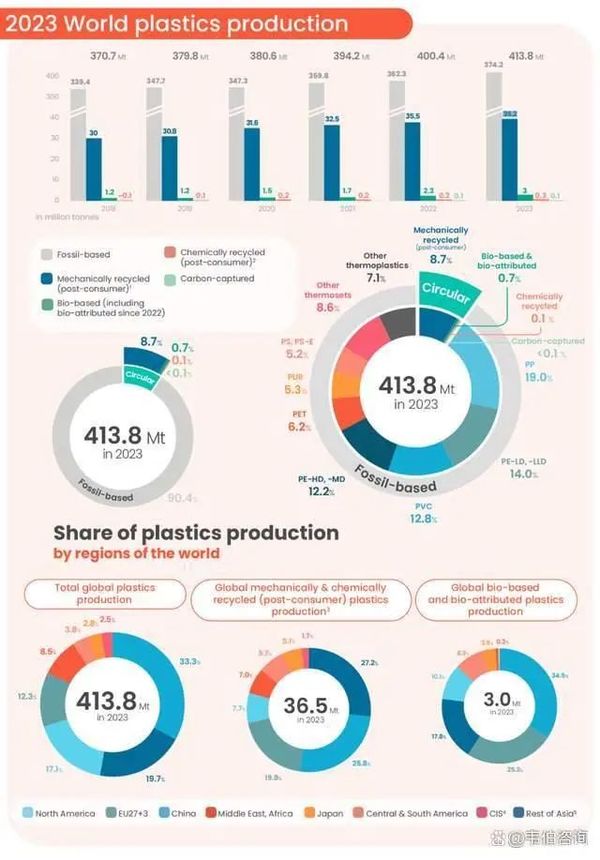

In 2023, the total global plastic production was 413.8 million tons, with China accounting for 33.3% of the total plastic production. Other regions in Asia (excluding China and Japan) accounted for 19.7%, North America accounted for 17.1%, the EU 27+3 accounted for 12.3%, the Middle East and Africa accounted for 8.5%, Central and South America accounted for 3.8%, and Japan accounted for 2.8%.

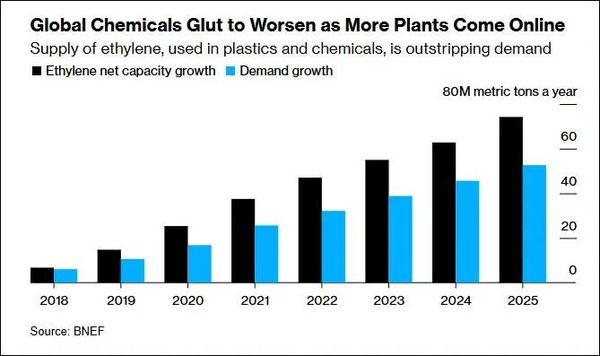

BloombergNEF analyst Philip Gertz stated that global production capacity for chemicals such as ethylene and propylene is expected to grow at a near-record level this year, with the vast majority of this expansion occurring in China. Since 2020, China's polyethylene market has experienced a second wave of capacity expansion. According to JLC Network statistics, China's polyethylene production capacity in 2024 remains dominated by oil-based feedstocks, with planned new installations totaling 1.5 million tons within the year. Additionally, 3.4 million tons of new capacity is set to come online in 2024.

Global degradable plastic capacity was approximately 1.7 million tons in 2023, with China's capacity at 1.28 million tons, accounting for 75% of global capacity. According to predictions by the China Plastics Processing Industry Association (CPPIA), China's total biodegradable plastic capacity is expected to exceed 6.5 million tons by 2025.

As of April 2023, China's annual production capacity of PBAT has reached approximately 1.3 million tons, with an output of about 120,000 tons, and the industry scale's annual growth rate is as high as 89%. Currently, the scale of PLA projects under planning and construction has approached 3.4 million tons/year, and the expected industry growth rate will reach around 90%.

Facing the global wave of plastic bans and restrictions, the plastic industry has not only failed to reduce production capacity but has instead expanded against the trend. As you sow, so shall you reap—what goes around comes around. A price collapse is naturally inevitable sooner or later!

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track