I. Points of Focus

1, 3/4: The US's increased tariff policy has sparked potential trade dispute risks, coupled with OPEC+ announcing a slight increase in production from April, leading to a decline in international oil prices. NYMEX crude futures for April fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude futures for May fell by $0.58 to $71.04 per barrel, a decrease of -0.81% month-over-month. China's INE crude futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and the night session fell by 12.7 to 518.8 yuan per barrel.

2, 3/4: Propylene FOB Korea remained stable at $825 per ton, and CFR China remained stable at $850 per ton.

3, 3/4: There were no changes in domestic PP maintenance facilities yesterday.

4, Longzhong Information reported on March 5: The two-oil polyolefin inventory was 825,000 tons in the morning, a decrease of 20,000 tons from the previous day.

Core Logic: The decline in oil prices is insufficient to support the cost of polypropylene.

II. Price Table

III. Market Outlook

Currently, the downward trend in oil prices is insufficient to support the cost of polypropylene. The supply side remains relatively stable, and the operating load of downstream enterprises is gradually increasing. However, due to insufficient orders and high inventory pressure, raw material procurement is relatively cautious.

```

I. Points of Focus

1. 3/4: The U.S. tariff increase policy has sparked potential trade dispute risks, coupled with OPEC+ planning a slight production increase from April, leading to a decline in international oil prices. NYMEX crude futures for April fell by $0.11 per barrel to $68.26, down -0.16% month-over-month; ICE Brent crude futures for May dropped by $0.58 per barrel to $71.04, down -0.81% month-over-month. China's INE crude futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

2. 3/4: Propylene FOB Korea remained steady at $825 per ton, and CFR China stayed stable at $850 per ton.

3. 3/4: There were no changes in domestic PP maintenance facilities yesterday.

4. According to Longzhong Information on March 5th: The inventory of two oil polyolefins was 825,000 tons in the morning, a decrease of 20,000 tons from the previous day.

Core Logic: The decline in oil prices has weakened the cost support for polypropylene.

II. Price List

III. Market Outlook

Currently, the downward trend in oil prices is insufficient to provide strong cost support for polypropylene. The supply side remains relatively stable, while downstream enterprises are gradually increasing their operating loads. However, due to insufficient orders and high inventory pressure, raw material procurement is being conducted cautiously. In the short term, there are no significant signals to boost the market. It is expected that today's polypropylene market will mainly undergo range-bound consolidation, with mainstream prices for wire drawing in East China ranging from 7330 to 7430 yuan per ton.

PE: Supply and Demand Margins Remain Stable, Expected to Maintain a Fluctuating Trend

1. Points of Focus

1. 3/4: The U.S. tariff policy has triggered potential trade dispute risks, and with OPEC+ planning a slight increase in production from April, international oil prices have fallen. NYMEX crude futures for April delivery fell by $0.11 to $68.26 per barrel, down -0.16% month-over-month; ICE Brent crude futures for May delivery dropped by $0.58 to $71.04 per barrel, down -0.81% month-over-month. China's INE crude futures main contract for 2504 fell by 7.7 to 531.5 yuan per barrel, and during the night session, it fell by 12.7 to 518.8 yuan per barrel.

2. 3/4: Propylene FOB Korea remained stable at $825 per ton, while CFR China remained stable at $850 per ton.

3. 3/4: There were no changes in domestic PP maintenance facilities yesterday.

4. According to Longzhong Information on March 5th: The two-oil polyolefin inventory was 825,000 tons in the morning, a decrease of 20,000 tons from the previous day.

Core Logic: With the decline in oil prices, there is insufficient cost support for polypropylene.

2. Price Table

3. Market Outlook

Currently, the downward trend in oil prices provides insufficient cost support for polypropylene. The supply side remains relatively stable, and the operating load of downstream enterprises is gradually increasing. However, due to insufficient orders and high inventory pressure, raw material purchases are relatively cautious. In the short term, there are no clear signals to boost the market, and it is expected that the polypropylene market will mainly consolidate within a range today, with mainstream prices for wire drawing in East China ranging from 7330 to 7430 yuan per ton.

PE: Supply and demand margins remain, expecting a fluctuating trend

1. Focus Points

1. 3/4: The U.S. tariff hike policy has triggered potential trade dispute risks, coupled with OPEC+ announcing a slight production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 per barrel to $68.26, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for May fell by $0.58 per barrel to $71.04, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and the night session fell by 12.7 to 518.8 yuan per barrel.

2. 3/4: Propylene FOB Korea remained stable at $825 per ton, and CFR China remained stable at $850 per ton.

3. 3/4: There were no changes in domestic PP maintenance facilities yesterday.

4. Longzhong Information reported on March 5th: The two-oil polyolefin inventory was 825,000 tons in the morning, a decrease of 20,000 tons from the previous day.

Core Logic: The decline in oil prices weakens the cost support for polypropylene.

2. Price Table

3. Market Outlook

Currently, the downward trend in oil prices provides insufficient cost support for polypropylene. Supply is relatively stable, and downstream enterprises are gradually increasing their operating loads. However, due to insufficient orders and high inventory pressure, raw material purchases remain cautious. In the short term, there are no clear signals to boost the market. It is expected that today's polypropylene market will mainly consolidate within a range, with mainstream prices for drawing wire in East China ranging from 7,330 to 7,430 yuan per ton.

PE: Marginal supply and demand remain balanced, expecting a fluctuating trend

1. Focus Points

1. Focus Points1. Focus Points

1, 3/4: The U.S. policy of imposing additional tariffs has triggered potential risks of trade disputes, coupled with OPEC+ announcing a small production increase starting from April, leading to a decline in international oil prices. The NYMEX crude oil futures contract for April was down by $0.11 per barrel at $68.26, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures contract for May was down by $0.58 per barrel at $71.04, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

2, 3/4: Propylene FOB Korea remained stable at $825 per ton, and CFR China remained stable at $850 per ton.

3, 3/4: There were no changes in domestic PP maintenance facilities yesterday.

4, According to Longzhong Information on March 5th: The inventory of polyolefins from the two major oil companies in the morning was 825,000 tons, a decrease of 20,000 tons from the previous day.

Core logic: The decline in oil prices has weakened the cost support for polypropylene.

II. Price List

3. Market Outlook

3. Market Outlook3. Market Outlook

Currently, crude oil is showing a downward trend, which provides insufficient cost support for polypropylene. The supply side remains relatively stable, and the operating load of downstream enterprises is gradually increasing. However, due to insufficient orders and high inventory pressure, raw material procurement is relatively cautious. In the short term, there are no obvious signals to boost the market, and it is expected that today's polypropylene market will mainly be in a range-bound consolidation, with the mainstream price of drawing in East China ranging from 7330-7430 yuan/ton.

Currently, crude oil is showing a downward trend, which provides insufficient cost support for polypropylene. The supply side remains relatively stable, and the operating load of downstream enterprises is gradually increasing. However, due to insufficient orders and high inventory pressure, raw material procurement is relatively cautious. In the short term, there are no obvious signals to boost the market, and it is expected that today's polypropylene market will mainly be in a range-bound consolidation, with the mainstream price of drawing in East China ranging from 7330-7430 yuan/ton.

PE: Supply and Demand Margins Remain Stable, Expected to Show Fluctuating Trends

PE: Supply and Demand Margins Remain Stable, Expected to Show Fluctuating TrendsPE: Supply and Demand Margins Remain Stable, Expected to Show Fluctuating Trends

1. Points of Focus

1. Points of Focus1. Points of Focus

1、Cost End: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ planning a small production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, down -0.16% month-over-month; ICE Brent crude futures for May dropped by $0.58 to $71.04 per barrel, down -0.81% month-over-month.

11

、Cost End:、Cost End: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ planning a small production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, down -0.16% month-over-month; ICE Brent crude futures for May dropped by $0.58 to $71.04 per barrel, down -0.81% month-over-month.

2、Current Shutdown Units: Currently, 15 polyethylene units are shut down, with additional maintenance at Sino-Korean Petrochemical and a certain company in Tianjin.

22

、Currently parked facilities: Currently parked facilities: The currently parked facilities involve 15 polyethylene units, with newly added maintenance for Sino-Korean Petrochemical and a certain enterprise in Tianjin.

3、Market Review of Yesterday: The domestic polyethylene market on the previous day showed mixed increases and decreases, ranging from 1-13 yuan/ton. Spot supply remains relatively abundant, the market is cautious about pushing up prices, mainly making minor adjustments according to the market trend, and there has been no significant increase in transactions.

33

、Market Review of Yesterday: Market Review of Yesterday: The domestic polyethylene market on the previous day showed mixed increases and decreases, ranging from 1-13 yuan/ton. Spot supply remains relatively abundant, the market is cautious about pushing up prices, mainly making minor adjustments according to the market trend, and there has been no significant increase in transactions.

Core Logic: The polyethylene spot market is fluctuating.

Core Logic: Core Logic: The polyethylene spot market is fluctuating.

II. Price List

II. Price List II. Price List

III. Market Outlook

III. Market Outlook III. Market Outlook

In the short term, upstream continues to hold firm on prices, and increased maintenance reduces supply pressure; downstream resists high prices and insists on buying at low levels. Therefore, overall, the supply and demand balance is maintained, and an oscillating trend is expected.

In the short term, upstream continues to hold firm on prices, and increased maintenance reduces supply pressure; downstream resists high prices and insists on buying at low levels. Therefore, overall, the supply and demand balance is maintained, and an oscillating trend is expected.

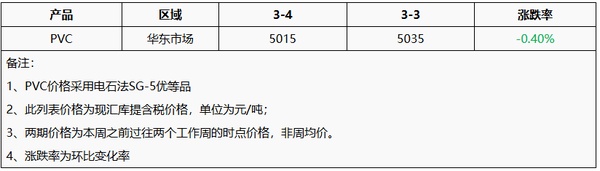

PVC: The market's wait-and-see sentiment has intensified, and PVC market prices have slightly decreased

PVC: PVC: The market's wait-and-see sentiment has intensified, and PVC market prices have slightly decreased

1. Focus Points

1. 3/4: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ planning a modest production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 per barrel to $68.26, down -0.16% month-over-month; ICE Brent crude oil futures for May fell by $0.58 per barrel to $71.04, down -0.81% month-over-month. China's INE crude oil futures main contract for 2504 fell by 7.7 to 531.5 yuan per barrel, and in the night session, it dropped further by 12.7 to 518.8 yuan per barrel.

2. Calcium carbide: The domestic calcium carbide market remained stable at 2,550 yuan per ton yesterday, with smooth sales from producers. As road transportation pressures eased, there was a regional concentration of arrivals. Today, Inner Mongolia is expected to see another power rationing, leading to a reduction in supply. Currently, there is a shortage of regional deliveries, and buyers are actively purchasing, creating a strong atmosphere for regional price increases.

3. PVC: Yesterday, the domestic PVC market price center slightly declined, The U.S. tariff hikes have intensified the wait-and-see attitude towards bulk commodity exports, with intra-day prices weakly oscillating downward, dampening trading sentiment, and prices falling slightly in the afternoon. In the short term, there is insufficient new maintenance, and demand remains stable. As of March 4, the cash-on-delivery warehouse withdrawal price for five-type calcium carbide method in East China is 4,900-5,050 yuan per ton, and for ethylene method, it is 5,100-5,400 yuan per ton.

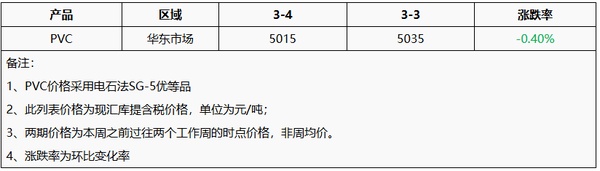

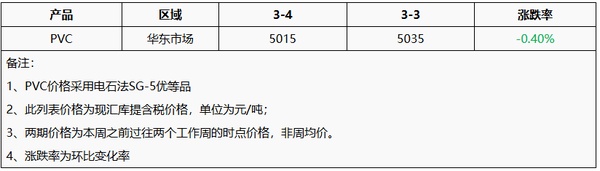

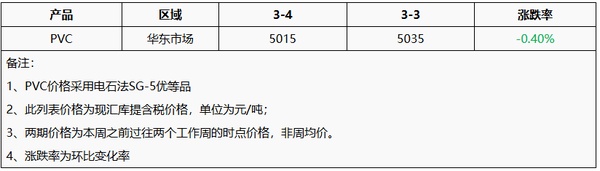

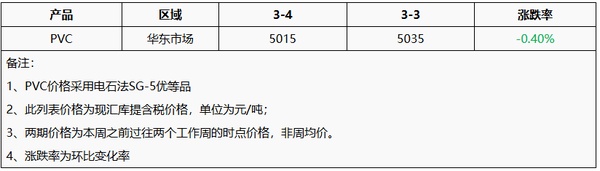

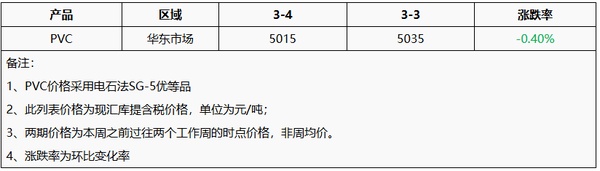

2. Price Table

3. Market Outlook

In the short term, there are fewer PVC maintenance operations, and production is expected to increase within the week. Downstream operations are gradually returning to normal levels, and just-in-time purchases have increased; the cost side provides support, but due to external macroeconomic fluctuations, the wait-and-see sentiment in the market has intensified, and confidence in the future is lacking. It is expected that today's domestic PVC market prices will slightly decrease.

1. Focus Points

1, 3/4: The U.S. tariff increase policy has sparked potential trade dispute risks, coupled with OPEC+ planning a small production increase from April, leading to a decline in international oil prices. The NYMEX crude oil futures contract for April fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures contract for May fell by $0.58 to $71.04 per barrel, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and dropped further by 12.7 to 518.8 yuan per barrel in night trading.

2, Calcium carbide: Yesterday, the domestic calcium carbide market remained stable at 2,550 yuan per ton, with smooth sales from producers. As road transportation pressure eased, there was a regional concentration of arrivals. Today, it is expected that power rationing will occur again in Inner Mongolia, weakening supply. Currently, there is a shortage of regional arrivals downstream, with active purchasing and a strong atmosphere of regional price increases.

3, PVC: Yesterday, the domestic PVC market price center slightly decreased. The U.S. once again raised tariffs, increasing the wait-and-see attitude towards bulk commodity exports. During the day, prices showed weak fluctuations and declined, dampening market trading sentiment. In the afternoon, prices slightly fell. Short-term new maintenance is insufficient, and demand remains stable. As of March 4, the cash pick-up price for SG-5 type PVC (calcium carbide method) in the East China region is between 4,900-5,050 yuan per ton, while the ethylene method is between 5,100-5,400 yuan per ton.

2. Price Table

3. Market Outlook

In the short term, fewer PVC manufacturers are undergoing maintenance, and output is expected to increase within the week. Downstream operations are gradually returning to normal levels, and rigid demand purchases have increased somewhat. The cost end provides support, but due to external macroeconomic expectations fluctuating, the market's wait-and-see attitude has intensified, and confidence in the future market is lacking. It is expected that today's domestic PVC market prices will slightly decrease.

1. Points of Focus

1. 3/4: The U.S. tariff increase policy has triggered potential trade dispute risks, and with OPEC+ planning a slight production increase from April, international oil prices have fallen. The NYMEX crude oil futures 04 contract dropped by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures 05 contract fell by $0.58 to $71.04 per barrel, a decline of -0.81%. China's INE crude oil futures main contract 2504 decreased by 7.7 to 531.5 yuan per barrel, and in night trading, it further declined by 12.7 to 518.8 yuan per barrel.

2. Calcium Carbide: Yesterday, the domestic calcium carbide market remained stable at 2550 yuan per ton, with smooth sales from producers. As road transportation pressure eases, there is regional concentration of arrivals. Today, Inner Mongolia is expected to experience power rationing again, leading to a reduction in supply. Currently, there is a shortage of regional arrivals downstream, and purchasing is active, creating a strong atmosphere for regional price increases.

3. PVC: Yesterday, the domestic PVC market price center slightly declined, the U.S. tariff hike has increased the wait-and-see sentiment for bulk commodity exports, and during the session, prices showed weak fluctuations and declines, dampening market trading sentiment. Prices slightly decreased in the afternoon, with insufficient new maintenance shutdowns in the short term and steady demand performance. As of March 4, in the East China region, the cash pickup price for calcium carbide-based type five was between 4900-5050 yuan per ton, and for ethylene-based, it was between 5100-5400 yuan per ton.

2. Price Table

3. Market Outlook

In the short term, fewer PVC companies are undergoing maintenance, and output is expected to show an increasing trend within the week. Downstream operations are gradually returning to normal levels, and rigid demand purchases have increased. Cost support exists, but due to external macroeconomic expectations, the wait-and-see sentiment in the market has intensified, and confidence in the future is low. It is expected that today, domestic PVC market prices will slightly decrease.

1. Points of Focus

1. Points of Focus1. Points of Focus

1. 3/4: The U.S. tariff increase policy has triggered potential trade dispute risks, and with OPEC+ planning a slight production increase from April, international oil prices have fallen. The NYMEX crude oil futures 04 contract dropped by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures 05 contract fell by $0.58 to $71.04 per barrel, a decline of -0.81%. China's INE crude oil futures main contract 2504 decreased by 7.7 to 531.5 yuan per barrel, and in night trading, it further declined by 12.7 to 518.8 yuan per barrel.

1, 3/4: The U.S. tariff increase policy has sparked potential trade dispute risks, coupled with OPEC+ announcing a slight production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude futures for May dropped by $0.58 to $71.04 per barrel, a reduction of -0.81% month-over-month. China's INE crude oil futures main contract for 2504 decreased by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

2, Calcium carbide: The domestic calcium carbide market remained stable at 2550 yuan/ton yesterday, with smooth sales from producers. As road transportation pressures ease, there is a regional concentration of arrivals. Today, Inner Mongolia is expected to see power rationing again, leading to a decrease in supply. Currently, there is a regional shortage of deliveries, prompting active purchasing, and a strong atmosphere of regional price increases.

3, PVC: The domestic PVC market price center slightly declined yesterday, The U.S. once again increased tariffs, adding to the wait-and-see attitude towards the export of commodities. Prices weakened and fluctuated downward during the trading day, dampening market trading sentiment, and prices slightly fell in the afternoon, In the short term, there is insufficient new maintenance, and demand remains stable. As of March 4, the cash delivery price of Type V ethylene method in East China was between 4900-5050 yuan/ton, and the ethylene method was between 5100-5400 yuan/ton.

II. Price Table

3. Market Outlook

3. Market Outlook3. Market Outlook

In the short term, there are fewer PVC maintenance enterprises, and production is expected to increase within the week. Downstream operations are gradually returning to normal levels, and rigid demand purchases have increased somewhat; although cost support exists, external macro expectations fluctuations have led to a stronger wait-and-see attitude in the market, with insufficient confidence in the future. It is expected that domestic PVC prices will slightly decrease today.

In the short term, there are fewer PVC maintenance enterprises, and production is expected to increase within the week. Downstream operations are gradually returning to normal levels, and rigid demand purchases have increased somewhat; although cost support exists, external macro expectations fluctuations have led to a stronger wait-and-see attitude in the market, with insufficient confidence in the future. It is expected that domestic PVC prices will slightly decrease today.

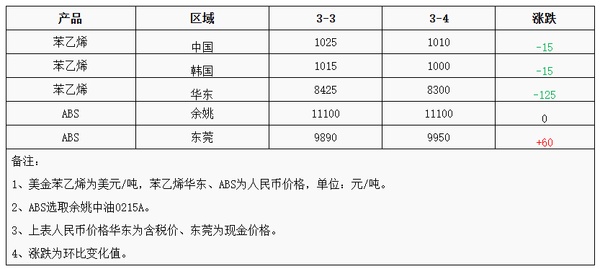

ABS: The cost support has weakened, and it is expected that the ABS market will maintain a narrow range consolidation today.

ABS:ABS: The cost support has weakened, and it is expected that the ABS market will maintain a narrow range consolidation today.

1. Focus Points

1. Crude Oil: 3/4: The U.S. tariff hike policy has triggered potential trade dispute risks, and coupled with OPEC+ planning a modest production increase from April, international oil prices have fallen. NYMEX crude futures for April fell 0.11 USD per barrel to 68.26, a decrease of -0.16% month-over-month; ICE Brent crude futures for May dropped 0.58 USD per barrel to 71.04, a decline of -0.81% month-over-month. China's INE crude futures main contract 2504 fell 7.7 to 531.5 CNY per barrel, and in the night session, it further decreased by 12.7 to 518.8 CNY per barrel.

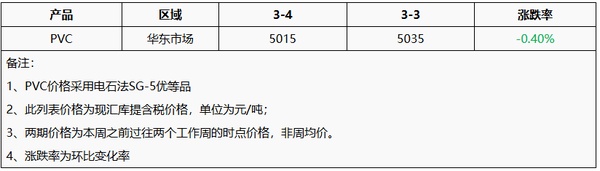

2. Price List:

3. Market Outlook

Yesterday, the market prices in Dongguan saw local increases, with transactions mainly driven by rigid demand. The East China market showed slight adjustments, with overall changes being minimal. As raw material prices declined yesterday, the cost support for ABS weakened. It is expected that today, domestic ABS market prices will maintain a narrow range of adjustment.

1. Focus Points

1. Focus Points1. Focus Points

1. Crude Oil: 3/4: The U.S. tariff hike policy has triggered potential trade dispute risks, and coupled with OPEC+ planning a modest production increase from April, international oil prices have fallen. NYMEX crude futures for April fell 0.11 USD per barrel to 68.26, a decrease of -0.16% month-over-month; ICE Brent crude futures for May dropped 0.58 USD per barrel to 71.04, a decline of -0.81% month-over-month. China's INE crude futures main contract 2504 fell 7.7 to 531.5 CNY per barrel, and in the night session, it further decreased by 12.7 to 518.8 CNY per barrel.

11

. Crude OilCrude Oil: 3/4: The U.S. tariff hike policy has triggered potential trade dispute risks, and coupled with OPEC+ planning a modest production increase from April, international oil prices have fallen. NYMEX crude futures for April fell 0.11 USD per barrel to 68.26, a decrease of -0.16% month-over-month; ICE Brent crude futures for May dropped 0.58 USD per barrel to 71.04, a decline of -0.81% month-over-month. China's INE crude futures main contract 2504 fell 7.7 to 531.5 CNY per barrel, and in the night session, it further decreased by 12.7 to 518.8 CNY per barrel.

II. Price List:

II. Price List:II. Price List:

III. Market Outlook

III. Market OutlookIII. Market Outlook

The prices in Dongguan partially increased yesterday, with the market transactions mainly driven by rigid demand. The East China market saw minor adjustments, with overall changes not being significant. Raw material prices decreased yesterday, leading to a weakened support for ABS costs. It is expected that today's domestic ABS market prices will maintain a narrow range of consolidation.

The prices in Dongguan partially increased yesterday, with the market transactions mainly driven by rigid demand. The East China market saw minor adjustments, with overall changes not being significant. Raw material prices decreased yesterday, leading to a weakened support for ABS costs. It is expected that today's domestic ABS market prices will maintain a narrow range of consolidation.

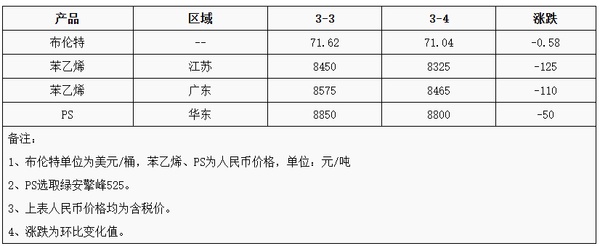

PS: As the raw material styrene continues to decline, the PS market may shift towards reducing prices for sales in the short term.

PS:PS: As the raw material styrene continues to decline, the PS market may shift towards reducing prices for sales in the short term.

1. Focus Points

1, 3/4: The U.S. tariff increase policy has triggered potential trade dispute risks, coupled with OPEC+ planning a small production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, down -0.16% month-over-month; ICE Brent crude oil futures for May fell by $0.58 to $71.04 per barrel, down -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and the night session fell by 12.7 to 518.8 yuan per barrel.

Core Logic: The continued decline of styrene, the raw material, is dragging down the market due to cost factors.

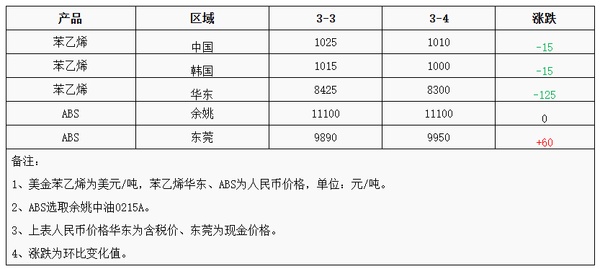

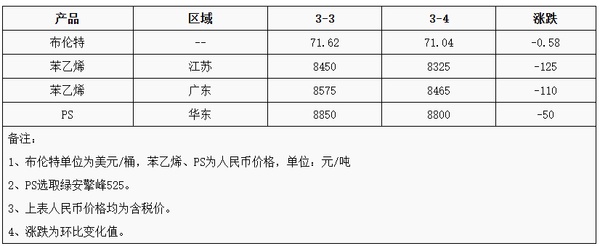

2. Price List

3. Market Outlook

The continued decline of styrene, the raw material, is dragging down the market due to cost factors. The recovery speed of small and medium-sized downstream factories is slower than the supply, and the industry still faces pressure on sales. In the short term, the PS market may turn to selling at reduced prices. It is expected that the transparent modified benzene in the East China market will be in the range of 8700-10300 yuan per ton.

I. Key Points

1. 3/4: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ announcing a slight increase in production from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for May dropped by $0.58 to $71.04 per barrel, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and the night session fell by 12.7 to 518.8 yuan per barrel.

Core Logic: The continued decline in styrene, the raw material, is weighing down on the market costs.

II. Price List

III. Market Outlook

The continuous decline in styrene, the raw material, is putting pressure on the market costs. The recovery speed of small and medium-sized downstream factories is slower than the supply, and the industry still faces sales pressure. In the short term, the PS market may shift towards reducing prices to promote sales. It is estimated that the transparent modified benzene in the East China market will be in the range of 8700-10300 yuan per ton.

1. Focus

1, 3/4: The U.S. tariff policy has sparked potential trade dispute risks, coupled with OPEC+ planning a slight increase in production from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for May dropped by $0.58 to $71.04 per barrel, a reduction of -0.81% month-over-month. China's INE crude oil futures main contract 2504 decreased by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

Core Logic: The continued decline in the raw material styrene is dragging down market costs.

2. Price List

3. Market Outlook

The continued decline in the raw material styrene is dragging down market costs. The recovery speed of small and medium-sized downstream factories is not keeping up with supply, and there is still pressure on shipments. In the short term, the PS market may turn to reducing prices to promote sales. It is expected that the transparent modified benzene in the East China market will be between 8,700 and 10,300 yuan per ton.

1. Points of Focus

1. 3/4: The U.S. tariff policy has sparked potential trade dispute risks, coupled with OPEC+ planning to slightly increase production from April, leading to a decline in international oil prices. The NYMEX crude oil futures contract for April (04) fell by $0.11 per barrel to $68.26, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures contract for May (05) dropped by $0.58 per barrel to $71.04, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 decreased by 7.7 to 531.5 yuan per barrel, and during the night session, it fell further by 12.7 to 518.8 yuan per barrel.

Core Logic: The continued downward trend of styrene as raw material is weighing on the market due to cost factors.

2. Price List

3. Market Outlook

The continued decline in styrene as a raw material is putting pressure on the market through costs. The recovery rate of small and medium-sized downstream factories is not keeping up with supply, and the industry still faces shipping pressure. In the short term, the PS market may shift towards reducing prices to promote sales. It is expected that the transparent modified benzene in the East China market will be in the range of 8700-10300 yuan per ton.

1. Points of Focus

1. Points of Focus1. Points of Focus

1. 3/4: The U.S. tariff policy has sparked potential trade dispute risks, coupled with OPEC+ planning to slightly increase production from April, leading to a decline in international oil prices. The NYMEX crude oil futures contract for April (04) fell by $0.11 per barrel to $68.26, a decrease of -0.16% month-over-month; the ICE Brent crude oil futures contract for May (05) dropped by $0.58 per barrel to $71.04, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract 2504 decreased by 7.7 to 531.5 yuan per barrel, and during the night session, it fell further by 12.7 to 518.8 yuan per barrel.

1, 3/4: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ planning a small production increase from April, leading to a decline in international oil prices. The NYMEX crude oil futures 04 contract fell by $0.11 to $68.26 per barrel, down -0.16% month-over-month; the ICE Brent crude oil futures 05 contract dropped by $0.58 to $71.04 per barrel, down -0.81% month-over-month. China's INE crude oil futures main contract 2504 fell by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

Core Logic: The continued decline of raw material styrene is dragging down market costs.

Core Logic: Core Logic: The continued decline of raw material styrene is dragging down market costs.

II. Price List

II. Price ListII. Price List

III. Market Outlook

III. Market OutlookIII. Market Outlook

The continued decline of raw material styrene is dragging down market costs. The recovery speed of smaller downstream factories is not keeping up with supply, and there is still pressure on sales. In the short term, the PS market may turn to selling at reduced prices. It is expected that the transparent modified benzene in the East China market will be between 8700-10300 yuan per ton.

The continued decline of raw material styrene is dragging down market costs. The recovery speed of smaller downstream factories is not keeping up with supply, and there is still pressure on sales. In the short term, the PS market may turn to selling at reduced prices. It is expected that the transparent modified benzene in the East China market will be between 8700-10300 yuan per ton.

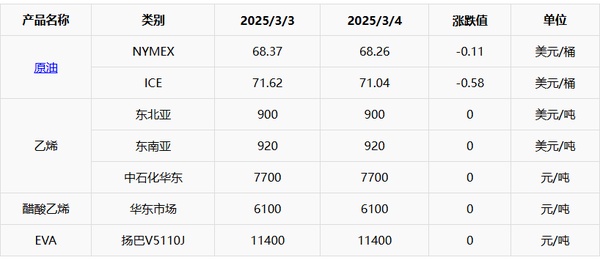

EVA: The supply side continues to support prices, and it is expected that the EVA market will mainly remain stable.

EVA:EVA: The supply side continues to support prices, and it is expected that the EVA market will mainly remain stable.

1. Focus Points

1, 3/4: The U.S. tariff increase policy has sparked potential trade dispute risks, coupled with OPEC+ announcing a slight production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $0.11 per barrel to $68.26, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for May fell by $0.58 per barrel to $71.04, a decrease of -0.81% month-over-month. China's INE crude oil futures main contract for 2504 fell by 7.7 to 531.5 yuan per barrel, and further declined by 12.7 to 518.8 yuan per barrel during the night session.

2, Ethylene: Given the current market conditions, from the perspective of production enterprises, their quotations continue to set new low records. This situation has further exacerbated the wait-and-see attitude of downstream enterprises, making the market trading atmosphere more cautious and hesitant. Under such circumstances, there is a possibility that the negotiated prices will see a correction. Analyzing the US dollar market, the pressure on the supply side cannot be effectively relieved in the short term. Moreover, the demand for shipments remains strong. In summary, prices may maintain a stable state at high levels. It is expected that the transaction range will remain between 7600-7700 yuan per ton; the US dollar market is expected to rise to between 900-910 dollars per ton.

Vinyl Acetate: With some vinyl acetate facilities resuming operations, overall operating load has increased, and cost support has grown. Downstream demand remains relatively stable, and industry players have a firm mindset, with negotiations focusing on higher-end pricing. Based on the expectation of supply-side contraction, intermediaries are reluctant to sell at low prices, with particular attention paid to changes in the operating load of calcium carbide-based facilities. It is anticipated that the market trend will continue to consolidate at high levels recently.

Core Logic: There is an upward expectation for costs of ethylene and vinyl acetate, providing cost support. The domestic EVA supply side offers robust support, suggesting a firm and steady market trend.

2. Price List

3. Market Outlook

In the short term, the petrochemical supply side continues to support price stability, and tight agency inventory leads to firm prices. Downstream foam demand revolves around essential needs, with some resistance to high-priced goods. Holders are very cautious, and it is expected that the domestic EVA market will mainly consolidate sideways. Mainstream market prices: Rigid materials will fluctuate between 11300-11700 yuan per ton, flexible materials may fluctuate between 11500-12000 yuan per ton, and photovoltaic materials between 11500-12000 yuan per ton.

1. Key Points of Focus

1, 3/4: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ planning a modest production increase from April, leading to a decline in international oil prices. NYMEX crude oil futures for April 2023 fell by $0.11 per barrel to $68.26, a decrease of -0.16% month-over-month; ICE Brent crude futures for May 2023 dropped by $0.58 per barrel to $71.04, a reduction of -0.81% month-over-month. China's INE crude oil futures main contract for 2504 decreased by 7.7 to 531.5 yuan per barrel, and during the night session, it further declined by 12.7 to 518.8 yuan per barrel.

2, Ethylene: From the current market situation, producers are continuously setting new low price records. This further intensifies the wait-and-see attitude among downstream enterprises, making the market trading atmosphere more cautious and hesitant. In this context, there is a possibility that negotiation prices may experience a pullback. Analyzing the US dollar market, the pressure on the supply side is unlikely to be effectively alleviated in the short term. Moreover, the demand for cargo shipments remains robust. Overall, prices might maintain a stable state at high levels. It is expected that the transaction range will remain between 7600-7700 yuan per ton; the US dollar market is projected to rise to 900-910 dollars per ton.

Vinyl Acetate: With some vinyl acetate production facilities restarting, overall operating loads have increased, enhancing cost support. Downstream demand is relatively stable, and industry players' confidence is strong, with negotiations focusing on higher prices. Based on expectations of a supply-side contraction, intermediaries are reluctant to sell at low prices, with particular attention being paid to changes in the operating load of calcium carbide-based plants. It is anticipated that the market trend will continue to consolidate at high levels in the coming days.

Core Logic: There is an upward expectation for the costs of ethylene and vinyl acetate, providing cost support. Domestic EVA supply is strongly supported, and the market may show a firm consolidation trend.

2. Price List

3. Market Outlook

In the short term, the petrochemical supply side continues to support prices, and tight agent inventories lead to firm prices. Downstream foam demand revolves around essential needs, with some resistance to high-priced supplies. Traders are very cautious. It is expected that the domestic EVA market will mainly stabilize. Mainstream market prices: rigid materials will fluctuate between 11,300-11,700 yuan per ton, soft materials between 11,500-12,000 yuan per ton, and photovoltaic materials between 11,500-12,000 yuan per ton.

1. Key Points of Focus

1, 3/4: The U.S. tariff hike policy has sparked potential trade dispute risks, coupled with OPEC+ announcing a slight increase in production from April, leading to a decline in international oil prices. NYMEX crude oil futures for April 2023 contract fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for May 2023 contract dropped by $0.58 to $71.04 per barrel, a reduction of -0.81% month-over-month. China's INE crude oil futures main contract for 2504 fell 7.7 to 531.5 yuan per barrel, and further decreased 12.7 to 518.8 yuan per barrel during the night session.

2, Ethylene: From the perspective of the current market situation, manufacturers' quotations continue to set new low records. This situation has further intensified the wait-and-see attitude among downstream enterprises, making the market trading atmosphere more cautious and hesitant. Under such circumstances, there is a possibility of price adjustments. Analyzing the US dollar market, the pressure on the supply side cannot be effectively alleviated in the short term. Moreover, demand for shipments remains strong. Overall, prices may remain stable at high levels. It is expected that the transaction range will be maintained between 7600-7700 yuan/ton; the US dollar market is expected to rise to 900-910 dollars/ton.

Vinyl Acetate: With some vinyl acetate facilities restarting, the overall operating load has increased, and cost support has strengthened. Downstream demand is relatively stable, and industry participants maintain a firm stance, with negotiation focuses remaining at higher levels. Based on expectations of supply-side contraction, intermediaries are reluctant to sell at low prices, with particular attention paid to changes in the operating load of calcium carbide-based facilities. It is anticipated that the market trend will continue to consolidate at high levels in the near future.

Core Logic: There is an expectation for upward movement in the costs of ethylene and vinyl acetate, providing cost support. The domestic EVA supply side is also strongly supported, suggesting the market may maintain a firm consolidation trend.

2. Price List

3. Market Outlook

In the short term, the petrochemical supply side continues to support firm pricing, with tight agent inventories leading to firm prices. Downstream foam demand is focused on essential needs, with some resistance to high-priced supplies. Holders are very cautious, and it is expected that the domestic EVA market will mainly see sideways consolidation. Mainstream market prices: rigid materials will fluctuate between 11300-11700 yuan/ton, flexible materials or between 11500-12000 yuan/ton, and photovoltaic materials between 11500-12000 yuan/ton.

1. Key Points of Focus

1. Key Points of Focus1. Key Points of Focus

1, 3/4: The U.S. policy of imposing additional tariffs has triggered potential risks of trade disputes, coupled with OPEC+ announcing a slight increase in production starting from April, leading to a decline in international oil prices. NYMEX crude oil futures for the 04 contract fell by $0.11 to $68.26 per barrel, a decrease of -0.16% month-over-month; ICE Brent crude oil futures for the 05 contract dropped by $0.58 to $71.04 per barrel, a decrease of -0.81% month-over-month. The main contract of China's INE crude oil futures 2504 decreased by 7.7 to 531.5 yuan per barrel, and during the night session, it further dropped by 12.7 to 518.8 yuan per

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.