Ministry of Commerce: Continue to impose anti-dumping duties on imported resorcinol originating from Japan for a period of 5 years

On March 22, the Ministry of Commerce announced the final ruling on the expiry review of the anti-dumping measures applicable to resorcinol imported from Japan, which mentioned that starting from March 23, 2025, anti-dumping duties will continue to be levied on resorcinol imported from Japan for a period of 5 years. The scope of products subject to anti-dumping duties is consistent with the product scope applicable under the original anti-dumping measures, as outlined in Announcement No. 13 of 2013 by the Ministry of Commerce.

full announcement

The Ministry of Commerce announces the final review decision on the anti-dumping measures applicable to imported resorcinol originating from Japan

On March 22, 2013, the Ministry of Commerce issued Announcement No. 13 of 2013, deciding to impose anti-dumping duties on imported resorcinol originating from Japan and the United States starting from March 23, 2013, with an implementation period of 5 years. The tax rate for Japanese companies was 40.5%, and for American companies, it was 30.1%. On March 22, 2019, the Ministry of Commerce issued Announcement No. 10 of 2019, deciding to continue imposing anti-dumping duties on imported resorcinol originating from Japan and the United States, with an implementation period of 5 years.

On March 22, 2024, at the request of China's resorcinol industry, the Ministry of Commerce issued Announcement No. 9 of 2024, deciding to conduct a final review investigation on the anti-dumping measures applicable to imported resorcinol originating from Japan starting from March 23, 2024. As the United States has ceased production of resorcinol, the applicant did not file for a final review investigation of the anti-dumping measures applicable to imported resorcinol originating from the United States. Starting from March 23, 2024, the anti-dumping measures applicable to imported resorcinol originating from the United States will expire and terminate.

The Ministry of Commerce conducted an investigation into the possibility of continued or recurring dumping of resorcinol imported from Japan if anti-dumping measures were terminated, and the likelihood of continued or recurring damage to China's resorcinol industry. Based on Article 48 of the Anti-Dumping Regulations of the People's Republic of China (hereinafter referred to as the "Anti-Dumping Regulations"), a review decision was made (see attachment). The relevant matters are hereby announced as follows:

I. Reconsideration Decision

The Ministry of Commerce has ruled that if the anti-dumping measures are terminated, the dumping of imported resorcinol originating from Japan into China may continue or recur, and the damage to China's resorcinol industry may continue or recur.

II. Anti-dumping Measures

According to Article 50 of the Anti-Dumping Regulations, based on the investigation results, the Ministry of Commerce proposes to the Tariff Commission of the State Council to continue implementing anti-dumping measures. The Tariff Commission of the State Council makes a decision based on the proposal from the Ministry of Commerce, and as of March 23, 2025, will continue to impose anti-dumping duties on resorcinol imported from Japan for a period of 5 years.

The scope of products subject to anti-dumping duties is the same as the products covered by the original anti-dumping measures, consistent with the product scope in Announcement No. 13 of 2013 by the Ministry of Commerce. Specifically, it is as follows:

Chinese name: resorcinol, also known as 1,3-benzenediol, resorcin

English name: M-dihydroxybenzene or Resorcinol

Molecular formula: C6H6O2

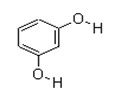

chemical structure formula

Physical and chemical characteristics: usually appears as white needle-like crystals, gradually turns red when exposed to air, easily soluble in water, ethanol, and ether, soluble in chloroform and carbon tetrachloride, insoluble in benzene.

Main use: Resorcinol is an important chemical synthesis intermediate and fine chemical raw material, mainly used in the production of rubber adhesives and UV absorbers. In addition, resorcinol can also be used in the production of wood adhesives, flame retardants, and various pharmaceutical and pesticide intermediates, etc.

The product is classified under the Customs Tariff of the People's Republic of China: 29072100. Resorcinol salts under this tariff number are not included in the scope of the products under investigation.

According to the provisions of Announcement No. 13 of 2013 and Announcement No. 10 of 2019 by the Ministry of Commerce, the anti-dumping duty rates levied on various Japanese companies are as follows:

Sumitomo Chemical Co., Ltd. 40.5%

(Sumitomo Chemical Company,Limited)

2. Mitsui Chemicals, Inc. 40.5%

(Mitsui Chemicals, Inc.)

3. Other Japanese companies 40.5%

III. Method of Levying Anti-dumping Duties

Starting from March 23, 2025, import operators importing resorcinol originating from Japan shall pay the corresponding anti-dumping duties to the Customs of the People's Republic of China. The anti-dumping duty is levied on an ad valorem basis according to the dutiable value determined by the Customs, and the calculation formula is: the amount of anti-dumping duty = the dutiable value determined by the Customs for imported goods × the rate of anti-dumping duty. The value-added tax at the import stage is levied on an ad valorem basis, using the sum of the dutiable value determined by the Customs, tariffs, and anti-dumping duties as the dutiable value.

IV. Administrative Reconsideration and Administrative Litigation

According to the provisions of Article 53 of the Anti-Dumping Regulations of the People's Republic of China, if dissatisfied with this review decision, one may lawfully apply for administrative reconsideration or file a lawsuit with the People's Court.

V. This announcement shall be implemented from March 23, 2025.

Ministry of Commerce of the People's Republic of China

March 22, 2025

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track