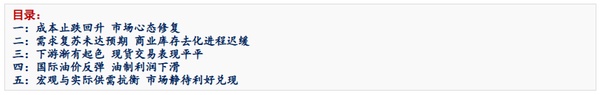

This week, the polypropylene market has not changed much. Due to unstable geopolitical situations, the potential supply risk of crude oil has increased, and oil prices have stopped falling and rebounded, with the overall market sentiment improving. Fundamentally, multiple facilities have temporarily shut down, causing the utilization rate of polypropylene production capacity to drop to a relatively low level. The pressure from new expansions and maintenance outages offset each other, temporarily easing the supply pressure; demand remains stable, with domestic demand still under pressure while the export window continues to open. Overall, as concerns over crude oil diminish and the fundamental situation improves, polypropylene enters a short-term consolidation phase under a pattern of reduced supply and stable demand. As of the 20th, the national average price for drawing fiber is 7325 yuan/ton, a decrease of 20 yuan/ton from last week, a decline of 0.27%. Recent focus points in the polypropylene market:

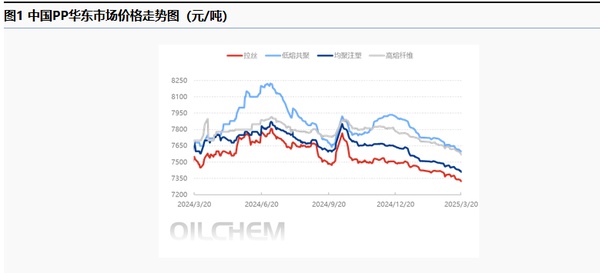

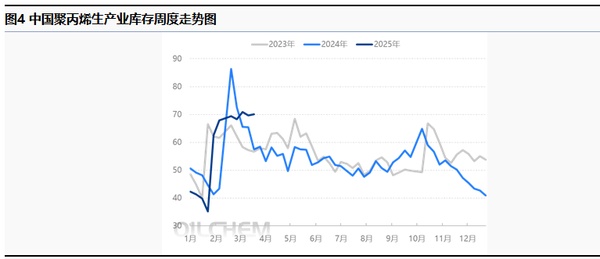

1. This week, China's polypropylene commercial inventory decreased by 0.84% compared to the previous period, while the total inventory of production enterprises increased by 0.66%; the inventory of sample traders increased by 3.23%: the inventory of sample port warehouses increased by 2.70%. Looking at the inventory by grade, the filament grade inventory increased by 0.95%; the fiber grade inventory decreased by 3.05%.

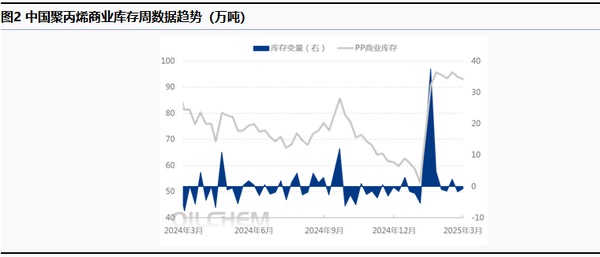

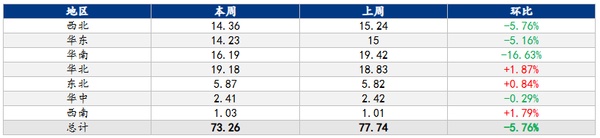

2, This week's domestic polypropylene production was 732,600 tons, a decrease of 44,800 tons from last week's 777,400 tons, a decline of 5.76%. Compared to the same period last year, which was 642,500 tons, it increased by 90,100 tons, an increase of 14.02%.

3, This week (March 14-20, 2025) PP plant loss was 224,270 tons, up 25.10% from last week; of which maintenance loss was 159,840 tons, up 60.43% from last week; load reduction loss was 64,430 tons, down 19.24% from last week.

I. Costs Stop Falling and Begin to Risemarket sentiment recovery

This week, the polypropylene market has not changed much. Due to unstable geopolitical situations, the potential supply risk of crude oil has increased, leading to a rise in oil prices and a recovery in the overall market sentiment. Fundamentally, with multiple facilities undergoing temporary shutdowns, the operating rate of polypropylene production capacity has dropped to a relatively low level. The pressure from new capacity expansions and maintenance outages have offset each other, temporarily easing the supply pressure. Demand remains stable, with domestic demand still under pressure while export opportunities continue to be open. Overall, as concerns over crude oil diminish and the fundamental situation improves, polypropylene enters a short-term consolidation phase under a scenario of reduced supply and steady demand. As of the 20th, the national average price for drawing yarn is 7325 yuan/ton, down 20 yuan/ton from last week, a decrease of 0.27%.

Table 1 Domestic Polypropylene Weekly Supply and Demand Balance Sheet

II. Demand recovery falls short of expectations, and the process of reducing commercial inventory is slow.

Prediction: Next week, Zhejiang Petrochemical Line 1 and Zhongjing Petrochemical dual lines are planned to restart, while Jinneng Chemical Line 2 and Maoming Petrochemical Line 2, among others, are scheduled for maintenance. The restarted capacity is greater than the newly added maintenance capacity, and the polypropylene production capacity utilization rate is expected to slightly increase. Currently, the operational pressure on polypropylene enterprises is concentrated at the PDH end, with high propane prices, the operational pressure on PDH enterprises remains unabated. It is recommended to pay attention to the operation of PDH enterprises, and it is estimated that the polypropylene production capacity utilization rate will operate around 77%.

1downstream purchasing sentiment is poor, commercial inventory slightly decreases

As of March 19, 2025, the total commercial inventory of polypropylene in China was 931,300 tons, a decrease of 7,900 tons from the previous period, down 0.84% month-over-month. During the week, the number of maintenance shutdowns increased, slightly easing supply-side pressure. However, demand was weaker than expected, and overall transactions were sluggish, with producer inventories rising slightly this week. As downstream factories gradually resumed operations, there was a slight reduction in the inventory of sample trading companies for domestic polypropylene. With a decline in shipping prices, domestic producers and traders actively delivered previously agreed export orders, leading to a decrease in port inventories. Overall, the total commercial inventory decreased this week.

2、Maintenance loss of the unit surges,polypropylene capacity utilization rate dropped significantly

error

Table 2 Weekly Polypropylene Production in Various Domestic Regions

3demand recovery below expectations, manufacturers' inventory slightly increased

As of March 19, 2025, the inventory of polypropylene production enterprises in China was 70.07 million tons, an increase of 0.46 million tons from the previous period, a rise of 0.66% month-on-month. Within the week, there were more maintenance shutdowns, slightly alleviating the supply pressure. However, demand performance was below expectations, with overall transactions being weak, leading to a slight increase in the inventory of production enterprises this week.

III. Downstream gradually shows improvement, spot trading performance is mediocre

Prediction: The continuous expansion and increase in supply contrast sharply with the weak demand, overseas tariff hikes suppress downstream export orders, and the slow growth of domestic demand drags down mainstream market transactions. The market's bottom support lies in the relatively stable cost side and the continued benefits of maintenance, alleviating downward pressure on the market. In the short term, the market will revolve around the confrontation and game between supply and demand and the cost side, with an expected weak fluctuation around 7250-7450 yuan/ton. Close attention should be paid to changes in overseas tariffs, progress in destocking social inventories, and the status of demand-side variables.

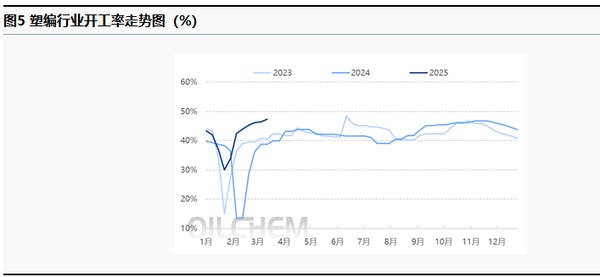

The plastic weaving industry welcomes the peak season, with a slight increase in operating rates.

This week, the operating rate of sample plastic weaving enterprises was at 47.40%, an increase of 0.9% from last week. From the perspective of raw materials, due to unstable geopolitical situations, the potential risks to oil supply increased during the week, leading to a rebound in oil prices and a recovery in the overall market sentiment. The PP market, which is the raw material end, did not change much, providing limited support to product costs, and plastic weaving prices mostly remained stable. Looking at the demand side, as the weather warms up, the plastic weaving industry enters its peak season, with a sudden increase in demand from end markets such as agriculture and construction. Currently, spring farming activities have driven up sales of fertilizer bags. A large number of construction projects have started, warming up orders for cement bags and pushing up their prices. Orders for medium and large plastic weaving enterprises have steadily increased, with companies adjusting their equipment load according to orders, and the overall market trading atmosphere is active. It is expected that the demand for plastic weaving will continue during the golden March and silver April periods, with the possibility of slight increases in plastic weaving prices.

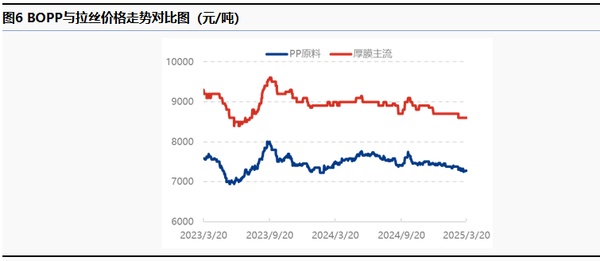

This week, BOPP prices have stabilized with a downward trend. As of March 20th, the mainstream price for thick bright film in East China is between 8600-8800 yuan/ton, remaining flat on a month-on-month basis. International crude oil prices have been adjusted within a range, PP futures have slightly declined, and most of the spot market has also fallen. The ex-factory prices from petrochemical companies have also adjusted, weakening the cost support. The ex-factory prices of some film enterprises have decreased by 50-100 yuan/ton. Traders are mostly maintaining stable prices for sales, but there is a small concession in actual transactions. Due to the weakening price trend of various products in the industry chain, both BOPP and downstream sectors generally hold a pessimistic view towards the future market. The raw material inventory of film enterprises has decreased, and although the finished product inventory has decreased compared to last week, the decline in film prices to some extent restrains the willingness of downstream buyers, affecting their cooperation in receiving goods. New orders for film enterprises are basically on par with previous levels, with some feedback indicating a decrease. At present, the operation of facilities in various film enterprises is basically stable. Additionally, new production facilities expected to be commissioned in East China, Southwest China, and North China are mostly in the installation phase, which will lead to an increase in supply in the later period.

IV. International oil prices rebound, oil production profits decline

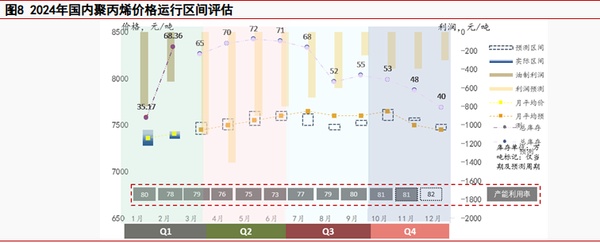

Profit: In the short term, geopolitical tensions and a temporary easing of demand-side pressures may provide some positive support, but overall, there is still a lack of strong rebound momentum. It is expected that international oil prices may have a small upward space next week. Regarding the thermal coal market, both domestic and foreign trade markets are performing poorly. Although port inventories have declined, due to reduced inflows, actual port shipments are still mainly based on rigid demand. Market activity is low, and with no significant increase in daily consumption at the terminal under seasonal influences, indicating a low-demand season, it is difficult for demand to improve in the short term. It is expected that the market price of coal will remain stable in the short term. It is also forecasted that the profit from oil-based PP will decline, while the profit from coal-based PP will see a slight recovery.

This week, the profit of PP produced from externally sourced propylene has been restored, while the profits of PP produced from oil, coal, methanol, and PDH have declined. The United States has taken military action against the Houthi forces in Yemen and continues to impose sanctions on Iran and Russia, increasing potential supply risks. This week, international oil prices showed an upward trend, leading to a slight decline in the profit of oil-based PP. In terms of the thermal coal market, most mines in the region are maintaining normal production, primarily focusing on fulfilling long-term contracts. Overall sales in the mining areas are acceptable, with no inventory pressure at present. The market is mostly in a wait-and-see state, and thermal coal prices are showing a weak but stable trend, resulting in a slight decline in the profit of coal-based PP.

V. Macro and Actual Supply-Demand Confrontation Market Awaits Positive Factors to Materialize

Table 3 Domestic Polypropylene Supply and Demand Balance Forecast

Supply: Maintenance units may increase, temporarily easing supply-side pressure

At the end of March and beginning of April, domestic polypropylene plant maintenance plans remain relatively concentrated, with an increase in planned maintenance facilities. It is expected that the loss of domestic polypropylene plant production due to maintenance may slightly increase next week. Pay attention to the progress of new capacity releases and unexpected shutdown situations.

Demand: Rigid procurement continues, downstream operations slightly increase

Downstream rigid demand procurement is the main focus, as the global economic downturn and overseas tariffs have affected some downstream export orders. Under the dual pressure of reduced domestic and international orders, the willingness to replenish raw material inventories downstream is low. Plastic weaving data shows that the raw material inventory days of large enterprises in the plastic weaving sample increased by 2.60% compared to last week; the raw material inventory days of BOPP sample enterprises decreased by 5.39% compared to last week. The raw material inventory days for modified PP increased by 0.79% compared to last week.

Cost: International oil prices rose slightly, leading to a marginal increase in the cost end.

Cost support still exists, although there is an expectation of easing in international oil prices, due to the recent geopolitical benefits leading to a rise from the low levels of recent international oil prices; propane follows the trend of international oil prices, with recent downstream market entry supporting prices; propylene has limited high-level transmission recently and is mainly stable in the short term.

Conclusion (short-term):The continuous expansion and increase in the supply side contrasts sharply with the weak response on the demand side. The imposition of additional tariffs overseas has suppressed downstream export orders, coupled with a slow increase in domestic demand, dragging down the mainstream market transactions. The bottom support of the market lies in the relatively stable cost side and the continued benefits of maintenance, alleviating the downward pressure on the market. In the short term, the market will revolve around the confrontation and game between supply and demand and the cost side. It is expected that the market will fluctuate weakly within the range of 7250-7450 yuan/ton in the short term, with close attention to changes in additional tariffs overseas, progress in social inventory destocking, and the status of demand-side variables.

Conclusion (medium to long term):Supply and demand drivers work together, with maintenance benefits and rigid demand supporting the market at the beginning of the month. Expectations for policy benefits from the Two Sessions are high, and the market consolidates low-price transactions in the short term. New capacity expansion is weaker than expected, just countering the weak recovery on the demand side. The key to influencing market balance lies in the guidance of cost-side and demand-side variables. The short-term market needs to gather more positive support. It is estimated that the March market will shift its focus to a range of 7300-7550 yuan/ton, then return to a fluctuating situation. Special attention should be paid to the impact of additional tariffs overseas, the release of new capacity, and the inventory consumption and demand-side variable conditions along the industrial chain.