LGD is deeply trapped in a cash shortage dilemma and faces an oversupply of large-sized OLED capacity.

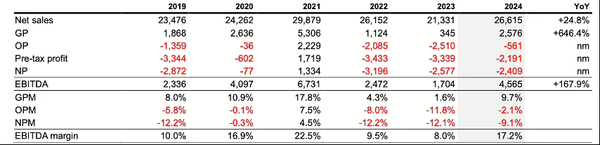

CINNO Research industry news: According to a report by Display daily, LG Display (LGD) faced severe financial challenges from 2019 to 2024. During these six years, LGD's total revenue reached 151.715 trillion Korean won, yet its net operating profit margin was as low as -4.4%, and its pre-tax profit margin fell to -7.4%. More notably, there is a significant mismatch between LGD's OLED production capacity and current market demand. The company has two 8.5G OLED TV panel factories with a combined monthly capacity of 962,500 square meters, but the utilization rate of these high-end capacities has been hovering around 50% to 60%, and market demand has not shown significant growth. In contrast, the capacity for small and medium-sized displays (with a monthly capacity of 294,300 square meters) has an utilization rate as high as 90%, and market demand is steadily growing at a rate of about 10% per year.

LGD Full Year Financial Performance Summary for 2019-2024 (in billion KRW) (Data Source: LGD)

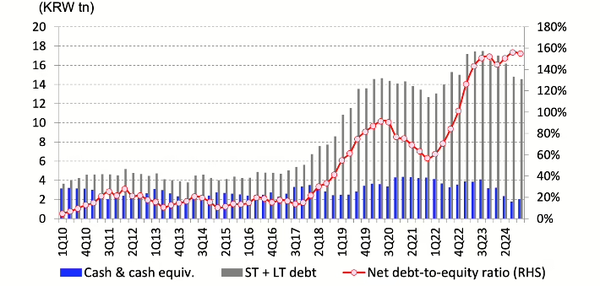

In-depth analysis of LGD's financial performance reveals that from 2019 to 2024, the company's cumulative net profit was only 9.792 trillion won (approximately 6.77 billion USD), and the net debt-to-equity ratio on the balance sheet surged to 160%, a significant deterioration compared to 100% in 2019. This high level of debt severely restricts LGD's ability to finance new production capacity, resulting in its inability to construct an 8.7-generation OLED IT panel factory that can compete with its rivals as planned.

LGD Cash/Cash Equivalents, Debt, and Net Equity/Debt Situation from 2010 to 2024 (Data Source: LGD)

In terms of cash flow management, although LGD has made some improvements in cash flow over the past two years through measures such as layoffs, optimizing production processes, and increasing the output of small and medium-sized panels, its financial situation remains severe. It is expected that by the end of the first quarter of 2025, with the completion of the sale of the Guangzhou 8.5 generation LCD factory, LGD will receive a cash injection of 2 trillion won, which is expected to be primarily used to repay part of its existing debt.

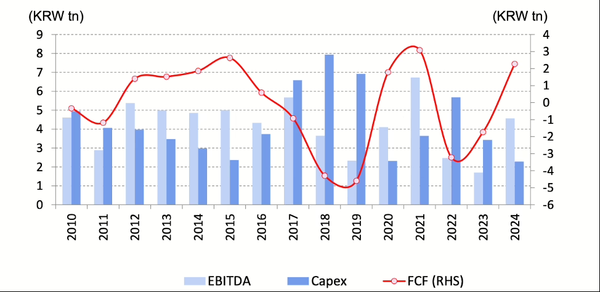

LGD's EBITA/Capex/Free Cash Flow (FCF) from 2010 to 2024 (Data Source: LGD)

It is worth noting that LGD still holds an important position in the LCD panel market, being a top supplier for MacBook and iPad, and surpassing Samsung Display (SDC) in the total supply of LCD and OLED panels for the automotive sector. The company's development momentum and profitability are gradually improving. However, LGD also faces multiple challenges: the cost competitiveness of OLED panels is inferior to that of LCD panels, coupled with the slow acceptance of OLED panels in the automotive sector, as well as the subpar demand for the iPad Pro (OLED version), all of which exert significant pressure on the company.

LG Display stated that due to limitations in production capacity and the restricted release of new iPhone models, the demand for OLED panels by iPhone is unlikely to see significant growth in 2025. However, LGD expects an increase in demand for OLED panels in iPads (possibly anticipating the introduction of new iPad models with OLED displays by Apple). Nevertheless, the total demand for OLED panels from LGD and SDC (combined) is expected to remain stable year-over-year at around 6 million units, with no notable growth in automotive applications, which makes it difficult to maintain an optimistic outlook for LGD’s OLED demand prospects in 2025.

In order to maintain a competitive edge against rivals such as Samsung Display (SDC), BOE, and Visionox, LGD needs to further increase its investment in technology and production capacity. Although LGD holds a dominant position in the LCD panel market for iPads and MacBooks, BOE also occupies a certain market share. Moreover, the LCD panel industry faces a tricky issue: high R&D costs combined with relatively low prices result in thin profit margins.

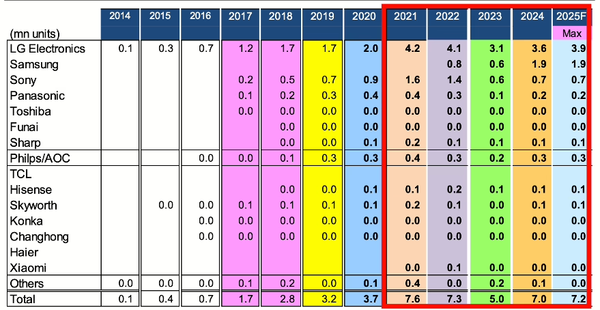

At the same time, although the operational status of the large-size WOLED panel production line has improved due to the growing demand from LG Electronics and Samsung Visual Display, the production line is currently still operating at a loss. Demand in 2025 and beyond remains highly dependent on these two customers. The annual production capacity of television panels is currently around 6 million units. To establish a profitable fixed cost structure, LGD needs to fully utilize its capacity to produce and sell display panels in order to achieve profitability for the production line.

Currently, LGD has no plans for additional investments in 6th and 8.7th generation OLED panels. Although selling the Guangzhou factory to TCL Huaxing Optoelectronics may bring in some funds, it does not seem realistic to recover the cash flow through profit.

LGD's financial situation is also concerning. As of the end of the fourth quarter of 2024, the company holds a total of 2 trillion Korean won in cash and deposits (this amount does not include the assets of its Guangzhou subsidiary). However, it carries interest-bearing debt of 14.5 trillion Korean won, resulting in a net debt of 12.5 trillion Korean won, with the debt-to-asset ratio climbing to an astonishing 155%.

LGD expects that due to factors such as the IT OLED 6th generation production line and the optimization of backend production processes in Vietnam, depreciation and amortization expenses in 2025 will decrease, with an expected year-on-year decline of 0.8 to 0.9 trillion Korean won, bringing it down to 4.3 trillion Korean won. At the same time, the company's capital expenditure plan is about 2 trillion Korean won (a decrease of 0.2 trillion won compared to last year), and it is expected that free cash flow will turn positive, which somewhat indicates that its financial condition is likely to improve. However, given the need to repay up to 3.5 trillion Korean won in debt each year, LGD still faces significant challenges on the road to restoring financial health.

To optimize its cost structure, LGD launched a voluntary early retirement program for factory workers/operators (mainly company headquarters employees) in the third quarter of 2024, with a scale of up to 1.5 trillion KRW. This program continued into the fourth quarter. It is expected that this measure will save the company over 2 trillion KRW annually. Additionally, management plans to sell the Guangzhou LCD plant (GP1/2, referring only to the LCD plant, not including the OLED plant) to TCL CSOT, which is expected to generate revenues of 2.03 trillion KRW. Although management has not yet clarified the specific use of these proceeds, it is highly likely that most of the funds will be used to pay off interest-bearing debt in order to further improve the company's financial situation.

Large-size OLED panels

LGD's financial performance continues to be impacted by its investment in two 8.5-generation OLED factories, with a total investment of approximately $10 billion. Over the past three years, the utilization rate of these two factories has remained at a low level of 50% to 60%, and this situation is expected to persist until 2025.

In 2022, the shipment of TV OLED panels decreased by 17% year-on-year to 6.4 million units, while the production capacity reached as high as 10.5 million units. It is estimated that the sales for that year amounted to 4.3 trillion Korean won, but the operating loss reached approximately 950 billion Korean won.

In 2023, due to continuously weak market demand, shipments further declined to 4.4 million units, a year-on-year decrease of 31%. The sales for the year were estimated to be around 29 trillion KRW, but the operating loss expanded to approximately 1 trillion KRW.

In 2024, LGD reported a shipment volume of 5.9 million units, with an average factory utilization rate of 60%, and sales slightly below 4 trillion won.

It is expected that Samsung Visual Display (SVD) will see demand reach 700,000 units in 2024. Although SVD will use panels of all sizes in 2024 (including 48-inch, 55-inch, 65-inch, and 77-inch panels), which is a positive sign, future demand may fluctuate based on market conditions and its own strategic adjustments. Meanwhile, LG Electronics' demand is expected to gradually rise, while demand from Sony and European companies may remain stable or slightly decline. In the display sector, shipments are expected to increase from 600,000 units in 2024 to around 800,000 units. Thanks to increased sales and cost-cutting measures, operational losses are gradually narrowing. The loss for the fiscal year 2024 is expected to be about 30% of the loss in fiscal year 2023, approximately 300 to 350 billion Korean won. Looking ahead to 2025, LGD plans to further reduce costs through full amortization of two 8.5-generation factories.

▲ OLED TV Panel Shipments by Brand * (Data Source: Mizuho) 2024-2025

Including 1.3 million QD-OLED panels for 2024 and 2025.

Transition to LTPO/Pro Models for Small and Medium-sized OLED Panels

Promote LGD to surpass SDC in the supply of iPhone 16 Pro/Max.

The E6-1, E6-2, and E6-3 production lines (each with a capacity of 45,000 panels per month) primarily serve the iPhone supply chain. For estimated shipment volumes in the past, please refer to the following chart. Due to a technological gap with SDC, LGD has been at a disadvantage in terms of the number, scale, and price of orders received.

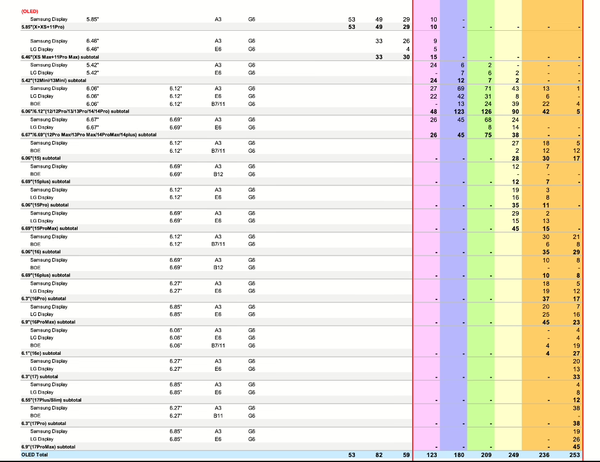

OLED Panels Supplied to Apple, by Size, Model, and Panel Manufacturer (in millions) (Data Source: Mizuho)

In the iPhone 15 series of 2023, LGD successfully secured orders for the high-end models 15 Pro Max and Pro (both using LTPO technology). Although the mass production certification process was delayed, thanks to a rapid recovery in the fourth quarter, the shipment volume for the Pro models reached 15 million units, while the Pro Max model reached 16 million units, bringing the total annual shipment volume to over 50 million units for the first time, reaching 55 million units. As the high-priced LTPO models became the main products, LGD's profitability also significantly improved. Entering 2024, the company continued to receive orders for the iPhone 16 Pro Max and Pro, and for the first time, obtained Apple's certification almost simultaneously with SDC.

In terms of market share, LGD has surpassed SDC. Specifically, LGD supplied 25 million units for the Pro Max model (accounting for 55%) and 21 million units for the Pro model (accounting for 53%). It is expected that by 2025, all iPhone 17 models will adopt LTPO panels, with LGD providing OLED panels for the Pro Max (which may no longer include the Pro model), Plus (which is designed with the concept of “Slim+Light”, possibly referred to as the 17 Air), and mainstream iPhone 17 models. Since BOE's LTPO process has not yet been certified, LGD is expected to take over some of the panel supply for the “17” series models originally assigned to BOE. Additionally, LGD will provide panels for the 16e model based on low-temperature polycrystalline silicon (LTPS) technology, although in limited quantities, and production capacity will become a medium- to long-term concern. To address this challenge, the company plans to shift around 5,000 units of iPad production capacity to the iPhone production line.

OLED panels in the IT field

Starting from the first quarter of 2024, LGD began utilizing its 6th-generation factory (the E6-4 production line of P10) to produce OLED panels for iPads. Among the two OLED iPad models released in 2024 (11.1 inches and 12.9 inches), LGD is expected to become the primary supplier of the 12.9-inch panel. The modular production capacity of this production line is anticipated to reach up to 900,000 units per month, with an annual total production of approximately 4 to 4.5 million units. However, due to weak market sales performance, the actual supply was ultimately reduced to around 3.5 million units. The E6-4 production line uses a tandem structure (i.e., two stacked emissive layers) to produce OLED panels, employing 6th-generation substrate dimensions and 6th-and-a-half generation deposition processes, consistent with the E6-1/2/3 production lines. In contrast, SDC supplies the 11.1-inch panels through its existing A3/A4 factories; however, its supply was revised downward from an initial estimate of 3.5 to 4 million units in early 2024 to 2.5 million units.

SDC is actively advancing the construction of the world’s first 8.7-generation RGB OLED production line for MacBooks. This production line utilizes oxide substrates and Canon Tokki's 8.7-generation semi-deposition equipment, with plans for mass production supply by the end of 2025 or early 2026, providing 14.3-inch and 16.3-inch panels. As for LGD, while it is evaluating 8.7-generation RGB OLED panels for MacBooks at its P10 factory (using oxide substrates, ion implantation, and G8.7 semi-deposition processes), and originally planned to build a prototype production line before establishing a large-scale production line (increasing capacity from 7,500 sheets per month in 2025 to 15,000 sheets per month in 2026), this plan has been temporarily shelved due to insufficient cash flow.

At the same time, BOE and Visionox are actively building 8.7G OLED factories, with each production line's monthly capacity expected to be around 15,000 units. BOE is预计将在2026-27年实现大规模生产,而维信诺则计划到2028年达到每月1.5万片的产能。 BOE is expected to achieve large-scale production between 2026 and 2027, while Visionox plans to reach a capacity of 15,000 units per month by 2028.

It is noteworthy that the sales weakness of the first iPad model to use an OLED display, the iPad Pro, may significantly impact LGD's investment decisions. It is predicted that the demand for iPad Pro panels in 2025 will be roughly the same as in 2024, leading to underutilization of the E6-4 production line’s capacity of 15,000 sheets per month. As a result, LGD plans to convert the excess capacity for production related to iPhones.

In terms of equipment selection, SDC chose Canon Tokki's 8.7-generation semi-deposition equipment based on Apple's requirements. Following SDC's decision to invest in the 8.7-generation production line, China's BOE is likely to use the systems developed in collaboration with LGD from the Korean company Sunic. Visionox may initially choose to use equipment from Sunic or Tokki in the first phase, and then switch to Applied Materials' Max OLED equipment.

Outlook for the first quarter of 2025 and beyond

For the first quarter of 2025, LGD expects its total shipment volume (calculated based on panel area and considering seasonal factors leading to a decrease in television application shipments) to experience a single-digit percentage decline quarter-over-quarter. Additionally, the average selling price (ASP) is also expected to decline by approximately 15% quarter-over-quarter, mainly due to the decreasing weight of mobile device OLED panels in the overall shipment volume. Management pointed out that since the second half of 2024, the company's profitability has stabilized, and it anticipates a recovery in profitability as the OLED smartphone market is expected to grow by about 20% in the first half of 2025, excluding one-time costs. On the technical front, LGD stated that it is well-prepared to meet the market demand for foldable smartphones, while developments in other areas will entirely depend on actual market and customer demand. Although the demand for OLED iPad panels is currently insufficient, LGD still predicts that its shipments will achieve year-over-year growth in 2025.

In terms of capital expenditure, LGD invested 2.2 trillion Korean won in 2024, which is a decrease from 5.2 trillion Korean won in 2022 and 3.6 trillion Korean won in 2023. The company expects its capital expenditure to remain at last year's level in 2025, approximately between 2 trillion Korean won and 2.5 trillion Korean won. Regarding whether to invest in constructing an 8.7-generation OLED IT panel production line, LGD is adopting a wait-and-see approach. At the fourth-quarter earnings release in 2024, management revealed that depreciation costs are expected to decline in the second half of 2025, which will help further improve the company's profitability.

However, a key issue that LGD faces is that 50% of its large-sized OLED production capacity remains underutilized, a problem that has not been publicly addressed since 2021 and is one of the main reasons for the company's market capitalization plummeting by 400%. At LGD's regular general meeting of shareholders, CEO Kwon Young-soo explicitly stated, "In the area of large-sized panels, we will strive to shift towards a more profitable business model by increasing product sales and optimizing our cost structure."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track