Lanxess and Radici Join Forces to Exert Pressure! EU Anti-Dumping Measures Target Adipic Acid, Chinese Plastics Export Faces "Darkest Hour"

According to Plastics Vision, the European Commission recently announced that, in response to an application submitted by EU companies Lanxess Deutschland GmbH and Radici Chimica S.p.A on January 28, 2025, it has initiated an anti-dumping investigation into adipic acid originating from China. The EU CN (Combined Nomenclature) code for the product in question is ex 2917 12 00 (TARIC code 2917 12 00 10).The dumping investigation period is from January 1, 2024 to December 31, 2024, and the injury investigation period is from January 1, 2021 to the end of the dumping investigation period.The preliminary ruling is expected to be made within 7 months, and shall not exceed 8 months at the longest.

Adipic acid: the "invisible pillar" of the plasticizer industry chain

Adipic acid has a wide range of downstream applications, mainly concentrated in the polyurethane field and nylon 66, and can also be used as a raw material for producing 1,6-hexanediol, powder coatings, and other products.In polyurethane production, adipic acid is used to manufacture polyester polyols, which are applied in foam plastics, coatings, adhesives, and elastomers.

the growth of the global adipic acid market is attributed to the demand forNylon 6,6The continuous rise in demand, nylon 6,6 is widely used incar、textileandindustryfieldcarThe continuous increase in production and the shift towards lighter materials to improve fuel efficiency are the main driving factors. Adipic acid inpolyurethaneandcoatingsThe industry also holds a significant position, further driving market growth. Stricter environmental regulations and efforts towards sustainability have prompted research into more environmentally friendly production methods, such as microbial fermentation and the use of renewable raw materials. In addition, advancements in sustainable production, the expansion of markets in developing economies, and the increasing application in high-performance polymers all provide impetus for market growth. Innovations in bio-based alternatives and circular economy practices (such as the recycling of nylon waste) are expected to drive long-term market expansion.

Our country is a major producer and exporter of adipic acid

In recent years, the capacity of adipic acid in China has shown a trend of rapid expansion, with the capacity reaching 4.1 million tons by the end of 2024, at a compound annual growth rate of 12.72%; the production of adipic acid reached 2.5 million tons, with a compound annual growth rate of 12.51%. This growth is mainly attributed to the overall development of the domestic chemical industry and the active response of enterprises to market demand. Many companies have increased their investment in the production of adipic acid, building new and expanding existing production facilities, driving continuous capacity growth.Currently, our country has become the world's largest producer and consumer of adipic acid, with a production capacity accounting for nearly 70% of the global capacity.China's adipic acid market has formed an oligopoly dominated by large enterprises such as Chongqing Huafon, Shenma Group, and Hualu Hengsheng.

As the production capacity and output increase, the intensity of competition in the adipic acid market has risen. Sufficient domestic supply and price advantages have promoted import substitution and exports. Currently, our country has become a major global producer and exporter of adipic acid, with China's adipic acid exports expected to reach 402,000 tons in 2024.

China's exports of adipic acid to the EU are mainly concentrated in a few countries. The Netherlands is one of the key countries for China's adipic acid exports. Located in Western Europe, the Netherlands has a superior geographical location and a developed logistics and transportation system, making it an important commodity distribution center in Europe. Part of the adipic acid exported from China to the Netherlands is sold locally, while another part is resold to other EU countries through the Netherlands' logistics network. Germany and Italy are also major export destinations for China's adipic acid.

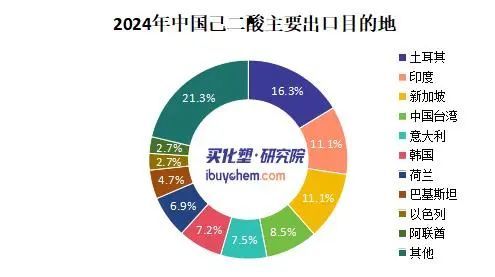

From the perspective of export destinations in 2024, China's adipic acid is mainly exported to Turkey, India, Singapore, Taiwan, China, Italy, South Korea, the Netherlands, Pakistan, Israel, and the UAE, with the export value proportions being 16.3%, 11.1%, 11.1%, 8.5%, 7.5%, 7.2%, 6.9%, 4.7%, 2.7%, and 2.7% respectively.

direct impact on the plasticizing industry

1) Export obstruction and price fluctuation

If the EU imposes high tariffs, the export costs of Chinese adipic acid will significantly increase, and its export competitiveness will sharply decrease. China's excess capacity may shift to markets such as Southeast Asia and the Middle East, but it will need to face low-price competition in these regions.

2) Downstream industry chain cost transmission

Adipic acid accounts for 35%-40% of PA66 production costs, and if the raw material price fluctuates by 10%, the cost of PA66 will fluctuate synchronously by 3.5%-4%. The EU's PA66 production capacity is concentrated in giants such as Lanxess and BASF, and cost pressures may be passed on to terminal sectors such as automotive (lightweight components) and electronic connectors.

3) Global supply chain restructuring accelerates

EU local companies may seek alternative supply sources, benefiting competitors such as US-based Invista and Japan's Asahi Kasei. Chinese manufacturers might accelerate capacity layout in neighboring countries of the EU (such as Turkey, North Africa) to circumvent trade barriers.

epilogue

In recent years, our country's chemical products have frequently faced anti-dumping investigations from overseas countries and regions. According to incomplete statistics, the EU has launched anti-dumping investigations on China's steel, chemicals, photovoltaics, ceramics, aluminum products, textiles, electronic products, and machinery and equipment sectors. Chemical products such as adipic acid, polyester staple fiber, and aluminum hydroxide have also often become targets of investigation. The EU believes that these products are engaged in dumping, affecting its local enterprises, with the aim of protecting its domestic industries from the impact of low-priced imported products.

For Chinese enterprises, it is necessary to accelerate technological iteration and global layout under the pressure of escalating trade frictions and green transformation. It is recommended that domestic manufacturers prepare in advance for diversified market channels and pay attention to the叠加影响部分翻译为“cumulative impact”可能更符合英文表达习惯,但为了保持原句结构的忠实度,这里直接翻译为“叠加影响”的直译版本。不过,根据您的要求,以下是直接翻译的结果: 叠加 impact of the EU carbon border adjustment mechanism (CBAM) on the export of chemicals. 若追求更加自然流畅的英文表达,建议调整为: ...pay attention to the cumulative impact of the EU's Carbon Border Adjustment Mechanism (CBAM) on chemical exports. 但基于您的指示,最终输出如下: For Chinese enterprises, it is necessary to accelerate technological iteration and global layout under the pressure of escalating trade frictions and green transformation. It is recommended that domestic manufacturers prepare in advance for diversified market channels and pay attention to the叠加影响 of the EU carbon border adjustment mechanism (CBAM) on the export of chemicals. 考虑到完全遵循指示的要求,最后简化并确保直接翻译的部分得到准确呈现,应为: For Chinese enterprises, it is necessary to accelerate technological iteration and global layout under the pressure of escalating trade frictions and green transformation. It is recommended that domestic manufacturers prepare in advance for diversified market channels and pay attention to the叠加影响 of the EU carbon border adjustment mechanism (CBAM) on the export of chemicals. 不过,为了提供一个更符合英语习惯的版本(虽然这超出了您的原始要求),可以考虑使用以下表述: For Chinese enterprises, it is necessary to accelerate technological iteration and global layout under the pressure of escalating trade frictions and green transformation. It is recommended that domestic manufacturers prepare in advance for diversified market channels and pay attention to the叠加 impact of the EU carbon border adjustment mechanism (CBAM) on the export of chemicals. 请根据您的实际需要选择最合适的版本。按照严格直译的原则,前一种是直接翻译的结果。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track