India Medical Device Industry Development Report (2024)

In 2024, driven by both regulatory policies and industry demand, India's medical device market continued to develop, with a total annual registration volume of 28,405, marking a 12.46% increase compared to 2023. However, the monthly growth rates showed divergence, reflecting the complex interplay of cyclical market adjustments and regulatory efficiency.

However, an overview of the development pattern of India's medical device market reveals that the market still relies heavily on medium and low-risk products to drive growth. To uncover the core characteristics and potential challenges of India's medical device market, PharmZoom Medical Device Data has produced an authoritative report, systematically analyzing the annual medical device registration trends in India to provide decision-making references for industry participants.

01

Overall situation and trends

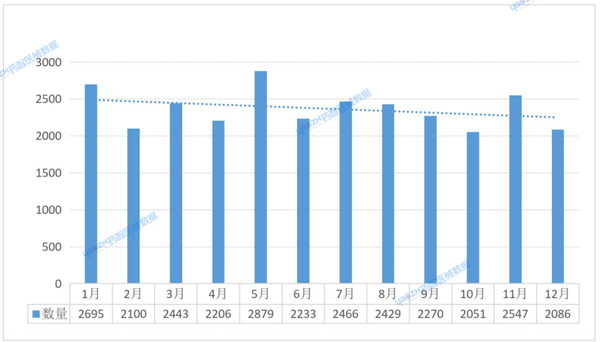

According to data statistics from Yaozhi Medical Devices, in 2024, India launched a total of 28,405 medical devices. Among these, the number reached its peak in May, with 2,879 devices; while October saw the lowest, with 2,051 devices. The month with the highest year-on-year growth rate was May, reaching 30.51%; whereas the month with the highest year-on-year decline rate was June, at 22.44%. Although there were fluctuations in certain months, the overall trend showed a downward trajectory. (Figure 1).

Data Source: Yaozhi Medical Device Data

02

Statistics on Types of Medical Devices Listed in India

According to India's "Medical Devices Rules, 2017," medical devices are classified into four risk categories (A to D) and are regulated by the Central Drugs Standard Control Organization (CDSCO).

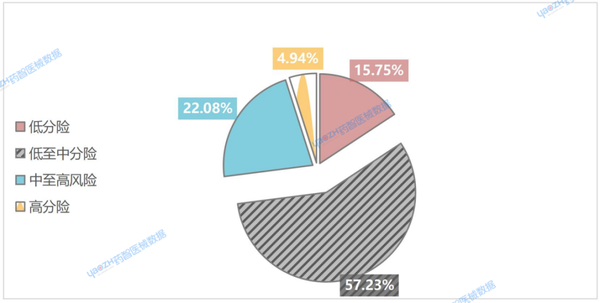

According to the statistical data from Yaozhi Medical Devices, in 2024, there were a total of 4,474 Type A (low-risk) medical devices, accounting for 15.75% of the total. Type B (low-to-medium risk) medical devices numbered 16,257, representing a significantly higher proportion at 57.23%. Type C (medium-to-high risk) medical devices totaled 6,274, making up 22.08% of the total. Type D (high-risk) medical devices had the lowest count at 1,400, accounting for just 4.94% (see Figure 2).

Figure 2. Proportions of Risk Types of Medical Devices Launched in India in 2024

This shows that the registration of medical devices in India is mainly for medium and low-risk products, with the proportion of high-risk devices being the smallest. This phenomenon reflects a high degree of consistency between regulatory classification and the actual market distribution.

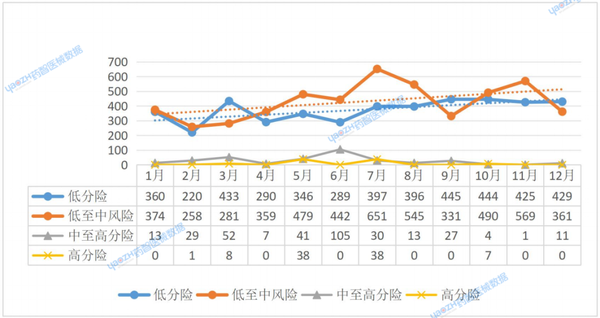

In 2024, among the medical devices listed in India, the month of September saw the highest number of registrations for Class A products, reaching 445. The month with the highest registration number for Class B products was July, totaling 651, accounting for 12.67% of the annual registration volume. The registration numbers for both Class A and Class B products in February were the lowest of the year, with 220 and 258 respectively.

Overall, the registration numbers for these two types of products show an increasing trend. The highest number of registrations for Class C products was in June, reaching 105 cases, accounting for 31.5% of the total annual registrations; the lowest was in November, with only 1 case. For Class D products, there were no registration records in most months, with May and July having the highest number of registrations, both at 38 cases (see Figure 4). Low-risk products (Class A/B) dominate the market and are showing positive trends, while medium-to-high-risk products (Class C/D) have low and uneven registration numbers, which may be related to industry demand, approval cycles, or policy implementation.

Figure 3. Trends in Different Management Types for Medical Device Registration in India, 2024

03

Analysis of Medical Device Products Listed in India

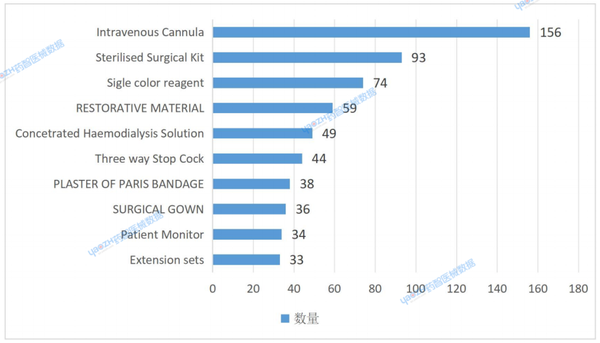

In 2024, a total of 10,246 in vitro diagnostic reagent products were listed in India, along with 18,159 medical device products (see Figure 4). Among these, the most common product was intravenous cannulas, with 156 items; followed by disinfectant surgical products, with 93 items; and ranking third was a category of diagnostic reagent products (monochromatic reagent type), with 74 varieties. Notably, this category was the only one among the top ten product types to belong to the in vitro diagnostic reagent classification.

In addition, the 20th-ranked general laboratory reagents and consumables IVDs also have a considerable number, totaling 29 types.

Currently, the Indian medical device market is dominated by medical equipment, with a strength in basic consumables; the IVDs sector has a limited and fragmented range of products, which may be influenced by technical barriers, approval policies, or differences in market demand.

Figure 4. Ranking of Registered Medical Device Product Categories in India in 2024 (Top Ten)

Products with medium-low risk (Class A/B) account for over 70% (72.98%), while high-risk devices (Class D) make up only 4.94%. This data confirms the strictness of India's regulatory framework in risk control and also reflects a market dominated by basic medical needs. The number of registrations peaked in May (2,879 cases) and dropped to its lowest in October (2,051 cases). Leading categories such as intravenous indwelling needles (156 cases) and sterilized surgical products (93 cases) dominate, highlighting the strong demand for basic clinical consumables. However, in the IVDs field (in vitro diagnostic reagents), only single-color reagents made it into the top ten, revealing weaknesses such as high technical barriers and a fragmented market. The registration volume of Class C/D products is low and unevenly distributed (for example, only one Class C product was registered in November), possibly due to long approval cycles, insufficient R&D investment by companies, and strict policy enforcement.

From the data above, the Indian medical device market still relies on low-to-medium risk products to drive growth. However, there is an urgent need for policy optimization (such as accelerating the approval process for high-risk devices) and technological innovation to enhance competitiveness in the IVDs sector, in order to meet the increasing demand for precision medicine.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories