In the plastic chemical industry, "compared to China, South Korea is falling behind step by step."

On March 21, Bloomberg published an article stating that for South Korean plastic chemical companies, China, once their largest market, is becoming a strong competitor. As Chinese companies rapidly develop, South Korean companies have suffered losses of hundreds of millions of dollars and are now being forced to explore new markets.

The report states that Korean plastic giants such as LG Chem and Lotte Chem, which rely on exports, once profited handsomely by outcompeting their Japanese rivals, thanks to the explosive growth of the Chinese economy and the massive demand for imported products. However, in recent years, the fortunes of these Korean companies have changed. Data shows that Korean chemical companies are experiencing increasingly difficult times, with the industry's exports declining by more than 15% in 2023.

Paul Joo, Executive Director of Olefins and Olefins Derivatives Research at S&P Global Commodity Insights, analyzed: "China is rapidly expanding its production of polyethylene and polypropylene, reducing its dependence on imports from South Korea, and has even begun exporting to other countries in Asia and South America."

He believes that unless decisive restructuring is carried out, "Korea may fall behind."

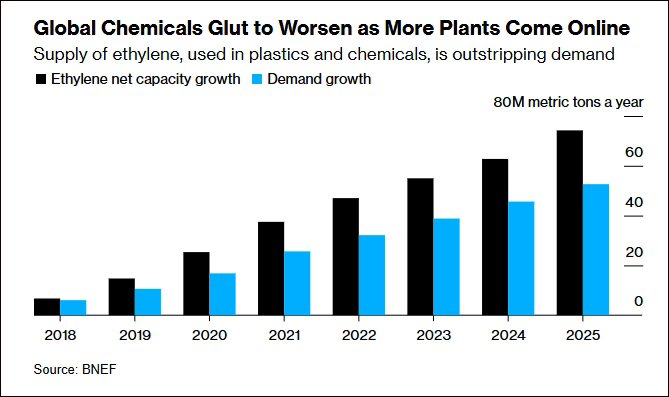

BloombergNEF analyst Philip Geritz said that this year, the global capacity for chemicals such as ethylene and propylene is expected to grow at a level close to record-breaking, with the vast majority of this growth occurring in China.

In recent years, the global production capacity of chemicals such as ethylene and propylene has rapidly increased Bloomberg chart (as below)

Bloomberg noticed that some South Korean companies have already begun to make adjustments. For example, LG Chem has closed some of its plants and exited the styrene monomer market used for plastic and rubber production. Meanwhile, Lotte Chemical is selling its shares in its Pakistani subsidiary and suspending operations at its synthetic rubber plant in Malaysia to limit losses.

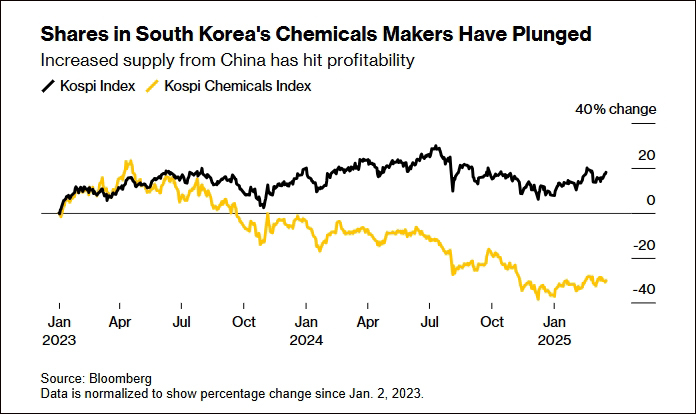

But the report points out that these asset divestitures are unlikely to significantly reduce Lotte Chemical's record annual operating loss of nearly 900 billion won (617 million US dollars) last year. The profitability of other Korean companies such as LG Chem has also declined significantly. This has hit company valuations, with the chemical industry being the worst-performing sector on the Korea Exchange over the past 12 months, falling by about a quarter.

Korean chemical manufacturers' stock prices continue to plummet

LG Chem and Lotte Chemical both stated that in order to recover, they are turning to more specialized products in the renewable energy sector. LG Chem said that the company "will continue to develop climate-friendly businesses, restructure its product portfolio, shift towards high-value products, and strive to overcome the stagnation of profitability through regional diversification."

However, Bloomberg is not optimistic about the development prospects of LG Chem and Lotte Chemical. Firstly, Chinese companies are also increasing their production capacity in the renewable energy sector; secondly, Chinese companies have newer production facilities than Korean companies. In addition, Chinese companies have other advantages, such as being able to more easily obtain cheaper raw materials from some production locations that are difficult for their Korean counterparts to access.

The report mentioned that as an ally of the United States, South Korea followed suit in imposing sanctions on countries such as Russia and Iran, not participating in oil product transactions with sanctioned countries. Data shows that since April last year, Russia has not exported naphtha to South Korea for use as fuel or for the production of chemicals.

Chua Sok Peng, a petrochemical analyst at the London Stock Exchange Group, said: "Due to US sanctions, South Korea cannot purchase liquefied petroleum gas from countries like Iran, which in turn gives China a significant cost advantage."

Bloomberg also mentioned that with the booming development of electric vehicles, China is accelerating changes in its energy structure, and chemical companies are beginning to reduce fuel production and increase petrochemical production. This shift towards "refining and petrochemical integration" (a production model combining oil refining and naphtha cracking for chemical production) in China is not a good omen for South Korean chemical companies.

Paul Joo of S&P Global said, "Thanks to lower costs and strong government support, China is rapidly achieving refining and petrochemical integration. In comparison with China, South Korea is losing its edge."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track