Heavyweight! "Bill-for-export" may come to an end! Joint issuance by five ministries

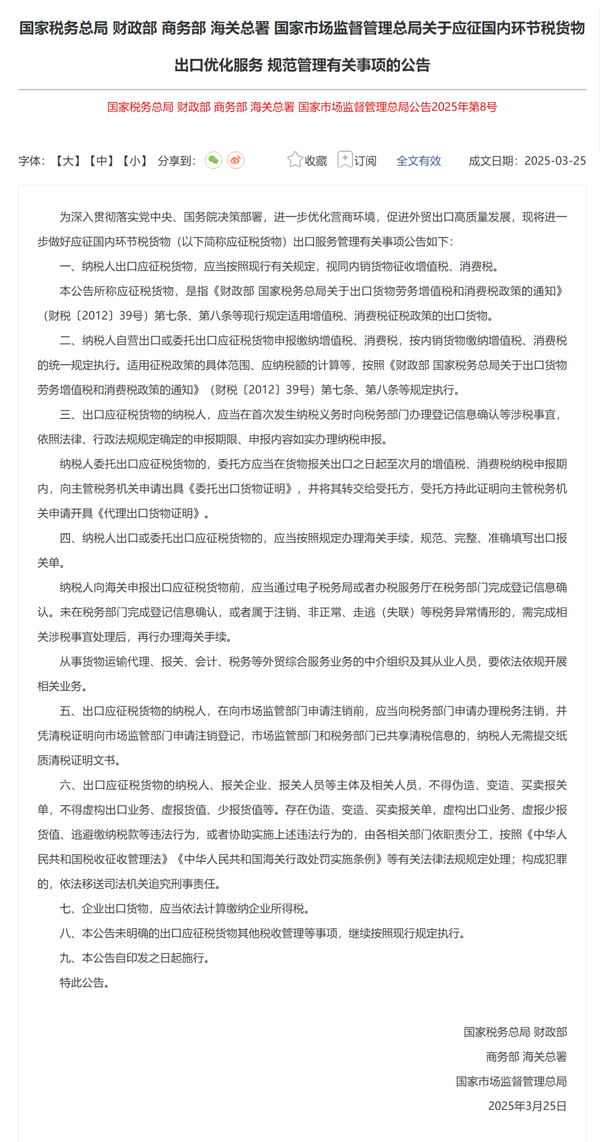

Recently, five major departments including the State Administration of Taxation, the Ministry of Finance, the Ministry of Commerce, the General Administration of Customs, and the State Administration for Market Regulation jointly issued the "Announcement on Optimizing Services and Standardizing Management for the Export of Goods Subject to Domestic Taxation" (hereinafter referred to as the "Announcement").

The "Announcement" emphasizes that taxpayers of taxable export goods, customs declaration enterprises, customs declarants, and other relevant entities and individuals must not forge, alter, or trade customs declaration forms, and must not fabricate export businesses, overstate or understate the value of goods.

The core purpose of the joint announcement by the five national departments is to target low-price tax evasion in exports, particularly in the steel industry, commonly referred to as "false declaration exports" in the industry. Given the massive export volume and significant tax implications involved in steel false declaration exports, they have become a key focus of this announcement.

Industry analysis suggests that this policy carries significant influence, as the "Announcement" essentially represents a comprehensive review and enhancement of previous issues related to low-price tax evasion through export buying. This move signals that the government's crackdown on tax evasion via export buying has escalated from sporadic actions to the level of laws and regulations, indicating that such practices will be fundamentally curbed.

How tax evasion and fake export schemes profit and their harms

According to analysis, since 2021, the government has completely abolished export tax rebates for all steel product categories. This change has resulted in exporters no longer needing to rely on invoices from upstream suppliers or export documents to apply for tax rebates at tax authorities.

At the same time, foreign recipients have never required domestic exporters to provide invoices, so domestic exporters have accumulated a large number of goods that do not require invoicing.

These "no-invoice-needed" goods provide exporters with a new "profit channel": they can be resold to downstream users who "only need input invoices without actual goods." By purchasing these VAT invoices at a low price, downstream users use them as input tax credits, thereby obtaining tax reductions without actually purchasing the steel.

In this industrial chain, all parties benefit: exporters earn certain profits by selling tax tickets; downstream users reduce their tax burden by purchasing tax tickets for input tax credits; foreign recipients acquire the required goods at lower prices. However, the only party that suffers is the national revenue.

To evade potential subsequent audits and accountability, many companies that exploit low prices to evade taxes through export declarations adopt the strategy of quickly registering foreign trade companies and immediately deregistering them after completing transactions.

Since these enterprises are not required to provide tax payment certificates when they are deregistered, they can often evade the investigation of the tax authorities, making this kind of tax evasion behavior more concealed and difficult to crack down on.

Analysis suggests that in recent years, the booming steel exports have stimulated a peculiar phenomenon of false invoicing, which has far-reaching consequences. At its core, low-price exporters and foreign clients benefit from this practice, while the national tax revenue suffers significant losses. Additionally, this behavior severely damages the reputation of China's steel exports and provides foreign countries with "ammunition" to launch anti-dumping investigations against Chinese steel exports.

Article 4 of the *Announcement* clearly stipulates: Taxpayers must complete registration information confirmation with the tax authorities through the electronic tax bureau or tax service hall before declaring export dutiable goods to customs. For taxpayers who have not completed registration information confirmation or have tax-related irregularities such as deregistration, abnormal status, or evasion (loss of contact), they must first resolve the relevant tax matters before proceeding with customs procedures.

Article 5 stipulates that before the taxpayer of export goods subject to taxation applies for cancellation with the market supervision department, they must first apply for tax cancellation with the tax department and apply for cancellation registration with the market supervision department with the tax clearance certificate.

"Full Text and Interpretation of the 'Announcement'"

Interpretation of the Announcement by the State Taxation Administration, Ministry of Finance, Ministry of Commerce, General Administration of Customs, and State Administration for Market Regulation on Optimizing Services and Regulating Management of Export of Goods Subject to Domestic Taxation

One, what is the background for the release of the "Notice"?

The scope of goods subject to export duties includes which items?

According to the provisions of the first item of Article 7 and the first item of Article 8 of the "Notice of the Ministry of Finance and the State Administration of Taxation on the Value-Added Tax and Consumption Tax Policies for Export Goods and Labor" (Cai Shui [2012] No. 39), the scope of goods subject to value-added tax and consumption tax policies for export is as follows:

(I) Export goods subject to VAT taxation policy

1. Export enterprises exporting or deemed to be exporting goods for which the Ministry of Finance and the State Taxation Administration have determined to cancel the export tax refund (exemption) according to the State Council's decision [excluding processing trade exports, bid-winning electromechanical products, listed raw materials, water, electricity, and gas input into special regions, and marine engineering structures].

Export enterprises or other units sell daily consumer goods and transportation tools to special areas.

3. Export enterprises or other units that have their value-added tax refund (exemption) processing suspended by the tax authorities due to fraudulently obtaining export tax rebates during the period of export of goods.

Export enterprises or other units providing goods with false filing documents.

5. Export enterprises or other units have forged or false content on VAT refund (exemption) certificates for goods.

Export enterprises or other entities that fail to declare tax-exempt write-off within the time limit specified by the State Administration of Taxation, as well as those for which the competent tax authority does not approve the tax-exempt write-off for exported cigarettes.

The export of goods or services by export enterprises or other entities that fall under one of the following circumstances:

(1) Handing over blank export customs declaration forms, export collection verification certificates, and other tax exemption documents to other units or individuals, excluding freight forwarding companies and customs brokers that have signed a power of attorney contract, or freight forwarding companies designated by the overseas importer (providing contractual agreements or other relevant proofs).

(2) Exporting in the name of self-operation, where the export business is essentially carried out by units or individuals other than the enterprise itself or its invested enterprises under the name of the exporting enterprise.

Exporting in the name of self-operation, where the same batch of goods is covered by both a purchase contract and an agency export contract (or agreement).

(4) After the export goods are cleared by customs, if the exporter or the entrusted freight forwarder modifies the name, specifications, etc. on the ocean bill of lading or other transportation documents, resulting in discrepancies between the export customs declaration and the relevant contents of the ocean bill of lading or other transportation documents.

(5) Exporting under its own name but not bearing the risks of quality, collection of payment, or tax rebate of the export goods, namely, not bearing the responsibility for claims from the buyer in case of quality issues of the export goods (unless the contract specifies the party responsible for quality issues); not bearing the responsibility for non-cancellation due to failure of collecting payment on time (unless the contract specifies the party responsible for collecting payment); not bearing the responsibility for non-refund of tax due to problems with the documents or certificates submitted for export tax rebate (exemption).

(6) Exporting under the pretense of being self-operated while not substantially participating in export activities and merely engaging in other export businesses introduced by intermediaries.

(II) Export goods subject to consumption tax policy

According to Article 7 of the Notice of the Ministry of Finance and the State Administration of Taxation on the VAT and Consumption Tax Policies for Export Goods and Services (Cai Shui [2012] No. 39), taxpayers who export goods subject to taxation on their own or through agents shall declare and pay VAT and consumption tax in accordance with the unified regulations applicable to domestic sales of goods.

(I) Calculation of VAT Payable

For export goods and services subject to the VAT levy policy, the payable VAT shall be calculated according to the following method:

1. General taxpayer for exported goods

Output tax amount = (FOB price of export goods - amount of bonded imported materials used in processing trade) ÷ (1 + applicable tax rate) × applicable tax rate

If the exported goods have been calculated for the non-refundable and non-deductible tax amount based on the difference between the levy and refund tax rates and have already been transferred to the cost, the corresponding tax amount should be transferred back to the input tax credit.

2. Export of goods by small-scale taxpayers

(II) Calculation of Consumption Tax Payable

Consumption tax is calculated based on ad valorem rates, specific rates, or a combination of both (hereinafter referred to as composite taxation). The formula for calculating the tax payable is as follows:

The tax payable calculated using the ad valorem method = Sales amount × Proportional tax rate

Taxable amount calculated using the fixed quantity method = sales quantity × fixed tax rate

5. What are the specific requirements and procedures for issuing entrusted export certificates and agency export certificates for taxpayers exporting taxable goods?

6. Why should taxpayers complete the confirmation of tax registration information before declaring export dutiable goods to customs?

7. Tax-related matters that taxpayers exporting taxable goods need to pay attention to when applying for deregistration with the market regulatory authorities.

VIII. What are the key points that taxpayers should pay attention to when exporting taxable goods at the customs declaration stage?

According to the relevant provisions of the "Tax Collection and Administration Law of the People's Republic of China" and the "Regulations on the Implementation of Administrative Penalties by the Customs of the People's Republic of China," the "Announcement" reiterates that taxpayers, customs declaration enterprises, customs declarants, and other entities and relevant personnel involved in the export of taxable goods must not forge, alter, or trade customs declaration forms, must not fabricate export businesses, overstate or understate the value of goods. If any of the aforementioned illegal acts exist, or if assistance is provided in carrying out such illegal acts, the relevant departments shall handle them according to their respective responsibilities in accordance with the provisions of laws and regulations such as the "Tax Collection and Administration Law of the People's Republic of China" and the "Regulations on the Implementation of Administrative Penalties by the Customs of the People's Republic of China." If the illegal acts constitute a crime, they will be transferred to the judicial authorities for criminal investigation in accordance with the law.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track