Golden hair increases, Dawn abandons, what happened to this material?

On March 24, the Zhuhai Municipal Ecological Environment Bureau announced that it is planning to approve the environmental impact assessment documents for the project of adding a modification production line and pilot workshop to the Polyethylene Terephthalate E line at Zhuhai Jinfa Biomaterial Co., Ltd.The total investment for this project is 10.43 million yuan, and it is an expansion project. It will produce 10,000 tons of PBAT modified resin and 2,000 tons of PLA modified resin annually.。

On March 11, Shandong Daon High Polymer Materials Co., Ltd. announced the above content.Terminate the investment in the construction of the Dawn Biodegradable Materials Project (including the PBAT project).For the reasons of termination, Daowen Co., Ltd. stated that the biodegradable material market is facing multiple challenges such as weak demand growth, overcapacity, and intensified market competition, leading to increasing market pressure. To avoid wasting further resources and to reduce potential economic losses, the company decided to terminate the biodegradable material project.

As a leader in modified plastics, Jinfa is increasing its investment while Dawn is opting to divest. Why is there such a polarization regarding PBAT? Specialized Plastics World invites you to take a look at the current market situation of PBAT and analyze the motivations behind these two companies.

I. Current Market Situation of PBAT in China

PBAT is synthesized from terephthalic acid (PTA), adipic acid (AA), and butanediol (BDO). The upstream cost of PBAT mainly comes from raw materials, accounting for 72%. Among these, butanediol (BDO) accounts for 34%, and terephthalic acid (PTA) accounts for 22%. The midstream primarily involves the production and manufacturing of PBAT, with a notable increase in domestic enterprises entering the market in recent years, leading to a gradual increase in capacity. The downstream of the industrial chain is the application field of PBAT resin, mainly including plastic packaging films, agricultural films, single-use plastic bags, disposable tableware, etc.

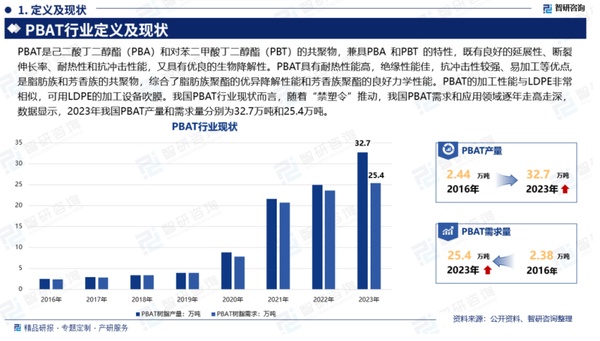

In terms of the current situation of the PBAT industry in China, with the promotion of the "Plastic Ban Order," the demand and application fields for PBAT in China have been increasing year by year. Data shows that in 2023, China's PBAT production and demand were 327,000 tons and 254,000 tons, respectively.

Wang Jiangping, a member of the National Committee of the Chinese People's Political Consultative Conference and former Vice Minister of the Ministry of Industry and Information Technology, stated in an interview during this year's "Two Sessions" that China's biodegradable plastic industry will reach a total production capacity of 1.96 million tons in 2024, with a total output value of raw materials and products approximately 13 billion yuan. Numerous companies are entering the market and laying out production lines, leading to rapid expansion of capacity. However, in stark contrast,Market demand fell short of expectations, resulting in a serious mismatch between actual output and production capacity. Around 400,000 tons were produced in 2024, with capacity utilization rate at only about 20%, leading to a significant amount of idle production capacity.causing waste of resources.

II. PBAT Production Enterprises in China

Currently, major domestic producers of PBAT include Kingfa Sci. & Tech., Blue Ridge Tunhe, Donghua Technology, Ruian Technology, Wanhua Chemical, Huayang Group, Chang Hong High-tech, and Wu Tu New Materials.

Leading enterprises such as Jinfa Technology and Lanshan Tunhe dominate the market due to their technological advantages and economies of scale. Jinfa Technology has an annual production capacity of over 200,000 tons and holds 44 national patents, giving its products strong competitiveness in the market. However, overall, the domestic market has a vast number of enterprises with varying scales, and the price war among companies is intensifying, leading to a continuous compression of industry profit margins. The industry concentration is low, with leading companies occupying a significant market share, while small and medium-sized enterprises face survival pressures, indicating a need for further regulation of market competition order.

Three, the first-mover advantage of blonde hair

Jinfa Technology is one of the earliest companies in China to布局 PBAT.As early as 2004, efforts were initiated for the research and industrialization of fully biodegradable plastics, including PBAT materials. By 2023, the production capacity of PBAT ranks first in Asia, and its market share in the film and bag category also holds the top position in Asia.。

In 2023, the company's sales of fully biodegradable plastics reached 144,200 tons, with PBAT being one of the main products. The sales of fully biodegradable plastics in the first half of 2024 were 74,200 tons, and by the end of the third quarter of 2024, the sales volume had reached 126,700 tons.

By continuously optimizing product performance, the company has significantly enhanced the market competitiveness of its PBAT products. For example, it has overcome the industry challenges related to the difficult formation and processing of biodegradable mulch films, low water retention properties, and short weathering duration. This has strengthened the compatibility with planting regions and crop growth characteristics, resulting in the iterative upgrade of three specialized biodegradable mulch film materials.

In December 2024, Gold Unicorn invested a total of 52 million yuan to expand its annual production capacity of modified resins by 100,000 tons, which includes 70,000 tons of PBAT modification, 20,000 tons of PLA modification, and 10,000 tons of PBS modification.

Daoen Co., Ltd. is located inAnnounced entry into the PBAT polymerization ranks in 2021.In the downstream of PBAT, Dawn Group has also laid out downstream modification and product projects. As early as 2020, Dawn began researching PLA foam sheets, PLA/PBAT film modification materials, starch-filled biodegradable film modification materials, PE-based starch-filled masterbatches, and biodegradable materials for thermoforming/injection molding/3D printing, among others.

On January 17, 2021, Dawn Holdings signed a cooperation agreement with the China Textile Institute to invest in the construction of a 120,000-ton annual production project for biodegradable resin (PBAT). The first phase involves an investment in a 60,000-ton continuous polymerization production facility, with a construction period of 15 months. The first phase of the project is expected to be operational by February 2024 and will be put into production by December 2024.

In summary, Jinfa Technology has established a solid position in the Chinese market for PBAT, leveraging its first-mover advantage, and its production capacity ranks first in the country. In contrast, Daon Group will not start its PBAT project until December 2024, by which time the market landscape has changed significantly—demand for biodegradable materials has weakened, the industry faces the risk of overcapacity, and market competition has become increasingly intense. Against this backdrop, Daon's decision to terminate further investment in PBAT is a rational choice based on market realities and its own strategic considerations.

Sources: Zhian Industry Research Institute, JuFeng Plastic, Kingfa official website, Daon official website, Reusable & Degradable Center

Editor: Shi Shenbing

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track