I. In the first half of the year, PVC prices fluctuated and weakened.

Figure 1 International Market Price Trend of PVC from 2024 to 2025

![[隆众聚焦]:全球供应充足 PVC价格重心趋弱 [隆众聚焦]:全球供应充足 PVC价格重心趋弱](https://oss.plastmatch.com/zx/image/38432cdd07104fb7bee789257b4ec2f1.png)

In the first half of the year, the price of PVC in major global regions rose with the end of winter, early stockpiling, and the arrival of peak season demand. However, after February 2025, prices did not rise as in previous years but instead fluctuated downward, with prices in the Asian region falling by more than $60 per ton.

The slowdown in demand growth, with relatively ample supply being the main reason.

At the beginning of the Spring Festival in 2025, the US unilaterally imposed additional import tariffs on multiple major countries and regions, with related countries and regions retaliating by imposing additional tariffs, leading to a unilateral trend in global trade. On one hand, the cost of basic energy increased, while on the other hand, supply and demand developed unevenly, especially for the basic manufacturing industry mainly engaged in processing trade exports, which saw a significant decrease in orders. Secondly, the urgency for importing raw materials diminished, shifting towards just-in-time procurement or domestic industries, such as the Indian market, where PVC imports noticeably decreased compared to before the Spring Festival. Furthermore, with slowing demand, regional supplies became more abundant and inventories reached high levels; for example, US PVC inventory grew by nearly one-third compared to the same period last year, while its production capacity increased by almost 10% year-over-year, under the circumstances of weakened demand due to the trade war.

III. The uncertainty of policies, or the differentiation of PVC export trade

The global PVC import and export trade pattern is relatively clear, with the United States, China, Japan and South Korea, and Taiwan, China being the main PVC exporting regions, while India, Southeast Asia, and Latin America are the primary importing regions. Affected by policies such as additional tariffs and anti-dumping duties on imports in India, the future PVC import and export trade may further diverge.

Affected by the additional tariffs, the U.S. will face pressure of continuously declining prices or reduced export sales volume in Latin America and Europe, and its future export direction may focus more on the Asian region, where the price advantage of U.S. long-distance goods will pose a challenge to the Asian area.

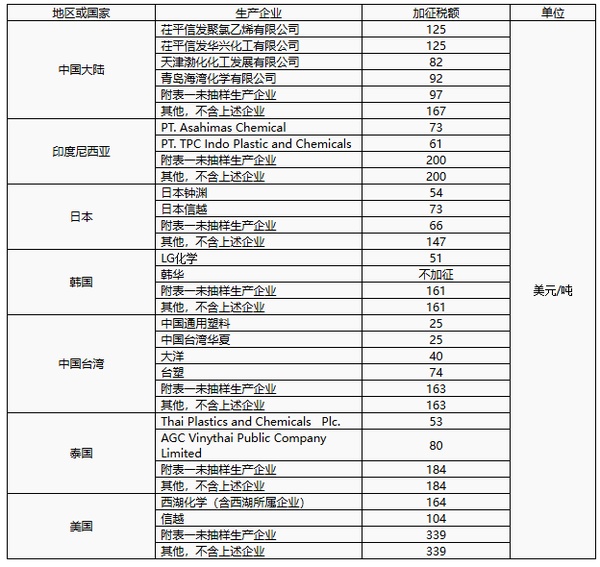

Indian import anti-dumping duties on PVC have been a topic of much discussion recently, and it is not ruled out that they may be implemented as early as the end of March. However, based on recent research and global economic policies, there may be adjustments to the tax rules, and it is possible that restrictions on US sources could be relaxed.

Table 1 India's Provisional Anti-dumping Duty Rate Table (PVC Produced by Suspension Polymerization Process, K Value 55 to 77)

appendix list

List of unsampled producers from China

Chiping Xinfaxing Chemical Co., Ltd.

2. Zhongyan Jilantai Chlor-Alkali Chemical Co., Ltd.

3. Formosa Plastics (Ningbo) Co., Ltd.

4. Guangxi Huayi Chlor-Alkali Chemical Co., Ltd.

5. Inner Mongolia Yihua Chemical Co., Ltd.

6. Inner Mongolia Erdos Electric Power Metallurgy Group Co., Ltd.

7. Inner Mongolia Junzheng Chemical Co., Ltd.

8. Ordos Junzheng Energy and Chemical Co., Ltd.

9. Shaanxi Beiyuan Chemical Group Co., Ltd.

10. Shanghai Chlor-Alkali Chemical Co., Ltd.

11. Tianjin LG Bohai Chemical Co., Ltd.

12. Wanhua Chemical (Fujian) Co., Ltd.

13. WanHua Petrochemical (Yantai) Co., Ltd.

14. Xinjiang Shengxiong Chlor-Alkali Co., Ltd.

15. Xinjiang Zhongtai Import and Export Co., Ltd.

16. Yibin Haifeng and Rui Co., Ltd.

17. China-Thai International Development (Hong Kong) Co., Ltd.

At that time, Japan and South Korea will maintain their export advantages to India within the Asian region, the United States may increase its exports, while mainland China and Taiwan may be restricted. Mainland Chinese companies that respond to the lawsuit will maintain growth due to their cost-effective export advantages, whereas non-responding companies will find it difficult to enter the Indian market due to anti-dumping duties. Overall, exports of PVC originating from China to the Indian market will be restricted.

Four, policy and rainy season dual addition, PVC moves forward with determination

The rainy season in many areas of the Northern Hemisphere is about to start from May, and the demand for agricultural pipes has weakened, especially as the Indian market's stockpiling and production needs have slowed down, leading to a decrease in the demand for imported PVC.

In the first half of the year, the tariff policies of multiple countries remain unclear, which has a significant impact on the trade of bulk commodities, especially PVC raw materials and PVC products, making it difficult to increase the export demand for the PVC industry.

PVC production enterprises in many parts of the world enter their annual maintenance period from April to June, leading to an expected reduction in PVC market supply. According to the scale of maintenance in previous years, the reduction in PVC output due to maintenance exceeds 20% of the normal production volume, which is beneficial for reducing the sales pressure on production enterprises and facilitating market destocking. However, considering the unstable demand mentioned above, and the fact that new capacities are still being put into operation in regions such as mainland China, Thailand, and the UAE, the global regional supply pressure remains high, and the price trend in the off-season for PVC is still weak.