Five consecutive years of growth! How has the heat pump two-unit system managed to advance against the odds under environmental pressure?

In the context of insufficient domestic economic demand and a declining real estate market, both sales and investment growth rates have fallen, making weak consumption the biggest constraint on the development of the central air conditioning industry. Although policies to stabilize the real estate sector have been continuously introduced, which have somewhat boosted inventory digestion in the real estate industry, the central air conditioning industry still faces significant growth resistance under the compounded effects of weak demand and high channel inventory levels, amidst an increasingly competitive market situation.

Facing the market environment of consumption stratification, the heat pump dual-supply market achieved counter-cyclical growth in 2024 and has become a hotspot for competition among brands due to its considerable growth potential. With the accelerating release of comfort-driven demand, heat pump dual-supply products are rapidly expanding their market reach by accurately aligning with market trends and leveraging the strong push from leading brands, gradually emerging as a key product for unlocking growth potential in high-end scenarios.

Seize the opportunity, dual supply meets demand and accelerates expansion.

According to the "China Heat Pump Two-in-One Supply Product Market Research Report" released by Industrial Online, the Chinese heat pump two-in-one supply market achieved continuous scale growth for five years from 2020 to 2024, with a compound annual growth rate of domestic sales reaching 26%. From 2020 to 2023, the market maintained high growth of 20%-40%, and in 2024, despite a challenging market environment, it still achieved a growth of 4.4%.

Among the many brands entering the market, Hitachi's sales scale ranked first in the industry in 2024, with year-on-year growth exceeding 44%. Thanks to continuous innovation in product technology, deep expansion of channel layout, and precise alignment with user needs, Hitachi not only consolidated its leading position in the high-end market but also promoted the overall upgrading development of the two-link supply industry.

From a segmented product perspective, the two-pipe system market is dominated by water-to-water products, which hold a "half-market share." However, water-to-refrigerant products have also shown strong growth momentum due to accelerated promotion by entering brands, with their market share rapidly increasing in recent years. In 2024, water-to-refrigerant products continue to lead in growth speed, maintaining their top position in the two-pipe system market thanks to vigorous promotion by industry-leading brands and continuous upgrades in product functionality. Meanwhile, water-to-water products, supported by collaborative efforts from both air conditioning and heat pump system companies, enjoy a solid market foundation and steadily increasing user recognition.

From the perspective of product regional distribution, the "TianShuiDiShui" system penetrates both northern and southern markets with a higher普及率; whereas, the "TianFuDiShui" system predominantly concentrates in the Yangtze River basin market, targeting高端 users with improvement-oriented demands, and its product coverage is still expanding at an accelerating pace. Overall, both types of products have their own advantages as well as growth potential.

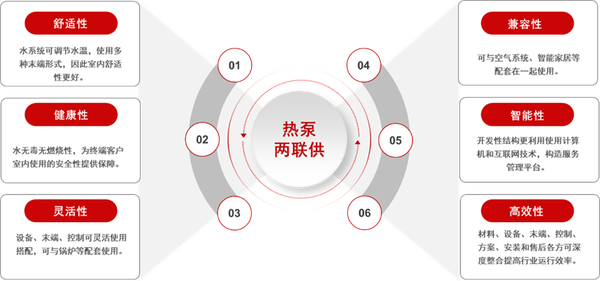

Compared to other household air conditioning products, heat pump two-pipe systems have significant advantages. On one hand, this product can be paired with various terminal forms such as radiators, fan coil units, and underfloor heating, providing flexible combinations. On the other hand, its strong compatibility also expands the application scenarios of the product. By seamlessly integrating with boilers, fresh air systems, and other smart home devices, it continuously increases the product's penetration rate.

Most importantly, in a competitive environment characterized by product homogeneity and intense competition, heat pump dual-supply products can achieve differentiated competition not only through targeting different customer segments and upgrading comfort experiences but also by relying on higher product profit margins to facilitate win-win cooperation between channel partners and brand owners, precisely aligning with the inevitable trend of breaking through challenges in the central air conditioning industry.

Intensified competition leads to increased marketing efforts and production line expansion for top brands.

Thanks to continuous technological optimization and promotional efforts over the years, the recognition of heat pump dual-source systems has been steadily increasing in key markets such as East and Central China. Due to their highly efficient and energy-saving features that integrate cooling and heating, these systems are being rapidly adopted in large residential spaces like villas and spacious apartments. Moreover, as a representative product for comfortable home solutions, heat pump dual-source systems are also gaining traction in the high-end market, enjoying strong recognition among premium users.

Under this trend, various enterprises are accelerating their research and development efforts in the field of heat pump dual-supply products, gradually presenting a competitive landscape of "a hundred schools of thought contending, each with its own strengths."

From the perspective of market segmentation, Japanese brands currently dominate. With their technological accumulation in the central air conditioning field, Japanese brands primarily promote the "Air to Water" system, occupying an important position in high-end residential and commercial sectors. European and American brands focus on "Water to Water" products, intensifying their marketing efforts in large commercial projects and high-end supporting scenarios. Chinese brands mainly accelerate the promotion of the dual-energy supply market through advantages in large-scale production and multi-channel coverage, capturing the mid-to-low-end market with high cost-performance products and smart ecological linkage, while also speeding up their penetration into the high-end sector.

In 2024, the heat pump dual-supply market presents a competitive landscape characterized by "leading enterprises occupying the main share, while emerging companies accelerate their pursuit." In terms of specific brands, Hitachi and Daikin, as representative brands of dual-supply systems, have long held significant advantages in channels and resources due to their years of accumulation in the multi-split system market. York VRF has placed the promotion of its sky-to-water layout as an important strategic position, achieving continuous market share growth through product innovation and marketing empowerment, with a steadily increasing brand share. Johnson Controls York, as the leader in the sky-to-water market, has a comprehensive water ecological central air conditioning product line that covers both residential and commercial scenarios, occupying a significant market position.

Overall, the number of companies entering the dual-supply market in 2024 continues to increase, driving the prosperity of the heat pump dual-supply industry through multi-dimensional layouts in product innovation and marketing strategies. Relying on extensive channel systems and mature product technology support, leading brands enhance their brand competitiveness continuously by amplifying brand marketing and expanding product lines.

Taking the Hitachi brand as an example, this brand has rapidly risen in the two-pipe system market and continues to explore technological innovation and product diversification to meet the growing demand for personalized solutions. In addition to deepening its product layout in the ground water and air-to-water two-pipe systems, it is also accelerating innovation breakthroughs and market expansion in the air-to-water field. Relying on strong customization capabilities and rich channel resources, Hitachi is promoting the upgrade and innovation of the two-pipe market, aiming to rank first in the industry with outstanding strength in 2024 and continuously lead industry development.

In summary, Industry Online believes that against the backdrop of intensifying consumption stratification, dual-purpose heat pump units continue to perform exceptionally well in the high-end market. This not only indicates that short-term development challenges have not suppressed user demand but also proves that differentiated new products tailored to user pain points and targeting potential sectors will lead the way in breaking through, helping manufacturers build competitive advantages in the new development cycle. As a typical product in the comfort home segment, dual-purpose heat pump units will still seize growth opportunities driven by the demand from high-end households for home system installations, injecting greater certainty into the recovery and positive development of the central air conditioning submarket by 2025.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track