Enjoy tariff exemptions before 9 months? US strictly investigates underreporting of goods and imposes heavy fines.

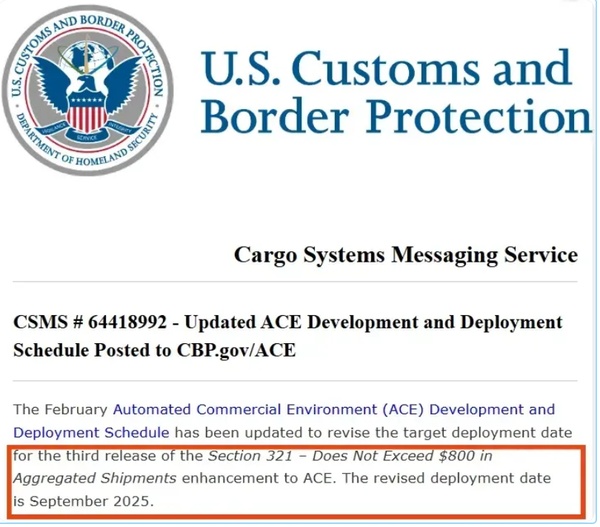

The U.S. Customs CSMS (Cargo Systems Messaging Service) has released a重磅公告 that has caused a stir in the cross-border e-commerce industry. The announcement focuses on the "Commercial Environment (ACE) Development and Deployment Program," and clearly sets key deployment milestones for September 2025. This news has immediately caught the attention of many practitioners, signaling a major upcoming transformation in the industry.

Recently,The inspection rate of U.S. Customs has soared to 70%.China's cross-border e-commerce has encountered a severe crackdown on "underreporting shipment values." Overnight, the "American Dream" of Chinese cross-border sellers was awakened by a surge in customs inspection rates.The inspection rate skyrocketed from 5% to 70%, causing a chain reaction of opening shipping containers, astronomical fines, logistics paralysis, and stockout crises for Chinese goods.

In terms of the declaration processThe addition of the "Estimated Arrival Time" field may seem like a minor adjustment, but it has a profound impact on the collaboration between logistics and customs clearance. Sellers must take this factor into account when arranging the transportation of goods to ensure smooth declaration.

Meanwhile,The U.S. Customs has also drawn a warning "red line."When the import amount per day or per person exceeds the $800 limit, the ACE system will immediately trigger an alert. This means that the previous space for sellers to engage in risky operations using the small import tax exemption has been significantly reduced. Once the warning is triggered, subsequent customs clearance processes will face stricter scrutiny.

In terms of compliance oversightThe ACE system has also undergone comprehensive upgrades. Even within the $800 duty-free exemption, Customs will strictly control non-compliant goods. Past practices that attempted to circumvent regulations will be completely ineffective. Only fully compliant merchandise will be able to pass smoothly.

A home furnishings seller in Ningbo had their container seized and received a $280,000 fine due to a 12% discrepancy between the declared cargo value and the actual purchase price. This fine was equivalent to one-third of their annual profit. Additionally, logistics timelines were disrupted, with inspection times extending from an average of 3 days to 21 days, and the out-of-stock rate at Amazon warehouses soared to 47%.The cost aspect has become even more challenging, with ordinary inspections taking 7-15 days and exceeding 30 days in total time, leading to a 30%-50% increase in logistics costs. Some sellers have exclaimed, "Logistics fees are higher than the value of the goods."

The "microscopic scrutiny" by U.S. Customs is triggering a chain reaction. Amazon sellers are facing life-and-death challenges, with stockouts causing their IPI scores to plummet and warehouse capacities being cut.The independent site has seen a "return wave," with logistics delays exceeding expectations and the return rate of consumers soaring by 20%, leading to a surge in operational costs.

Industry insiders point out thatAccording to the calculation based on a 70% inspection rate, a 28-day delay, and a 30% increase in logistics costs, the seller's overall costs will increase by more than 40%.The low-price strategy has completely failed, and profits have become extremely thin.

It is worth noting that while the development and deployment schedule for the ACE system has been updated to September 2025, officials have explicitly stated that this is a conceptual timeline and is subject to change at any time. This announcement has sparked heated discussions among the seller community. Some sellers are hopeful that the $800 exemption policy may be extended until September as a result, providing them with a temporary safe haven amidst the tumultuous trade winds. However, there are also voices of reason pointing out,The announcement did not directly state a direct connection with the "removal of the $800 duty-free threshold," so the 800-dollar exemption policy still faces the risk of cancellation.

Looking back, tariff storms have repeatedly battered the dyke of the cross-border e-commerce industry. From initial shock to panic over the future, and now to gradual calm, behind the scenes are the hardships and explorations of countless practitioners. Fortunately, the postponement of T86's cancellation has injected a shot of adrenaline into the industry. Many sellers are seizing time to prepare response strategies to cope with potential policy changes.

Veteran sellers in the industry suggest,Once T86 is ultimately canceled, relying on the customs clearance model of T01 and T11 through commercial express is a more reliable approach. At the same time, caution must be exercised when considering the seemingly "shortcut" method of bypassing customs through transit countries.In the battlefield of cross-border trade, only compliant operations can go further.

An experienced logistics expert candidly stated that...Chinese sellers are facing the daunting challenge of transitioning from the "duty-free advantage" comfort zone to the new normal of "full compliance and high-cost operations."The key strategy to cope with this transformation lies in implementing a compliance-oriented, diversified, and refined "three-dimensional development blueprint." Only by deeply embedding "compliance" into every aspect of business operations can Chinese sellers achieve the transition from pursuing short-term profits to stable long-term profitability.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track