Domestic polylactic acid leader's net profit continues to decline! why is imported polylactic acid priced higher?

The release of Haizheng Biomaterials' third-quarter report has brought renewed focus to the polylactic acid (PLA) industry. The financial report shows that the company's total operating revenue for the first three quarters was 621 million yuan, a year-on-year decrease of 5.74%. The net profit attributable to shareholders of the parent company was only 4.9057 million yuan, a sharp year-on-year decline of 85.34%. The core reason for the decline in net profit is directly attributed to the contraction in gross profit caused by the drop in product prices.This data precisely confirms the current situation of oversupply in the polylactic acid market.。

Looking at another set of data: From January to September 2025, China imported 40,681 tons of polylactic acid (PLA) in primary form, with an import average price equivalent to approximately 16,548 yuan per ton. After adding a 6.5% most-favored-nation tariff and a 13% value-added tax, the comprehensive cost is approximately 16,548 × (1 + 6.5%) × (1 + 13%) ≈ 20,200 yuan per ton, which is significantly higher than the quoted prices of domestic companies like Fengyuan and Haizheng, which range from 17,000 to 18,000 yuan per ton. Why does the high-priced imported PLA still attract a large number of customers in a context of oversupply? Despite the high price, so many companies are willing to pay for it? Is imported material really "you get what you pay for"? Today, let's discuss this topic together.

1. First-mover advantage builds barriers: the "inertia premium" of twenty years of market cultivation.

The price structure of the polylactic acid (PLA) industry has been foreshadowed since its inception. The global industrialization of PLA was first initiated by the American company Nature Works in 2001, leveraging its advantage in corn resources and technological breakthroughs to quickly dominate the early market. Subsequently, European companies like Total Corbion followed suit and began production, together establishing the early supply system of the global PLA market.

The first-mover advantage not only brings market share but also entrenched usage habits. In the years when the domestic polylactic acid industry had yet to start, downstream companies ranging from packaging films to tableware production almost had to rely on imported materials to fine-tune equipment and optimize processes.

The temperature parameters, mold design, and processing rhythm of a production line often need to be deeply adapted to specific imported grades, forming a fixed matching pattern of "equipment-material-process."

This market inertia is more apparent in high-end sectors, where there are stringent requirements for material stability. Companies tend to choose imported brands that have been validated in the market for over a decade. The large-scale production of polylactic acid in China began in the last decade, with leading companies like Anhui Fengyuan and Zhejiang Hisun breaking through the lactide technology barriers and gradually breaking the monopoly. However, changing the "path dependency" of downstream enterprises will still require time to accumulate.

Quality Stability Game: The Gap from Molecular Control to Batch Consistency

If market inertia is "soft power," then quality stability is the "hard support" for the pricing of imported materials. The performance of polylactic acid is highly dependent on molecular structure control, and foreign companies have formed a significant advantage in this core aspect.

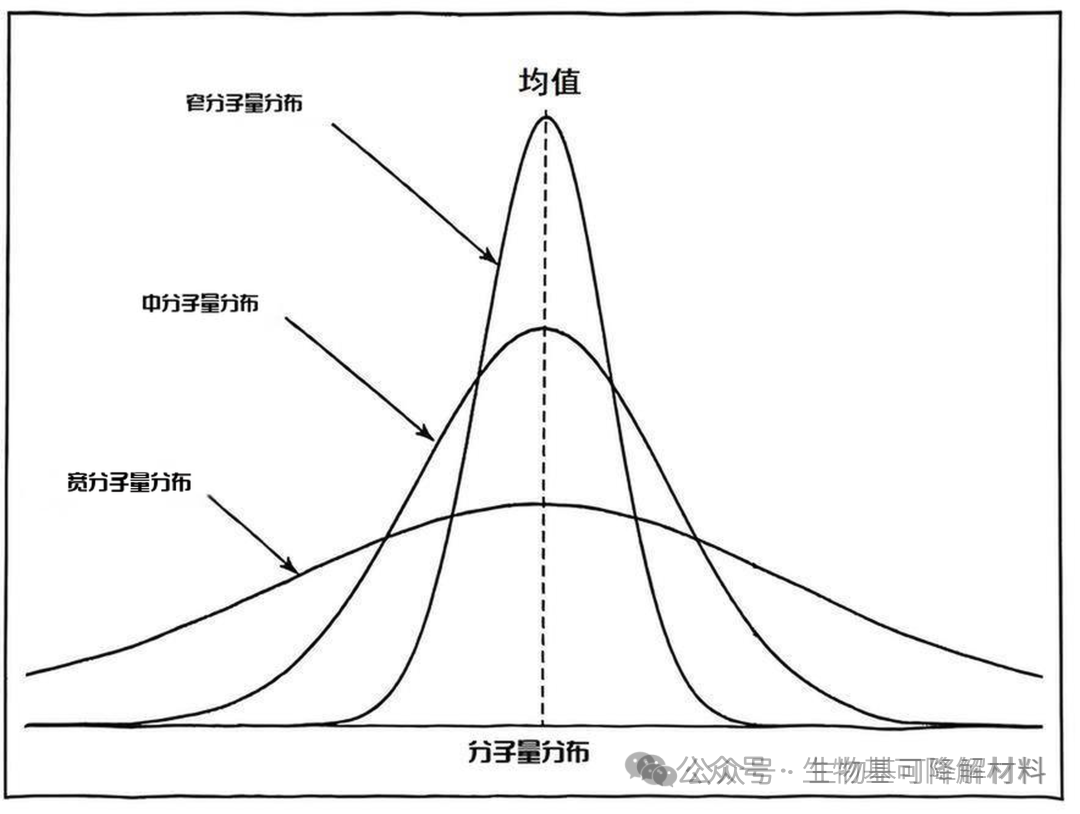

In terms of key indicators, the molecular weight distribution dispersity coefficient of imported polylactic acid is generally narrower than that of domestic polylactic acid. Products with a narrow molecular weight distribution exhibit more uniform flow during melt extrusion, resulting in films with smaller thickness deviations, whereas domestic materials typically have wider deviations compared to imported polylactic acid. For food packaging companies with stringent requirements, this precision difference directly affects barrier properties and shelf life, and they are willing to pay a premium for it.

The refined control of the production process is a "moat" for import enterprises. Nature Works uses a fully automated control system to maintain the fluctuation of polymerization reaction temperature within ±0.5℃. The direct effect of this stability is that the melt index deviation of different batches of the same grade imported material is small. For downstream enterprises that require continuous production, batch stability means a reduction in the defect rate, and the cost savings from this can cover the price difference of raw materials.

However, this gap is rapidly narrowing. Leading domestic companies such as Fengyuan Bio have, through technological innovation, reduced the molecular weight distribution coefficient to levels similar to imported materials, and the batch stability of certain grades has reached the level of imports. This is also the core reason for the rapid increase in the market share of domestic materials in recent years.

3. Technological Deepening to Break Through Bottlenecks: Application Barriers Constructed by Special Grades

Polylactic acid naturally has defects such as poor toughness, slow crystallization, and easy moisture absorption and hydrolysis. However, after more than two decades of technological development, import companies have established a specialized grade system that covers all scenarios. NatureWorks' Ingeo polylactic acid products have over thirty grades, including 11 grades specifically for single fiber spinning. This refined grade classification is another key reason for their high price.

In addressing inherent defects, the modification technologies of imported companies have become quite mature. To tackle the issue of insufficient toughness, toughened grades have been developed by incorporating caprolactone copolymer components, which increase the impact strength to over 50 kJ/m², more than three times that of pure PLA, making it suitable for thin-walled packaging. To overcome the problem of slow crystallization, companies have developed fast-crystallization grades by adding specially formulated nucleating agents, reducing the molding cycle to 25 seconds and significantly enhancing production efficiency. These modification technologies are based on long-term research and development accumulation. Although domestic companies can replicate the formulations, there remains a gap in additive selection and proportion control.

4. Supply Chain and Certification: The Invisible "Hidden Cost" Differences

In addition to explicit technical and market factors, the "hidden costs" associated with the integrity of the industrial chain and international certification arrangements have also driven up the pricing of imported polylactic acid.

In terms of control over the industrial chain, imported companies have formed a closed loop from raw materials to recycling. Nature Works relies on the corn farming base in the Midwest of the United States, achieving a raw material cost that is 12% lower than the market price. In contrast, domestic companies largely depend on external procurement of lactic acid raw materials. The 12% increase in corn prices in the first quarter of 2025 directly led to an 8% year-on-year increase in PLA production costs for domestic companies, making it difficult for them to absorb cost pressures like imported brands.

The disparity in the layout of international certification systems is more evident. Import companies generally hold "global passes" such as FDA food contact certification, EU EN13432 compostable certification, and medical-grade ISO10993 certification. These certifications often require 2-3 years and millions of investments. Although there have been breakthroughs among domestic companies, with some having obtained EU certifications, most small and medium-sized enterprises still lack high-end certifications. Their products are limited to the low and mid-range markets, unable to participate in price competition in high-end fields.

In addition, the costs associated with trade barriers should not be overlooked.

The thousand-yuan price difference of imported polylactic acid (PLA) essentially reflects the comprehensive embodiment of twenty years of technological accumulation, market cultivation, and industrial chain control capabilities, rather than a simple "brand premium." However, this situation is being rewritten by the rapid rise of domestic PLA—its substitution scope is continuously expanding, from production capacity to technical specifications, from mainstream markets to high-end sectors.

In the polylactic acid market of 2025, there is both the steadfast presence of imported materials and the strong advancement of domestic materials. The price difference of a thousand yuan serves as a reminder to domestic companies and a clear signal of growth: when technological stability catches up with international standards, when specialized grades cover more scenarios, and when the resilience of the industrial chain continues to strengthen, domestic polylactic acid will ultimately achieve a breakthrough in both "quality and price."

As predicted by customs data, the continuous decline in import dependency is not just a story of category substitution, but also a reflection of the Chinese bio-based materials industry transitioning from catching up to surpassing. The end of this price difference game will ultimately be the value return of Chinese polylactic acid in the global market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

-

Kingfa Sci & Tech Q3 Net Profit Attributable to Shareholders Rises 58.0% YoY to 479 Million Yuan

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

China-U.S. Summit in Busan Tomorrow! Syensqo Launches New PAEK Material; Ascend Debuts at Medical Summit

-

MOFCOM Spokesperson Answers Questions from Reporters on China-U.S. Kuala Lumpur Trade Consultations Joint Arrangement