Commissioning! Surges by over 700%!

Recently, multiple PMMA project updates have been announced: 1. Jiangxi Jingsu Technology Co., Ltd. has publicized an 88,000-ton optical-grade PMMA project; 2. Zhejiang Huashuaite New Material Technology Co., Ltd. has commenced a 35,000-ton annual aviation PMMA project; 3. Yan'an Energy and Chemical plans to build a 50,000-ton/year MMA and 50,000-ton/year PMMA facility.

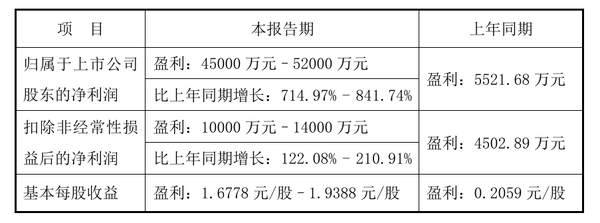

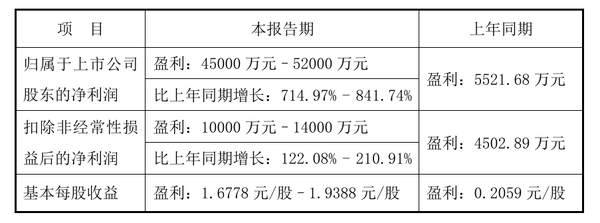

Notably, at the beginning of the year, Shuangxiang Corporation released its 2024 performance forecast: the net profit attributable to shareholders is expected to increase by 714.97% - 841.74% year-on-year; the net profit after deducting non-recurring gains and losses is projected to grow by 122.08% - 210.91% year-on-year. The significant growth in performance is mainly attributed to the gradual release of production capacity from its wholly-owned subsidiary, Chongqing Shuangxiang Optical Materials Co., Ltd., which includes a 300,000-ton annual PMMA, MS, and 40,000-ton special ester project.

A New Round of Expansion

A New Round of Expansion

A New Round of Expansion

A New Round of Expansion

A New Round of Expansion

A New Round of ExpansionCurrently, domestic PMMA still benefits from the demand for replacing high-end imported products, while some capacities with low integration levels, small scale, and limited technology will face the risk of being phased out.

Currently, domestic PMMA still benefits from the demand for replacing high-end imported products, while some capacities with low integration levels, small scale, and limited technology will face the risk of being phased out.At present, the PMMA industry has entered a new round of expansion. The rapid increase in the production scale of upstream MMA monomers and the replacement of imported products provide significant opportunities for the development of downstream industries.

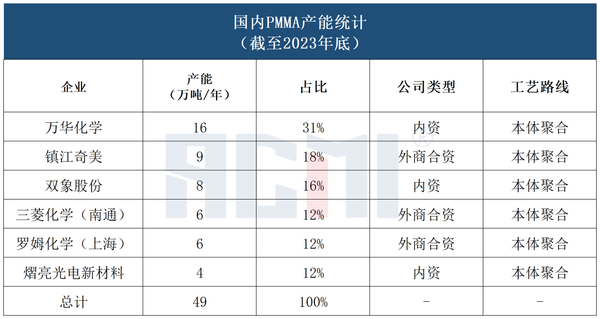

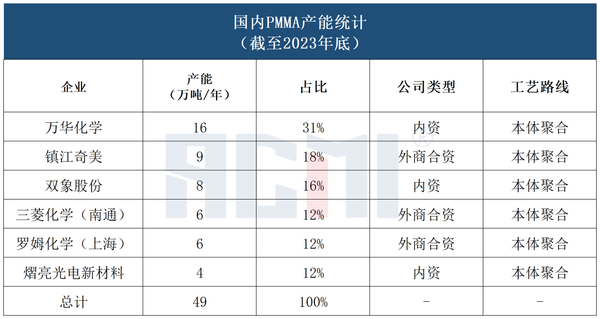

At present, the PMMA industry has entered a new round of expansion. The rapid increase in the production scale of upstream MMA monomers and the replacement of imported products provide significant opportunities for the development of downstream industries.As of 2023, the domestic PMMA capacity is about 800,000 tons/year, including 490,000 tons/year of PMMA resin pellets, 300,000 tons/year of PMMA sheet, and about 10,000 tons/year of other forms of PMMA. The specific distribution of PMMA resin is as follows:

From the perspective of imports and exports, primary form PMMA remains the main imported product. In 2024, the import volume of primary shape polymethyl methacrylate (PMMA) is about 163,000 tons, while the export volume is 54,000 tons. In 2023, the corresponding import volume was about 182,000 tons, and the export volume was 37,000 tons.

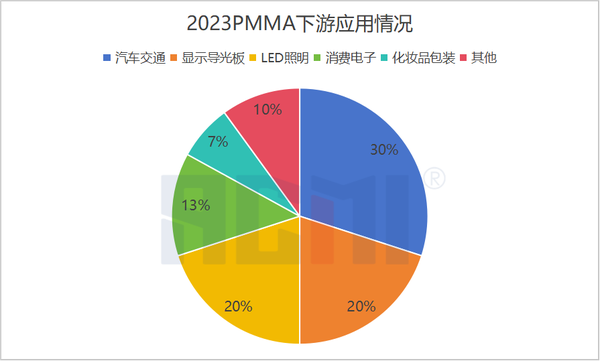

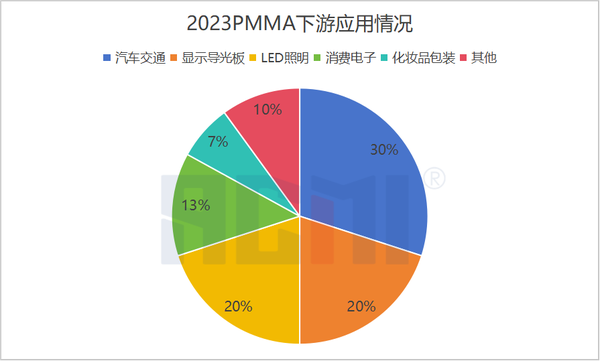

From the perspective of imports and exports, primary form PMMA remains the main imported product. In 2024, the import volume of primary shape polymethyl methacrylate (PMMA) is about 163,000 tons, while the export volume is 54,000 tons. In 2023, the corresponding import volume was about 182,000 tons, and the export volume was 37,000 tons.In terms of actual consumption, in 2023, the domestic consumption of PMMA (resin granules) was about 310,000 tons, a year-on-year increase of 3%. In the detailed demand for this market, the four major sectors—automotive transportation, display light guide plates, consumer electronics, and LED lighting—account for the majority of the market share.

In terms of actual consumption, in 2023, the domestic consumption of PMMA (resin granules) was about 310,000 tons, a year-on-year increase of 3%. In the detailed demand for this market, the four major sectors—automotive transportation, display light guide plates, consumer electronics, and LED lighting—account for the majority of the market share.

Based on a comprehensive analysis of domestic production capacity, customs import and export data, and other sources, China's PMMA resin production capacity has increased from 350,000 tons/year to 490,000 tons/year over the past five years, with an annual compound growth rate of about 7%. However, despite this, the corresponding import volume remains at a high level, while the operating rate of domestic PMMA facilities lingers around a low of about 60%. The main reason for this phenomenon is the overcapacity and high concentration of low-end products.

In addition, local companies such as Wanhua Chemical and Shuangxiang Co., Ltd. have begun to stand out, while foreign enterprises like Chimei Chemical (Zhenjiang) and Mitsubishi Chemical have experienced declines in capacity utilization and market share, indicating an accelerating trend of "domestic substitution."

PMMA Application Situation

Applications of PMMA

Applications of PMMA

Applications of PMMA

Applications of PMMA

Applications of PMMAWith the continuous increase in domestic production capacity, it is essential to place greater emphasis on developing diversified downstream applications in the future to maintain a competitive edge.

With the continuous increase in domestic production capacity, it is essential to place greater emphasis on developing diversified downstream applications in the future to maintain a competitive edge.

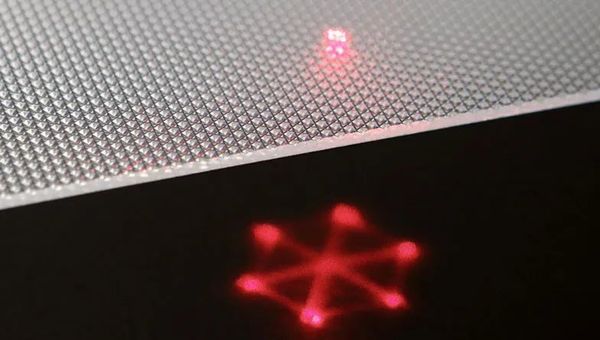

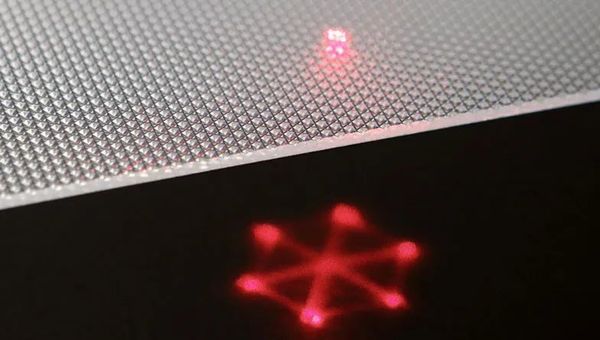

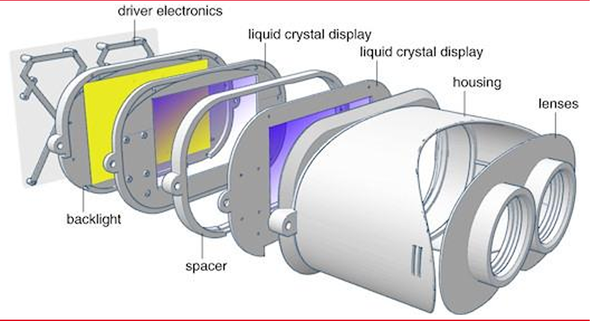

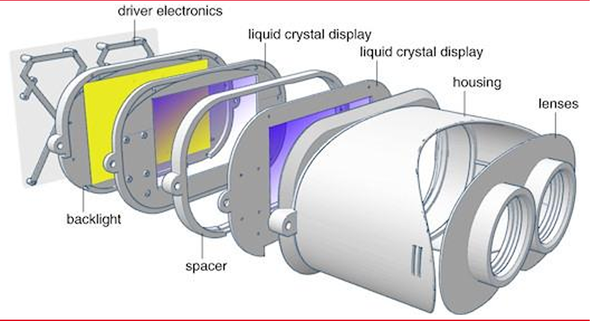

Light guide plates for liquid crystal displays

Light guide plates for liquid crystal displays

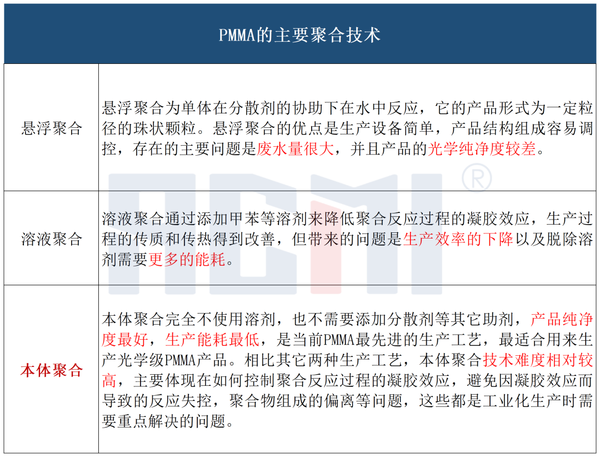

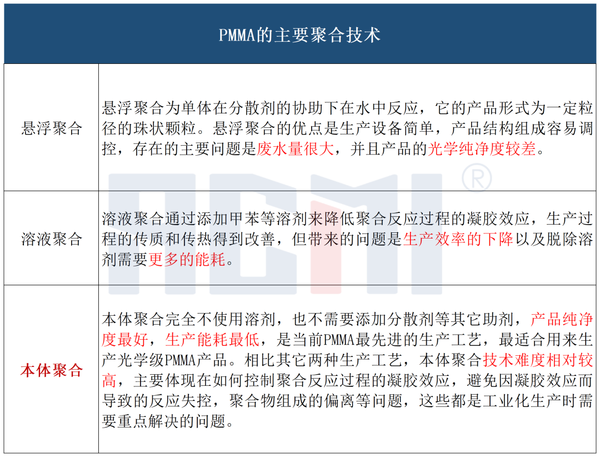

About the polymerization process of PMMA and global production capacity

About the polymerization process of PMMA and global production capacity

About the polymerization process of PMMA and global production capacity

About the polymerization process of PMMA and global production capacity

About the polymerization process of PMMA and global production capacity

About the polymerization process of PMMA and global production capacity

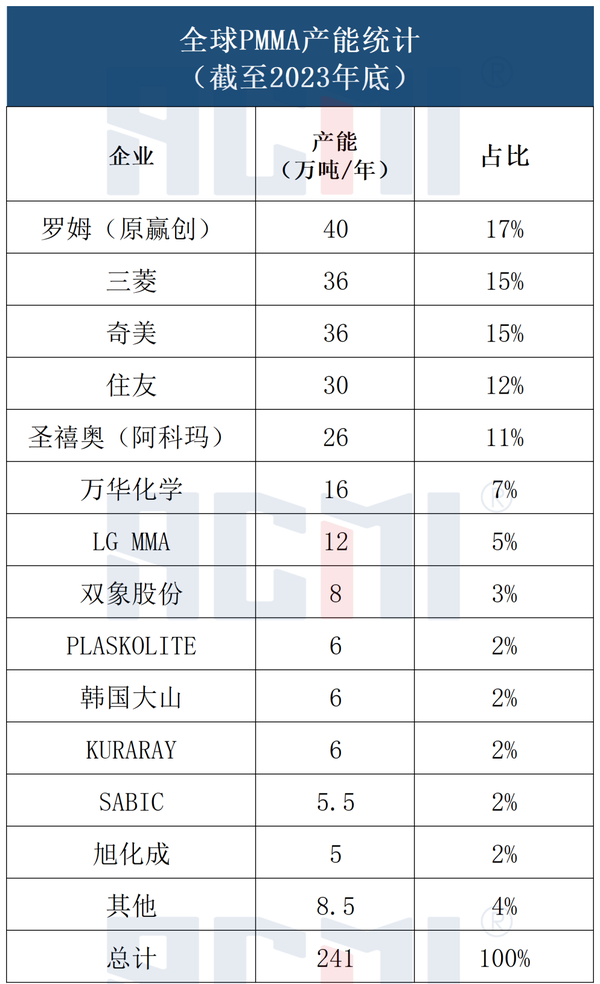

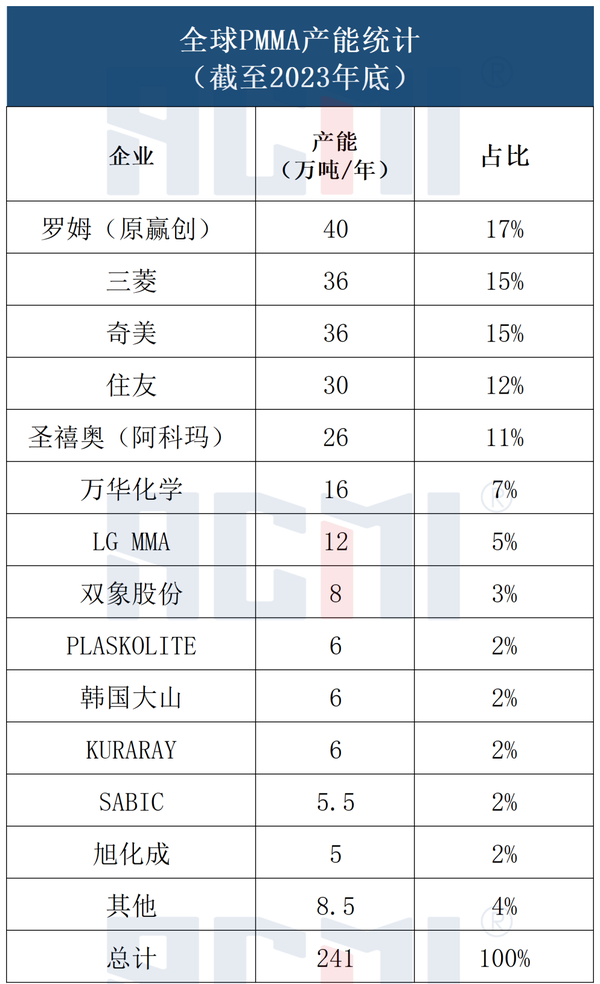

As of the end of 2023, the global capacity distribution of PMMA is as follows:

As of the end of 2023, the global capacity distribution of PMMA is as follows:

Source: Petrochemical Federation, Chemical New Materials, Donghai Securities, official websites of various companies

Source: Petrochemical Federation, Chemical New Materials, Donghai Securities, official websites of various companies【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track