Clariant releases its full-year 2024 financial report, expecting to achieve moderate growth and improved underlying profitability in 2025.

-

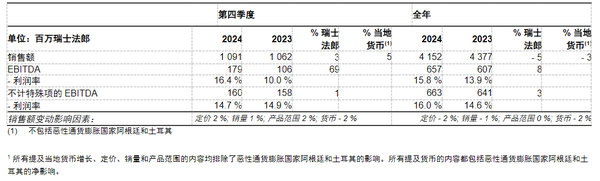

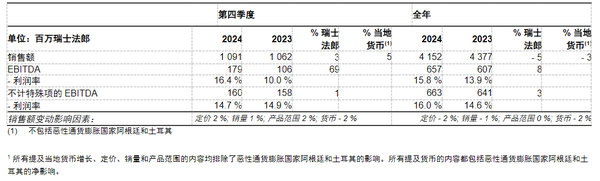

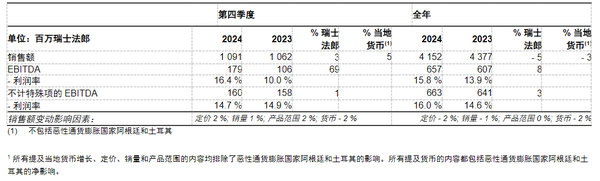

In Q4 2024, sales grew by 5% in local currency1 to CHF 1.091 billion; a 10% sequential growth in local currency, mainly driven by increased volumes in the Catalysts business.

-

In Q4 2024, the EBITDA margin (EBITDA margin) was 16.4%, benefiting from improvements in the Adsorbents & Additives and Catalysts businesses, as well as from sunliquid™ related reversals; the underlying EBITDA margin excluding special items remained stable at 14.7%.

-

The full-year 2024 performance met guidance expectations: Sales reached CHF 4.152 billion, down 3% in local currency; the EBITDA margin was 15.8%, or 16.0% excluding special items.

-

For the full year 2024, free cash flow remained resilient at CHF 211 million, with a free cash flow conversion rate of 32%.

-

A dividend of CHF 0.42 per share is proposed for the Annual General Meeting on April 1, 2025.

-

Confirming the 2025 outlook: expecting moderate growth and an improvement in underlying margins.

-

Clariant remains committed to achieving its mid-term targets by the end of 2027.

Conrad Keijzer, CEO of Clariant, said: "In Q4 2024, all our businesses achieved growth. Our EBITDA margin improved due to volume growth and positive margin management, although the Care Chemicals business performed slightly below expectations due to seasonal demand decreases in aviation and refining. I am particularly pleased with the strong operational performance, cash generation, and non-financial results for the full year 2024. In 2024, we raised our 2030 greenhouse gas reduction targets, with Scope 1 and 2 emissions decreasing by 9% compared to 2023. Our safety performance continued to lead the industry, with a further 19% reduction in the DART (Days Away, Restricted, or Transferred) rate. Looking ahead to 2025, we expect to achieve moderate growth, an improvement in underlying margins, and continued cost savings, which will enhance cash generation. Despite challenging market conditions and ongoing macroeconomic risks and uncertainties, we are making steady progress towards achieving our mid-term targets, supported by our self-help initiatives."

Business Overview

Business Overview

Conrad Keijzer, CEO of Clariant, said: "In the fourth quarter of 2024, all our businesses achieved growth. Our EBITDA margin improved due to increased sales volume and active margin management, but the performance of the Care Chemicals business was slightly below expectations due to seasonal decreases in demand for aviation and refining. I am particularly pleased with the strong operational performance, cash generation, and non-financial achievements throughout 2024. In 2024, we raised our 2030 greenhouse gas reduction targets, with Scope 1 and 2 emissions decreasing by 9% compared to 2023. Our safety performance remains at the top of the industry, with a further 19% decrease in the recordable restricted lost time (DART) rate. Looking ahead to 2025, we expect to achieve moderate growth, improve underlying margins, and continue cost savings, thereby enhancing cash generation. Despite the challenging market environment and ongoing macroeconomic risks and uncertainties, we are steadily advancing towards our mid-term goals, supported by the self-help measures we have implemented."

Conrad Keijzer, CEO of Clariant, stated: "In the fourth quarter of 2024, all our businesses achieved growth. Thanks to increased sales volume and positive margin management, our EBITDA margin improved. However, due to the seasonal decline in demand for aviation and refining, the performance of the Care Chemicals business was slightly below expectations. I am particularly pleased with the strong operational performance, cash generation, and achievement of non-financial goals throughout 2024. In 2024, we raised our 2030 greenhouse gas emission reduction targets, reducing Scope 1 and 2 emissions by 9% compared to 2023. Our safety performance remains at the forefront of the industry, with the Recordable Restricted Workday (DART) rate further declining by 19%. Looking ahead to 2025, we expect to achieve moderate growth, improve underlying margins, and continue to realize cost savings, thereby enhancing cash generation. Despite a challenging market environment and ongoing macroeconomic risks and uncertainties, we are steadily progressing towards our mid-term goals, supported by self-help measures implemented by the company."

Business Overview

Business Overview

2025 Full-Year Outlook and Mid-term Targets

2025 Full-Year Outlook and Mid-term Targets

2025 Full-Year Outlook and Mid-term Targets

2025 Full-Year Outlook and Mid-term Targets

2025 Full-Year Outlook and Mid-term Targets

Looking ahead to the full year 2025, Clariant expects overall inflation to ease, but the economy will not see a significant recovery due to ongoing macroeconomic challenges, uncertainties, and risks (including potential trade tensions and tariffs). Therefore, Clariant anticipates local currency sales growth of 3% to 5% in 2025, with the growth rate likely to be closer to the lower end of this range, given the current economic environment. The Care Chemicals business as well as the Adsorbents & Additives business are expected to grow, while sales in the Catalysts business are expected to remain flat compared to 2024.

Clariant continues to expect further improvement in profitability in 2025, with an EBITDA margin before exceptional items expected to reach between 17% and 18%. Exceptional items for 2025 are expected to include approximately CHF 75 million in restructuring costs. These costs are related to the savings program announced at the company's Investor Day in November 2024. It is expected that these programs will achieve savings of around CHF 80 million (annualized) by the end of 2027 through initiatives at both the business unit and corporate levels, with a significant portion of the savings targets to be achieved in 2025. Other exceptional items for 2025 are expected to amount to approximately CHF 20 million. As a result, Clariant expects the reported EBITDA margin for 2025 to be in the range of 15.0% to 15.5%. Clariant also expects to make further progress towards achieving its target of a 40% free cash flow conversion rate in 2025.

Clariant reaffirms its commitment to achieving the following mid-term targets by the end of 2027: local currency sales growth of 4-6%; a reported EBITDA margin of 19-21%; and a free cash flow conversion rate of around 40%.

Clariant is capable of achieving these mid-term targets because sales growth, on a reduced cost base, will drive improved operating leverage, which will be reinforced by high-margin growth in the area of innovation. As mentioned above, Clariant will also implement more stringent cost management and production efficiency measures. Overall, Clariant expects about two-thirds of the margin improvement from 2024 to 2027 to come from growth drivers and about one-third from self-help initiatives taken by the company.

Looking ahead to the full year 2025, Clariant expects overall inflation to moderate, but due to ongoing macroeconomic challenges, uncertainties, and risks (including potential trade tensions and tariffs), there will be no significant economic recovery. As a result, Clariant anticipates local currency sales growth of 3% to 5% in 2025, which, given the current economic environment, is likely to be closer to the lower end of this range. The Care Chemicals business as well as the Adsorbents and Additives business are expected to grow, while the Catalysts business is expected to remain at 2024 levels.

Clariant continues to expect further improvement in profitability for 2025, with an EBITDA margin before exceptional items between 17% and 18%. Exceptional items for 2025 are expected to include approximately CHF 75 million in restructuring costs. These costs are related to the savings program announced on the company's Investor Day in November 2024. It is anticipated that these plans will deliver savings of around CHF 80 million (annualized) by the end of 2027 through initiatives at both the business unit and corporate level, with a significant portion of the savings target to be achieved in 2025. Other exceptional items for 2025 are expected to amount to about CHF 20 million. Therefore, Clariant expects the reported EBITDA margin for 2025 to be between 15.0% and 15.5%. Clariant also expects to make further progress towards achieving its 40% free cash flow conversion rate target in 2025.

Clariant reiterates its commitment to achieving the following mid-term targets by the end of 2027: local currency sales growth of 4-6%; a reported EBITDA margin of 19-21%; and a free cash flow conversion rate of around 40%.

Clariant is capable of achieving these mid-term goals because sales growth on a lower cost base will drive operational leverage improvement, which will be reinforced by high-margin growth in the innovation sector. As mentioned above, Clariant will also implement more stringent cost management and production efficiency enhancement measures. Overall, Clariant expects that from 2024 to 2027, about two-thirds of the profit margin improvement will come from growth drivers, and about one-third will come from self-help initiatives taken by the company.

Clariant is capable of achieving these mid-term goals because sales growth on a lower cost base will drive operational leverage improvement, which will be reinforced by high-margin growth in the innovation sector. As mentioned above, Clariant will also implement more stringent cost management and production efficiency enhancement measures. Overall, Clariant expects that from 2024 to 2027, about two-thirds of the profit margin improvement will come from growth drivers, and about one-third will come from self-help initiatives taken by the company.

Q4 2024 Group Performance

Q4 2024 Group Performance

Q4 2024 Group Performance

Q4 2024 Group Performance

Q4 2024 Group Performance

Clariant, a specialty chemicals company focused on sustainability, today announced that its sales for the fourth quarter of 2024 were CHF 1.091 billion, representing an organic growth of 3% in local currency1 compared to the fourth quarter of 2023, with a local currency growth of 5% (including the impact of portfolio, or 3% in Swiss francs). Year-over-year pricing increased by 2%, and volumes grew by 1%. The acquisition of Lucas Meyer Cosmetics (portfolio) continued to contribute to growth as expected.

Sequentially, sales for the fourth quarter of 2024 grew by 10% (both in local currency and Swiss francs), mainly driven by volume growth across all business areas, with the most significant contribution from the Catalysts business. Pricing remained stable across businesses.

The Care Chemicals business saw a 4% increase in sales in local currency, benefiting from the contribution of Lucas Meyer Cosmetics, with organic sales remaining stable compared to the fourth quarter of 2023. Strong volume growth was observed in Crop Solutions, along with improved volumes and pricing in Industrial Applications. Sales in Basic Chemicals declined due to relatively mild weather (especially in Europe), leading to seasonal volume decreases in Aviation and Refining. The Catalysts business reported a 7% increase in sales in local currency, driven by strong volume growth in the Propylene business. Sales in Adsorbents and Additives grew by 4% in local currency, thanks to improvements in key end markets for Additives and robust demand for Adsorbents in the US.

In the fourth quarter, sales in EMEA (Europe, Middle East, and Africa) in local currency were flat compared to the fourth quarter of 2023 (with 1% related to the portfolio). Positive price performance was offset by lower volumes, due to reduced seasonal business in Care Chemicals and weaker industry demand for Adsorbents. Sales in the Americas increased by 5% (with 4% related to the portfolio), supported by continued strong volume growth in the Adsorbents business, particularly in biodiesel purification, while Catalysts sales decreased due to the project nature of the business. Sales in Asia Pacific grew by 11% (with 1% related to the portfolio), with China growing by 46%, driven by strong sales performance in the Catalysts business. While all business areas in Asia Pacific showed growth, the Catalysts business stood out, with double-digit volume growth rates.

Group EBITDA increased by 69% to CHF 179 million, corresponding to a margin of 16.4%, up 640 basis points from 10.0% in the fourth quarter of 2023, during which the Group incurred restructuring costs of CHF 43 million (of which CHF 35 million were related to sunliquid™). The profitability of the Catalysts business improved due to higher operational leverage from volume growth. Additionally, the reversal of provisions and a reduction in negative operational impacts in the sunliquid™ business contributed positively. In the Adsorbents and Additives business, besides achieving slight volume growth, there were positive effects from the performance program implemented in the previous year. The profitability of the Care Chemicals business decreased due to lower seasonal sales affecting volumes and product mix, which also impacted fixed cost absorption, along with negative effects from maintenance costs. The performance program generated cost savings of approximately CHF 6 million, used to address residual costs from divested businesses and to positively contribute to offsetting inflation.

Clariant, a company focused on sustainable specialty chemicals, today announced that its sales for the fourth quarter of 2024 were 1.091 billion Swiss francs, representing an organic growth of 3% in local currency1 compared to the fourth quarter of 2023, with a local currency growth of 5% including the impact of product scope (a 3% increase in Swiss francs). Pricing increased by 2% year-over-year, and volume grew by 1%. The acquisition of Lucas Meyer Cosmetics (product scope) continues to contribute to growth as expected.

On a sequential basis, sales for the fourth quarter of 2024 increased by 10% (both in local currency and Swiss francs), primarily driven by volume growth across all business areas, with the most significant contribution from the catalysts business. Pricing remained stable across businesses.

The Care Chemicals business saw a 4% increase in sales in local currency, benefiting from the contribution of Lucas Meyer Cosmetics, with organic sales remaining stable compared to the fourth quarter of 2023. Crop Solutions experienced strong volume growth, while industrial applications also saw increases in both volume and pricing. Sales of base chemicals declined due to relatively mild weather, especially in Europe, leading to seasonal decreases in volumes for aviation and refining. The Catalysts business saw a 7% increase in sales in local currency, driven by strong volume growth in the propylene business. The Adsorbents and Additives business saw a 4% increase in sales in local currency, benefiting from improved demand in key end markets for additives and robust demand for adsorbents in the US.

In the fourth quarter, sales in Europe, the Middle East, and Africa (EMEA) remained flat in local currency terms compared to the fourth quarter of 2023 (with 1% related to product scope). Positive price performance was offset by a decline in volumes, due to reduced seasonal business in care chemicals and weaker industry demand for adsorbents. Sales in the Americas increased by 5% (with 4% related to product scope), driven by continued strong volume growth in the adsorbents business for biodiesel purification, while catalyst sales decreased due to the project nature of the business. Sales in Asia Pacific grew by 11% (with 1% related to product scope), with China growing by 46%, thanks to strong sales performance in the catalyst business. Although all business units in Asia Pacific saw sales growth, the catalyst business was the most significant, with volume growth reaching high double digits.

The Group's EBITDA increased by 69% to CHF 179 million, with a corresponding margin of 16.4%, an improvement of 640 basis points over the 10.0% in the fourth quarter of 2023, during which the Group incurred restructuring costs of CHF 43 million (of which CHF 35 million were related to sunliquid™). The profitability of the catalyst business improved due to the operational leverage from volume growth. Additionally, the reversal of provisions and reduction in negative operational impacts in the sunliquid™ business made a positive contribution. In the adsorbents and additives business, besides achieving slight volume growth, it also benefited from the positive effects of the performance programs implemented in the previous year. The profitability of the care chemicals business declined, as lower seasonal sales affected volumes and product mix, impacting the absorption of fixed costs, and maintenance costs also had a negative impact. Cost savings of approximately CHF 6 million from the performance program were used to address remaining costs from divested businesses and contributed positively to offsetting inflation.

The group's EBITDA grew by 69% to 179 million Swiss francs, with a corresponding margin of 16.4%, an increase of 640 basis points compared to 10.0% in the fourth quarter of 2023. During the same period, the group incurred restructuring costs of 43 million Swiss francs (of which 35 million Swiss francs were related to sunliquid™). The profitability of the catalyst business increased due to improved operational leverage from higher sales volumes. Additionally, the reversal of provisions and reduced negative operational impacts in the sunliquid™ business also made positive contributions. In the adsorbents and additives business, in addition to achieving modest volume growth, it benefited from the positive effects of performance programs implemented in the previous year. The profitability of the care chemicals business declined, due to the impact of seasonal sales declines on volumes and product mix, which also affected fixed cost absorption, while maintenance costs had a negative impact. Cost savings of about 6 million Swiss francs from performance programs were used to address residual costs from divested businesses and made a positive contribution to offsetting inflation.

The EBITDA excluding special items, reflecting underlying profitability, increased by 1% to 160 million Swiss francs, with a basic margin of 14.7%, compared to 14.9% in the same period last year.

The EBITDA excluding special items, reflecting underlying profitability, increased by 1% to 160 million Swiss francs, with a basic margin of 14.7%, compared to 14.9% in the same period last year.

2024 full-year group performance

2024 full-year group performance

2024 full-year group performance

2024 full-year group performance

2024 full-year group performance

In 2024, sales amounted to CHF 4.152 billion, a decrease of 3% in local currency and 5% in Swiss francs. Over the year, pricing decreased by 2%, and volumes decreased by 1%. The product mix impact was neutral over the full year, as the contribution from Lucas Meyer Cosmetics was offset by the divestiture of the North American land oil business and the quaternary ammonium business.

The Care Chemicals business saw a 1% decrease in sales in local currency terms for the full year 2024, with volume growth being offset by price decreases, primarily due to formula-based price adjustments in the first half of the year. Sales in Mining Solutions showed the strongest growth, with positive contributions from both prices and volumes, while volume growth in Personal & Home Care and Industrial Applications also made positive contributions. In the Catalysts business, sales decreased by 9% in local currency terms. A challenging global economic environment led to lower customer utilization rates, extending regular reload cycles, and a reduction in new plant projects expected in the industry. Sales in the Adsorbents & Additives business remained stable in local currency terms, as growth driven by improved demand in additive end markets and new business development was offset by weaker industry demand for adsorbents in the Asia Pacific and EMEA regions.

For the full year 2024, sales in the EMEA region decreased by 4% in local currency terms, mainly due to price decreases. Growth in the Catalysts business (benefiting from European process technology partners supplying their global customers from the region) was offset by declines in the Care Chemicals and Adsorbents & Additives businesses. Sales in the Americas decreased by 2%, as volume growth in the Care Chemicals and Adsorbents & Additives businesses was offset by a decline in the Catalysts business due to fewer projects. Sales in the Asia Pacific region also decreased by 2%, due to a decline in Catalysts sales, despite growth in other businesses.

Group EBITDA increased by 8% to CHF 657 million, with the corresponding EBITDA margin improving by 190 basis points from 13.9% in 2023 to 15.8%. In a deflationary environment, profitability was positively impacted by margin management, with raw material and energy costs decreasing by 7% and 5%, respectively. Profitability was also supported by cost reductions and performance improvement plans for sunliquid™, with the negative operational impact improving from CHF 43 million to CHF 10 million on an annualized basis. Additionally, the group was able to close the bioethanol plant ahead of its financial expectations and scale down related activities, leading to partial reversals of provisions. The performance improvement plan generated additional cost savings of CHF 33 million during the period.

On an underlying basis, excluding special items, the EBITDA margin for 2024 was 16.0%, an improvement of 140 basis points compared to 14.6% in 2023.

For the full year 2024, Group EBIT (earnings before interest and taxes) increased from CHF 282 million in the previous year to CHF 440 million. This improvement was mainly due to impairment reversals related to sunliquid™ in the Catalysts business, and no significant impairments in other businesses in 2024, compared to CHF 89 million in impairments in the previous year.

For the full year 2024, the Group's total net profit was CHF 280 million, up from CHF 179 million in the previous year. Despite higher net financial expenses and taxes, the

In 2024, sales amounted to CHF 4.152 billion, a decrease of 3% in local currency1 and 5% in Swiss francs. For the full year, pricing decreased by 2%, and volumes decreased by 1%. The product mix impact was flat for the year, as the contribution from Lucas Meyer Cosmetics was offset by the divestment of the North American land oil business and the quaternary ammonium compounds business.

The Care Chemicals business saw a 1% decrease in sales in local currency for the full year 2024, with volume growth being offset by price decreases, primarily due to formula-based price adjustments in the first half of the year. Mining Solutions experienced the strongest sales growth, with both positive price and volume contributions, while Personal & Home Care and Industrial Applications also contributed positively through volume growth. In the Catalysts business, sales in local currency decreased by 9%. A challenging global economic environment led to lower customer utilization rates, extending regular refill cycles, and a reduction in new plant project expectations within the industry. Absorbents and Additives business maintained stable sales in local currency, as the improved demand in end markets for additives and growth from new business development were offset by weaker industry demand for absorbents in the Asia Pacific and EMEA regions.

In 2024, sales in Europe, Middle East, and Africa (EMEA) decreased by 4% in local currency, mainly affected by price decreases. Growth in the Catalysts business (benefiting from European process technology partners supplying their global customers from this region) was offset by declines in the Care Chemicals and Absorbents and Additives businesses. Sales in the Americas decreased by 2%, as volume growth in the Care Chemicals and Absorbents and Additives businesses was offset by a decline in the Catalysts business due to fewer projects. Sales in the Asia Pacific region also decreased by 2%, due to a decline in Catalysts sales despite growth in other businesses.

2024 saw a 4% decline in sales in the Europe, Middle East, and Africa (EMEA) region in local currencies, mainly due to lower pricing. The growth in the catalyst business (benefiting from European process technology partners supplying their global customers from this region) was offset by declines in the care chemicals, as well as the adsorbents and additives businesses. In the Americas, sales decreased by 2%, with the volume growth in the care chemicals, as well as the adsorbents and additives businesses, being offset by a decrease in the catalyst business due to fewer projects. Sales in the Asia-Pacific region also fell by 2%, attributable to a decline in catalyst sales, despite growth in other businesses.

The Group's EBITDA increased by 8% to CHF 657 million, with the corresponding EBITDA margin improving by 190 basis points to 15.8% from 13.9% in 2023. In a deflationary environment, profitability was positively impacted by margin management, with raw material and energy costs decreasing by 7% and 5% respectively. Profitability was also supported by cost reductions and performance improvement plans for sunliquid™, whose negative operational impact improved from CHF 43 million to CHF 10 million on an annualized basis. Additionally, the Group was able to close the bioethanol plant ahead of its financial expectations and scale down related activities, leading to partial provisions being reversed. Performance improvement initiatives during the period resulted in additional cost savings of CHF 33 million.

The Group's EBITDA increased by 8% to CHF 657 million, with the corresponding EBITDA margin improving by 190 basis points to 15.8% from 13.9% in 2023. In a deflationary environment, profitability was positively impacted by margin management, with raw material and energy costs decreasing by 7% and 5% respectively. Profitability was also supported by cost reductions and performance improvement plans for sunliquid™, whose negative operational impact improved from CHF 43 million to CHF 10 million on an annualized basis. Additionally, the Group was able to close the bioethanol plant ahead of its financial expectations and scale down related activities, leading to partial provisions being reversed. Performance improvement initiatives during the period resulted in additional cost savings of CHF 33 million.

On an underlying basis excluding special items, the 2024 EBITDA margin was 16.0%, up 140 basis points from 14.6% in 2023.

On an underlying basis excluding special items, the 2024 EBITDA margin was 16.0%, up 140 basis points from 14.6% in 2023.

For the full year 2024, the Group's EBIT (earnings before interest and taxes) increased from CHF 282 million in the previous year to CHF 440 million. This improvement was primarily driven by impairment reversals related to sunliquid™ in the catalyst business, and no significant impairments in other businesses in 2024, compared to CHF 89 million in impairments in the prior year.

For the full year 2024, the Group's EBIT (earnings before interest and taxes) increased from CHF 282 million in the previous year to CHF 440 million. This improvement was primarily driven by impairment reversals related to sunliquid™ in the catalyst business, and no significant impairments in other businesses in 2024, compared to CHF 89 million in impairments in the prior year.

For the full year 2024, the Group's total net profit was CHF 280 million, an increase from CHF 179 million in the previous year. Despite higher net financial expenses and taxes, overall performance improved thanks to increased operating income.

The Group's net cash flow from operating activities remained stable at CHF 418 million, roughly on par with CHF 421 million in 2023. Free cash flow amounted to CHF 211 million, a slight decrease from CHF 216 million in 2023. The free cash flow conversion rate for the full year 2024 was 32%, slightly lower than 36% in the previous year, despite cash outflows related to sunliquid™.

Total net debt of the Group increased from CHF 755 million at the end of 2023 to CHF 1,489 million. This was mainly due to the acquisition of Lucas Meyer Cosmetics, which added to the debt. At the end of 2024, the net debt to EBITDA ratio, excluding special items, stood at 2.25x. Clariant remains committed to its target of reducing this ratio below 2.0x.

Based on Clariant’s 2024 performance, the Board of Directors proposes to the Annual General Meeting (AGM) to be held on April 1, 2025, a regular dividend of CHF 0.42 per share. This distribution is intended to be achieved through a capital reduction via a par value reduction.

The Board of Directors has nominated Ben van Beurden as an independent candidate for the position of Chairman of the Board and member of the Board. If elected, Ben van Beurden will succeed Günter von Au, who has been a member of the Board since 2012 and served as Chairman since 2021. The Board expresses its sincere gratitude to Günter von Au for his outstanding service and significant contributions during his tenure. All other members of the Board have indicated their support for re-election. Clariant's 2024 Integrated Report will be published on March 5, 2025.

The board has nominated Ben van Beurden as an independent candidate for the position of chairman and member of the board. If elected, Ben van Beurden will succeed Günter von Au. Günter von Au has been a member of the board since 2012 and has served as the chairman since 2021. The board expresses its heartfelt gratitude to Günter von Au for his outstanding service and significant contributions during his tenure. All other board members have expressed support for re-election. Clariant's 2024 Integrated Report will be released on March 5, 2025.

Environmental, Social, and Governance (ESG) Update

—Leading in Sustainability and Safety

Environmental, Social, and Governance (ESG) Update

—Leading in Sustainability and Safety

Environmental, Social, and Governance (ESG) Update

—Leading in Sustainability and Safety

Environmental, Social, and Governance (ESG) Update

Environmental, Social, and Governance (ESG) Update—Leading in Sustainability and Safety

—Leading in Sustainability and Safety

In 2024, Clariant's total Scope 1 and 2 greenhouse gas emissions decreased to 490,000 tons, a 9% reduction from the 540,000 tons in 2023. The 2024 emissions represent a 35% decrease compared to the new 2019 baseline, marking a significant step towards the 2030 target of reducing emissions by 46.9% (to 400,000 tons). Last year, all business units achieved significant emission reductions by further reducing coal consumption and substituting it with natural gas and sustainable biomass. Additionally, the transition to green electricity continued, with usage increasing from 60% to 67% in 2024.

The total indirect greenhouse gas emissions from purchased goods and services (Scope 3.1) decreased by 5% from 2.7 million tons in 2023 to 2.58 million tons in 2024. This represents a 26% reduction compared to the new 2019 baseline, moving closer to the 2030 target of 2.54 million tons (a 27.5% reduction from 2019). The 2024 results were partly due to the procurement of raw materials with lower carbon footprints. For example, Clariant substituted raw materials for renewable energy production in key areas. Furthermore, through supplier engagement programs, Clariant significantly increased the proportion of primary data based on procurement volume and total emissions. This transparency enables us to continuously identify more potential for emission reductions in our raw material portfolio.

Clariant's latest Carbon Disclosure Project (CDP) scores highlight our progress in sustainability—maintaining a "B" rating for "Water" and "Forests," and achieving an "A-" rating for "Climate" for the first time. This aligns with our strategy focused on impactful sustainability practices. CDP scores drive transparency and risk management, providing guidance for our ongoing efforts to create long-term value.

In the 2024 customer satisfaction survey, global Clariant customers evaluated the company's operations, commercial, and innovation performance. Clariant's overall Net Promoter Score (NPS) remained stable at 45, which is 5 points higher than the industry average and 11 points higher than the B2B (business-to-business) average. Customers cited "customer service" and "product quality" as the main reasons for their recommendations.

Clariant is committed to achieving a zero-accident culture and becoming a leader in safety within the chemical industry. In 2024, the company made significant progress in safety, with the DART (Days Away, Restricted, or Transferred) rate decreasing from 0.21 in 2023 to 0.17. This 19% reduction reflects Clariant's high level of safety awareness, training, and accountability, placing the company in the top quartile of the chemical industry.

In 2024, Clariant's total Scope 1 and 2 greenhouse gas emissions decreased to 490,000 tons, a 9% reduction from the 540,000 tons in 2023. The 2024 emissions represent a 35% decrease compared to the new 2019 baseline, marking a significant step towards the 2030 target of reducing emissions by 46.9% (to 400,000 tons). Last year, all business units achieved significant emission reductions by further reducing coal consumption and substituting it with natural gas and sustainable biomass. Additionally, the transition to green electricity continued, with usage increasing from 60% to 67% in 2024.

In 2024, Clariant's total Scope 1 and 2 greenhouse gas emissions decreased to 490,000 tons, a 9% reduction from the 540,000 tons in 2023. The 2024 emissions represent a 35% decrease compared to the new 2019 baseline, marking significant progress towards the 2030 target of a 46.9% reduction (to 400,000 tons). Last year, all business units achieved notable emission reductions by further decreasing coal consumption and substituting it with natural gas and sustainable biomass. Additionally, the transition to green electricity continued, with usage increasing from 60% to 67% in 2024.

The total indirect greenhouse gas emissions from purchased goods and services (Scope 3.1) decreased by 5% from 2.7 million tons in 2023 to 2.58 million tons in 2024. This represents a 26% reduction from the new 2019 baseline, moving closer to the 2030 target of 2.54 million tons (a 27.5% reduction from 2019). The 2024 results were partly due to the procurement of raw materials with lower carbon footprints. For example, Clariant achieved the substitution of raw materials for renewable energy production in key raw materials. Furthermore, through supplier engagement programs, Clariant significantly increased the proportion of primary data based on procurement volume and total emissions. This transparency enables us to continuously identify more reduction potential in our raw material portfolio.

The total indirect greenhouse gas emissions from purchased goods and services (Scope 3.1) decreased by 5% from 2.7 million tons in 2023 to 2.58 million tons in 2024. This represents a 26% reduction from the new 2019 baseline, moving closer to the 2030 target of 2.54 million tons (a 27.5% reduction from 2019). The 2024 results were partly due to the procurement of raw materials with lower carbon footprints. For example, Clariant achieved the substitution of raw materials for renewable energy production in key raw materials. Furthermore, through supplier engagement programs, Clariant significantly increased the proportion of primary data based on procurement volume and total emissions. This transparency enables us to continuously identify more reduction potential in our raw material portfolio.

Clariant's latest CDP (Carbon Disclosure Project) scores highlight our progress in sustainability — maintaining a "B" rating for "Water" and "Forests" and achieving an "A-" rating for "Climate" for the first time. This aligns with our strategy focused on impactful sustainability practices. CDP scores drive transparency and risk management, providing guidance for our ongoing efforts to create long-term value.

Clariant's latest CDP (Carbon Disclosure Project) scores highlight our progress in sustainability — maintaining a "B" rating for "Water" and "Forests" and achieving an "A-" rating for "Climate" for the first time. This aligns with our strategy focused on impactful sustainability practices. CDP scores drive transparency and risk management, providing guidance for our ongoing efforts to create long-term value.

In the 2024 customer satisfaction survey, global Clariant customers evaluated the company's operations, commercial, and innovation performance. Clariant's overall Net Promoter Score (NPS) remained stable at 45, 5 points higher than the industry average and 11 points higher than the B2B (business-to-business) average. Customers cited "customer service" and "product quality" as the main reasons for their recommendations.

In the 2024 customer satisfaction survey, global Clariant customers rated the company's operations, business, and innovation performance. Clariant's overall Net Promoter Score (NPS) remained stable at 45 points, 5 points higher than the industry average and 11 points above the B2B (business-to-business) average. Customers cited "customer service" and "product quality" as the main reasons for their recommendations.

Clariant is committed to achieving a zero-accident culture and becoming a leader in safety within the chemical industry. In 2024, the company made significant progress in safety, with the DART (Days Away, Restricted, or Transferred, i.e., recordable restricted lost workday) rate dropping from 0.21 in 2023 to 0.17. This 19% decrease reflects Clariant's high level of safety awareness, safety training, and sense of responsibility, placing Clariant in the top quartile of the chemical industry.

Clariant is committed to achieving a zero-accident culture and becoming a leader in safety within the chemical industry. In 2024, the company made significant progress in safety, with the DART (Days Away, Restricted, or Transferred, i.e., recordable restricted lost workday) rate dropping from 0.21 in 2023 to 0.17. This 19% decrease reflects Clariant's high level of safety awareness, safety training, and sense of responsibility, placing Clariant in the top quartile of the chemical industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track