Breaking! Major Changes to the 120 Million Square Meter POE Film Expansion Project; Environmental Impact Assessment Public Notice Launched

On March 26, the Yichun Municipal Ecological Environment Bureau released a public notice of the proposed acceptance of the environmental impact assessment documents for the expansion project of Mingguan New Materials Co., Ltd.'s 120 million square meters per year POE film used in photovoltaic module encapsulation (significant changes).

In June 2021, Mingguan New Material Co., Ltd. entrusted Yichun Yixin Environmental Protection Technology Co., Ltd. to complete the "Environmental Impact Report Form for the Expansion Project of Mingguan New Material Co., Ltd. to Produce 120 Million Square Meters of POE Encapsulation Film for Photovoltaic Modules Annually". On December 15, 2021, it received the "Approval of the Environmental Impact Report Form for the Expansion Project of Mingguan New Material Co., Ltd. to Produce 120 Million Square Meters of POE Encapsulation Film for Photovoltaic Modules Annually" (Yi District Environmental Assessment [2021] No. 28) issued by the Yichun Economic and Technological Development Zone Branch of Yichun Ecological Environment Bureau. Currently, the project is under construction, and some equipment has been installed.

During the actual construction process of the project, there were changes compared to the original environmental impact assessment and approval content. The specific changes are as follows:

(1) The construction site of the project has changed. The original environmental impact assessment (EIA) approval was for the construction site located at No. 32 Jingfa Avenue, Yichun Economic and Technological Development Zone, with geographic coordinates E114°23′53.498″, N27°52′13.163″. It has been changed to No. 666 Chunchao Road, Yichun Economic and Technological Development Zone, Jiangxi Province, with geographic coordinates E114°23′45.928″, N27°52′22.510″. The new plant location is 20 meters north of the original plant site.

(2) Adjustments to the production process: the main production process remains unchanged, and a new crushing process for edge scraps is added. After crushing, the edge scraps will be returned to the feeding process for reuse.

(3) Adjust and optimize part of the production equipment for the project, adding 2 slitter rewinders and 3 crushers;

(4) Due to the change in construction site, the production layout will be adjusted accordingly;

(5) A new broken waste gas emission outlet is added. According to the "Technical Specification for Application and Issuance of Pollution Discharge Permit Rubber and Plastic Products Industry" (HJ1122-2020) 5.1.5.2.5 Emission outlet type: The waste gas emission outlets of simplified management discharge units are all general emission outlets. The project is C2921 plastic film manufacturing. According to the "Classification Management List of Pollution Discharge Permit for Fixed Pollution Sources" (2019 Edition), it belongs to the simplified management discharge unit, so the newly added broken waste gas emission outlet is a general emission outlet.

First Adjustment: In March 2021, Mingguan New Materials announced a change to part of its raised funds investment projects. The original fundraising projects, "Expansion Project of 30 Million Square Meters of Solar Cell Backsheet Annually" and "Expansion Project of 10 Million Square Meters of Lithium Battery Aluminum Plastic Film Annually," due to reduced prices of purchased production equipment and improved production equipment technology, will have surplus funds under the condition of maintaining the original project capacities. The saved excess funds are intended for the construction of an additional "Expansion Project of 120 Million Square Meters of POE Encapsulation Film for Photovoltaic Modules Annually." The POE film project investment is approximately 194 million yuan.

At the time, analysis indicated that the solar cell encapsulation film market, where POE film is located, had a high concentration and significant head effect. The existing and under-construction capacities of the major companies were essentially aligned with market demand. During the reporting period, Mingguan New Materials' solar cell encapsulation film business had a relatively small revenue scale, with a product gross margin of only 2.13%, and there were instances of returned and substandard inventory.

The second adjustment: In April 2022, Mingguan New Materials released a public offering announcement: This time, it plans to raise 2 billion yuan to invest in the construction of the "Mingguan Lithofilm Company's 200 million square meters per year aluminum塑film project," "Mingguan Lithofilm Company's 100 million square meters per year aluminum塑film project," "Jiaming Film Company's 100 million square meters per year fluorine-free backsheet project," as well as补充working capital. This expansion project is precisely the aluminum塑film project that was reduced the previous year.

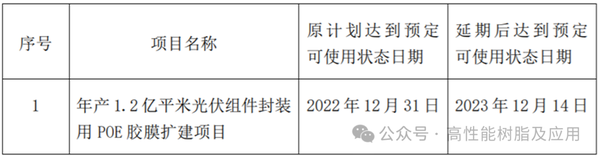

Project Extension: On December 14, 2022, Mingguang New Material Co., Ltd. issued an announcement regarding the extension of some fundraising project schedules.

The reason for the delay is that the fundraising investment project "Expansion Project for Annual Production of 1.2 Billion Square Meters of POE Encapsulant Film for Photovoltaic Modules" has been postponed mainly due to the impact of the COVID-19 pandemic. Strict epidemic prevention and control measures have been implemented in various regions, leading to restricted logistics and personnel mobility. This has affected the procurement of materials, logistics transportation, and has also delayed the progress of construction work due to restricted mobility of construction personnel and daily epidemic prevention efforts.

Photovoltaic Film

Photovoltaic film is a key encapsulant material in the solar industry, serving as an auxiliary material in the manufacturing of photovoltaic modules. It plays a protective and efficiency-enhancing role for photovoltaic cells, belonging to the photovoltaic industry chain. Its protective function is primarily reflected in minimizing the impact of external environmental factors on the cells during the operation of photovoltaic modules, thereby extending their service life and improving their power generation efficiency. In other words, photovoltaic film is a critical material for ensuring the quality and longevity of photovoltaic modules.

The production of photovoltaic encapsulants typically uses resins (EVA, POE) as the main material, with cross-linking agents, thickeners, antioxidants, and light stabilizers added. The process involves melting and extruding, then casting to form the film into its final product. Currently, there are four main types of photovoltaic encapsulants on the market: transparent EVA encapsulant, white EVA encapsulant, POE encapsulant, and co-extruded POE composite film (EPE, EVA-POE-EVA) encapsulant.

The global competition in the photovoltaic encapsulation film market is becoming increasingly intense. Well-known companies such as Forster, Swicofil, and Bekaert are standing out in the market. In the first half of 2024, based on a module production volume of 283GW, the total demand for encapsulation films reached 2.57 billion square meters, a year-on-year increase of 15%. The combined shipments of the top three manufacturers exceeded 1.94 billion square meters, with their combined market share surpassing 75%. Forster leads in shipment volume, firmly holding the top position; Swicofil and Bekaert's shipment volumes continue to rise. Notably, second-tier manufacturers are also emerging strongly, actively capturing a portion of the market share, leading to a diversified competitive landscape. For instance, Bekaert advanced into the top three in the first half of 2024 with robust shipment volumes, becoming a dark horse in the market. Additionally, major domestic encapsulation film manufacturers, in order to enhance their global delivery capabilities and flexibility, are accelerating their global production capacity layout. Companies such as Forster and Bekaert, while maintaining production bases in their home countries, are gradually expanding into regions like Southeast Asia.

Breakthroughs in various battery component technologies have continuously raised higher and more diverse encapsulation requirements for photovoltaic film products. This has driven film manufacturers to possess the capability to consistently support downstream component manufacturers in technological iteration and product validation. For example, POE film, which combines the properties of both plastic and rubber, offers excellent performance and is seeing growing demand in applications such as n-type cells and double-sided double-glass modules. However, POE involves high technical barriers and has long been monopolized by foreign companies. In recent years, China has gradually broken through these technical barriers, accelerating the localization process. In December 2023, Beioyi Company successfully launched the country's first independently developed POE industrial production facility. By June 2024, Wanhua Chemical achieved full-process integration and produced qualified products in its Phase I 200,000-ton/year POE project. According to incomplete statistics, China's planned POE projects have a total capacity of approximately 2.95 million tons/year, with some companies' industrial facilities expected to commence production between 2024 and 2025.

In summary, while the photovoltaic film market is experiencing growth in scale, it also faces challenges and opportunities in areas such as supply-demand structural adjustments, changes in competitive landscape, and technological advancements. Enterprises need to closely monitor market dynamics, continuously enhance their technological capabilities and production capacity, in order to adapt to the evolving market landscape.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track