Behind the Major Shift in the PMMA Industry: Who is Reshaping the Market Landscape?

Recently, the 2024 annual performance of Shuangxiang Co., Ltd. has seen a significant year-on-year increase (mainly due to the gradual release of production capacity from its wholly-owned subsidiary, Chongqing Shuangxiang Optical Materials Co., Ltd., which has an annual output of 300,000 tons of PMMA, MS, and 40,000 tons of special esters), the environmental impact assessment announcement for the 88,000-ton optical-grade PMMA project by Jiangxi Jingsu Technology Co., Ltd. with an investment of 400 million yuan, and the commencement of Zhejiang Huashuaite New Materials Technology Co., Ltd.'s 35,000-ton aviation PMMA project have garnered considerable attention in the chemical materials sector. The advancement of these projects not only represents important measures for companies to expand their business and enhance competitiveness but also reflects that the PMMA (polymethyl methacrylate) industry is currently in a critical period of rapid development and transformation.

So, what is the current situation regarding PMMA's production capacity and market structure? What are the future development directions? Zuan Plastic Vision will take you on an exploration.

Image source: Internet

I PMMA: Capacity Expansion at the Right Time

PMMA, commonly known as acrylic glass, is hailed as the "Queen of Plastics" due to its excellent transparency, optical properties, weather resistance, chemical resistance, hardness, and appearance. It has a wide range of applications in numerous fields such as construction, advertising, optics, medicine, and automotive. For instance, in the construction sector, it is often used as an alternative to glass for windows, doors, and skylights; in the advertising industry, it is used for light boxes and display stands; in the field of optics, it serves as a key material for LCD light guides and optical lenses; in the medical field, it can be used to manufacture disposable medical supplies and dental restoration materials; and in the automotive industry, it is used for taillights and body parts.

From the perspective of production capacity data, domestic PMMA production capacity shows a growth trend in 2024. According to relevant statistics, by the end of 2024, the domestic PMMA production capacity is expected to reach approximately 735,350 tons/year, representing an 18.5% increase compared to 2023. Moreover, over 1.5 million tons of additional capacity are currently under planning and construction, with the total future domestic PMMA production capacity projected to exceed 2.5 million tons.

PMMA Production Capacity Statistics (Unit: 10,000 tons)

PMMA Production Capacity Statistics (Unit: 10,000 tons)In terms of regional distribution, the existing PMMA production capacity in China is mainly concentrated in the East China region, with a total capacity of 645,000 tons, accounting for 87.71% of the national total capacity; the Southwest region has an annual capacity of 75,000 tons, accounting for 10.20%; and the Northeast region has a capacity of about 15,350 tons, accounting for 2.09%.

In terms of regional distribution, the existing PMMA production capacity in China is mainly concentrated in the East China region, with a total capacity of 645,000 tons, accounting for 87.71% of the national total capacity; the Southwest region has an annual capacity of 75,000 tons, accounting for 10.20%; and the Northeast region has a capacity of about 15,350 tons, accounting for 2.09%.As the country's economy develops, the domestic demand for PMMA will increase, not just in East China, but also in other regions, driving the expansion of PMMA production centers to enterprise areas across the country.

As the country's economy develops, the domestic demand for PMMA will increase, not just in East China, but also in other regions, driving the expansion of PMMA production centers to enterprise areas across the country.II The Trend of Domestic Substitution is Gradually Accelerating

II II The Trend of Domestic Substitution is Gradually AcceleratingThe trend of domestic substitution is gradually acceleratingIn terms of market structure, the domestic PMMA industry presents a complex competitive landscape. On one hand, local enterprises are continuously rising, such as Wanhua Chemical, Shuangxiang Co., Ltd., which have gained significant positions in the market through technological research and development and capacity expansion. Among them, Wanhua Chemical has a PMMA production capacity of 160,000 tons per year, while Shuangxiang Co., Ltd. has 155,000 tons per year. These companies are actively positioning themselves in high-end product areas like optical-grade PMMA, gradually breaking the monopoly held by foreign enterprises. On the other hand, foreign enterprises such as Zhenjiang Chi Mei, Mitsubishi Chemical, although they occupied a large market share in the past, have faced issues of declining capacity utilization and shrinking market share in recent years, accelerating the "domestic substitution" trend.

In terms of market structure, the domestic PMMA industry presents a complex competitive landscape. On one hand, local enterprises are continuously rising, such as Wanhua Chemical, Shuangxiang Co., Ltd.Wanhua Chemical, Shuangxiang Co., Ltd. which have gained significant positions in the market through technological research and development and capacity expansion. Among them, Wanhua Chemical has a PMMA production capacity of 160,000 tons per year, while Shuangxiang Co., Ltd. has 155,000 tons per year. These companies are actively positioning themselves in high-end product areas like optical-grade PMMA, gradually breaking the monopoly held by foreign enterprises. On the other hand, foreign enterprises such as Zhenjiang Chi Mei, Mitsubishi ChemicalZhenjiang Chi Mei, Mitsubishi ChemicalAlthough companies like [company names, if any, were not provided in the original text, so this part remains as is] once held a significant market share, they have recently faced issues with declining capacity utilization and shrinking market shares, with the trend of "domestic substitution" accelerating.Import and export data also reflect changes in the domestic PMMA industry's market landscape. In the past, the domestic market relied heavily on imported PMMA products, with annual import volumes exceeding 180,000 tons, peaking at 345,300 tons in 2021. However, starting from 2022, imports began to decrease, while exports started to rise. From January to November 2024, the total domestic PMMA imports amounted to 214,000 tons, and the total exports were approximately 273,700 tons. This change indicates an acceleration in the domestic substitution process for PMMA, with a continuous increase in the product's international competitiveness. Nevertheless, due to the fact that many domestic enterprises can only produce standard-grade products, high-quality optical-grade and impact-resistant PMMA are still dominated by a few leading global chemical companies, making the domestic market still dependent on imports for premium products.

From the demand side, the market demand for PMMA is influenced by various factors. With the rapid development of the advertising industry, mid-to-high-end furniture, transportation, and the growth of the liquid crystal display (LCD) market, the demand for PMMA has been continuously increasing. Especially for optical-grade PMMA molding compounds, demand has surged significantly with the expansion of the LCD market. In 2023, China's apparent consumption of PMMA reached 389,200 tons. However, standard models of PMMA products face fierce competition in the market against substitute materials such as PS (polystyrene) and PC (polycarbonate), leading to a decline in demand.

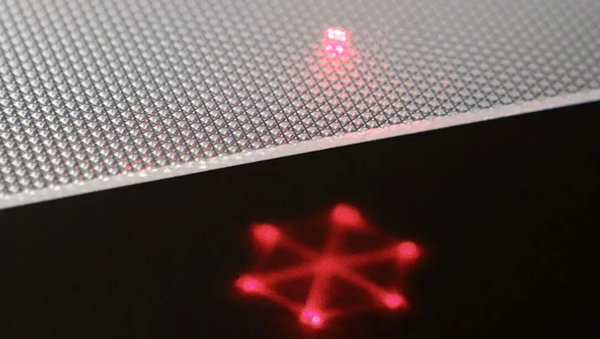

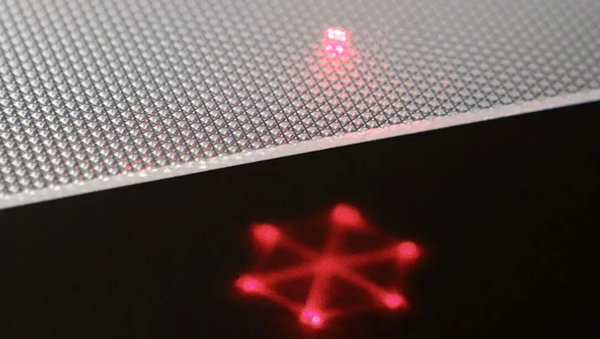

Figure: Light Guide Plate for LCD Displays

Figure: Light Guide Plate for LCD DisplaysIn terms of price trends, the overall trend of China's polymethyl methacrylate (PMMA) market in 2024 is characterized by an initial rise followed by a decline. The annual average price of imported PMMA pellets reached 17,691 yuan/ton, up 25.8% year-on-year; the average market price of domestically produced pellets was 17,667 yuan/ton, up 28.52% year-on-year. The price trend mainly revolves around costs and supply. In the first quarter, affected by the Spring Festival holiday, supply and demand were stable, and prices remained steady; in the second quarter, raw material prices increased, and plant maintenance led to tight supply, pushing prices higher; although supply decreased in the third quarter, weak demand limited the price increase; in the fourth quarter, as raw material prices fell, supply increased, and demand remained weak, leading to a downward trend in prices.

In terms of price trends, the overall trend of China's polymethyl methacrylate (PMMA) market in 2024 is characterized by an initial rise followed by a decline. The annual average price of imported PMMA pellets reached 17,691 yuan/ton, up 25.8% year-on-year; the average market price of domestically produced pellets was 17,667 yuan/ton, up 28.52% year-on-year. The price trend mainly revolves around costs and supply. In the first quarter, affected by the Spring Festival holiday, supply and demand were stable, and prices remained steady; in the second quarter, raw material prices increased, and plant maintenance led to tight supply, pushing prices higher; although supply decreased in the third quarter, weak demand limited the price increase; in the fourth quarter, as raw material prices fell, supply increased, and demand remained weak, leading to a downward trend in prices.III The Path to Breakthrough: Opportunities and Challenges in the PMMA Industry

III III The Path to Breakthrough: Opportunities and Challenges in the PMMA IndustryThe Path to Breakthrough: Opportunities and Challenges in the PMMA IndustryCurrently, the PMMA industry is at a critical development juncture, facing numerous opportunities and challenges. In terms of opportunities, with the development of high-tech industries such as 5G communications, VR/AR/MR, and smart homes, there is a continuous strong demand for PMMA materials that offer high transparency, strength, and excellent weather resistance. For example, high-end optical-grade PMMA can be used as optical lenses in head-mounted displays (HMDs), and PC/PMMA composite panels meet the requirements for signal transmission in 5G communications, as well as the trend towards thinner and more portable devices. At the same time, the demand for PMMA in the automotive industry is also growing. Besides traditional applications like rear lights, its ASA alloy series, transparent toughening series, solvent-resistant series, laser welding series, and color series products provide more innovative comprehensive material solutions for automotive body components.

However, the industry also faces several challenges. Firstly, the overcapacity of low-end products and their high concentration have led to the operating rate of domestic PMMA facilities remaining at around 60% for a long time. This not only results in a waste of resources but also intensifies market competition. Secondly, although domestic companies have made some progress in technological research and development, they still lag behind international leading enterprises in the production technology of high-end products. The reliance on imported key technologies limits the development of domestic companies in the high-end market.

Looking ahead, the development direction of the PMMA industry mainly focuses on the following aspects: First, technological innovation, where companies need to increase R&D investment, break through the bottlenecks in the production technology of high-end products, improve product quality and performance, and develop more products with differentiated competitive advantages. For instance, by improving polymerization processes, enhancing the optical and mechanical properties of PMMA. Second, expanding application areas, besides existing fields, actively exploring the potential of PMMA applications in emerging areas such as new energy and aerospace, further expanding market demand. Third, optimizing the industrial structure, phasing out outdated capacities, promoting industrial upgrading, and enhancing the overall competitiveness of the industry. Fourth, strengthening the integration of the industrial chain, through cooperation between upstream and downstream enterprises, achieving resource sharing, complementary strengths, improving production efficiency, and reducing production costs.

Looking ahead, the development direction of the PMMA industry mainly focuses on the following aspects: First, technological innovation. Companies need to increase R&D investment, break through the technical bottlenecks in the production of high-end products, improve product quality and performance, and develop more products with differentiated competitive advantages. For example, by improving polymerization processes, enhancing the optical and mechanical properties of PMMA. Second, expanding application fields. In addition to existing application areas, it is necessary to actively explore the application possibilities of PMMA in emerging fields such as new energy and aerospace, further expanding market demand. Third, optimizing the industrial structure, phasing out outdated capacities, promoting industrial upgrading, and improving the overall competitiveness of the industry. Fourth, strengthening the integration of the industrial chain, through cooperation among upstream and downstream enterprises, achieving resource sharing and complementary advantages, improving production efficiency, and reducing production costs.The PMMA industry, after experiencing changes in market patterns, fluctuations in demand, and price volatility, is now standing at a new starting point for development. Enterprises need to seize opportunities, actively respond to challenges, and through technological innovation, market expansion, and industrial upgrading, seek better development in fierce market competition, driving the entire industry towards higher-end, diversified, and sustainable directions.

The PMMA industry, after experiencing changes in market patterns, fluctuations in demand, and price volatility, is now standing at a new starting point for development. Enterprises need to seize opportunities, actively respond to challenges, and through technological innovation, market expansion, and industrial upgrading, seek better development in fierce market competition, driving the entire industry towards higher-end, diversified, and sustainable directions.

Editor: Lily

Editor: LilySources: High-Performance Resins and Applications, China Chemical Information Weekly, Aibang Polymers, Chemical New Materials, etc., public reports

Sources: High-Performance Resins and Applications, China Chemical Information Weekly, Aibang Polymers, Chemical New Materials, etc., public reports【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track