BASF has signed agreements with Li Auto and NIO. How big is the automotive coatings market in China?

On March 28, BASF and Li Auto signed a Memorandum of Understanding (MoU) to advance and apply coating innovations driven by sustainability and digital innovation. Based on the MoU, BASF Coatings and Li Auto will collaborate to explore new low-carbon emission material technologies, establish a joint innovation platform, develop new materials and processes to enhance product performance, and offer more competitive coating solutions including e-coat, basecoat, and clearcoat.

Just recently, on March 10, BASF announced that its Coatings Division has signed a Letter of Intent (LoI) with NIO, a pioneer and leader in the global smart electric vehicle market, aiming to establish a strategic partnership to strengthen cooperation in the automotive coatings sector.

BASF has signed agreements with two major Chinese automakers and has also strengthened its cooperation with Li Auto and NIO in the automotive coating sector. Why is BASF placing such emphasis on the automotive coatings market? What is the current state of China's automotive coatings market? Exclusive analysis by Monopolis Insights will provide answers.

One, BASF Bets on Automotive Coatings Business

In February this year, BASF announced,Selling the Brazilian architectural coatings business to the global coatings giant Sherwin-Williams for $1.15 billion.The transaction, covering the Suvinil and Glasu! brands and related production bases, is expected to be completed in the second half of 2025. This move aims to optimize the asset portfolio and focus resources on high-profit core businesses such as automotive coatings.

BASF sold its Brazilian architectural coatings business while expanding its automotive coatings business in China.On March 24, BASF announced that its coatings business had successfully expanded the capacity for polyester and polyurethane resins at its Shanghai Caorong plant.The factory was originally established in 2015, with an annual production capacity of 8,000 tons of polyester and polyurethane resins. Its current capacity has increased to 18,800 tons per year, achieving a doubling of production capacity.

BASF's Caojing Resin Plant is located in the Shanghai Chemical Industry Park and serves the automotive coatings industry in China and the Asia-Pacific region. The plant produces a range of coating raw materials, including acrylic resins, polyester resins, polyurethane resins, electrophoretic emulsions, and grinding resins. Notably, the plant is highly automated, operates on 100% renewable energy, and this year marks the 10th anniversary of its successful operation.

BASF's coatings division includes automotive coating solutions, surface treatment technologies and system solutions, and decorative coatings. Among them, automotive coating solutions encompass automotive OEM coatings, automotive repair coatings, and decorative paints.

2. Global Automotive Coatings Market

Automotive coatings generally refer to coatings applied to the bodies and components of vehicles such as cars. They can be divided into two major categories: original equipment manufacturer (OEM) automotive coatings (including car body coatings, automotive component coatings, etc.) and automotive touch-up paints. Additionally, they can be categorized into passenger car coatings and commercial vehicle coatings, with significant differences in product applications, design structures, coating requirements, end customers, sales models, and other aspects. The demand for automotive coatings is mainly related to the overall growth trend of the automotive market and the increase in the number of supporting production lines.

Due to the growth in global automobile production and sales,In 2023, the global automotive coatings market grew by approximately 5% year-on-year to $23 billion, of which: the automotive OEM coatings market was valued at around $16 billion; the automotive refinish and collision repair coatings market was valued at $7 billion.The growth in market value was primarily driven by the increase in global automotive production and the rise in sales prices of automotive coatings, but was impacted by unfavorable exchange rates.

The 2023 financial report shows that it is the world's largest automotive coatings manufacturer, the top global automotive OEM coatings producer, and the second-largest automotive refinish coatings manufacturer globally.Last year, PPG's sales revenue in the United States was $18.246 billion, a year-on-year increase of 3%. Both the automotive refinish coatings and automotive OEM coatings businesses achieved growth in net sales.。

BASF's Coatings division achieved sales of €4.387 billion (approximately $4.7577 billion) in 2023, representing a year-on-year increase of 3.9%.Among them, sales drove growth by 4.3%, price drove growth by 5.5%, unfavorable exchange rate impact was 5.7%, and product mix had an impact of 0.2%. The coatings division increased prices across all business areas while also increasing sales, especially in the automotive OEM coatings and surface treatment businesses. This was mainly due to the resolution of supply chain issues and increased inventory by automakers, leading to higher levels of automobile production.

Axalta's net sales in 2023 increased by 6.1% year-over-year to $5.1841 billion. Among this, the Performance Coatings segment reported sales revenue of $3.4077 billion in 2023, up 2.4% year-over-year.Automotive refinish paint revenue amounted to $2.0843 billion, a year-on-year increase of 7.3%; industrial coatings revenue was $1.3234 billion, a year-on-year decrease of 4.3%. Axalta's Mobility Coatings segment generated $1.7764 billion in sales, a year-on-year increase of 14%, of which: light vehicle coatings revenue was $1.3404 billion, a year-on-year increase of 13.5%; commercial vehicle coatings revenue was $436.0 million, a year-on-year increase of 15.8%.

AkzoNobel achieved sales of 10.668 billion euros (approximately 11.569 billion US dollars) in 2023, a year-on-year decrease of 2%.Among them, sales revenue from automotive and specialty coatings businesses increased by 7% year-on-year to 1.422 billion euros (approximately 1.4815 billion US dollars), or an increase of 13% at constant exchange rates. Good sales growth was achieved in the aerospace and automotive end markets. The consumer electronics end market continued to be weak, although sales volumes improved consecutively throughout the year. The sales performance of the automotive refinish business varied across regions, with North America being relatively stronger than Europe. Overall, driven by pricing efforts and body shop gains, the automotive refinish business continued to achieve revenue growth.

Nippon Paint achieved sales of 1,442.574 billion yen (approximately 10.217 billion US dollars) in 2023, representing a year-on-year increase of 10.2%.Among which: automotive OEM coatings revenue was 182.411 billion yen, increasing 11.34% year-on-year; other coatings businesses (including marine coatings, automotive refinishes, etc.) revenue was 80.964 billion yen, increasing 18.63% year-on-year.

Kansai Paint achieved a sales revenue of 562.277 billion yen (approximately 3.879 billion USD) in 2023, representing a year-on-year increase of 10.5%.The growth was mainly due to an overall increase in sales prices and the expansion of automotive coatings sales. The automotive coatings business revenues in Japan, India, and other parts of Asia saw increases, leading to a total revenue increase of 23.5 billion Japanese yen in automotive coatings.

The list shows that PPG of the United States once again topped the list with sales revenue of 6.2036 billion US dollars. This is the sixth consecutive year for the company to top the list as the world's No. 1 brand in automotive coatings; BASF of Germany and Axalta of the United States ranked second and third, respectively, with sales revenues of 4.0916 billion US dollars and 3.8607 billion US dollars, respectively. The three companies' global automotive paint market shares are 26.97%, 17.79%, and 16.79%, respectively, with a total market share of 61.55%. (Data source: Coatings World)

3. China's Automotive Coatings Market

After introducing the overview of the global automotive coatings market, how is the automotive coatings market in our country? According to statistics from the Coatings Industry Research Center,By the end of 2023, the automotive coatings industry in China is estimated to be approximately 41 billion yuan.The automotive paint industry is composed of more than 300 large, medium, and small manufacturers. With the growing demand from Chinese consumers for the appearance and personalization of automobiles, the automotive paint industry is facing unprecedented development opportunities. At the same time, advancements and innovations in technology have injected new vitality into the industry, leading to significant improvements in color, gloss, and durability of automotive paints.

According to the Industrial Research Center, based on an average demand of approximately 12 kilograms of coating per new vehicle, China's automotive OEM paint demand in 2023 was about 360,000 tons, with a market size of approximately 18 billion yuan (including around 15.6 billion yuan for passenger vehicles and 2.4 billion yuan for commercial vehicles). The market size for automotive parts coatings was about 12.3 billion yuan, and the market size for automotive refinish coatings was approximately 10.7 billion yuan. In 2023, the total market size of China's automotive coatings reached 41 billion yuan (covering passenger vehicle coatings, commercial vehicle coatings, automotive body coatings, automotive parts coatings, automotive refinish coatings, power battery coatings, and some auxiliary materials revenue).

According to the China Association of Automobile Manufacturers, China's total vehicle sales in 2024 are expected to exceed 31 million units, a year-on-year increase of more than 3%. Among them, passenger vehicle sales are projected to reach 26.8 million units, a 3% year-on-year increase; commercial vehicle sales are expected to hit 4.2 million units, a 4% year-on-year increase. New energy vehicle sales are forecasted at 11.5 million units, with exports reaching 5.5 million units. Based on these projections,In 2024, the total demand for automotive coatings in China is 845,000 tons, corresponding to a market size of approximately 42.273 billion yuan.

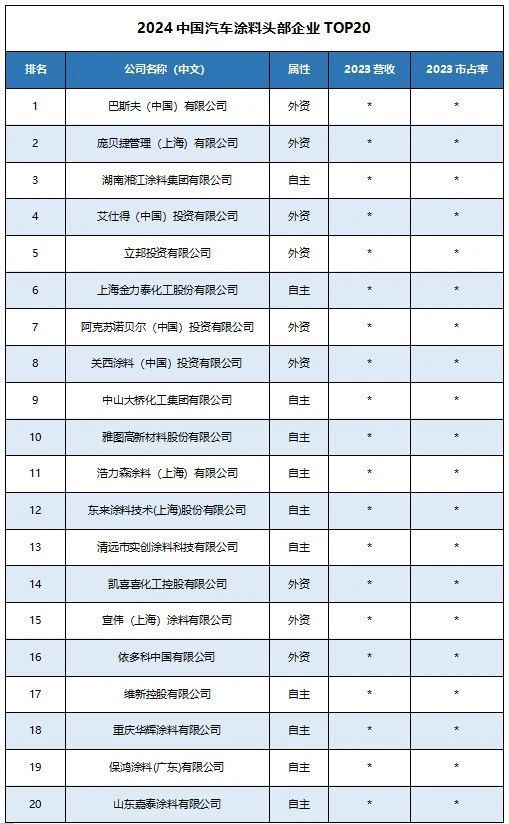

Note: 1. The ranking on the list is sourced from the Coatings Economic Industry Research Center and is for industry research purposes only. Some data comes from the listed financial reports of various companies, while some data is estimated. If there are any discrepancies, please refer to the actual sales revenue data of each company.

This ranking is solely for industry research and does not constitute any investment advice regarding the secondary market of the related companies. The data in the ranking is for reference only.

According to the ranking, among the top 20 automotive coating companies in China for 2024, foreign brands occupy 9 spots, while domestic brands hold 11. Data from the Coatings Economic Industry Research Center shows that the total sales revenue of the listed brands this year reached 24.989 billion yuan, an increase of 2.129 billion yuan compared to last year, accounting for 60.95% of the national automotive coating market share, which is up by 0.86% from the previous year. The combined sales revenue of the top 10 companies amounted to 20.998 billion yuan, representing 84.03% of the total sales revenue of the list and 51.21% of the national automotive coating market share, a decrease of 0.49% compared to last year.

According to the data, although the sales revenue of the top 10 companies has increased, their market share has decreased compared to previous years. This is mainly due to the growing number of companies entering the automotive coatings market, leading to a more fragmented market share. However, as automotive coatings is a high-barrier industry, the market concentration remains relatively high, with the top 20 companies accounting for over 50% of the total market sales revenue.

Additionally, according to the rankings, the nine foreign-funded enterprises (excluding Xiangjiang Kansai) accounted for a cumulative sales revenue of 16.921 billion yuan, representing 67.71% of the total revenue on the list and 41.27% of the national market share. The 11 domestic enterprises accounted for a cumulative sales revenue of 8.068 billion yuan, representing 32.28% of the total revenue on the list and 19.68% of the national market share. Overall, foreign brands dominate the automotive coatings market.

End of the document

According to data from the International Energy Agency, the global electric vehicle market is experiencing rapid growth, with sales surging by 35% year-on-year in 2023, reaching nearly 14 million units. Within this global trend, the Chinese automotive industry has deeply integrated into the international cycle, becoming a significant engine for the stable growth of the global automotive market, particularly in the field of new energy vehicles.

According to data from the China Association of Automobile Manufacturers, in 2023, China's new energy vehicle production and sales reached 9.587 million and 9.495 million units, respectively, representing year-on-year increases of 35.8% and 37.9%. The market share rose to 31.6%, an increase of 5.9 percentage points compared to the same period last year. This significant growth not only highlights the robust development momentum of China's new energy vehicle industry but also foreshadows its increasingly prominent strategic position in the global automotive industry.

Benefiting from the continuous growth of global automotive market consumption, the demand for automotive coatings will be driven. The strong development momentum exhibited by China's automotive industry may be the core reason driving BASF to actively collaborate with domestic automotive brands.

Source: BASF official website, Coatings Economic Industry Research Center, Coatings World

Editor: Shi Shenbing

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track