BASF Group reports a net income of 1.3 billion euros in 2024! "Core business" shows strong performance

On February 28, 2025, BASF Group released its financial data for 2024.

The data shows that in 2024, the sales of BASF Group reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. The net income was 1.3 billion euros, compared to 225 million euros in 2023.

BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments as a result of competitive pressures. Among these, the decline in precious metal prices in the Surface Technologies business area was particularly noticeable. Exchange rate fluctuations further impacted the sales performance.

On February 28, 2025, BASF Group released its financial data for 2024.

The data shows that in 2024, the sales of BASF Group reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. The net income was 1.3 billion euros, compared to 225 million euros in 2023.

BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments as a result of competitive pressures. Among these, the decline in precious metal prices in the Surface Technologies business area was particularly noticeable. Exchange rate fluctuations further impacted the sales performance.

On February 28, 2025, BASF Group released its financial data for 2024.

The data shows that in 2024, the sales of BASF Group reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. The net income was 1.3 billion euros, compared to 225 million euros in 2023.

BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments as a result of competitive pressures. Among these, the decline in precious metal prices in the Surface Technologies business area was particularly noticeable. Exchange rate fluctuations further impacted the sales performance.

On February 28, 2025, the BASF Group released its financial data for 2024.

The data shows that in 2024, the BASF Group's sales reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. Net income was 1.3 billion euros, compared to 225 million euros in 2023.

The BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments due to competitive pressures. Among these, the decrease in precious metal prices in the surface treatment technology business area was particularly notable. Exchange rate fluctuations further weighed on sales performance.

On February 28, 2025, the BASF Group released its financial data for 2024.

On February 28, 2025, the BASF Group released its financial data for 2024.On February 28, 2025, the BASF Group released its financial data for 2024.The data shows that in 2024, the BASF Group's sales reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. Net income was 1.3 billion euros, compared to 225 million euros in 2023.

The data shows that in 2024, the BASF Group's sales reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. Net income was 1.3 billion euros, compared to 225 million euros in 2023.The data shows that in 2024, the BASF Group's sales reached 65.3 billion euros, compared to 68.9 billion euros in the previous year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to 6.7 billion euros, while it was 7.2 billion euros in the same period of the previous year. Net income was 1.3 billion euros, compared to 225 million euros in 2023.The BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments due to competitive pressures. Among these, the decrease in precious metal prices in the surface treatment technology business area was particularly notable. Exchange rate fluctuations further weighed on sales performance.

The BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments due to competitive pressures.The BASF Group stated that the overall decline in sales was mainly due to price reductions across all business segments due to competitive pressures. Among these, the decrease in precious metal prices in the surface treatment technology business area was particularly notable. Exchange rate fluctuations further weighed on sales performance.BASF Key Data 2024

BASF Key Data 2024

BASF Key Data 2024

BASF Key Data 2024

BASF Key Data 2024

BASF Key Data 2024BASF Key Data 2024

● EBITDA before special items achieved growth

● EBITDA before special items achieved growth● EBITDA before special items achieved growthDespite a decline in sales, in a challenging market environment, the BASF Group's EBITDA before special items increased to 7.9 billion euros.

Although sales declined, in a challenging market environment, the BASF Group's EBITDA before special items increased to 7.9 billion euros.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said while presenting the 2024 financial figures together with Chief Financial Officer Dr. Dirk Elvermann: “We have performed well, thanks to the strong performance of our ‘core business’. The EBITDA before special items of the ‘core business’ increased by 18% compared to 2023.”

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF Group, together with Chief Financial Officer Dr. Dirk Elvermann, presented the 2024 financial figures, stating: “We have performed well, thanks to the strong performance of our 'core business'. EBITDA before special items for the 'core business' increased by 18% compared to 2023. We have performed well, thanks to the strong performance of our 'core business'. EBITDA before special items for the 'core business' increased by 18% compared to 2023.”In the 'core business', EBITDA before special items saw a strong increase, mainly due to higher sales volumes. Part of this growth was offset by a decline in earnings from the 'self-operated business'.

In the 'core business', EBITDA before special items saw a strong increase, mainly due to higher sales volumes. Part of this growth was offset by a decline in earnings from the 'self-operated business'.In the agricultural solutions business area, EBITDA before special items significantly declined, mainly affected by the development of the glufosinate business. In addition, a sharp drop in precious metal prices and lower sales volumes in the catalysts division led to a slight decrease in earnings in the surface technologies business area.

In the agricultural solutions business area, EBITDA before special items significantly declined, mainly affected by the development of the glufosinate business. In addition, a sharp drop in precious metal prices and lower sales volumes in the catalysts division led to a slight decrease in earnings in the surface technologies business area.The EBITDA margin before special items for the BASF Group was 12.0%, up from 11.1% in the previous year. Excluding revenues from precious and base metals, the EBITDA margin before special items for the BASF Group increased from 12.6% in 2023 to 13.1% in 2024.

The EBITDA margin before special items for the BASF Group was 12.0%, up from 11.1% in the previous year. Excluding revenues from precious and base metals, the EBITDA margin before special items for the BASF Group increased from 12.6% in 2023 to 13.1% in 2024.● EBITDA decreased

● EBITDA decreased● EBITDA decreasedEBITDA reached 6.7 billion euros, compared to 7.2 billion euros in the same period last year. Earnings before interest and taxes (EBIT) amounted to 2 billion euros, a reduction of 206 million euros compared to the same period last year. Total depreciation and amortization were 4.6 billion euros (previous year: 4.9 billion euros). This includes impairment losses totaling 702 million euros, primarily related to the battery materials business in the surface technologies business area. In the previous year, EBIT included total impairment losses of approximately 1.1 billion euros.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) reached 6.7 billion euros, compared to 7.2 billion euros in the same period last year. Earnings before interest and taxes (EBIT) were 2 billion euros, a decrease of 206 million euros from the previous year. Total depreciation and amortization amounted to 4.6 billion euros (previous year: 4.9 billion euros). This includes impairment losses of 702 million euros, mainly related to the battery materials business within the surface treatment technology sector. In the previous year, EBIT included total impairment losses of approximately 1.1 billion euros.● Net income significantly increased

● Net income significantly increased● Net income significantly increasedNet income was 1.3 billion euros, compared to 225 million euros in 2023. Net income from equity investments increased by 798 million euros, reaching 598 million euros. This was mainly due to improved earnings from non-core business companies accounted for using the equity method. In particular, the sale of Wintershall Dea assets to Harbour Energy resulted in a disposal gain of 390 million euros.

Net income was 1.3 billion euros, compared to 225 million euros in 2023. Net income from equity investments increased by 798 million euros, reaching 598 million euros. This was mainly due to improved earnings from non-core business companies accounted for using the equity method. In particular, the sale of Wintershall Dea assets to Harbour Energy resulted in a disposal gain of 390 million euros.In 2024, the cash flow generated from operating activities was 6.9 billion euros, a decrease of 1.2 billion euros compared to last year. The decline was mainly due to a reduction of 1.4 billion euros in cash released by net working capital.

In 2024, the cash flow generated from operating activities was 6.9 billion euros, a decrease of 1.2 billion euros compared to last year. The decline was mainly due to a reduction of 1.4 billion euros in cash released by net working capital.In 2024, the cash flow generated from investing activities was negative 5.1 billion euros, compared to negative 5.0 billion euros in 2023. Expenditure on property, plant and equipment, and intangible assets increased by 803 million euros to reach 6.2 billion euros, mainly related to the construction of the new integrated site in South China. Dr. Dirk Elvermann stated: "The investments are proceeding on schedule and within budget. Overall, we have saved 300 million euros compared to the originally forecasted 6.5 billion euros."

In 2024, the cash flow generated from investing activities was negative 5.1 billion euros, compared to negative 5.0 billion euros in 2023. Expenditure on property, plant and equipment, and intangible assets increased by 803 million euros to reach 6.2 billion euros, mainly related to the construction of the new integrated site in South China.In 2024, the cash flow generated from investing activities was negative 5.1 billion euros, compared to negative 5.0 billion euros in 2023. Expenditure on property, plant and equipment, and intangible assets increased by 803 million euros to reach 6.2 billion euros, mainly related to the construction of the new integrated site in South China. Dr. Dirk Elvermann stated: "The investments are proceeding on schedule and within budget. Overall, we have saved 300 million euros compared to the originally forecasted 6.5 billion euros."The cash flow generated from financing activities was negative 1.5 billion euros, compared to negative 2.9 billion euros in 2023. Both the repayment and new issuance of financial and similar liabilities were reduced, with the net change leading to an overall improvement in the cash flow from financing activities.

The cash flow generated from financing activities was negative 1.5 billion euros, compared to negative 2.9 billion euros in 2023. Both the repayment and new issuance of financial and similar liabilities were reduced, with the net change leading to an overall improvement in the cash flow from financing activities.Free cash flow, which is the cash flow generated from operating activities minus expenditure on property, plant and equipment, and intangible assets, amounted to 748 million euros, compared to 2.7 billion euros in 2023.

Free cash flow, which is the cash flow generated from operating activities minus expenditure on property, plant and equipment, and intangible assets, amounted to 748 million euros, compared to 2.7 billion euros in 2023.Dr. Dirk Elvermann, in introducing the progress of the cost reduction plan, stated: “We are on track to achieve our target of reducing costs by 2.1 billion euros annually by the end of 2026. By the end of 2024, we have achieved approximately 1 billion euros in annual cost savings, with about 100 million euros related to the cost improvement plan for the Ludwigshafen site announced in February 2024.”

Dr. Dirk Elvermann, in introducing the progress of the cost reduction plan, stated: “We are on track to achieve our target of reducing costs by 2.1 billion euros annually by the end of 2026. By the end of 2024, we have achieved approximately 1 billion euros in annual cost savings, with about 100 million euros related to the cost improvement plan for the Ludwigshafen site announced in February 2024.We are on track to achieve our target of reducing costs by 2.1 billion euros annually by the end of 2026. By the end of 2024, we have achieved approximately 1 billion euros in annual cost savings, with about 100 million euros related to the cost improvement plan for the Ludwigshafen site announced in February 2024.”By the end of 2024, BASF has incurred approximately 900 million euros in one-time costs for the implementation of the cost reduction plan. This amount represents about half of the total one-time costs that BASF expects to incur by the end of 2026. At that time, the company plans to complete all relevant projects and benefit from the full amount of the annual cost savings target.

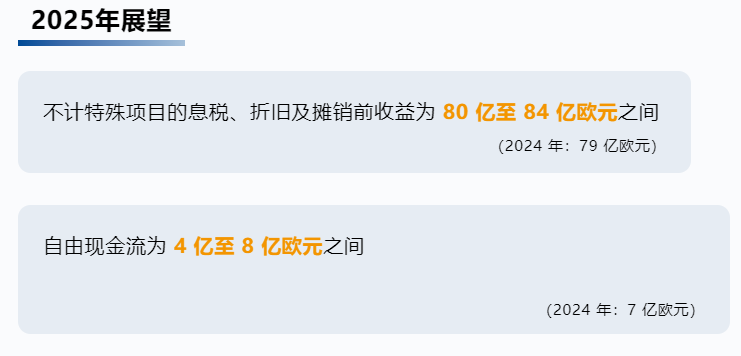

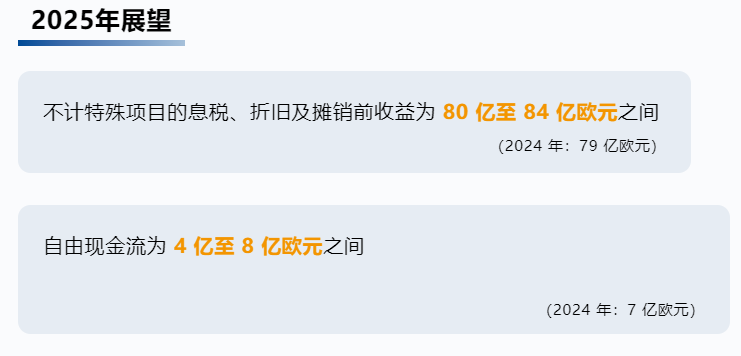

By the end of 2024, BASF has incurred approximately 900 million euros in one-time costs for the implementation of the cost reduction plan. This amount represents about half of the total one-time costs that BASF expects to incur by the end of 2026. At that time, the company plans to complete all relevant projects and benefit from the full amount of the annual cost savings target.In 2025, BASF Group's EBITDA before special items is expected to increase to between 8.0 billion and 8.4 billion euros (7.9 billion euros in 2024). Except for the Chemicals business area, all other business areas are expected to contribute to earnings growth. The earnings of the Petrochemicals division will be affected by higher fixed costs due to the start-up of a new integrated site in China and planned plant maintenance.

In 2025, BASF Group's EBITDA before special items is expected to increase to between 8.0 billion and 8.4 billion euros (7.9 billion euros in 2024).In 2025, BASF Group's EBITDA before special items is expected to increase to between 8.0 billion and 8.4 billion euros (7.9 billion euros in 2024). Except for the Chemicals business area, all other business areas are expected to contribute to earnings growth. The earnings of the Petrochemicals division will be affected by higher fixed costs due to the start-up of a new integrated site in China and planned plant maintenance.

The free cash flow of the BASF Group is expected to be between 400 million and 800 million euros (700 million euros in 2024).This is based on an anticipated cash flow from operating activities of 5.6 to 6.0 billion euros, minus the expected expenditure of 5.2 billion euros for property, plant, equipment, and intangible assets.

The free cash flow of the BASF Group is expected to be between 400 million and 800 million euros (700 million euros in 2024).The free cash flow of the BASF Group is expected to be between 400 million and 800 million euros (700 million euros in 2024).This is based on an anticipated cash flow from operating activities of 5.6 to 6.0 billion euros, minus the expected expenditure of 5.2 billion euros for property, plant, equipment, and intangible assets.This is based on the expected cash flow from operating activities of 5.6 to 6.0 billion euros, after deducting the anticipated expenditure of 5.2 billion euros for real estate, plant, and equipment, as well as intangible assets.Group CO2 emissions in 2025 are forecast to be between 16.7 and 17.7 million metric tons (2024: 17.0 million metric tons). Compared to the previous year, due to increased demand, the company expects higher production, leading to a corresponding increase in emissions. BASF will take targeted measures to address this growth, including improving energy efficiency, optimizing process flows, and continuing the transition to renewable energy electricity.

Group CO2 emissions in 2025 are forecast to be between 16.7 and 17.7 million metric tons (2024: 17.0 million metric tons). Group CO2 emissions in 2025 are forecast to be between 16.7 and 17.7 million metric tons (2024: 17.0 million metric tons). Compared to the previous year, due to increased demand, the company expects higher production, leading to a corresponding increase in emissions. BASF will take targeted measures to address this growth, including improving energy efficiency, optimizing process flows, and continuing the transition to renewable energy electricity.On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF has named its new strategy "Winning by Purpose," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes sectors such as chemicals, materials, industrial solutions, and nutrition & care, while the autonomous business covers environmental catalysts and metal solutions, battery materials, coatings, and agricultural solutions.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, stated: "BASF possesses a strong and extensive portfolio of chemical business products, which is our core, helping us to connect with customers in various industries worldwide. At the same time, our autonomous business serves specific industries with lower connectivity to our value chain. In the future, we will unlock the potential value of these businesses."

BASF's core business holds a significant advantage over competitors: at major production sites, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, excellent operations, and cost efficiency.

BASF's autonomous business serves specific industries, competing with peers focused on single business areas. Therefore, BASF will provide more strategic and operational flexibility to these businesses to address the specific needs of their markets.

To optimize strategic investments, BASF continues to divest some non-core businesses recently.

● On February 17, 2025, BASF signed an agreement with Sherwin-Williams to sell its decorative paints business in Brazil, part of BASF's Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and debt-free. BASF stated that the transaction would be conducted as a share deal, including production sites in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval from relevant competition management authorities.

● On January 9, 2025, BASF announced it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulating material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

On September 26, 2024, BASF announced its new corporate strategy. According to the published reform plan, BASF introduced a new strategy called "Winning Ways," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes sectors such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said, "BASF has a strong and broad portfolio of chemical products, which is our core and helps us connect with customers across various industries worldwide. At the same time, our autonomous businesses serve specific industries and have a lower degree of connection to our value chain. In the future, we will unlock the potential value of these businesses."

BASF's core business has significant advantages over competitors: in major production bases, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient use of resources, excellent operations, and cost efficiency.

BASF's autonomous businesses serve specific industries, competing with peers focused on single business areas. Therefore, BASF will provide more strategic and operational flexibility for these businesses to address the specific needs of their respective markets.

To optimize strategic investments, BASF continues to divest some non-core businesses recently.

● On February 17, 2025, BASF signed an agreement with Sherwin-Williams to sell its decorative paints business in Brazil, which is part of the BASF Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and debt-free. BASF stated that the transaction was conducted in the form of a share deal, including production sites in Demarchi and Jaboatão, related contracts, Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by relevant competition management authorities.

● On January 9, 2025, BASF announced it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulating material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:

On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF's new strategy is "Winning with Purpose," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes sectors such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF Group, stated: "BASF has a strong and broad portfolio of chemical business products, which is our core and helps us connect with customers across various industries globally. At the same time, our autonomous businesses serve specific industries and are less connected to our value chain. In the future, we will unlock the potential value of these businesses."

BASF's core business has a significant advantage over competitors: in major production bases, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient use of resources, excellent operations, and cost efficiency.

BASF's autonomous businesses serve specific industries and compete with peers focused on single business areas. Therefore, BASF will provide more strategic and operational flexibility to these businesses to address the specific needs of their markets.

To optimize strategic investments, BASF continues to divest some non-core businesses recently.

● On February 17, 2025, BASF signed an agreement with Sherwin-Williams to sell its decorative coatings business in Brazil, which is part of BASF's Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and debt-free. BASF stated that the transaction is in the form of a share deal, including production sites in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by relevant competition management authorities.

● On January 9, 2025, BASF announced that it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulation material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:

● On February 24, 2025, BASF India Limited broke ground on a new plant in Dahej, India, to increase the capacity of its Cellasto® microcellular polyurethane elastomer (MCU). According to BASF's new "Winning with Purpose" strategy, the plant will be constructed using state-of-the-art technology and automation systems to ensure adherence to BASF's high safety and quality standards. The plant is expected to begin operations in the second half of 2026, and the first phase will

On September 26, 2024, BASF released a new corporate strategy. According to the announced reform plan, BASF's new strategy is "Winning Ways," which includes four strategic levers: Focus, Accelerate, Transform, and Win. The company will manage its core and autonomous businesses differently. Among them, the core business includes segments such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said, "BASF has a strong and broad portfolio of chemical businesses, which form our core and help us connect with customers across various industries globally. At the same time, our autonomous businesses serve specific industries with lower connectivity to our value chain. In the future, we will unlock the potential value of these businesses."

BASF's core business holds significant advantages over competitors: at major production sites, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, excellent operations, and cost efficiency.

BASF's autonomous businesses serve specific industries and compete with peers focused on single business areas. Therefore, BASF will provide more strategic and operational flexibility to these businesses to address the specific needs of their respective markets.

To optimize strategic investments, BASF has recently continued to divest some non-core businesses.

● On February 17, 2025, BASF and Sherwin-Williams signed an agreement for the sale of BASF's decorative paints business in Brazil, which is part of the BASF Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and debt-free. BASF stated that the transaction is in the form of a share deal, including production facilities in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by relevant competition management authorities.

● On January 9, 2025, BASF announced it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulation material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:

● On February 24, 2025, BASF India Limited broke ground on a new plant in Dahej, India, to increase the capacity of its Cellasto® microcellular polyurethane elastomers (MCU). In line with BASF's new "Winning Ways" strategy, the plant will be constructed using state-of-the-art technology and automation systems to ensure adherence to BASF's high safety and quality standards. The plant is expected to start operations in the second half of 2026, with the first phase equipped with a new mold production

On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF has introduced a new strategy called "Winning Together," which includes four strategic levers: Focus, Accelerate, Transform, and Win. The company will also manage its core and autonomous businesses differently. The core business includes sectors such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said, "BASF has a strong and broad portfolio in the chemicals business, which is our core and helps us connect with customers across various industries globally. At the same time, our autonomous businesses serve specific industries and have a lower degree of connection to our value chain. In the future, we will unlock the potential value of these businesses."

BASF's core business holds significant advantages over competitors: in major production sites, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, operational excellence, and cost efficiency.

BASF's autonomous businesses serve specific industries and compete with peers focused on single business areas. Therefore, BASF will provide more strategic and operational flexibility to these businesses to address the specific needs of their markets.

To optimize strategic investments, BASF has recently continued to divest some non-core businesses.

● On February 17, 2025, BASF and Sherwin-Williams signed an agreement for the sale of BASF's decorative paints business in Brazil, which is part of BASF's Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and on a debt-free basis. BASF stated that the transaction is in the form of a share deal, including production sites in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by the relevant competition management authorities.

● On January 9, 2025, BASF announced that it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulating material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:

● On February 24, 2025, BASF India Limited broke ground on a new plant in Dahej, India, to increase the capacity of its Cellasto® microcellular polyurethane elastomer (MCU). According to BASF's new "Winning Together" strategy, the plant will be constructed using the latest technology and automation systems to ensure adherence to BASF's high safety and quality standards. The plant is expected to begin operations in the second half of 2026, with the first phase equipped with a new mold production line, enabling Cellast

On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF has declared its new strategy as "Winning with Purpose," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes segments such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.

On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF has declared its new strategy as "Winning with Purpose," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes segments such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.On September 26, 2024, BASF announced a new corporate strategy. According to the released reform plan, BASF has declared its new strategy as "Winning with Purpose," which includes four strategic levers: Focus, Accelerate, Transform, and Win. It will also manage core and autonomous businesses differently. The core business includes segments such as Chemicals, Materials, Industrial Solutions, and Nutrition & Care, while the autonomous business covers Environmental Catalysts and Metal Solutions, Battery Materials, Coatings, and Agricultural Solutions.Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said: "BASF has a strong and broad portfolio of chemical business products, which is our core, helping us to connect with customers in various industries around the world. At the same time, our autonomous business serves specific industries with less connection to our value chain. In the future, we will unlock the potential value of these businesses."

Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, said: "BASF has a strong and broad portfolio of chemical business products, which is our core, helping us to connect with customers in various industries around the world. At the same time, our autonomous business serves specific industries with less connection to our value chain. In the future, we will unlock the potential value of these businesses."BASF's core business has significant advantages over competitors: at major production sites, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, excellent operations, and cost efficiency.

BASF's core business has significant advantages over competitors: at major production sites, these businesses are closely linked to BASF's value chain and integrated production system, creating value through efficient resource utilization, excellent operations, and cost efficiency.BASF's autonomous business serves specific industries, competing with peers that focus on single business areas. Therefore, BASF will provide more strategic and operational flexibility for these businesses to address the specific needs of their markets.

BASF's autonomous business serves specific industries, competing with peers that focus on single business areas. Therefore, BASF will provide more strategic and operational flexibility for these businesses to address the specific needs of their markets.To optimize strategic investments, BASF has recently continued to divest some non-core businesses.

To optimize strategic investments, BASF has recently continued to divest parts of its non-core businesses.To optimize strategic investments, BASF has recently continued to divest parts of its non-core businesses.● On February 17, 2025, BASF and Sherwin-Williams signed an agreement for the sale of the Brazilian decorative paints business, which is part of BASF's Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and on a debt-free basis. BASF stated that the transaction will be carried out in the form of a share deal, including production sites in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by the relevant competition management authorities.

● On February 17, 2025, BASF and Sherwin-Williams signed an agreement for the sale of the Brazilian decorative paints business, which is part of BASF's Coatings division. BASF sold the business to Sherwin-Williams for $1.15 billion (approximately 8.4 billion RMB) in cash and on a debt-free basis. BASF stated that the transaction will be carried out in the form of a share deal, including production sites in Demarchi and Jaboatão, related contracts, the Suvinil and Glasu! brands, and about 1,000 employees. The transaction is expected to be completed in the second half of 2025, subject to approval by the relevant competition management authorities.● On January 9, 2025, BASF announced that it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH&Co.KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulating material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.

● On January 9, 2025, BASF announced that it had reached an agreement with German insulation material manufacturer Karl Bachl Kunststoffverarbeitung GmbH&Co.KG (BACHL) to sell its Styrodur® business. Styrodur® is an insulating material made from extruded polystyrene (XPS), and the sale also includes the Styrodur® brand.While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:

While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:While frequently divesting non-core businesses, BASF is also increasing its investment in core businesses:● On February 24, 2025, BASF India Limited broke ground on a new plant in Dahej, India, to increase the capacity of its Cellasto® microcellular polyurethane elastomers (MCU). According to BASF's new "Grow Smartly" strategy, the plant will be built using state-of-the-art technology and automation systems to ensure adherence to BASF's high safety and quality standards. The plant is expected to start operations in the second half of 2026, with the first phase equipped with a new mold production line, enabling Cellasto® to meet the rapidly growing local market demand.

● On February 24, 2025, BASF India Limited broke ground on a new plant in Dahej, India, to increase its production capacity for Cellasto® microcellular polyurethane elastomers (MCU). In line with BASF's new "Winning Ways" strategy, the plant will be constructed using state-of-the-art technology and automation systems to ensure adherence to BASF's high safety and quality standards. The plant is expected to commence operations in the second half of 2026, with the first phase featuring a new mold production line, enabling Cellasto® to meet the rapidly growing local market demand.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track