Appliance manufacturers have decided to spend more money.

When the overall growth rate of the industry hits a bottleneck, home appliance manufacturers begin a new round of investment布局. 注意:最后一词“布局”翻译时遗漏了,应为“layout”或“strategic positioning”。完整的翻译应该是: When the overall growth rate of the industry hits a bottleneck, home appliance manufacturers begin a new round of investment layout.

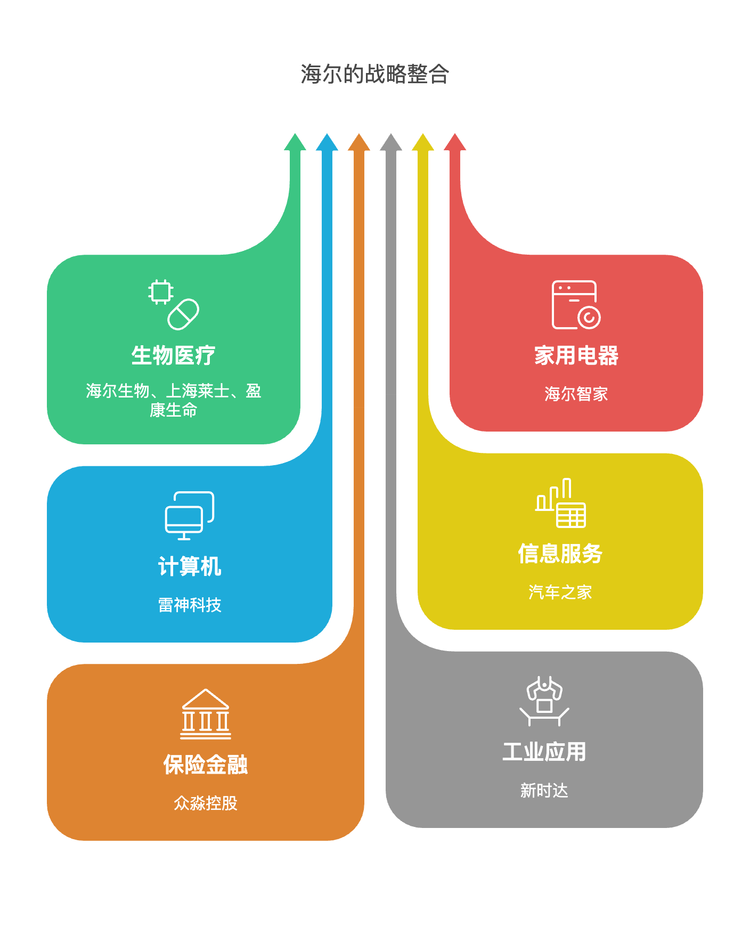

At the beginning of 2025, Katchi Holdings, a subsidiary of Haier Group, acquired the issued ordinary shares of Autohome held by Yunchen Capital for a total price of approximately $1.8 billion (about 13 billion RMB). After the transaction, Katchi Holdings will hold about 41.91% of the shares in Autohome, becoming the controlling shareholder of Autohome.

This is not the first time Haier has ventured into areas outside the home appliance industry. In February 2025, Haier also became the new controlling shareholder of STEP by acquiring shares from the controlling and actual controllers, entering the industrial robot field. According to incomplete statistics, Haier currently controls eight listed companies, including Autohome, STEP, Haier Smart Home, Haier Biomedical, Shanghai RAAS, Yingkang Life, Thunderobot, and Zhongmiao Holding.

Similar to Haier, the other two of China's white goods giants, Midea and Gree, are also adopting the same approach, entering more industries beyond home appliances through investment and acquisitions.

Among them, Midea Group and the He Xiangjian family actually control 8 listed companies, including: Midea Group, Hiconics, Wandong Medical, Clou Electronics, KUKA Home, Midea Real Estate, Infore Environment, Baena Qiancheng. GREE controls 2 A-share listed companies: Gree Electric Appliances, Dunan Environment.

If the market values of the listed companies actually controlled by Haier, Midea, and Gree are added together, these three companies have already created an investment landscape with a scale exceeding one trillion, involving various细分行业如房地产、智能制造、新能源汽车、生物医药、消费电子、光伏等。将更多的钱花出去,已成为家电巨头目前的共识。 翻译为: If the market values of the listed companies actually controlled by Haier, Midea, and Gree are added together, these three companies have already created an investment landscape with a scale exceeding one trillion, involving various sectors such as real estate, smart manufacturing, new energy vehicles, biomedicine, consumer electronics, and photovoltaics. Spending more money has become the current consensus among home appliance giants.

Home appliance giants, why the rush to spend money?

Spending money seems to have always been the prevailing logic for the expansion of Chinese home appliance companies.

In the early stages of the rapid development of the home appliance industry, Midea, Haier, and Gree increased their competitiveness in the home appliance sector and expanded into overseas markets through investments and acquisitions.

For example, during the period from 2004 to 2016, in the domestic market, Midea first acquired 50.5% of the shares in the Rongshida-Midea joint venture, entering the washing machine sector and further expanding its white goods business; it then acquired a 24.01% stake in Little Swan for 1.68 billion yuan, becoming its controlling shareholder.

In the overseas market, Midea acquired 51% of the shares in Carrier's Latin American air conditioning business for $223.3 million in 2011, further expanding its business in the South American market; in 2016, it acquired 80.1% of the equity in Toshiba's home appliance business (Toshiba Lifestyle) for 51.4 billion yen (approximately $473 million), entering the Japanese and Southeast Asian markets, and in the same year, it acquired 80% of the equity in the Italian central air conditioning company Clivet, further expanding its central air conditioning business in the European market.

Haier acquired New Zealand's Fisher & Paykel in 2012, gaining a high-end appliance brand and technology; in 2016, it further expanded into the North American market by acquiring the appliance business of American General Electric (GE) for $5.6 billion.

Gree then acquired Zhuhai Lingda Compressor Company in 2004, further integrating the air conditioning industry chain and enhancing the self-sufficiency of core components; later in 2012, it acquired Hefei Jinghong Electrical Appliances, entering the refrigerator sector and expanding its white goods business. In 2018, Gree acquired Nanjing Huaxin Nonferrous Metals Co., Ltd., to layout the upstream industry chain of air conditioners, enhancing the self-sufficiency of raw materials such as copper pipes.

Through multiple rounds of mergers and acquisitions, Haier, Midea, and Gree have established their technological barriers and continuously increased their market share in the global white goods market. However, as the ownership of home appliances approaches saturation, the overall industry growth rate has fallen to a low level.

Public data shows that the year-on-year growth rate of China's home appliance market size was about 11.9% in 2017. However, by 2022, this figure had dropped to 2.5%.

According to the data pushed by All View Cloud (AVC), in the first half of 2024, the retail sales of the white goods market was 231.9 billion yuan, a year-on-year decline of 7.0%, and the retail volume was 77.74 million units, a year-on-year decline of 3.6%. Driven by the downgrade in consumption and a significant drop in the price of air conditioning categories, the overall market showed a dual downward trend in both structure and price.

When the existing base is difficult to expand, home appliance companies begin to turn their attention to more fields in order to maintain the continuous growth of the entire system.

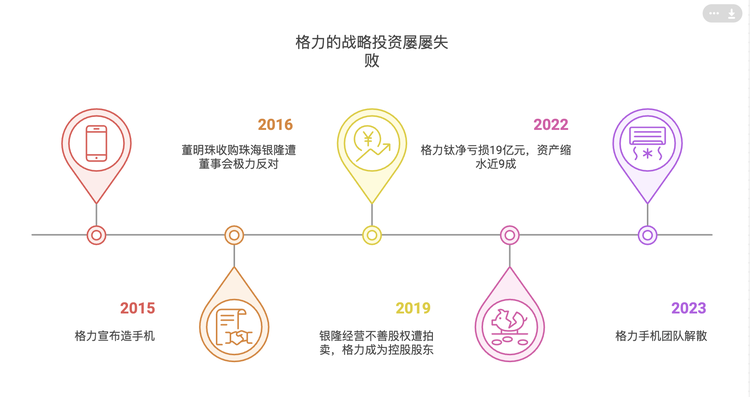

Investment 2.0 era, Gree frequently steps on mines

In the process of moving outward, Gree and Midea, Haier are no longer in the same tier.

Gree has successively laid out businesses such as mobile phones, chips, and new energy vehicles in its business transformation, but none of them have been effective. Taking mobile phones as an example, in the 2015 annual report, Gree Electric Appliances stated that Gree will continue to take the air conditioning industry as its pillar, vigorously develop emerging industries such as mobile phones, and broaden its industrial scope from a pure home appliance manufacturing enterprise to the new energy and equipment manufacturing industries.

At the GREE Electric Appliances shareholders' meeting in June of the same year, Dong Mingzhu officially announced the launch of GREE mobile phones. Taking the GREE 1st generation as an example, it is equipped with a 4-core processor, 5-inch 720P, 2-megapixel front camera, and priced at 1600 yuan. While the popular model Note2 at that time used an 8-core 64-bit, 5.5-inch 1080P, 13-megapixel, and was priced at only 799 yuan. The performance of the GREE phone was half that of its competitors, yet its price was twice as high.

In May 2023, it was rumored that GREE Electric Appliances had disbanded its core mobile phone team. Among them, former GREE employees said that starting from 2022, the Shenzhen team responsible for development, testing, and administrative human resources of GREE phones gradually disbanded, and then the entire Shenzhen team was completely disbanded. After this, GREE is unlikely to make mobile phones anymore.

Compared to Gree's mobile phone business, Gree's layout in the new energy industry is an even bigger "pit".

In 2016, Dong Mingzhu announced that Gree would acquire 100% of the equity in Zhuhai Yintong for 13 billion yuan, but this decision was strongly opposed by Gree's board of directors. By the end of that year, Dong Mingzhu personally, along with Dalian Wanda Group Co., Ltd., China International Marine Containers (Group) Ltd., Jiangsu Jingdong Bangneng Investment Management Co., Ltd., and Beijing Yanzhao Huixin International Investment Co., Ltd., signed an agreement to increase capital, collectively investing 3 billion yuan, obtaining 22.388% of the equity in Zhuhai Yintong.

Among them, Dong Mingzhu personally invested about 1 billion yuan, holding 7.46% of the shares. Afterwards, Dong Mingzhu continued to participate in the financing of Zhuhai Yintong, increasing her personal shareholding to 17.46%, becoming the second largest shareholder of the company.

However, with the personnel turmoil in the Yintong management in 2019 and a significant decline in the sales of Yintong's new energy buses, the equity of Yintong eventually ended up being publicly auctioned. GREE acquired 30.47% of Zhuhai Yintong's equity at the starting bid price, becoming the largest shareholder of Zhuhai Yintong. Dong Mingzhu delegated the voting rights of her 17.46% Yintong equity to GREE, making GREE Electric Appliances the controlling shareholder of Zhuhai Yintong - Yintong New Energy was renamed GREE Titanium New Energy.

In 2022, GREE Titanium's revenue and net loss were 2.587 billion yuan and 1.905 billion yuan, respectively. Total assets decreased from 27.282 billion yuan at the beginning of the year to 25.024 billion yuan, and total liabilities decreased from 25.135 billion yuan at the beginning of the year to 24.786 billion yuan. As a result, net assets shrank from 2.147 billion yuan at the beginning of the year to 237 million yuan.

The latest annual report data shows that in 2023, over 72% of Gree Electric's revenue still comes from air conditioners, with the combined revenue from home appliances, industrial products, smart equipment, and green energy accounting for less than 8%. Additionally, nearly 20% of the revenue is mainly obtained from reselling raw materials to upstream processors after procurement.

Midea, Haier, accelerating breakthroughs

While compared to Gree, Midea's business transformation shows a trend of becoming increasingly broad.

From the financial report data, home appliance business remains the main source of income for Midea — Midea's 2023 "smart home" business revenue exceeded 2400 yuan, accounting for more than 65% of total revenue. With this revenue alone, Midea surpassed the total business income of Gree.

In the B-end business transformation, Midea acquired KUKA, the world's largest manufacturer of automotive robots, at a premium rate of over 60% and a cost of 315 billion yuan. Meanwhile, Midea has also achieved controlling stakes in listed companies such as Wandong Medical, Kolod Electronics, and Hiconics.

The data shows that ToB business continues to maintain a good growth momentum in Midea's overall business, accounting for more than 20% of total revenue. In the first three quarters of 2024, the revenue from new energy and industrial technology was 25.4 billion yuan; the revenue from intelligent building technology was 22.4 billion yuan; the revenue from robotics and automation was 20.8 billion yuan.

So far, Midea's investment portfolio spans various sectors including real estate, intelligent manufacturing, new energy vehicles, biopharmaceuticals, and photovoltaics.

Similar to Midea, Haier is currently associated with eight listed companies including Shanghai RAAS, Autohome, STEP, Haier Smart Home, Haier Biomedical, Yingkang Life, Thunderobot, and Zhongmiao Holdings.

From the perspective of industry classification, Haier Biomedical, Shanghai RAAS, and Yingkang Life belong to the pharmaceutical and biotechnology industry, Haier Smart Home and Thunderobot belong to the household appliances industry and the computer industry respectively, Autohome belongs to the information service industry, and Zhongmiao Holdings belongs to the insurance and finance industry.

In the past, New Era stated during a reception for institutional investor research that the company's robot bodies have been continuously expanding based on more than ten years of control technology. Currently, they mainly include multiple categories such as multi-joint robots, Zhongwei Xing SCARA robots, and semiconductor robots. The products are widely used in industries such as 3C, semiconductors, and automotive parts.

Clearly, apart from Haier Smart Home, the other holding companies within the Haier system have little direct connection to the home appliance industry itself. Through these investments outside of the home appliance business, Haier is weaving together a rather substantial second ecosystem. The combined market value of the eight listed companies is approximately 350 billion yuan, spanning sectors such as home appliances, biomedicine, industry, technology, smart homes, and insurance.

Relying on the money earned from the home appliance industry, both Midea and Haier have chosen to spend more, in order to build a second growth curve. If the competitive landscape of the home appliance market remains stable, or if revolutionary innovation is still far from being realized, then the capital game of external investment and acquisitions by Midea and Haier will not stop.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track