Analysis of the Competitive Landscape and Development Trends of China's Biomedical Materials Industry in 2025: Acceleration of Domestic Substitution Process

Biomaterials, also known as biomedical materials, refer to functional materials used for medical purposes, which come into contact with living systems and interact with them. These materials can diagnose, treat, replace, or repair human tissues and organs, or enhance their functions. They include both natural and synthetic functional materials. Based on the material attributes, biomaterials can be categorized into medical metallic materials, bio-ceramic materials, medical polymer materials, and medical composite materials. According to their intended use, they can be classified into oral materials, hard tissue repair and replacement materials (mainly used for bone marrow and joints), soft tissue repair and replacement materials (primarily used for skin, muscles, heart, lungs, stomach, etc.), and medical devices.

The upstream market participants in the biomedical materials industry chain are mainly suppliers of biomedical raw materials. According to the different properties of materials, the upstream of the industry chain includes five major categories of raw material suppliers: metal materials, polymer materials, composite materials, inorganic materials, and regenerative materials. The midstream entities are biomedical materials manufacturing companies, including manufacturers of implantable medical devices. The downstream involves terminal sales institutions, including general hospitals, private hospitals, specialty hospitals, health centers, and various medical institutions and patients.

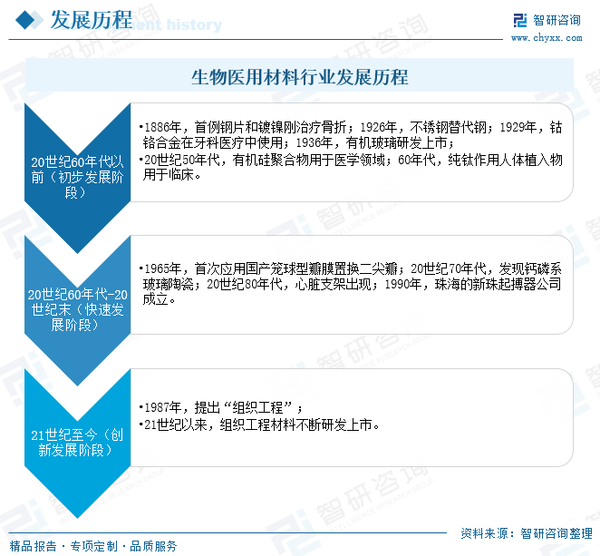

The application of biomaterials can be traced back to ancient times. In 3500 BC, the ancient Egyptians used cotton fibers and horsehair for wound suturing; the Native Americans in Mexico used wooden pieces to repair injured skulls. In 2500 BC, aristocratic families in China used materials such as gold, silver, tin, and mercury alloys to restore missing teeth. In the 1800s, reports of the widespread use of metal plates to stabilize fractures began to emerge. After the invention of vulcanized natural rubber in 1851, people started using it to create artificial dentures and jawbones, marking the emergence of biomaterials. By 1886, the first successful clinical use of steel plates and nickel-plated steel for fracture treatment officially opened the chapter for the biomaterials industry. In modern times, biomaterials have mainly undergone three developmental phases: initial development, rapid development, and innovative development.

In the initial development stage, biomaterials were primarily composed of inert materials, including four major types: metallic materials, polymer materials, inorganic materials, and composite materials. In 1926, stainless steel was used in surgery, replacing easily corroded steel. In 1929, cobalt-chromium alloys began to be used in dental medicine, initially for partial denture repairs. In 1936, acrylic glass was developed and quickly became widely used for making dentures and fillings. In 1943, the United States first used 302 stainless steel for fracture fixation, further improving the material's corrosion resistance. In the 1950s, silicone polymers were applied in the medical field, and the application range of polymer materials in artificial organs further expanded. In the 1960s, pure titanium began to be used clinically as an implant material. During this stage, inert biomaterials experienced initial development, and clinical applications continued to expand.

After the 1960s, scholars from various countries began to conduct in-depth research in materials science, medicine, biology, and other disciplines. At the same time, advanced instruments and equipment were continuously invented and released, leading to a rapid development phase for biomedical materials. This phase of rapid development was primarily characterized by the biocompatible evolution of biomedical materials, focusing on two main directions: 1) the development of new biomedical materials; 2) the productization development of inert biomaterials. In 1963, thoracic surgeons at Shanghai Hospital in China collaborated with several medical device research institutes to develop an artificial heart valve, which was successfully applied clinically for the first time in 1965, replacing the mitral valve with a domestically produced cage-ball type valve. The clinical use of heart valves is a primary manifestation of the productization development of biomedical materials. In the 1970s, calcium phosphate glass ceramics were discovered, which have a similar chemical composition to human bone tissue and can perfectly integrate with human tissue. During the same period, Chinese scholars began to engage in research on implantable cardiac pacemakers. In 1990, Zhuhai's New Pearl Pacemaker Company was established, developing a fully digital CMOS integrated programmable frequency SSI pacemaker to meet the market demand for cardiac pacemakers in China. In the 1980s, heart stents primarily made of pure metal structures began to emerge. During this stage, numerous new types of biomedical materials and their products began to appear, allowing for the rapid development of biomedical materials.

The biocompatible development of biomedical materials mainly considers the compatibility of the materials and aims not to alter their fundamental structures. Long-term use of such materials may lead to certain adverse reactions. On this basis, scholars from various countries have begun to develop tissue engineering materials that can promote tissue repair and regeneration in the human body. The term "tissue engineering" was first proposed by the National Science Foundation (NSF) in the United States in 1987. Since the 21st century, tissue engineering materials have been continuously developed and marketed, becoming one of the most promising high-tech industries of the 21st century.

Related report: The report released by Zhiyan Consulting titled "》

Industrial Status

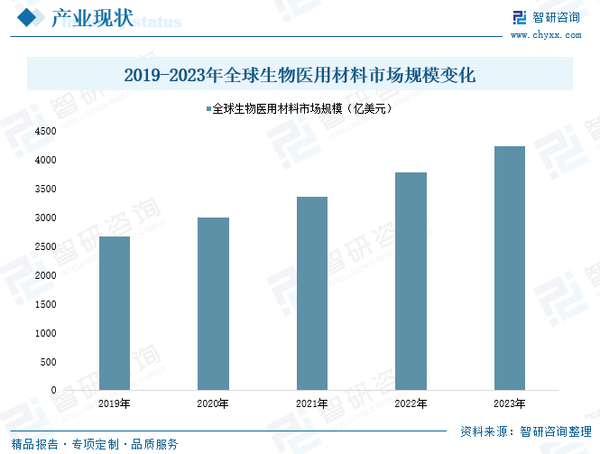

Biomedical materials can be widely used in fields such as surgical repair, physiotherapy rehabilitation, and the replacement of human tissues or organs, involving multiple medical specialties including orthopedics, cardiovascular surgery, neurosurgery, and plastic surgery. In addition, with the continuous development of biotechnology, the application of biomedical materials in drug delivery systems and biodegradable materials is also becoming increasingly widespread. As a result, in recent years, with the continuous improvement of global medical standards and the increasing medical expenditure of residents in various countries, the global biomedical materials market has shown rapid growth. According to data, in 2023, the global biomedical materials market size has reached 423.5 billion USD, with a compound annual growth rate of 12.24% over the past five years.

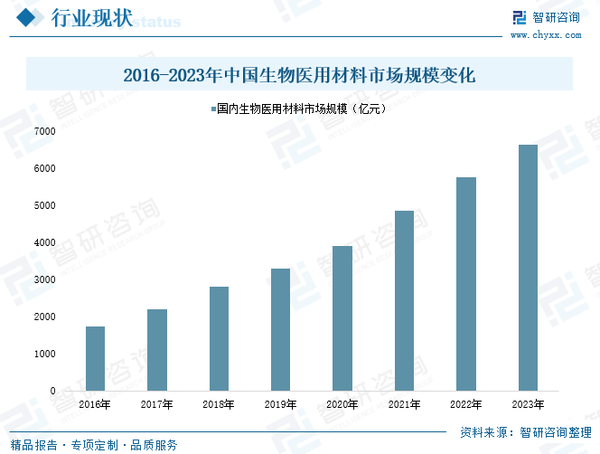

Compared to the foreign market, Chinese companies in the biomedical materials industry started later and have had less time to cultivate terminal consumption, but overall, the industry is developing rapidly with huge market potential. Data shows that the market size of China's biomedical materials industry has grown from 173 billion yuan in 2016 to 664 billion yuan in 2023. Globally, the top thirty companies, including Johnson & Johnson, Medtronic, Zimmer Biomet, Stryker, B. Braun, and Cook, account for over 70% of the global biomedical materials market. It is worth noting that while the global biomedical materials industry is highly concentrated, China's industry still presents a "small, disordered, and diverse" situation, leading to fierce and chaotic competition domestically. This results in weak market innovation capabilities. As such, most domestic biomedical materials production currently focuses on low-end products, with the industrialization process of high-end biomedical materials progressing slowly, and imported products dominate the high-end biomedical materials market in China.

In response to this situation, the Ministry of Industry and Information Technology and the National Medical Products Administration have jointly launched the initiative to support innovation in biomedical materials through various dimensions, including policies, financing, and commercialization. In the future, as the government's support for innovative biomedical materials policies deepens, the technological innovation capabilities of domestic biomedical material enterprises will continue to improve, the industrial chain will continually extend, and the upgrading process of China's biomedical materials industry will accelerate. Domestic biomedical materials are expected to capture a share of the international brand market, with the market share of domestic products further increasing and gradually replacing imported products. According to market development forecasts, as the process of domestic substitution in China's biomedical materials industry accelerates, coupled with the increasing international recognition of domestic products, the national market size for biomedical materials is expected to exceed 1.16 trillion yuan by 2029.

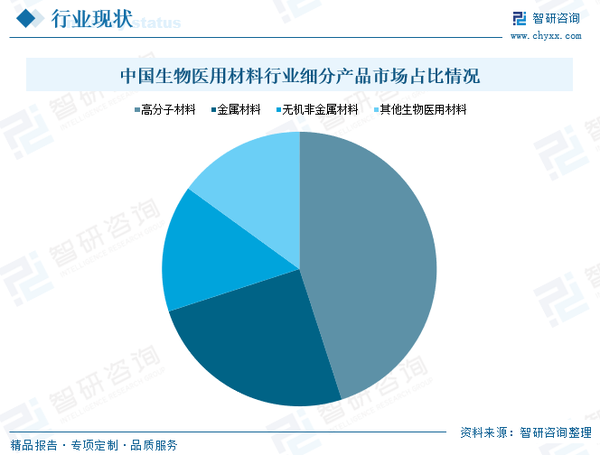

In terms of细分产品市场规模, currently in China, the commonly consumed biomaterials can be categorized into medical polymer materials, medical metallic materials, medical inorganic non-metallic materials, medical composite materials, bioregenerated materials, and nanobiomaterials. Among these, medical polymer materials and metallic materials account for a larger proportion of the total consumption; the demand for inorganic metallic materials such as medical ceramics is also increasing, continuously driving the growth of the domestic biomaterial market.

Development Trend

Currently, the frontiers and development directions of biomaterials mainly include: the design and development of next-generation biomaterials, nanobiomaterials and soft nanotechnology, surface modification and surface engineering research, and advanced manufacturing methodologies. The design and development of next-generation biomaterials represent the goal pursued in biomaterials research. Nanobiomaterials and soft nanotechnology are at the forefront and hotspots of biomaterials R&D. Surface modification and surface engineering are the primary approaches for developing new-generation biomomedical materials. Advanced manufacturing methodologies are a key focus in the field of biomaterials science. Therefore, many research institutions have focused their efforts on these research directions and achieved breakthrough progress in numerous subfields.

The United States has developed a new generation of bone substitute materials and polymer biomaterials that effectively extend the survival rate of stem cells. Japanese biomaterials experts have created polycaprolactone (PCL) reinforced composites and designed amorphous polymer monomer co-crystallization materials with a higher crystallinity range. In the European Union, German scholars have manufactured a novel bone healing material following human mechanisms and designed magnetic microsphere materials with stronger magnetic properties.

Chinese researchers are also constantly innovating in the field of novel biomaterials. A research team from Fudan University has developed a coronary stent that combines high mechanical properties with an appropriate degradation rate through the development of metal-polymer composite technology. Researchers from the Chinese Academy of Sciences have created a fullerene amino acid derivative that significantly reduces the side effects of cancer chemotherapy, greatly enhancing the tolerance to chemotherapy. Researchers from South China University of Technology have developed electroactive biomaterials that significantly promote bone integration and the repair of spinal cord nerve injuries.

In recent years, China's biomedical materials industry has made significant progress and has become one of the important pillars of the national economy. The "bottlenecks" restricting the development of China's biomedical materials industry mainly lie in the inability of technology to meet market needs, the disconnection between technology and management, weak engineering capabilities, and insufficient funding, resulting in slow conversion of research results and a low degree of industrialization. In response to these issues, as relevant national policies continue to be implemented effectively, the development mechanism of China's biomedical materials industry will accelerate its formation. The industry will gradually establish a unified and comprehensive planning and management system, continuously promoting an increase in R&D investment from domestic biomedical materials companies, and accelerating the complete pathway from research and development to application and industrialization of cutting-edge materials in key areas. This will provide a new approach to accelerate the resolution of clinical demands and better promote the sustainable, stable, and rapid development of the biomedical materials industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories