Air conditioner domestic sales surge by 11.4%, while washing machine exports see negative growth: The分化时刻 of the home appliance industry in 2025 It seems there was a part left untranslated, "分化时刻," which means a moment or period of differentiation or divergence. A more natural translation for the title would be: Air conditioner domestic sales surge by 11.4%, while washing machine exports see negative growth: The Divergence of the Home Appliance Industry in 2025

According to the latest data released by========, the total production of the three major white appliances (air conditioners, refrigerators, and washing machines) reached 40.5 million units in March 2025, up 7.6% from the same period in 2024. This growth is mainly due to the recovery of the domestic market and the complex situation of the export market. However, the Trump administration's announcement of an additional 10% tariff on Chinese home appliances, combined with existing tariffs, has brought new challenges to the industry.

Domestic Sales Performance of Home Appliances in March 2025

In March 2025, domestic sales of home air conditioners were scheduled to reach 13.76 million units, a 11.4% increase compared to the same period in 2024. This growth can mainly be attributed to the promotion of national subsidy policies and the recovery of consumer demand. As a necessity during summer, the growth trend in domestic sales of air conditioners is particularly prominent under the influence of seasonal factors and policy stimulation.

Refrigerators: In March, domestic production and sales of refrigerators reached 4.36 million units, a year-on-year increase of 2.7%. Although the growth rate is limited, the refrigerator market still benefits from the dual drivers of national subsidy policies and consumption upgrades. Some enterprises have further stimulated market demand through promotions and the launch of new products.

Washing Machine: In March, the domestic production of washing machines reached 3.3 million units, a year-on-year decrease of 1.7%. The decline in the washing machine market is mainly due to the "trade-in" policy, which partially exhausted demand in advance, leading to weak market growth in the second half of the year. However, driven by policies, the washing machine market is still expected to maintain steady growth.

Performance of the Home Appliance Export Market in March 2025

Air Conditioners: In March, the export production of air conditioners reached 11 million units, a year-on-year increase of 9.2%. Despite the significant growth, this increase is mainly concentrated in emerging markets, such as Southeast Asia and Latin America. The US market may face pressure in future growth due to tariff adjustments and the advance of order demand.

Refrigerators: In March, refrigerator exports reached 4.43 million units, a year-on-year increase of 8.9%. The growth in refrigerator exports is mainly attributed to the replenishment demand in the European market and the economic recovery in the Latin American market. However, the pressure on exports has gradually become evident after the U.S. imposed additional tariffs.

In March, the export production of washing machines reached 3.65 million units, a year-on-year decrease of 1.0%. The decline in washing machine exports is mainly due to the impact of U.S. tariffs, especially with large washing machines facing anti-dumping duties of 49.72%, leading to a significant reduction in export orders.

III. Impact of U.S. Tariffs on the Home Appliance Industry

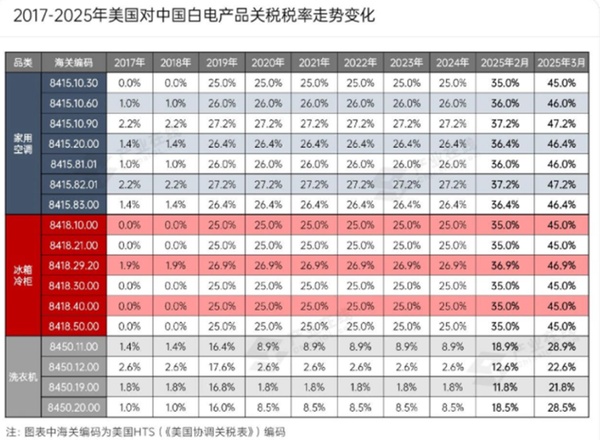

The Trump administration announced that, starting from March 4, 2025, a 10% additional tariff will be imposed on white goods exported from China to the United States. Combined with the existing tariffs, the comprehensive tax rate for air conditioners, refrigerators, and other products will reach 45%-47.2%. This policy has directly impacted the exports of Chinese home appliance companies to the U.S.

The air conditioning industry has been hit the hardest: As the most affected category, the comprehensive tax rate for air conditioners exceeds 45%, putting enormous pressure on corporate export profits. Data shows that China's air conditioner exports to the US decreased by more than 30% in 2024 compared to the previous year, with market share falling from 24% in 2018 to less than 10%.

Refrigerators and washing machines are facing dual pressures: the tariff rates for refrigerators and freezers range from 45% to 46.9%, while the rates for washing machines range from 21.8% to 28.9%. However, large washing machine products are subject to an anti-dumping duty of 49.72%. These tariff adjustments will further squeeze companies' profit margins.

Industry response strategies: In response to U.S. tax increases, Chinese home appliance companies have adopted multiple measures, including:

Capacity transfer: Chinese enterprises are accelerating the transfer of production capacity to Southeast Asian countries, especially Thailand and Indonesia. These countries attract a large number of home appliance companies to invest due to their low labor costs and favorable tax policies.

Global market layout: Enterprises are actively exploring emerging markets such as Latin America, Southeast Asia, and Africa. The economic growth and rising living standards in these regions are increasing the demand for home appliance products.

Technological Innovation and Upgrading: Enterprises enhance the added value of their products through technological innovation and product upgrading to compete in the international market.

Author: Zhao Hongyan, a plastic market analysis expert at Dedicated View

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track