Aesthetic medicine continues to return to serious medical practice, with "compliance" becoming the key term for the development of new materials in the aesthetics industry.

In recent years, while the medical aesthetics industry has been rapidly developing, it has also undergone profound changes and transformations. With the improvement of the regulatory system and the enhancement of consumer awareness, medical aesthetics is gradually returning to a serious medical practice, with safety and compliance becoming the core keywords for industry development. According to the "2024 Medical Aesthetics Consumer Research White Paper" produced by Meibei Platform's Medical Aesthetics Slow Talk, when choosing medical aesthetics projects, consumers are most concerned about safety, long-lasting effects, and noticeable changes, while the qualifications and experience of institutions and doctors have also become important factors in decision-making.

In addition, one of the new characteristics presented by the medical aesthetics industry is the polarization trend in consumer budgets. High-end consumers pursue high-quality anti-aging and regenerative medicine projects, while mass consumers prefer light medical aesthetics projects, driving diversified market development. Moreover, the increase in demand for restorative medical aesthetics, the rise of male medical aesthetics, and the compliant application of regenerative materials have also become new trends in the industry's development. These changes not only reflect the complexity and diversity of the medical aesthetics market but also point to the direction of refined and specialized development for the future of the industry.

Trend One: Security and Compliance Requirements Continuously Upgrade

'Medical aesthetics returning to serious medical practice' has been the major trend in the medical aesthetics industry in recent years.

As the regulatory system continues to improve and the maturity of the medical aesthetics market gradually increases, more and more consumers are beginning to recognize that 'medical aesthetics is a medical practice,' showing a more cautious trend in terms of consumer awareness and behavior. The 2024 Medical Aesthetics Consumer Research White Paper produced by Medical Aesthetics Slow Talk shows that among the concerns consumers have when making decisions, 'the industry is not standardized (hospitals, doctors, equipment, materials), and there may be risks/side effects' and 'due to various reasons such as equipment/materials/doctors, the results of medical aesthetics may not be ideal' rank in the top two positions.

Specifically, when beauty seekers choose medical aesthetics projects or categories, the most concerning factors are 'project technical safety, whether there are risks and side effects', 'effect durability', and 'whether the changes before and after the project are significant'. When choosing a medical aesthetics brand, 'safety' is the most important consideration, followed by 'stable effect', 'minor side effects', and 'natural effect', etc.

Image source: screenshot of the article from Aesthetic Medicine Slow Talk

Under the consumer consensus of 'safety is more important than beauty,' the future of the medical aesthetics industry will not only focus on refined and personalized services, but more importantly, on establishing a 'safety loop' throughout the entire process.

In addition to the safety and compliance requirements for medical aesthetics projects, categories, and brands, the demands of beauty seekers on institutions and doctors are more comprehensive. The data from the aforementioned white paper shows that the main concerns of beauty seekers when choosing an institution are 'better qualifications and experience of the institution's personnel', 'compliance of the institution’s qualifications', and 'whether the institution has proper equipment'. The main concerns when choosing a doctor are 'doctor’s compliance with qualifications and rich experience', 'the doctor is professional, approachable, and communicates well on-site', and 'the doctor has a good reputation'.

Image source: screenshot from Aesthetic Medicine Talks

From the past's reckless growth to the rational return of 'medical aesthetics returning to medicine', the perception of medical aesthetics among beauty seekers has further transformed from a simple beautification act into a scientific and professional medical practice.

Trend Two: Polarization of Medical Aesthetics Consumption Budget

The "2024 Medical Aesthetics Consumer Population Research White Paper" released by Medical Beauty Slow Talk shows that the budget for medical aesthetics consumption is showing a trend of polarization. Compared to the actual consumption of users in 2024, the overall users (including potential users) in 2025 have seen an increase in the polarization phenomenon of medical aesthetics budgets, with more people planning to spend either less than 10,000 yuan or more than 50,000 yuan.

If the 2025 medical aesthetics budget planned by respondents in the survey can be realized, compared to the actual spending of beauty seekers in 2024, the spending in 2025 will increase by 22.2%, and potential users will also generate 39.2% of the costs, truly becoming new consumption users from zero to one.

High-end consumers have a higher budget for medical aesthetics projects, especially with the continuous growth in demand for high-end anti-aging and regenerative medicine projects. These consumers place more emphasis on safety and effectiveness and are willing to pay a premium for high-quality medical aesthetic services.

On the other hand, light medical aesthetics projects (such as injection beauty, phototherapy, etc.) have attracted a large number of budget-limited consumers due to their low risk, low price, and convenience. These consumers tend to choose relatively lower-priced projects with shorter recovery periods, such as hyaluronic acid injections and photo rejuvenation, driving the rapid expansion of the mass market.

The polarization of budgets among medical aesthetics consumers reflects the diversity and complexity of the market. High-end consumers pursue high-quality, personalized services, while mass consumers place more emphasis on cost-effectiveness and convenience. This differentiation not only promotes the diversified development of the medical aesthetics market but also imposes higher demands on the service models and pricing strategies of medical aesthetics institutions.

Trend Three: Increase in Demand for Restorative Medical Aesthetics

Due to the previous unchecked growth of the medical aesthetics industry and the limited ability of consumers to discern and understand medical aesthetics services, some consumers still suffer from ineffective or even harmful medical aesthetics due to past "impulsive consumption." The "aftereffects" of these medical aesthetics services have driven an increase in the demand for restorative medical aesthetics.

Taking the relatively concentrated 'mantou-ization' phenomenon as an example, Huang Xiangping, partner and Chief Marketing Officer (CMO) of Meibei Medical Aesthetics Platform, told NBD that 'mantou-ization repair' is a byproduct of the rapid development of the medical aesthetics industry and also an opportunity for market self-correction. The surge in repair demand is actually due to early non-standard operations (imprecise dosage and techniques), non-standard injection materials, and consumers' aesthetic deviations leading to blind pursuit of excessive filling. These accumulated complications have started to burst out in recent years, so people can feel that the demand for mantou-ization repair is increasing.

Based on the comprehensive data from Meibei transactions and information obtained through communication with institutions, 'restoration' users are mainly concentrated in first- and second-tier cities, aged between 25 and 35. These users generally have had multiple experiences with minor medical aesthetic injections; a small portion are planning to try medical aesthetic injections but have learned about related negative information through various social channels, so they come for consultation in advance.

Huang Xiangping also mentioned that hyaluronic acid itself can be absorbed by the human body. The reason for the occurrence of 'doughiness' is generally due to excessive injection, improper technique, or substandard product quality, such as an excess of cross-linking agents. As long as everyone chooses a legitimate institution, qualified doctors, and certified products, and selects a reasonable injection plan based on their own circumstances, they can largely avoid the 'doughiness' phenomenon. Injecting dissolving enzymes is one way to address the 'doughiness' caused by hyaluronic acid injections, but it cannot completely meet the repair needs of beauty seekers. The postoperative solutions for 'doughiness' are diverse and require professional doctors to assess the specific situation of the beauty seeker and formulate a repair plan.

Trend Four: Male Aesthetic Medicine Consumption Continues to Increase

According to Deloitte's "2024 Insight Report on China's Medical Aesthetics Industry," male investment in medical aesthetics continues to grow, with an annual growth rate exceeding 20%. Moreover, male consumers are becoming increasingly willing to try more medical aesthetic procedures.

In addition to the increase in the number of consumers, male aesthetics also covers all age groups. It is understood that many '00s with spending power have joined the 'refined boy army', preferring light aesthetic treatments such as photorejuvenation and hyaluronic acid injections to maintain a youthful appearance; while men over 30 in the workplace are enthusiastic about hair loss prevention or hair transplant projects.

What is even more unexpected to the outside world is that the average transaction value for male medical aesthetics is higher than that for females. Data from iiMedia Research shows that the average transaction value for male consumers of beauty treatments is 2.75 times that of females.

Among them, as one of the most important sub-sectors, hair loss prevention (including hair transplantation) has become a necessity. In response to the issues of hair scarcity and thinning, the market has seen the emergence of innovative companies such as Yonghe Medical, Biliansheng, and Damai Micro-Needle Hair Transplantation. To expand the market, hair transplantation institutions are continuously broadening their business scope, providing comprehensive services including hair care, hair transplantation, and aesthetic design, in order to meet the diverse needs of consumers through diversified services.

Additionally, since men often have more active oil secretion in their skin compared to women, coupled with neglect in daily skincare, men are more prone to issues such as imbalanced skin hydration and oil, acne, and acne marks. Therefore, acne removal and spot treatment have become essential choices for many men.

Trend Five: Medical Aesthetics New Materials Moving Towards Compliance

In recent years, the new materials that have attracted much market attention mainly refer to regenerative materials in the light medical aesthetics field. The Insight Report on New Trends in Appearance Consumption shows that the market size of non-surgical medical aesthetics in China is expected to reach 204.6 billion yuan this year. For the industry, the light medical aesthetics market, with its wide audience, low threshold, and high repurchase rate, has become the main area of market growth.

Unlike traditional filler materials, regenerative materials achieve natural rejuvenation of the face by activating the body's own collagen regeneration mechanism. Their concept of 'natural beauty' and characteristics of safety and long-lasting effects are highly aligned with the demands of beauty seekers, thus gaining significant market favor. At the same time, the traditional hyaluronic acid and botulinum toxin markets have become a 'red ocean,' with intense competition and compressed corporate profits.

The rise of regenerative materials is essentially the result of both consumption upgrade and industry transformation, bringing unprecedented development opportunities to China's regenerative medical aesthetics market. According to a research report by Donghai Securities, the compound growth rate of the regenerative materials market is expected to reach 31.2% from 2025 to 2027. At this growth rate, the market size is expected to exceed 11.52 billion yuan by 2027.

In the current field of regenerative medical beauty products, the core of competition lies in obtaining official approval and certification. Whoever acquires the relevant qualifications first can gain a head start in the market. However, more importantly, compliance is the cornerstone for enterprises to establish themselves in the market. Regulatory authorities are strengthening the approval and supervision of regenerative materials to ensure the safety and efficacy of the products.

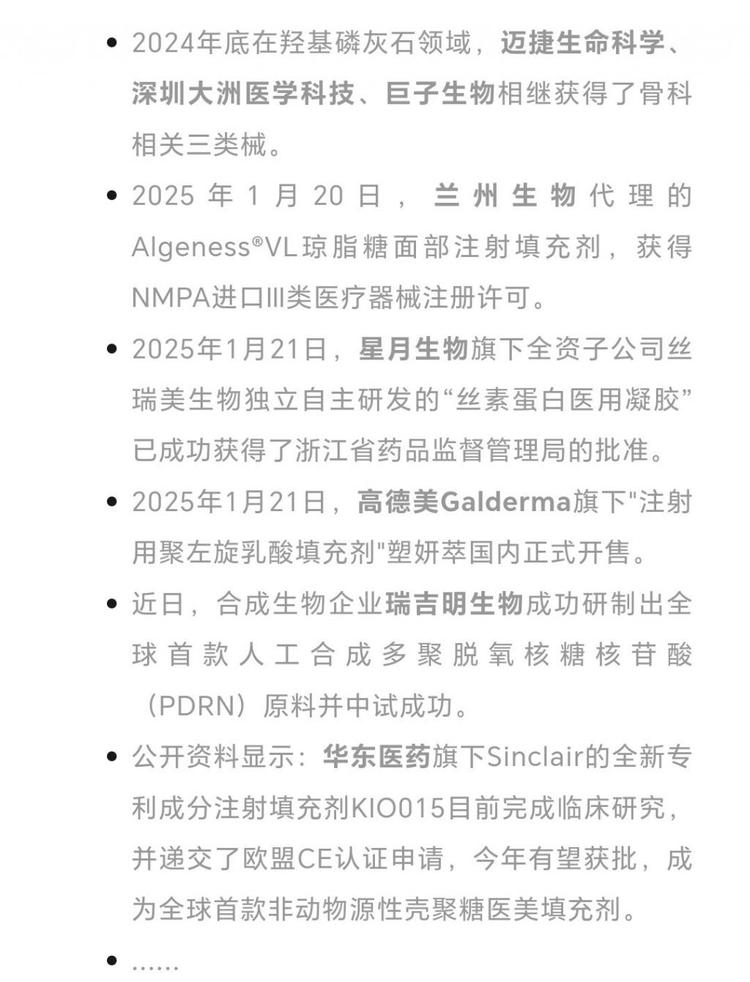

Since 2021, multiple regenerative products including East China Medicine's少女针 (CMC+PCL), Changchun Sinobiomaterials'童颜针 (PLLA), and Imeik's濡白天使 (PLLA+HA) have been successively approved. Around early 2025, even more new medical aesthetics regenerative materials have made new progress. Note: The terms "少女针", "童颜针", and "濡白天使" are brand names and thus kept in their original form. If you would like them to be literally translated, please let me know.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories