[ABS Weekly Review] Price Hits Bottom Stimulating Purchasing Enthusiasm, Market Transactions Surge This Week

1. This Week's Hot Topics:

This week, market prices have fallen more than they have risen.

Industry output slightly decreased this week.

After the holiday, the inventory levels at the petrochemical plant remain stable.

2. ABS market trends this week:

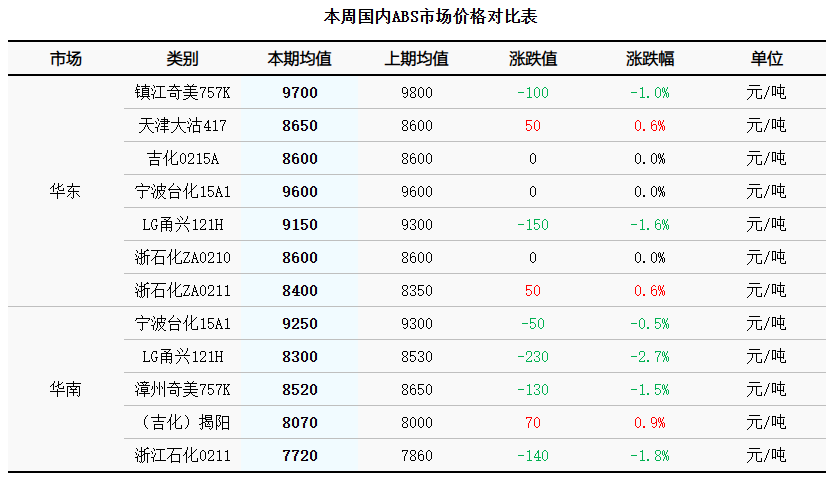

During this period (October 23, 2025 - October 30, 2025), ABS prices mostly fell with some increases. This week, the ABS market prices hit the bottom, sparking buying interest for stockpiling among market buyers. The enthusiasm for procurement among users increased, leading to slight price rebounds for certain localized models. However, prices for joint-venture products experienced volatile declines due to significant price differentials with domestic materials. This week, market prices showed both increases and decreases. On the raw material side, acrylonitrile showed a bottom rebound, butadiene saw larger declines, and styrene increased before retracing and consolidating. Overall, costs continued to decline. In terms of market prices, the range for domestic materials was 8,400-8,600 yuan/ton, while joint-venture materials ranged between 9,150-9,700 yuan/ton.

3. Raw material market trends this week:

3.1 Styrene: This week, domestic styrene prices rose and then corrected, showing an overall slight decline. The high-end spot transactions in Jiangsu were at 6,570 yuan/ton; the low-end transactions were at 6,390 yuan/ton; the price difference between high and low ends was 180 yuan/ton. During the period, crude oil prices experienced a slight correction, and the weak supply and demand for benzene reduced its support for styrene. In terms of styrene supply and demand, although new production units have come online, the overall supply has shown a slight decrease due to unexpected maintenance in some units. The demand side, despite minor fluctuations in some downstream units, still maintains a good demand status, with a continued tight balance between supply and demand. However, the pressure of spot supply in the market remains, and the market sentiment is predominantly bearish. After the macroeconomic upswing, prices continue to show a weakening trend.

3.2 Butadiene: This week, the domestic butadiene market accelerated its decline, with prices dropping to the lowest point of the year. As the supply-demand conflict in the market intensified, prices quickly fell, exacerbating the cautious attitude of downstream buyers. The atmosphere of waiting for further price drops led to sluggish transactions, further dragging the market down. During the week, both domestic and international prices fell simultaneously, and the ample supply of long-haul shipments led traders to expect that future import volumes would remain high, keeping the market supply under pressure. Although downstream buying gradually picked up after prices hit low levels and there were signs of stabilization in the butadiene supply side, buying sentiment remained cautious, and transactions for some slightly higher-priced offers were not successful.

3.3 Acrylonitrile: In this period, the spot price of the acrylonitrile market has bottomed out and consolidated, with localized prices rebounding slightly. The price range at East China ports fluctuated between 7,900-8,000 yuan/ton, up 100 yuan/ton from the previous period. The price range in the Shandong market fluctuated between 7,800-7,900 yuan/ton, remaining flat compared to the previous period. During the cycle, the fundamentals showed no significant fluctuations. Meanwhile, raw material costs continued to decline, and the market's ability to bottom out benefited from increased purchasing enthusiasm from downstream users. Currently, acrylonitrile prices are at the lowest level of the year. Considering cost pressures, the market anticipates limited room for further price declines, which in turn stimulates downstream buyers' desire to build inventories. At the same time, the sales pressure on acrylonitrile manufacturers has eased, and their quotations have also been adjusted upwards. However, supply remains ample, and there is no significant increase in actual downstream consumption, so the market primarily consolidates at the bottom, and the potential for a rebound is also limited.

4. Market Outlook:It is expected that the production and sales of ABS will continue to be in surplus in the next period, with overall transactions driven mainly by essential demand. Key points to focus on: 1. Supply side: It is anticipated that the overall supply in the industry will remain high next week. 2. Demand side: ABS procurement demand remains weak. 3. Cost side: The trends of the three major raw materials are in a narrow range of consolidation, with general support for ABS cost being limited. Sentiment: The high supply level has led to a predominantly pessimistic attitude among market participants, and it is expected that ABS will continue to trend downward in the long term.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

-

Kingfa Sci & Tech Q3 Net Profit Attributable to Shareholders Rises 58.0% YoY to 479 Million Yuan

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

China-U.S. Summit in Busan Tomorrow! Syensqo Launches New PAEK Material; Ascend Debuts at Medical Summit

-

MOFCOM Spokesperson Answers Questions from Reporters on China-U.S. Kuala Lumpur Trade Consultations Joint Arrangement