A Decade of Breakthroughs! Domestic Medical Devices Reach Nearly 70% Substitution Rate, Reshaping the Global Landscape

Domestic substitution, in the development of medical devices in our country in recent years, this topic has remained a hot topic, and it is also a long-term strategic direction for many细分领域. 似乎最后一部分没有完全翻译。让我继续完成整个句子的翻译。 Domestic substitution, in the development of medical devices in our country in recent years, this topic has remained a hot topic, and it is also a long-term strategic direction for many specialized fields, as well as an important focus for companies in formulating technology breakthrough routes and market layouts.

After nearly 10 years of "golden" development, to what extent has the domestic production rate of medical devices in our country developed? Which equipment has achieved a breakthrough from 0 to 1, which sectors can already keep pace with foreign giants, and in which technological fields are we still striving to catch up? Perhaps from the following summary of data, we can glimpse the true progress of domestic substitution in medical devices.

From "0" to "1", the Breakthrough List of Domestic Medical Devices

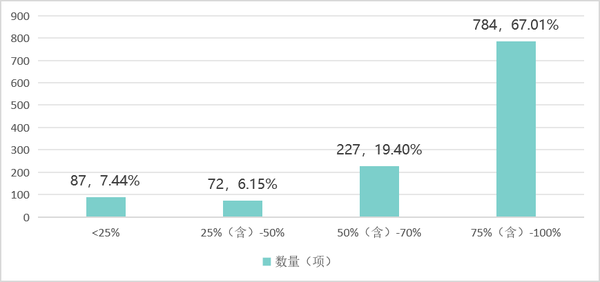

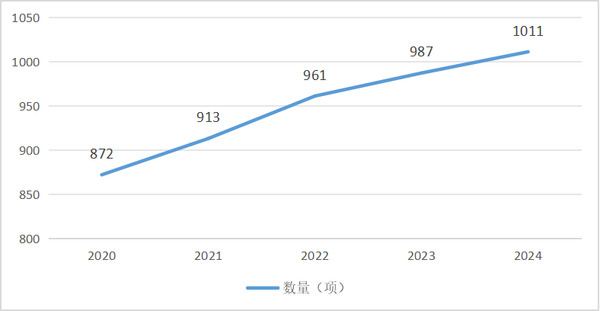

As of 2024, under the 1170 secondary product categories in the Catalogue of Medical Device Classification (Note: excluding in vitro diagnostic reagents), the localization rate of product registration (with a localization rate of domestic products exceeding 75%) reached 67.01%, covering 784 secondary product categories. The number of secondary categories with a localization rate of product registration exceeding (including) 50% increased from 872 in 2020 to 1011 in 2024.

Note: Product registration domestication rate = (Number of domestically registered products under the secondary category of the NMPA classification directory / (Number of domestically registered products + Number of foreign-registered products)) * 100%

Table 1 Distribution of Domestic Production Rate Intervals for Secondary Product Categories of Medical Devices in China as of 2024

Data source: High-end Medical Equipment Institute Data Center, Medical Device Innovation Network

Table 2 Changes in the Number of Secondary Product Categories with a Domestic Registration Ratio ≥50%

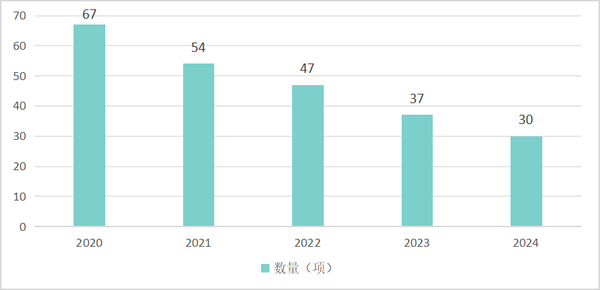

As of the end of 2024, among the 1170 secondary product categories in the Medical Device Classification Catalog, there are 30 secondary categories of products in our country that only have import product registration certificates, with no domestic products approved yet. This number has decreased by 37 from 2020. It is not difficult to see from the following data that the process of domestication of product registration in our country, from "0" to "1", is steadily advancing.

Table 3 Number of Second-Level Category Products with Zero Domestic Registration Certificates in China from 2020 to 2024

Data source: High-end Medical Equipment Institute Data Center, Medical Device Innovation Network

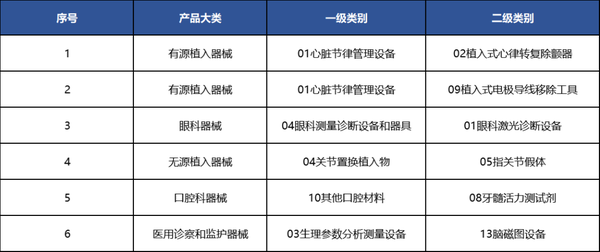

From a specific field perspective, our country has six second-level category products that achieved a "zero" breakthrough in 2024.

Table 4 List of Second-Level Categories for Domestic Breakthroughs Reaching "Zero" in 2024

Data source: High-end Medical Equipment Institute Data Center, Medical Device Innovation Network

Further细分来看, in 2024, there were a total of 29 second-level categories of products in our country that only received 1 domestic product registration certificate. Note: "细分" is directly translated as "细分" here, but for a more natural English translation, it could be "Further breaking it down," or "Looking at it in more detail,". If you prefer a fully natural English expression, please let me know!

Table 5 List of Secondary Categories with Only 1 Domestic Product Registration Certificate in 2024

Data source: High-end Medical Equipment Institute Data Center, Medical Device Innovation Network

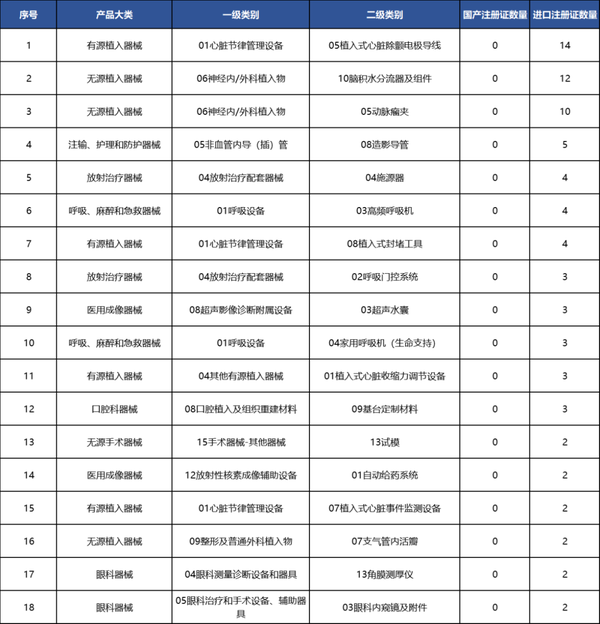

The products that have not yet achieved zero breakthrough are mainly concentrated in the fields of active implantation, radiation therapy, and medical imaging, among which implantable cardiac defibrillator lead wires are the most, with a total of 14 import registration certificates approved.

Table 6 List of Second-Level Category Products with Zero Domestic Registration Certificates in Our Country as of 2024

Data source: High-end Medical Device Institute Data Center, Medical Device Innovation Network

The path from 10% to 80% is full of hardships, and the breakthrough from 0 to 1% is even more difficult —— like a seedling growing in the crevice of a rock, it must break through the strata of technological blockade and also adapt to the storms of market testing. This is precisely a vivid portrayal of the development journey of domestic equipment.

mature track, a market of billions increasingly dominated by domestic products

Low-value consumables: Dominating the market in maturity phase

High-value consumables: replacement rate exceeds 80%

丨Monitoring Equipment and Biochemical Diagnosis: Mid-range Market Breakthrough

According to statistics, the domestic substitution rate of monitors in our country is about 70%, with companies such as Mindray Medical and Yuwell Medical expanding their market share through intelligent upgrades (such as remote monitoring, AI early warning). The domestic production rate of biochemical diagnostic reagents is 60%-70%, mainly benefiting from the cost advantages of domestic enterprises and the demand for tiered diagnosis and treatment policies.

Charting: Medical Device Innovation Network

Apart from some products with higher maturity having a relatively high degree of domestication, there is still a large part of the medical equipment market share that needs to be improved. In recent years, with the iteration of innovative technologies and policy support, some medical equipment has shown a trend of breaking through.

For example, high-end medical imaging equipment, according to statistics, the domestic substitution rate for CT, MRI, and other high-end medical imaging equipment is only 10%-20%, with foreign brands (such as GE, Siemens) still monopolizing the market in tertiary hospitals. However, companies like United Imaging Healthcare have achieved technological breakthroughs, with their PET-CT equipment capturing over 30% of the new market share domestically, and gradually entering the European and American markets.

Policy-driven, domestic substitution enters the "critical period"

In 2023, the "Guiding Standards for the Review of Government Procurement of Imported Products" jointly issued by the Ministry of Finance and the Ministry of Industry and Information Technology set domestic procurement ratios for 178 types of medical devices, with 137 types requiring 100% domestic production, directly promoting a shift in procurement at tertiary hospitals. In 2023, the central government allocated 20 billion yuan to support equipment procurement at county-level hospitals, clearly stipulating a preference for domestic products. The inclination of procurement policies is also a major driver in accelerating domestic substitution.

In addition, the normalization of centralized procurement is also accelerating the rise of domestic products, with categories such as cardiac stents and artificial joints seeing price reductions of over 80% through centralized procurement, forcing foreign capital to exit the mid-to-low-end market, and domestic enterprises taking the lead due to their cost advantages.

At the same time, our country is continuously increasing its efforts to tackle the technology of core medical device components. In the Ministry of Science and Technology's key R&D plan for the 14th Five-Year Plan, over 5 billion yuan has been invested in the medical equipment special project, supporting the development of critical components (such as CT tubes).

The rapid development of medical devices is also inseparable from the improvement and efficiency enhancement of the approval process. In recent years, the special approval procedure for innovative medical devices has reduced the product launch cycle by 30%. In 2024, a total of 62 products were approved through this channel, an increase of 25% year-on-year.

Going out to explore a broader global world has also become an important means for domestic development. Currently, our country is promoting the export of domestic equipment through the "Belt and Road" initiative, with medical equipment exports increasing by 18% year-on-year in 2023, and Southeast Asia becoming the main market.

Currently, the domestic substitution of medical devices in our country has shifted from low-end consumables to high-end equipment. Policies, technology, and capital have formed a synergy. More encouragingly, we are seeing more and more products evolving from non-existence to existence, and from existence to strength, gradually writing their own stories of domestic brands.

Over the next five years, the replacement of high-end equipment in tertiary hospitals, the localization of core components in the industrial chain, and globalization will become the three main themes. Companies need to focus on differentiated innovation based on clinical needs, while the policy side needs to continuously optimize the procurement environment and R&D ecosystem to seize more market share under new opportunities.

We will also conduct a detailed analysis of the domestication process of medical equipment in our country from the perspective of market share, so stay tuned.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track