$36.878 billion, a massive dividend! What chemical industry trends does Sinopec's 2024 annual report reveal?

On March 23, Sinopec released its 2024 annual report. According to the company's annual report, both the overall performance and the chemical sector's performance of Sinopec have declined.

Against the backdrop of a deep adjustment in the global energy structure and increased volatility in international oil prices, it is actually within expectations that Sinopec's business is under pressure. So, what information does this report convey? From which aspects should people in the chemical industry view Sinopec's annual performance? PlastInsight will provide an interpretation from five perspectives.

businessperformancetopoint

According to the International Financial Reporting Standards, Sinopec achieved operating revenue of RMB 3.07 trillion, and the profit attributable to Sinopec shareholders was RMB489.4billion yuan, earnings per share RMB 0.404 yuan.

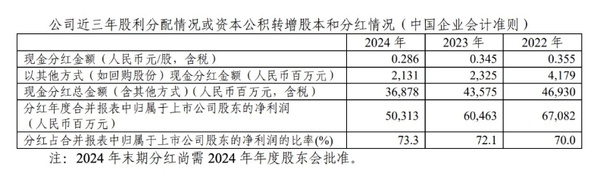

Sinopec focuses on shareholder returns, expecting to distribute a cash dividend of RMB 0.286 per share (including tax) for the full year.The total amount of cash dividends, after consolidating with the repurchase amount, is 36.878 billion yuan., calculated according to Chinese enterprise accounting standards, the dividend payout ratio reaches 73.3% of the net profit attributable to the shareholders of the listed company in the consolidated financial statements.

oil and gas equivalent production 515.35 million barrels, natural gas production 140.04 billion cubic feet, a year-on-year increase of 4.7%, the full natural gas industry chain profit reached a historical high, domestic oil and gas reserve replacement rate144%;

Processed 2.52 billion tons of crude oil, with kerosene production increasing by 8.6% year-on-year, and PX production reaching a new historical high; the total sales volume of refined oil products was 2.39 billion tons.

The emerging industries such as charging and swapping of electricity, hydrogen, biofuels, CCUS, etc., are developing rapidly, with more than a thousand gas stations and over ten thousand charging and swapping stations built.

Sinopec has formulated its first market value management system, considering market value management as a long-term strategic management practice. Meanwhile, the board of directors reviewed and approved a new round of share repurchase authorization. From 2021 to 2024, Sinopec repurchased shares worth a total of RMB 8.635 billion.

company announcement screenshot

I. Financial Resilience Highlighted: Strategic Confidence Behind High Dividend Payout Ratio

In 2024, Sinopec achieved a revenue of 3.07 trillion yuan, with a net profit attributable to shareholders of 489.4 billion yuan. Although the revenue scale has seen a slight decline compared to the previous two years, in the context of global energy companies generally facing pressure, its operational quality has shown significant resilience. Notably, the company increased its annual profit distribution ratio to 75%, expecting to distribute a cash dividend of 0.286 yuan per share, coupled with ongoing share repurchase plans (a cumulative repurchase of 8.635 billion yuan from 2019 to 2024), demonstrating a strong commitment to shareholder returns. This confidence in maintaining high dividends countercyclically stems from the company's precise control over cash flow management: the upstream oil and gas sector contributes stable cash flows, the refining and chemical business enhances profitability through structural optimization, and the new energy business gradually forms economies of scale.

In terms of capital expenditures, the company maintains a balance between strategic determination and flexibility. The cumulative investment in ten key projects amounts to 90.965 billion yuan, including both traditional energy production capacity enhancement projects such as Sichuan West natural gas and Shengli shale oil, and transformation and upgrading projects like Zhenhai Refining's high-end new materials and the Tianjin Nangang ethylene industry cluster. This investment strategy that equally emphasizes 'stabilizing the present' and 'planning for the long term' accumulates potential for future development.

II. Traditional Business Foundation: Full Industry Chain Optimization to Rebuild Competitiveness

In the traditional energy sector, Sinopec continues to consolidate its leading position in the industry through technological innovation and management upgrades. The upstream business achieved an equivalent oil and gas production of 515.35 million barrels, with natural gas production increasing by 4.7% year-on-year, and the domestic oil and gas reserve replacement rate reached 144%. Major exploration breakthroughs such as ultra-deep shale gas in the Sichuan Basin and shale oil in the Shengli Jiyang area indicate that the development technology for unconventional oil and gas has reached world-advanced levels. The refining and chemical sector demonstrated strong market adaptability: crude oil processing remained at a high level of 252 million tons, and through strategies like 'oil-to-chemicals' and 'oil-to-specialties', kerosene production increased by 8.6%, while the capacity for basic chemical raw materials such as PX and ethylene continued to be released, laying a raw material foundation for the development of downstream new materials.

China Petrochemical Shengli Jiyang Shale Oil National Demonstration Zone

The transformation of the refined oil sales network into integrated energy services has been remarkably effective, with the number of 'oil, gas, hydrogen, electricity, and service' integrated stations exceeding ten thousand, and the volume of ship fueling business steadily ranking second globally. This full-chain optimization of traditional businesses not only ensures current benefits but also provides channel support for the expansion of new energy businesses.

Sinopec's first super charging and battery swapping integrated energy station - Anhui Petroleum Zhongzhong Integrated Energy Station

III. Accelerating Green Transformation: Building a New Ecosystem of Diverse Energy Complementarity

Under the guidance of the 'dual carbon' goals, Sinopec's energy revolution has accelerated. In the hydrogen energy sector, 11 fuel cell hydrogen supply centers have been established, and the 'Beijing-Shanghai Hydrogen Corridor' demonstration project has opened up the main artery for hydrogen energy applications; the charging and battery swapping business has formed a network of ten thousand stations, integrating with existing gas stations to create an energy replenishment ecosystem for travel; CCUS technology has achieved a 20.1% increase in CO2 capture, forming large-scale applications in demonstration bases such as the Shengli Oilfield. These layouts are not simply a superposition of businesses, but through the synergistic development of 'traditional energy + new energy', they build a modern energy system that is complementary in multiple ways.

It is noteworthy that the company has innovatively proposed the 'Ten Thousand Stations Basking in Light' action plan, utilizing the rooftop resources of gas stations across the country to build photovoltaic power stations. This model of 'self-generation and self-use, with surplus electricity fed into the grid' not only reduces operational costs but also creates green revenue, forming a unique distributed energy solution.

IV. Science and Technology Innovation Drives: Activating a New Engine for High-Quality Development

The data of 9666 patent applications and 5550 authorized patents in the annual report confirms Sinopec's strategic determination of 'establishing the enterprise through technology.' The breakthrough in deep shale gas development technology has significantly increased the single-well production of the Sichuan Basin gas field; the world's first cyclohexene esterification hydrogenation unit has been put into operation, promoting the upgrade of the nylon industry chain; the digital twin system of the intelligent ethylene plant has achieved full-process optimized control. The industrial application of these innovative achievements is reshaping the core competitiveness of the enterprise.

In the integration of artificial intelligence and industrial internet, the company is focusing on building smart energy enterprises, such as: Jiangsu Oilfield applying artificial intelligence technology to achieve intelligent interpretation of velocity spectra, with prediction accuracy exceeding 90%; deployment of AI digital employees at gas stations in Henan, Jiangsu, and other places, achieving voice interaction, seamless payment, and more. Technological innovation has upgraded from a supporting tool to the core driving force for value creation.

V. Chemical Industry Sector's Growing Pains: Structural Adjustment Breeds New Opportunities

Despite the operating losses in the chemical division, it is necessary to view the underlying deep structural adjustments dialectically. The 10 billion yuan loss mainly comes from fluctuations in the prices of bulk basic chemicals, but the proportion of high-value-added products continues to increase: specialty oils have achieved import substitution in the aerospace field, and the domestic market share of high-end polyolefin materials has exceeded 25%, with the capacity for biodegradable materials ranking among the top three in the industry. As high-end new material projects in Zhenhai, Tianjin, and other places are put into production one after another, the optimization of the product structure will gradually deliver benefits.

chart Sinopec's chemical business operation in 2024 (source: Sinopec)

The company is reshaping its chemical competitiveness through a dual-wheel drive of 'basic + high-end': on one hand, it is expanding the scale of advantageous products such as ethylene and PX to maintain its voice in the industrial chain; on the other hand, it is focusing on breakthroughs in strategic areas such as medical polymers and new energy materials. This adjustment pain is actually an inevitable path for industrial upgrading. Aligning with the development paths of international giants like BASF and Dow, Sinopec's chemical business is at a critical leap from 'big' to 'strong'.

Six, ESGGovernance Upgrade: Sustainable Development Builds New Advantages

Sinopec has deeply integrated the ESG philosophy into its development strategy, with a 4.9% decrease in comprehensive energy consumption per ten thousand yuan of output value, a 9.4% increase in methane recovery, and the realization of large-scale production of bio-aviation fuel. In carbon asset management, the company actively participates in the national carbon market trading and explores new models such as carbon sink development and carbon finance innovation. These practices not only respond to global investors' expectations for sustainable development but also set a benchmark in the green transformation of traditional energy enterprises.

Facing the closing year of the 14th Five-Year Plan, the company proposed three major development directions: 'high-end, intelligent, and green'. The company willaccelerate transformation and upgradingUpstream business focuses on consolidating resource foundations to achieve stable growth in oil and gas, refining business accelerates the development of high-end carbon materials, sustainable fuels, and special waxes, oil product sales business, on the basis of consolidating market position, aims to build the number one brand in China for vehicle LNG business, expand and optimize charging and battery swap services, lead by example in scaling up hydrogen transportation, and develop new formats of Easy Joy services, chemical business takes multiple measures to reduce raw material costs and increase the proportion of high value-added products.

concluding remarks

Interpretation of Sinopec's 2024 performance, in the century-long transformation of the energy industry, Sinopec demonstrates a firm resolve and strong execution in strategic transformation: traditional businesses maintain their foundation through lean management, new energy layouts target future growth poles, and technological innovation builds long-term competitive barriers. This development logic of 'seeking progress while maintaining stability, and improving quality while advancing' is precisely the vivid practice of central enterprises in building a modern industrial system.

Editor: Lily

Material sources: Sinopec, DT New Materials, National Energy Administration, China Petrochemical News, China Petrochemical News, China Petrochemical News, Xinhua Red

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track