Today's Plastics Market: Mostly Up, Few Down! PVC and PET Decline, While ABS, PC, and PA Rise, Up to 300

Abstract: Summary of general-purpose and engineering plastic prices and forecasts for January 27th. In terms of general-purpose materials, positive macroeconomic factors continue to be released, and the market still intends to maintain prices; PP fluctuated slightly; PE and PS saw narrow increases of 14-80; ABS prices rebounded, with some rising by 20-300; PVC's recovery was weak, with some falling by 40; the EVA market remained stable. In terms of engineering materials, PC maintained an upward trend, with some rising by 50-250; PA6 and PA66 increased by 100-200; the PET market retreated, with some falling by 130-190; POM, PMMA, and PBT were in a wait-and-see mode.

General materials

PE: Wait-and-see sentiment rises, prices adjust within a narrow range

International oil prices trended downward today. Oil prices were dragged down by the combined impact of the U.S. cold snap not causing a significant drop in crude oil production and the planned resumption of production at some oil fields in Kazakhstan. Specifically, NYMEX crude oil futures for March delivery closed at $60.63 per barrel, down $0.44, or 0.72%, from the previous trading day; ICE Brent crude oil futures for March delivery closed at $65.59 per barrel, down $0.29, or 0.44%.

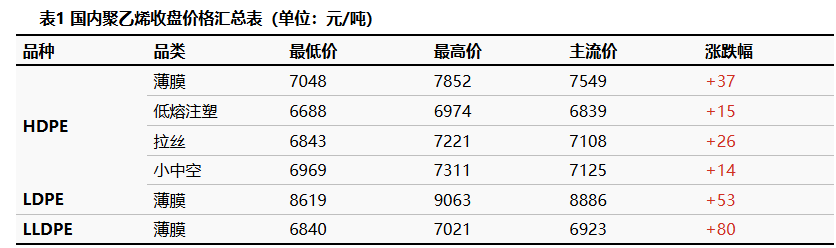

Polyethylene market prices showed slight fluctuations, with different grades exhibiting varying trends. HDPE market prices adjusted within a range of 10-20 CNY/ton, LDPE market prices saw a slight increase of 10 CNY/ton, while LLDPE market prices experienced a marginal decrease of 5 CNY/ton.

In the spot market, positive macroeconomic factors continue to be released, and the market's intention to hold prices firm remains. However, the atmosphere for terminal procurement has somewhat cooled, and merchants mostly adopt a strategy of selling as the market dictates. The previous over-selling phenomenon has, to some extent, alleviated the pressure brought by new capacities coming online, such as Yulong Petrochemical. The current market is generally in a wait-and-see state.

From a price prediction perspective, short-term demand-side negative impacts are gradually becoming prominent. Downstream enterprises are successively announcing their Spring Festival holiday arrangements, and procurement intentions are continuously weakening. The support from tight spot supply is gradually becoming insufficient. Considering the potential inventory pressure after the Spring Festival, market pre-sales continue, and the short-term price difference remains around 50 yuan/ton. Market sentiment is becoming more stable, and polyethylene prices are expected to fluctuate narrowly by 30-50 yuan/ton tomorrow.

PP: Tightening funding conditions constrain polypropylene's range-bound consolidation.

Sinopec East China announced price adjustments for PP products today, with prices of several products increasing by 50 yuan/ton. Specifically, the prices of Zhong'an United's T03 and T03C (raffia grade), Anqing Baiju's T03 and F03T/M70 (raffia grade) all increased from 6500 yuan/ton to 6550 yuan/ton. Shanghai Petrochemical's transparent series M800E and M250E increased from 8100 yuan/ton to 8150 yuan/ton, and CPP series F800E and F800EDF increased from 7700 yuan/ton to 7750 yuan/ton. Jiujiang Branch's T03 (raffia grade) increased from 6500 yuan/ton to 6550 yuan/ton, and BOPP series F03D/G increased from 6600 yuan/ton to 6650 yuan/ton.

Regarding the supply side of the industry, the impact rate of domestic polypropylene shutdown units increased by 1.22 percentage points today compared to yesterday, reaching 20.54%. In terms of production structure, the daily production proportion of drawing grade decreased by 1.82 percentage points from yesterday, to 27.28%; the daily production proportion of low-melt copolymer decreased by 1.52 percentage points, to 6.37%.

In terms of supply and demand, the polypropylene market maintained a tight balance during this period. However, the negative supply-demand gap narrowed significantly, leading to a marked weakening in price support. It is expected that the market supply and demand will remain near the equilibrium point in the next period, further weakening the supporting effect.

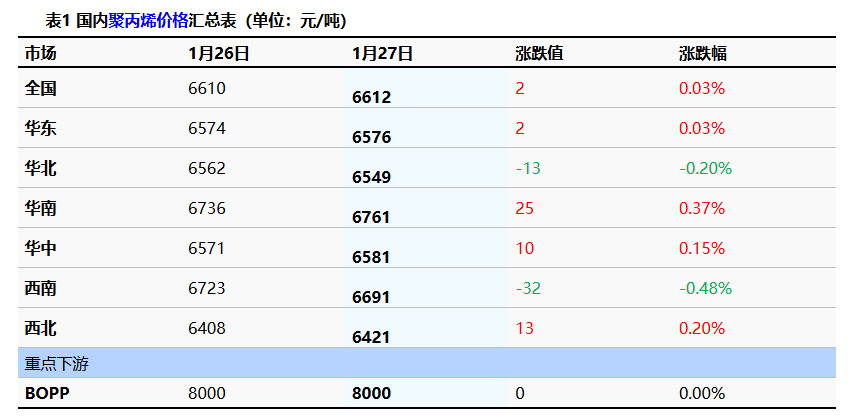

The spot market is centered in East China, with East China polypropylene drawn wire prices closing at 6576 yuan/ton today, an increase of 2 yuan/ton from yesterday. The national average price for drawn wire also rose by 2 yuan/ton, in line with market expectations this morning. Futures prices fluctuated downward, with most market offers decreasing by 10-50 yuan/ton in the morning. Terminal purchasing did not show a significant improvement, and weak demand constrained transaction volume, leading to a slight downward shift in some spot price centers. In the context of a supply-demand tug-of-war, the market is expected to maintain a weak and downward fluctuating trend in the near future. As of midday, the mainstream quotation range for drawn wire in East China was 6520-6650 yuan/ton.

In terms of price prediction, international oil prices are expected to ease, but propane import costs show an upward trend, providing some stabilizing support to the market in the short term. Downstream demand is clearly differentiated, with only a few sectors such as film and modified PP still rushing orders. Exports and most other industries are experiencing a downturn in demand, coupled with tightening capital flow at the end of the year, making it difficult to effectively support prices. It is expected that the polypropylene market will see a slight pullback in the short term, with prices maintaining in the range of 6520-6600 yuan/ton.

PVC: Impact of Cold Wave Subsides, Market Recovery Remains Weak

Today, domestic PVC producers in China have implemented differentiated price increases, ranging from 20-100 RMB/ton. On the supply side, there have been no new plant shutdowns recently. While some of Hengtong's units are undergoing maintenance, close attention should be paid to the operating rates of Wanhua Fujian's units, as well as the planned turnaround schedules for Tosoh and Formosa Plastics (Taiwan) in the future. Internationally, the cold wave in the US has not had a substantial impact on PVC production. Although Olin, the largest chlor-alkali producer in the US, implemented temporary shutdowns due to the cold wave, it has already started resuming production today.

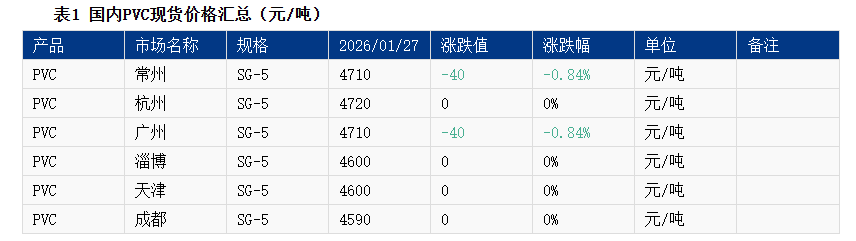

Spot market prices, based on Changzhou in East China, saw East China carbide-based PVC type 5 cash-on-delivery prices closing at 4710 RMB/ton today, down 40 RMB/ton from the previous trading day. The domestic PVC spot market is generally showing a weak and volatile pattern, with prices temporarily stable but intraday trading exploring lower levels. In February, demand in many Asian regions gradually weakened due to the impact of the Spring Festival holiday. Furthermore, the impact of the US cold wave on supply was less than expected, reducing the market enthusiasm brought by earlier export rushes. Meanwhile, domestic spot supply remained high, and industry inventories continued to accumulate, putting pressure on the center of gravity for spot transactions. Currently, the quotation range for carbide-based PVC type 5 cash-on-delivery in East China is 4650-4750 RMB/ton, and the quotation range for ethylene-based PVC is 4750-4950 RMB/ton.

From a price forecast perspective, market sentiment is gradually slowing down. The impact of the US cold wave is less than expected, and the rise in chemical product prices has not provided favorable support to the supply and demand fundamentals of PVC. Market sentiment is turning bearish. This week, PVC still faces the pressure of oversupply and inventory accumulation. Export order signing sentiment is cooling down, and Southeast Asian markets are entering the Spring Festival off-season, leading to cautious transaction sentiment. Support from the cost side is weak. In the absence of macroeconomic policy stimulus, the PVC market will fluctuate and fall. It is expected that the price of Type 5 calcium carbide method PVC (cash, ex-warehouse) in East China will operate in the range of 4600-4700 yuan/ton.

PS: Cost support remains, market consolidates and rises slightly.

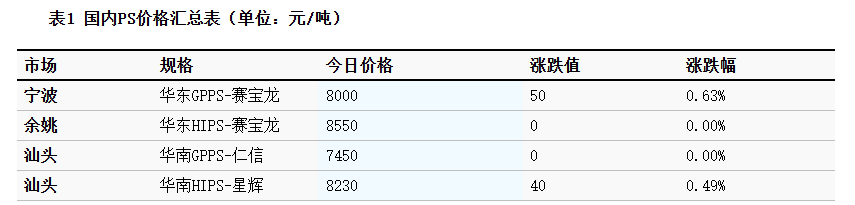

Today, GPPS prices in East China rose by 50 RMB/ton, closing at 8000 RMB/ton. The styrene monomer market, a raw material, showed a slight downward trend. In East China, it closed at 7890 RMB/ton, down 15 RMB/ton; in South China, it closed at 7835 RMB/ton, down 5 RMB/ton; and in Shandong, it closed at 7665 RMB/ton, down 20 RMB/ton.

In the spot market, styrene, the raw material, has entered a consolidation phase after an increase, with no significant change in its supporting and pressuring impact on the PS market. PS manufacturers' quotations remained stable with some upward adjustments during the day, and holders attempted to follow suit. However, downstream demand was mainly for immediate needs, resulting in generally sluggish market trading sentiment.

Regarding price forecasts, the short-term styrene raw material will maintain a consolidating trend, and the cost support and pressure on PS will continue to exist. The market sentiment between buyers and sellers is in a state of contention. Holders still have some intention to raise prices, but under the downstream rigid demand purchasing model, the momentum for spot price increases is insufficient. It is expected that the short-term PS market will maintain a stable and consolidating trend, with a small room for increase.

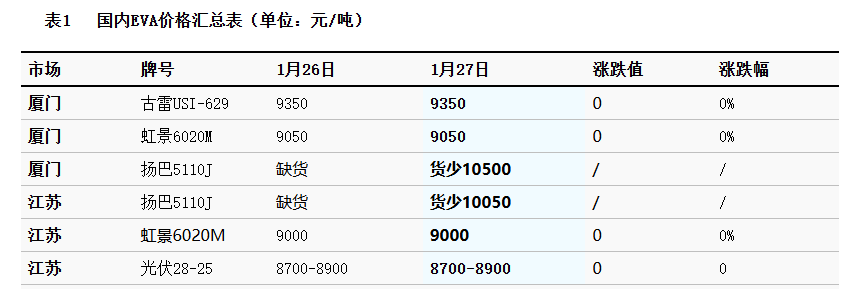

EVA: Market maintaining stable operation, trading focused on rigid demand.

This week, the ex-factory price of EVA petrochemicals remained stable. The operation of supply-side facilities showed divergence, with the Sinochem Quanzhou plant undergoing a scheduled shutdown for major maintenance, while other facilities maintained stable production.

Today, the domestic EVA market in China remained stable. Manufacturers' ex-factory prices remained firm, while traders' quotes were stable. On-site transactions were mainly focused on the delivery of previous orders. Downstream factories replenished spot goods strictly based on immediate needs, and the overall trading atmosphere was tepid. Currently, the mainstream market prices are: soft EVA materials are referenced in the range of RMB 9,000-10,100 per ton, and hard EVA materials are referenced in the range of RMB 8,600-10,200 per ton.

From a price forecast perspective, the EVA market's supply and demand fundamentals will continue to be in a game of tug-of-war in the near future. On the supply side, producers face limited inventory pressure and have a strong willingness to support prices, maintaining a stable ex-factory price mechanism. On the demand side, downstream terminal factories are gradually entering the Spring Festival holiday, and raw material replenishment has entered its final stages. Market transaction activity will gradually weaken. The market is expected to enter a pattern of weak supply and weak demand, with the domestic EVA market mainly consolidating sideways with narrow fluctuations.

ABS: Trading atmosphere improves, prices rebound slightly.

Today, ABS market prices showed an upward trend, with prices increasing in both the East China and South China core markets. Market transactions were acceptable. In terms of production, the monthly ABS output in January decreased compared to the previous month.

Spot market prices, based on Yuyao and Dongguan areas, are rising simultaneously in both locations, with traders reporting increased transaction volumes. On the raw material side, styrene and butadiene prices are fluctuating and retracing, providing limited support to ABS costs.

In terms of price forecasting, today's increase in market trading volume has provided some support for prices; however, the decline in raw material prices has weakened cost support. It is expected that the domestic ABS market will maintain a narrow range of consolidation tomorrow.

Engineering material

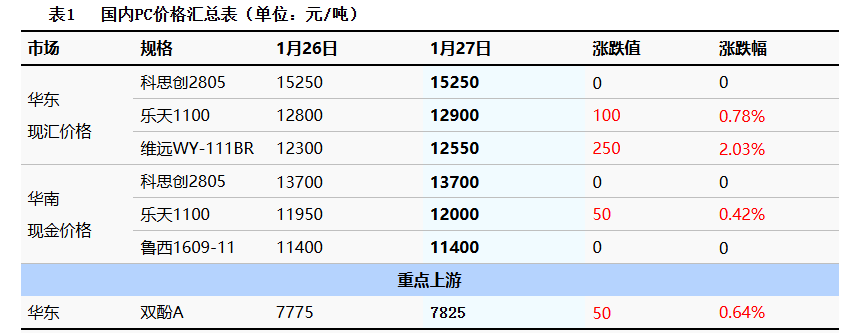

PC: Supply and demand support continues, the market maintains an upward trend.

International crude oil prices edged lower on Monday, with ICE Brent crude futures for March delivery closing at $65.59 per barrel, down $0.29 per barrel from the previous trading day. The raw material bisphenol A (BPA) market strengthened, with the closing price in the East China market reaching 7,825 RMB/ton, an increase of 50 RMB/ton month-on-month. This week, ex-factory prices from domestic PC (polycarbonate) plants were mostly raised by 200-300 RMB/ton, while the auction price for ZPC (Zhejiang Petrochemical) PC fell by 100 RMB/ton compared to last week.

Today, the domestic PC market in China maintained a firm upward trend. As of the afternoon close, the mainstream negotiable price range for low-end injection molding grade materials in East China was RMB 11450-13450/ton, while the negotiable range for mid-to-high-end materials was RMB 14700-15250/ton. Prices for some varieties continued to rise by about RMB 200/ton compared to yesterday. Zhejiang Petrochemical's PC auction concluded after 5 rounds of bidding, with prices falling by RMB 100/ton compared to last week. In the spot market, prices in both East and South China continued to fluctuate and rise. Recently, the overall sentiment in the commodity market has been mildly positive, coupled with a relatively small amount of spot goods in circulation, operators are maintaining upward adjustments. Downstream buyers are following up as needed, but the volume of high-priced transactions is limited.

In terms of price forecasting, the domestic PC market has seen continuous price increases recently, primarily driven by factories having no pressure with spot sales and low inventory in circulation. Before the Lunar New Year holiday, the situation of low inventory and low sales pressure for PC suppliers will continue. However, the pace of downstream just-in-time purchasing has slowed down, and market sentiment has shifted from active to cautious wait-and-see. It is expected that the domestic PC market will mainly consolidate at high levels to digest the gains. Close attention should be paid to subsequent trading changes and market trends.

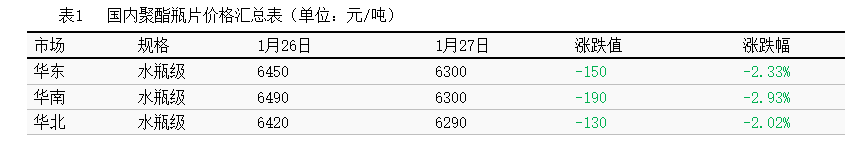

PET: Cost Support Collapses, Polyester Bottle Chip Market Recedes

Today, the domestic trade price of PET bottle chips in factories has decreased significantly, with adjustments ranging from RMB 80-250/ton. On the supply side, the domestic PET bottle chip capacity utilization rate is 64.99%.

Based on the East China market, today's spot price for polyester bottle chips (water bottle grade) closed at 6300 yuan/ton, a decrease of 150 yuan/ton from the previous trading day, in line with morning market expectations. The decline in international oil prices led to a collapse in cost support, and polyester bottle chip factories generally lowered their quotations, causing the market center to shift downwards. Currently, some market supplies are tight, and price differences between brands are significant. It is heard that the transaction price range for January-February goods is 6230-6360 yuan/ton, with futures contracts for 2603 trading at par to a premium of 100 yuan/ton, indicating a slight strengthening of the basis. Downstream buyers are primarily replenishing inventory for immediate needs, and trading activity today was better than yesterday.

Regarding price forecasts, the raw material market still has downward expectations, and cost support is insufficient. However, tight supply of some goods forms a certain support for prices, with limited further downward space in the short term. The spot price of bottle grade material in the East China market is expected to operate in the range of 6200-6400 yuan/ton tomorrow. Close attention should be paid to changes in crude oil and raw material prices.

POM: Operators under pressure, market transactions weak.

On the supply side, Yankuang Luhu's 80,000 tons/year POM plant is operating smoothly across all lines. Hebi Longyu's 60,000 tons/year POM plant shut down for maintenance on October 20th, with no definite restart time yet.

Based on the Yuyao region as a benchmark, the price of Yuntianhua M90 POM closed at 11,100 yuan/ton today, remaining unchanged from the previous period. The domestic POM market as a whole is showing a narrow consolidation trend, with slow spot circulation. Petrochemical plants are facing increasing pressure to ship, and the fundamentals indicate a bearish outlook, leading to a strong wait-and-see atmosphere in the market. Traders are under pressure in their operations, and some grades offer room for negotiation and concessions. End-users show low interest in taking orders, and the buying and selling atmosphere is flat. As of closing, the ex-tax quoted price range for domestic POM in the Yuyao region is 8,800-11,300 yuan/ton, while the cash transaction price in the Dongguan region remains at 7,800-10,400 yuan/ton.

Regarding price predictions, shipments are poor in various regions, and some manufacturers continue to accumulate inventory. The bearish fundamentals have led to a quiet market inquiry atmosphere, and traders' bearish sentiment is rising. Short-term shipping pressure is difficult to alleviate, and some grades may further expand their concession margins. Terminal factories are operating at low loads, and users are primarily in a wait-and-see mood, with limited transaction fluctuations. It is expected that the POM market will maintain a narrow range consolidation in the short term.

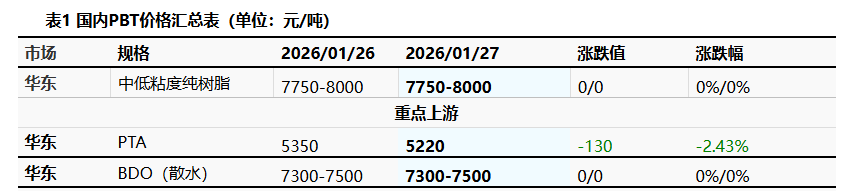

PBT: Feedstock prices fluctuate, market maintains a wait-and-see attitude.

This week, PBT manufacturers generally raised their quotations. There were few plant maintenance shutdowns in the industry, resulting in relatively stable supply. In terms of production, this period's PBT production was 26,800 tons, with a capacity utilization rate of 59.58%, the same as the previous period. Regarding profitability, the average gross profit of domestic PBT this week was -658 yuan/ton, an increase of 99 yuan/ton compared to the previous week.

In the spot market, using East China as the benchmark, the mainstream price range for low-to-medium viscosity PBT resin today is 7,750-8,000 RMB/ton, remaining flat compared to the previous trading day. The PBT market maintained a wait-and-see stance today. On the raw material side, PTA prices declined while the BDO market remained in a stalemate, leading to weakened cost support and intensified market caution. Pre-holiday stockpiling activity before the Spring Festival has been mediocre, with supply and demand locked in a standoff. The transaction price range for low-to-medium viscosity PBT pure resin in the East China market stands at 7,750-8,000 RMB/ton.

Looking at price forecasts, the PBT market is expected to remain range-bound. On the raw material front, for PTA, with the Spring Festival approaching, downstream operating rates are decreasing, and polyester plant turnarounds are increasing, leading to a larger accumulation of inventory. Overall commodity sentiment is weakening, and downstream purchasing enthusiasm is limited, so the spot market may continue to face pressure in the short term. For BDO, supply-side support is general, and downstream players are mostly focused on inventory digestion or purchasing based on contracts for immediate needs. Holders are cautiously bearish on the outlook, and actual transactions are slightly lower, leading to weak and volatile market activity. While there is some cost-side support, downstream buyers have stronger bargaining power as they enter the pre-holiday stocking period. With the ongoing psychological tug-of-war between supply and demand, the PBT market will primarily experience range-bound fluctuations. It is anticipated that the price of medium-to-low viscosity PBT resin in the East China market will operate within the range of 7700-7950 RMB/ton tomorrow.

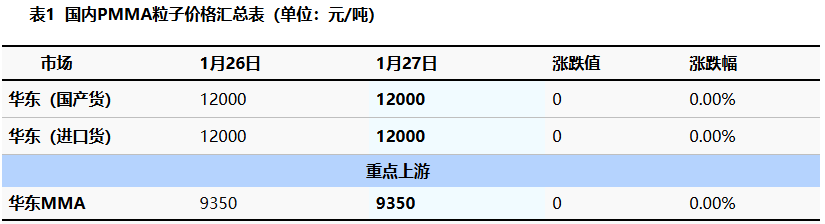

PMMA: Cost Support Under Pressure, Particle Market Operating Stably

Domestic PMMA particle prices remained stable today, with the industry capacity utilization rate at 61%.

The spot market, benchmarked in East China, reported PMMA resin prices at 12,000 yuan/ton today, unchanged from the previous trading day, in line with morning expectations. The price of the raw material MMA continued its firm trend, providing some cost support to the market. However, market sentiment remained under pressure, with holders adjusting their offers in line with market conditions. Downstream demand was primarily driven by immediate needs, resulting in limited actual transaction volumes and prices tending towards the lower end of the range.

In terms of price forecasting, the raw material side is in a stalemate, with limited cost support. Downstream players are largely bearish, and holders are mainly maintaining stable prices, adjusting their offers flexibly based on their own inventory levels. They are also closely monitoring low-priced sources in the market. It is expected that the PMMA particle market will remain range-bound in the short term.

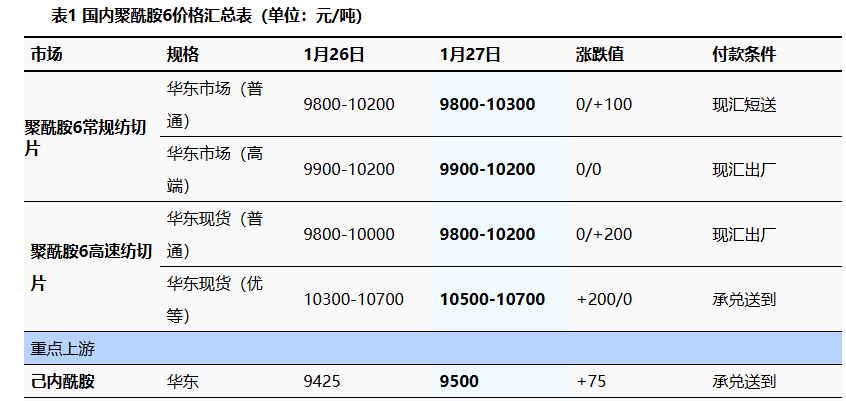

PA6: Cost advantages support continued market uptrend.

Regarding raw materials, Sinopec's high-end caprolactam settlement price for January 2026 is 9770 yuan/ton (liquid premium grade, six-month acceptance for self-pickup), a decrease of 115 yuan/ton from the December settlement price. Sinopec's refineries in East China, South China, and Central China have raised their pure benzene prices by 150 yuan/ton, executing at 5900 yuan/ton, effective January 23rd.

In the spot market, the polyamide 6 market continued its upward trend today. The price of caprolactam, a raw material, increased, and slicing enterprises faced significant losses and cost pressures. Polymerization enterprises continued to raise slice prices, but downstream players were more cautious about following high-priced slices, and some transactions in the market were still acceptable. Currently, the price range for conventional spinning ordinary PA6 in East China is 9800-10300 yuan/ton (cash delivery), and the spot price range for high-speed spinning is 10500-10700 yuan/ton (acceptance and delivery).

From a price forecast perspective, the raw material caprolactam market is operating at a high level, putting significant cost pressure on PA6 chip manufacturers. The operating rate of domestic polymerization plants is relatively stable with ample market supply, and some polymerization companies are conducting pre-sale businesses. Downstream manufacturers are cautiously following up on high-priced chips and replenishing stocks at lower prices. It is expected that the PA6 chip market will remain firm in the short term.

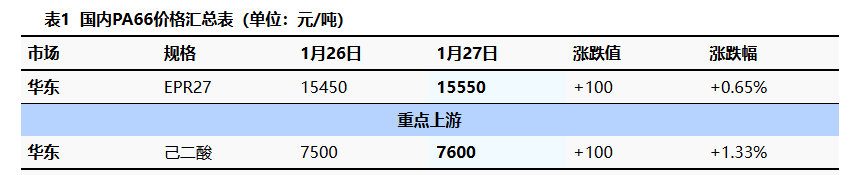

PA66: Cost pressure is prominent, market is running strong.

Regarding international oil prices, on January 26th, international oil prices fell as the cold wave storm in the United States did not lead to a significant decline in crude oil production, and some oil fields in Kazakhstan planned to resume production. NYMEX crude oil futures for March delivery closed at $60.63/barrel, down $0.44/barrel, a decrease of 0.72%; ICE Brent crude oil futures for March delivery closed at $65.59/barrel, down $0.29/barrel, a decrease of 0.44%. China's INE crude oil futures for contract 2603 rose by 11.5 yuan/barrel to 450.9 yuan/barrel, and fell by 0.8 yuan/barrel to 450.1 yuan/barrel in night trading. On the supply side, the domestic PA66 capacity utilization rate today is 70%, with a daily output of approximately 2850 tons. The capacity utilization rate remains stable, the industry has sufficient supply, and downstream demand is generally weak.

Based on the Yuyao market in East China, the reference price range for EPR27 grade PA66 today is 15500-15600 CNY/ton, an increase of 100 CNY/ton from the previous trading day, representing a rise of approximately 0.65%. The price of raw material adipic acid has increased, and hexamethylenediamine prices are running at a high level, indicating significant cost pressure. Suppliers are reluctant to sell at low prices, leading to a reduction in low-priced offers in the market.

In terms of price forecasting, raw materials hexamethylenediamine and adipic acid are expected to remain at high levels, continuously exerting cost pressure on the market. The industry supply and demand are in a weak balance, with a prevailing sentiment of reluctance to sell at low prices. It is anticipated that the domestic PA66 market will maintain a strong and consolidating trend in the short term.

(Images compiled from Longzhong)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers