Prehike of 194.73%! Plit's Modified Business Grows Rapidly

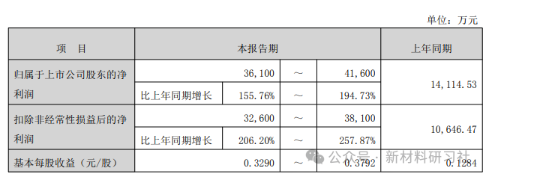

On the evening of January 26th, Pulisite (002324.SZ), a leading modified materials company, released its 2025 annual performance forecast, delivering a bright report. The company expects a full-year net profit attributable to shareholders of 361 million yuan to 416 million yuan, a year-on-year surge of 155.76%-194.73%; the year-on-year increase in net profit excluding non-recurring items is even higher at 206.2%-257.87%, with basic earnings per share of 0.3290-0.3792 yuan/share, indicating full momentum in the company's main business growth.

This performance surge is no coincidence, but rather the dual result of the company's strengthened modified materials core business and breakthroughs in the new energy and cutting-edge materials tracks, making the growth logic increasingly clear.

Focusing on the core business of modified materials, solidifying the foundation for growth.

With over thirty years of deep cultivation in modified polymer materials, Puliite uses this business as its "ballast stone," contributing over 74% of its revenue in the first half of 2025. Its products penetrate critical areas such as automotive interiors, exteriors, and battery pack casings, forming deep partnerships with mainstream automakers like BMW, Mercedes-Benz, and BYD. Nearly 90% of its modified material revenue comes from the automotive industry.

With the increasing proportion of new energy vehicle business and the release of overseas base capacity, the sales of automotive materials continue to grow. At the same time, the company is actively reducing its dependence on a single industry and has successfully entered non-automotive fields such as energy storage, home appliances, and power tools. Driven by both new customers and new markets, the growth of the main business is becoming more resilient. Currently, the company has 12 production bases with a modified materials production capacity of approximately 500,000 tons. After the new bases are put into operation, the total production capacity will exceed 1 million tons, laying the foundation for increasing market share.

Breaking the deadlock in the new energy vehicle sector and creating a second growth curve.

If modified materials represent Prudence's "present," then the new energy business is its core incremental growth driver for the future. After strategically acquiring its way into the lithium battery sector, the company's new energy battery business revenue reached RMB 1.05 billion in the first half of 2025, a year-on-year increase of 21.32%.

With an annual capacity of 15.32 GWh, the lithium battery business firmly secures its foundation, while the Malaysia project accelerates overseas expansion. The sodium-ion battery sector is particularly noteworthy with frequent highlights, including winning a large domestic sodium-ion battery energy storage demonstration project and securing a purchase order of no less than 1 GWh over four years from an overseas customer, achieving a breakthrough in large-scale supply. The continuous realization of energy storage and sodium battery orders makes the new energy sector a strong engine for performance growth.

LCP technology breaks the ice, seizing a position in the high-end materials track.

Beyond its financial performance, Prit's breakthroughs in cutting-edge materials are even more anticipated. In December 2025, the company announced the mass production of LCP film, which has been supplied in large quantities to leading customers for next-generation mobile phone flexible board antennas, breaking the monopoly of foreign manufacturers in the high-end field. From 0 to 1! Prit's LCP film is applied on a large scale for the first time, breaking the monopoly!

As one of the few global enterprises with LCP full-industry chain capabilities, Pilit's materials have been delivered in batches to the low-Earth orbit satellite and brain-computer interface fields. At the same time, the company is advancing AI server PCB rigid board verification, precisely positioning itself in future trends such as 6G and AI computing power. This technological barrier not only helps the company break away from low-to-mid-end competition, but also holds the promise of unlocking excess profit margins.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!