[pp daily review] year-end tightening of capital flow: Polypropylene Prices Consolidate in Range

1 Today's Summary

Sinopec East China Continue PP Price Adjustment Notice Today: 1. Zhong'an United: Raffia increased by 50 yuan/ton, T03 raised from 6500 to 6550, T03C also adjusted accordingly. 2. Anqing Baiju: Raffia increased by 50 yuan/ton, T03 raised from 6500 to 6550, F03T/M70, etc. also adjusted accordingly. 3. Shanghai Petrochemical: Transparent series increased by 50 yuan/ton, M800E raised from 8100 to 8150, M250E/GM1600E/M800EC, etc. also adjusted accordingly; CPP series increased by 50 yuan/ton, F800E raised from 7700 to 7750, F800EDF/F780R, etc. also adjusted accordingly. 4. Jiujiang Branch: Raffia/BOPP increased by 50 yuan/ton, T03 raised from 6500 to 6550, F03D/G raised from 6600 to 6650.

②==Today, the impact of domestic polypropylene shutdowns increased by 1.22% from yesterday to 20.54%. The daily production ratio of raffia decreased by 1.82% from yesterday to 27.28%, and the daily production ratio of low melt copolymer decreased by 1.52% from yesterday to 6.37%.

③. The supply and demand balance of polypropylene in this period continues to be tight, but the negative supply-demand gap has narrowed significantly, greatly weakening the support for market prices. The supply and demand in the next period will remain near the equilibrium point, which will affect... Polypropylene market Price support weakened again.

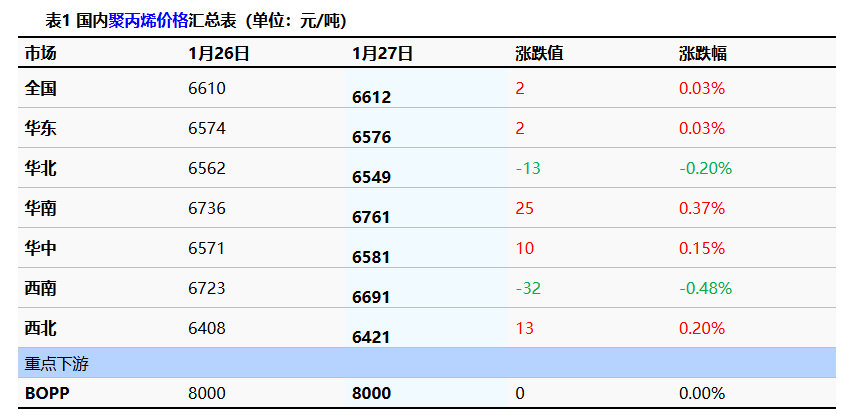

2 Spot Overview

Based on East China, the price of polypropylene raffia in East China closed at 6576 today. Yuan/ton, up 2 yuan/ton from yesterday, the national average price of drawing wire rose by 2 yuan/ton from yesterday, in line with the morning's expectations.

Today, futures prices fluctuated and trended lower, with most market quotations falling by 10-50 yuan/ton in the morning. Downstream follow-up has not improved significantly, and sluggish demand is restricting the increase in market trading volume. Spot prices have partially narrowed and shifted downwards. With the game between supply and demand advantages and disadvantages, it is expected that the market will show a weak and downward fluctuating trend in the near future. By midday, mainstream prices for East China drawn wire were in the range of 6520-6650 yuan/ton.

|

Figure 1: Domestic Polypropylene Price Trend (Unit: Yuan/ton) |

Figure 2: Price Trend of Polypropylene in Various Regions of China (Unit: Yuan/Ton) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/bea26048e6c2459394a0dcbeb77dfa0a.png) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/fbc0df8a6e5048cc84bb2bfcbdcd08f0.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

3 Cash-Futures Basis

From the perspective of basis, the basis for polypropylene in East China today is -CNY 115/ton, a decrease of CNY 42/ton compared to yesterday; the basis for North China is -CNY 142/ton, a decrease of CNY 57/ton compared to yesterday.

|

Figure 3 Basis Trend in North China (Unit: Yuan/Ton) |

Figure 4 Basis Trend in East China (Unit: Yuan/Ton) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/cb97ec3436b74e07908ee4eb0badd8e5.png) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/bccf099fe0114a9baff35e70332e79d8.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4 Production Dynamics

Polypropylene capacity utilization decreased by 0.57% from yesterday's 75.86% to 75.29%. Oil-based profit increased by 46.04 yuan/ton to -492.91 yuan/ton.

|

Figure 5. Trend of Domestic Polypropylene Capacity Utilization Rate |

Figure 6: Domestic Polypropylene Profit and Price Trend Chart (Unit: Yuan/Ton) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/f87d3f2b117248729ce6c5e2965fe386.png) |

![[PP日评]:下游采购维持刚需 聚丙烯价格偏弱整理(20260120)](https://oss.plastmatch.com/zx/image/2e436fe0f9d145c5b526f2cc85850cba.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

5 Market sentiment

Upstream manufacturers actively destock to reduce the risk of year-end inventory; intermediaries maintain low to medium inventory through quick turnover; downstream factories slow down raw material replenishment due to limited new orders, and some offer price concessions to ship goods.

6 Price prediction

International oil prices are expected to loosen, but propane import costs are trending upward, providing stable support in the short term. Downstream demand, with the exception of a few areas such as film and modified PP that continue to fulfill orders, is declining across the board from export demand to most other industries. The demand side shows a weak downward trend, and the tightening of capital flow at the end of the year offers little support to market prices. It is expected that the market will slightly decline in the short term, with prices maintained at 6520-6600 yuan/ton.

7 Related Product Information

Table 2: Price Summary of Polypropylene Related Products (Unit: Yuan/Ton)

|

Market |

1 26th of [Month] |

1 27th of [Month] |

Change |

Percentage change |

|

Shandong Propylene |

6350 |

6405 |

55 |

0.87% |

|

Shandong Methanol |

2200 |

2200 |

0 |

0.00% |

|

Linyi PP Powder |

6510 |

6490 |

-20 |

-0.31% |

Data source: Longzhong Information

8 Data Calendar

Table 3. Overview of Domestic Polypropylene Data (Unit: 10,000 tons)

|

Data Items |

Release date |

Last period data |

Trend forecast for this period |

Unit |

|

PP Total inventory |

Wednesday at 4:30 PM |

68.01 |

↓ |

Ten thousand tons |

|

PP Production capacity utilization rate |

Thursday 4:30 PM |

76.02% |

↑ |

% |

|

PP Weekly Maintenance Impact |

Thursday at 4:30 PM |

17.67 |

↓ |

Ten thousand tons |

|

Total domestic PP production in China |

Thursday, 4:30 PM |

78.49 |

↑ |

Ten thousand tons |

|

Profit of oil-based PP enterprises |

Thursday, 4:30 PM |

-562.15 |

↑ |

Yuan/ton |

|

Coal-to-PP enterprise profit |

Thursday 4:30 PM |

-294.73 |

↑ |

Yuan/ton |

|

PDH PP enterprise profit after tax |

Thursday 4:30 PM |

-1421.9 |

↓ |

Yuan/ton |

|

PP Import profit |

Thursday 4:30 PM |

-429.88 |

↓ |

Yuan/ton |

|

PP Export profit |

Thursday, 4:30 PM |

-26.55 |

↑ |

USD/ton |

|

1 Consider "==↓↑" as significant fluctuations, highlighting data dimensions with fluctuations exceeding 3%. 2 Treat ==↗↘ as narrow fluctuations, highlighting data with price changes within 0-3%. |

||||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers