[PC Daily Review] Market Maintains Upward Exploration Pattern

1 Today's Digest

①、 On Monday, international crude oil prices edged lower, with ICE Brent crude futures for March delivery down $0.29/barrel to $65.59. 。

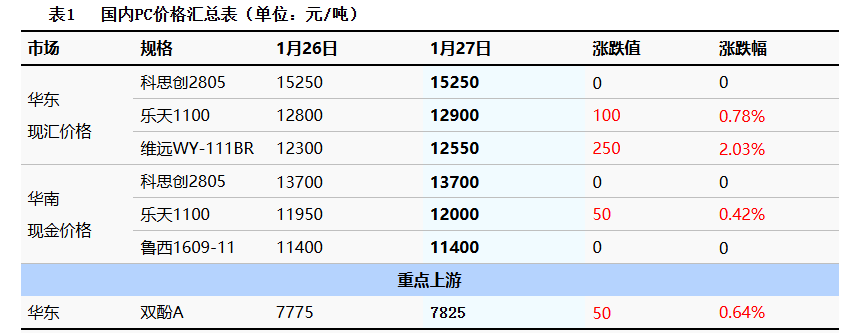

②、 The closing price of bisphenol A in the East China market was 7825.Yuan/ton, up 50 yuan/ton month-on-month.

③This week, domestic PC factories raised ex-factory prices by 200-300 yuan/ton, while Zhejiang Petrochemical's auction price decreased by 100 yuan/ton.

2. Spot Overview

Today, the domestic PC market remained firm and trended upward. As of the afternoon close, mainstream negotiations for low-end injection-molding grade materials in East China were referenced at 11,450–13,450 RMB/ton, while mid-to-high-end materials were negotiated at 14,700–15,250 RMB/ton, with some price centers continuing to rise by around 200 RMB/ton from yesterday. This week, ex-factory prices from domestic PC plants were mostly adjusted upward by 200–300 RMB/ton. ZPC's PC auction opened high and concluded after five rounds, down 100 RMB/ton from last week. In the spot market, both East and South China continued to fluctuate upward. Recently, the overall atmosphere of the commodities market has been mildly positive. Coupled with the continued scarcity of circulating spot supply, market players maintained a wait-and-see approach while pushing prices higher. Downstream buyers followed up at appropriate prices, though trading volume at high price levels remained average.

|

Figure 1 East China PC Market Price Trend Chart (Unit: RMB/ton) |

Figure 2: PC Price Trend Chart in Various Regions of China (Unit: Yuan/Ton) |

|

|

|

|

Source: OilChem International |

Data source: Longzhong Information |

3 Production dynamics

Today, the operating rate of domestic PC factories is at 81.46%; the price of raw material bisphenol A in the East China market increased by 50 yuan/ton to 7825 yuan/ton, and the gross profit margin of the domestic PC industry increased by 205 yuan/ton to 1507.5 yuan/ton compared to the previous working day (Note: The industry cost formula has been revised from January 2026, corresponding to the updated gross profit).

|

Figure 3: Trend Chart of Domestic PC Weekly Capacity Utilization Rate |

Figure 4. Comparison of domestic PC profits and prices (Unit: yuan/ton) |

|

|

![[PC日评]:市场维持探涨格局(20260127)](https://oss.plastmatch.com/zx/image/f7ea994be2fc4cbd9ca47a5636d63121.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4 Price Prediction

Recently, prices in the domestic PC market have continued to rise, driven primarily by a lack of pressure on factory ex-factory sales and low levels of circulating spot inventory. Heading into the Chinese New Year holiday, the low sales pressure for PC suppliers is expected to persist. However, considering the slowing pace of downstream demand-driven purchases, market sentiment is shifting towards cautious observation. Therefore, the domestic PC market is anticipated to trade within a high range, consolidating recent gains, with attention focused on further transaction dynamics and market trends.

5. Related Products

Bisphenol A Market: Based on the East China region, today's East China Bisphenol A closed at 7825 yuan/ton, with a range of 7800-7850 yuan/ton, up 50 yuan/ton from the previous trading day, in line with morning expectations. The East China market continued its upward trend today. Downstream buyers were resistant to high spot prices and lacked sufficient order-taking capacity. However, the spot circulation of Bisphenol A was low, and suppliers still had a strong desire to push prices up, continuing to raise their offers. The market was approaching a state of price increases with little to no actual trading, and few transactions were heard in the market.

6 Data Calendar

Table 2. Overview of Domestic PC Data (Unit: Yuan/Ton)

|

Data |

Release date |

Previous Period Data |

This issue's trend forecast |

|

Capacity utilization rate |

Thursday 4:30 PM |

81.46% |

↗ |

|

PC Weekly Profit |

Thursday 16:00 PM |

1259.5 |

↗ |

|

Data source: Longzhong Information Notes: 1. ↓↑ is considered a significant fluctuation, highlighting data dimensions with a rise or fall exceeding 3%. 2. ↗↘ is considered a narrow fluctuation, highlighting data with a rise or fall within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers

![[PC日评]:市场继续走高(20260126)](https://oss.plastmatch.com/zx/image/69b851aec09f4a3cb68166cc0a405f11.png)

![[PC日评]:市场继续走高(20260126)](https://oss.plastmatch.com/zx/image/6e167a5b8c9140f5be30521c5b54943f.png)

![[PC日评]:市场观望趋弱整理(20260121)](https://oss.plastmatch.com/zx/image/919846ef9a2545a6a6cf7e35894807d3.png)