[PA66 Daily Review] High Cost Pressure Results in Strong Market Trend

1 Today's Summary

①、 1/26: The cold wave storm in the United States has not yet led to a significant decline in crude oil production. Coupled with the planned resumption of production in some oil fields in Kazakhstan, international oil prices have fallen. NYMEX crude oil futures, March contract, fell $0.44/barrel to $60.63, a decrease of 0.72% month-on-month. ICE Brent crude oil futures, March contract, fell $0.29/barrel to $65.59, a decrease of 0.44% month-on-month. China's INE crude oil futures, 2603 contract, rose 11.5 to 450.9 yuan/barrel, and fell 0.8 to 450.1 yuan/barrel in overnight trading.

②. Today, the domestic PA66 capacity utilization rate is 70%, with a daily output of approximately 2850 tons. The capacity utilization rate is relatively stable, downstream demand is average, and the domestic PA66 industry has a sufficient supply of goods.

2 Current Stock Overview

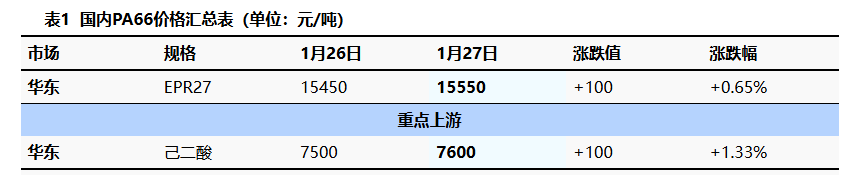

Based on the Yuyao market in East China, the current market price for EPR27 is 15500-15600 CNY/ton, an increase of 100 CNY/ton from the previous trading day, a rise of approximately 0.65%. 。 The raw material adipic acid price is rising, and the price of hexamethylenediamine is running at a high level, resulting in significant cost pressure. Suppliers are reluctant to sell at low prices, and low-price offers in the market are decreasing.

|

Figure 1 2025-2026 Domestic PA66 Price Trend Chart in China (Yuan/Ton) |

Figure 2 2025-2026 China Domestic PA66 East China Price Trend Chart (RMB/Ton) |

![[聚酰胺66日评]:成本支撑向上 国内PA66价格上涨(20260123)](https://oss.plastmatch.com/zx/image/01e6de4092114cb8abe14bef0c19a7f5.png) |

![[聚酰胺66日评]:成本压力偏大 市场低价惜售情绪较浓(20260127)](https://oss.plastmatch.com/zx/image/b16710a923cf4b25a2cd6dde0f2bec3c.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

Today, the average capacity utilization rate of domestic Copolyester (PETG) enterprises is around 70%, indicating a sufficient supply of goods in the industry. Regarding profits, raw material prices are running strong, increasing cost pressure. Downstream players are cautious about following high prices, and losses are expected to increase in the short term.

|

Figure 3 2025-2026 Domestic PA66 Capacity Utilization Rate Trend Chart in [Year] |

Figure 4 2025-2026 China's domestic PA66 profit vs. price chart (RMB/ton) |

![[聚酰胺66日评]:成本压力偏大 市场整理运行(20260119)](https://oss.plastmatch.com/zx/image/f68e269e216a4cad840fb059e78cd411.png) |

![[聚酰胺66日评]:成本压力偏大 市场低价惜售情绪较浓(20260127)](https://oss.plastmatch.com/zx/image/3905b18bfa4049efa0b3d303a4265a31.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4 Price Prediction

With raw materials hexamethylenediamine and adipic acid running at high levels, cost pressures are significant. Market supply and demand are weakly balanced, leading to a high degree of reluctance to sell at low prices within the industry. Short-term, the domestic PA66 market is expected to consolidate with a slightly bullish bias.

5 Related Product Information

Adipic Acid Market East China adipic acid market reference price is RMB 7500-7700/ton acceptance delivered, up RMB 100/ton from yesterday. Today East China Adipic acid market The center of gravity is strengthening. Suppliers raised their guidance prices again in early trading, with a clear intention to support the market. Intermediary quotations followed suit, strengthening. Downstream resistance remained, with cautious entry into the market. There were sporadic inquiries for rigid demand, but limited spot negotiations.

6 Data calendar

Table 2: Overview of Domestic PA66 Data (Unit: 10,000 tons)

|

Data |

Release date |

Last period data |

This issue's trend forecast |

|

Capacity utilization rate |

Thursday 11:30 AM |

70% |

→ |

|

Weekly Production |

Thursday 4:00 PM |

2.01 |

→ |

|

Data source: Longzhong Information Note: 1. Consider "↓↑" as significant fluctuations, highlighting data points where the increase or decrease exceeds 3%. 2. ↗↘ considered narrow fluctuations, highlighting data with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers