Recently, six departments, including the Ministry of Industry and Information Technology, jointly issued the "Interim Measures for the Management of Recycling and Comprehensive Utilization of Waste Power Batteries for New Energy Vehicles," marking a new stage of standardized management for the entire chain of waste power battery recycling and utilization in China.

The new regulations specify and reinforce the responsibilities of all parties involved, and administrative penalties are set to strengthen supervision. This means that whether it's battery manufacturers, complete vehicle enterprises, or recycling companies, their own compliance records will directly impact their business qualifications and cooperation opportunities. When selecting partners or evaluating companies in the supply chain, it has become a necessary step to check their industrial and commercial information to verify their business scope, and to use risk assessment tools (like "Tianyancha" or similar) to screen for records of environmental penalties, safety production accidents, or major legal disputes. This helps prevent supply chain risks and ensures compliant collaboration.

The new regulations are expected to integrate resources from various parties, promote the industry's transformation towards standardization, efficiency, and green development, and provide support for the sustainable development of the new energy vehicle industry.

Industry consolidation and upgrading are often accompanied by capital operations and adjustments to equity structures. For investors, industry researchers, or institutions seeking deep cooperation, clarifying the capital background and control relationships of key enterprises within the industry is crucial. Through shareholder information inquiries and panoramic equity penetration charts, one can clearly see the investment institutions behind enterprises, their holding layers, and their associated networks, and accurately locate the ultimate beneficiaries, thereby assessing their strategic resources, synergy potential, and their true control and influence within the industrial chain.

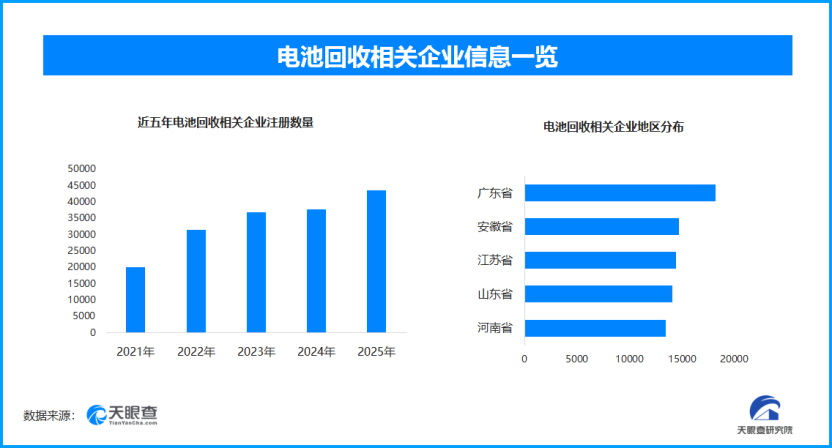

According to Tianyancha Professional Edition data, as of now, there are over 204,000 battery recycling-related enterprises in operation or existence in China. Among them, over 43,000 new enterprises were registered in 2025. From the trend of enterprise registration numbers, the number of battery recycling-related enterprises registered has shown a yearly increase over the past five years, peaking in 2025.

From a regional distribution perspective, Guangdong, Anhui, and Jiangsu provinces lead in the number of battery recycling-related enterprises, with over 18,000, 14,000, and 14,000 respectively. Shandong and Henan provinces follow.