[today’s plastic market] narrow range adjustments! general materials mostly decline, engineering materials fluctuate weakly

Summary: On November 12, the plastic market overview and price forecast for general and engineering plastics. In general plastics, crude oil support is strengthening, with PP and PS experiencing fluctuations; PVC transactions have slowed down, with some prices dropping by 10-20; ABS continues to decline, with some prices dropping by 10-70, and EVA is steady to slightly lower, with individual prices dropping by 100. In engineering plastics, PC is under pressure with individual prices dropping by 50; PET is fluctuating weakly, with some prices dropping by 10-30; the PA6 market is moving upwards, with some prices increasing by 50-100; POM, PBT, PMMA, PA66 are remaining stable and quiet.

General material

PP: Crude Oil Support Strengthens, Polypropylene Prices Fluctuate and Consolidate

1 Today's Summary

①, Sinopec East China PP pricing partly reduced: 1. Jiujiang Branch: Raffia homopolymer series down by 50 yuan/ton, T30S reduced from 6450 to 6400, F03G/F03D simultaneously; 2. Zhong'an United: Raffia homopolymer series increased by 50 yuan/ton, T30S increased from 6350 to 6400, T03C simultaneously; Copolymer K8003 reduced by 100 yuan/ton, price decreased from 6800 to 6700; 3. Anqing Petrochemical: Copolymer series price adjusted, M30RH reduced from 6750 to 6650, K8003 reduced from 6700 to 6650; Homopolymer F08 reduced by 100, from 7000 to 6900; 4. Zhenhai Refining & Chemical: Thin-wall injection down by 50 yuan/ton; Power pipe DL001 down by 200 yuan/ton; 5. Zhenhai Limited: Homopolymer injection down by 50 yuan/ton.

Today, the domestic polypropylene shutdown impact decreased by 1.44% compared to yesterday to 15.83%. The daily production proportion of raffia grade polypropylene increased by 1.99% compared to yesterday to 26.04%, and the daily production proportion of low melt copolymer increased by 0.96% compared to yesterday to 9.08%.

The supply-demand balance in this period continues to be in a tight equilibrium, but its boosting effect on the market is weaker than expected. In the next period, the supply-demand balance difference will narrow to a negative value due to increased supply and a slowdown in demand growth, which is expected to further weaken the support for prices.

2 Spot Overview

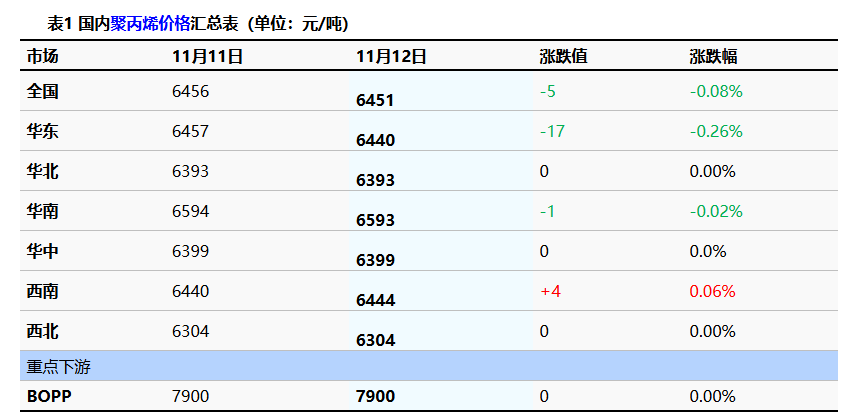

Based on the East China region, today's polypropylene raffia closed at 6,440 yuan/ton, down 17 yuan/ton compared to yesterday. The national average price of raffia decreased by 5 yuan/ton compared to yesterday, a drop of 0.08%, which basically meets the morning expectations.

The futures market underwent narrow-range fluctuations and consolidation today, with spot quotations stabilizing and adjusting. Market transactions were average, downstream demand showed moderate purchasing enthusiasm, and most intermediaries adjusted their quotations and sales according to market trends. Overall trading was average, with prices mainly fluctuating and consolidating. By midday, the mainstream price for East China wire drawing was between 6360-6600 yuan/ton.

3. Price Prediction

The previous maintenance units are gradually starting up, slightly increasing supply-side pressure. Downstream continues with just-in-need procurement, and the market transactions are generally average. The supply-demand contradiction still exists. Although the cost side support is strengthening, market prices are still difficult to rise and continue to oscillate within a narrow range. It is expected that the polypropylene market will remain in a stalemate in the short term, with the mainstream price of East China raffia fluctuating between 6300-6550 yuan/ton.

PVC: Industry Expectations Poor, V Spot Transactions Slowing Down

1. Today's Summary

Some domestic PVC manufacturers have reduced their ex-factory prices by 20-50 yuan/ton.

②. Lianchuang, Xinfalaochang, Hengtong, and LG facilities are under maintenance.

③、 The central bank: Maintain a moderately loose monetary policy and expand financial supply in the consumption sector.

2 Spot Overview

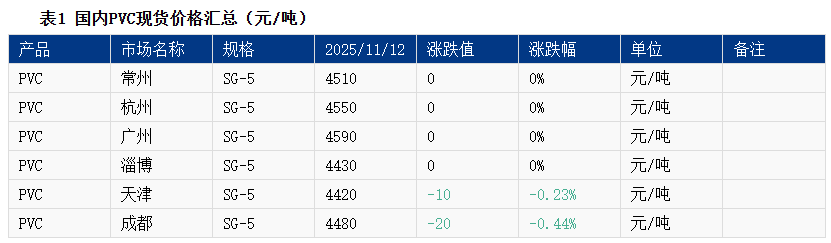

Based on the East China Changzhou market, the cash and carry price for carbide-based Type 5 in East China is 4,510 yuan/ton today, remaining stable compared to the previous trading day. 。

Recently, the domestic PVC spot market has been experiencing weak fluctuations within a range, with transaction prices continuing to dip during trading sessions. The fundamentals of supply and demand are relatively weak, and future expectations are not optimistic. The foreign trade market in India is in a wait-and-see mode due to policy reasons, and short-term cost-driven momentum is limited. The market sentiment is running weakly. In the East China region, the carbide method Type 5 spot is priced at 4500-4600 yuan/ton, and the ethylene method is priced at 4550-4680 yuan/ton.

3. Price Forecast

The short-term supply and demand changes for PVC are limited, with upstream production expected to increase slightly month-on-month due to the weakened impact of maintenance activities. The domestic market demand remains stable, but foreign trade exports have decreased due to policy restrictions in India, putting overall supply and demand under pressure. The cost has a stable bottom support; however, industrial policies and macroeconomic expectations are relatively weak. It is expected that the spot market prices will fluctuate weakly in the near future, with the cash warehouse delivery price for Type 5 calcium carbide-based PVC in the East China region fluctuating between 4,500-4,600 yuan/ton.

PS: Raw materials fluctuate at low levels and the market experiences narrow rises and falls.

1 Today's Summary

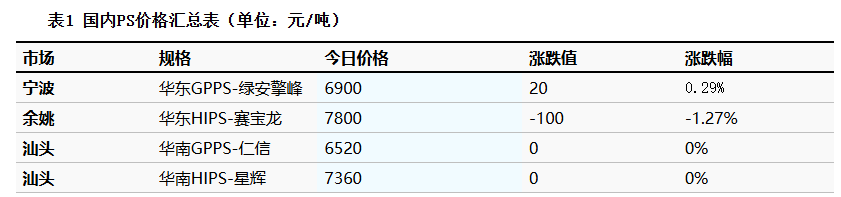

Today, the price of GPPS in East China has increased by 20 to 6,900 RMB/ton.

② 、 On Wednesday, the East China market for styrene rose by 10 to close at 6,305 yuan/ton, South China rose by 30 to close at 6,350 yuan/ton, and Shandong rose by 20 to close at 6,165 yuan/ton.

2 Spot Overview

According to According to Longzhong Information, today's GPPS in East China increased by 20 to 6,900 yuan/ton.The raw material styrene is fluctuating at low levels, with weak cost support, leading some sources to slightly reduce prices to sell. Supply in the industry has slightly recovered, and downstream demand is for procurement. Low-level transactions in the market are acceptable, but the overall situation is average.

3 Price Forecast

The raw material styrene is fluctuating at a low level, resulting in a lower cost center. The industry's supply is gradually recovering, with some growth expectations, while downstream purchasing pace is slowing. In the short term, the PS market may experience narrow consolidation. It is expected that the East China market for transparent and modified polystyrene will be around 6,850-7,800 yuan/ton.

ABS: Today's market trading is average, and market prices continue to decline slightly.

1 Today's Summary:

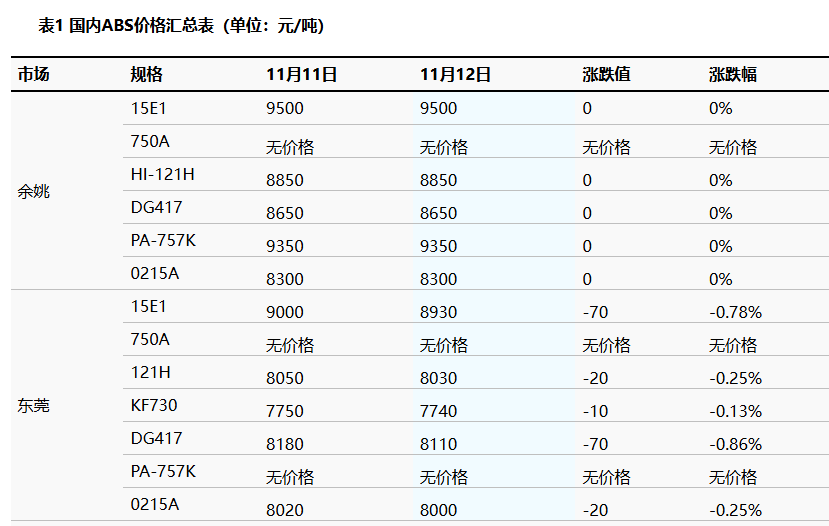

①. Today, the price in the East China market is declining; the price in the South China market is declining, with market transactions maintaining just the necessary demand.

②. The monthly ABS production in November decreased slightly month-on-month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, the prices in the East China market are declining slightly, and the prices in the South China market are also declining slightly. Today's market transactions are driven by rigid demand. Although raw material prices have increased, the impact on the market is minimal. The market environment remains bearish, with terminal demand being weak. It is expected that tomorrow the domestic ABS market prices will continue to run with a bearish trend.

3 Price prediction:

Based on the regions of Yuyao and Dongguan, the prices in the East China market are declining steadily, and the prices in the South China market are also declining steadily. Today's market transactions are driven by rigid demand, supply remains at a high level, and raw material prices are rising, but the impact on the spot market is expected to be limited. It is anticipated that ABS prices will continue a downward trend tomorrow.

EVA: Market Transactions Obstructed, Transaction Focus Steadily Declines

1 Today's Summary

①. This week's EVA petrochemical ex-factory price remains stable.

This week's EVA petrochemical units: Zhejiang Petrochemical and Ningbo Formosa are shut down for maintenance; Yanshan Petrochemical unit has been idle for a long time, while the others are in stable production. South Korea's Hanwha-GS Energy's 300,000 tons/year unit began production on September 25th.

2. Spot Overview

Today, the domestic EVA market offers are stable to slightly lower. Recently, market transactions have been sluggish, and downstream end-user factories are not eager to take deliveries. The pressure for holders to sell is gradually increasing, compounded by a decline in auction source prices. Today's market offers are stable to slightly lower, with transactions based on actual negotiations. Mainstream prices: soft materials are referenced at 9,600-10,200 RMB/ton, and hard materials are referenced at 9,800-10,300 RMB/ton.

3 Price Forecasting

In the short term, the domestic EVA petrochemical units are experiencing increased maintenance shutdowns, leading to overall abundant supply. Although certain grades are somewhat tight, there is a lack of improvement expectations in downstream demand. The upcoming arrival of imported sources and the commissioning of new production capacities by the end of the year will exert negative pressure on the market, which lacks substantial positive support. Overall, it is expected that the domestic EVA market will operate in a weak consolidation manner in the near future. 。

Engineering materials

PC: The market is under pressure.

1 Today's Summary

Tuesday International Crude OilRise , ICE Brent crude oil futures January contract at 65.16, up by $1.10 per barrel.

②、 The raw material bisphenol A closed at 7200 in the East China market. Yuan/ton, a month-on-month decrease of 50 yuan/ton.

③. This week, domestic PC factory shipments are stable or have decreased by 50-100 yuan/ton.

Spot price

Today, the domestic PC market experienced weak fluctuations and consolidation. As of the afternoon closing, the mainstream negotiation reference for low-end injection molding grade in East China was 10,150-13,100 yuan/ton, while mid-to-high-end materials were negotiated at 14,000-14,800 yuan/ton, with some domestic prices dropping by 50 yuan/ton compared to yesterday. Most domestic PC factories have not adjusted their latest ex-factory prices, with only a certain PC factory in Shandong offering slightly lower negotiation prices. In the spot market, East China saw a weak decline, while South China experienced narrow fluctuations. The fundamental news is bearish, and the sentiment among industry players remains cautious and difficult to uplift. Transactions are flexible, with real orders mostly negotiated flexibly. Downstream demand purchasing is slow, and trading volume remains difficult to increase.

3 Price Forecast

Recently, with the main PC factory in Shandong restarting its equipment, the supply of prime-grade PC material has been steadily increasing. However, the downstream demand for procurement has not improved, and market transactions remain slow. Additionally, the continuous decline in the price of raw material bisphenol A poses a bearish pressure on PC costs. Overall, it is expected that the domestic PC market will primarily experience weak fluctuations in the near future.

PET: Trading Stalemate, Polyester Bottle Chip Market Fluctuates Weakly

1 Today's Summary

①. China Resources and Sinopec Yizheng decreased by 30, while other factories reported stable. (Unit: RMB/ton)

②. Today's domestic polyester bottle chip capacity utilization rate is 71.37%.

2. Spot Overview

Based on the East China region, today's spot price for polyester bottle-grade chips closed at 5745, down 15 compared to the previous working day, not meeting the morning expectations.

The decline in raw materials has dragged down the focus of the polyester bottle chip market. Some factories are maintaining stable prices, while holders have lowered their selling prices. Offers for November-December supply are quoted at 5650-5800, with some slightly higher at 5820; it's heard that small amounts have been traded at 5680-5760, mainly in sporadic small orders, with traders restocking. The downstream market is adopting a wait-and-see approach, with low willingness to stockpile, leading to a stalemate in transactions. (Unit: RMB/ton)

3. Price Prediction

Despite the supply side maintaining production cuts, ample supply, and strong expectations of weakened supply and demand, raw materials still provide some support. It is expected that the polyester bottle market will continue to fluctuate. Tomorrow, the spot price of polyester bottle-grade chips in the East China region is expected to operate in the range of 5650-5780 yuan/ton. Pay attention to changes in crude oil.

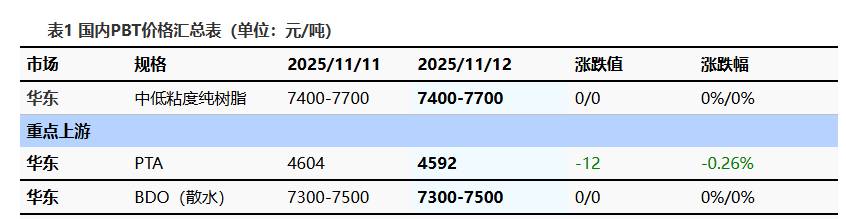

PBT: Increased Caution Leads to Market Fluctuations within a Range

1 Today's Summary

This week, PBT manufacturers' quotations remained generally stable.

This week, there are fewer PBT plant maintenance activities.

③ The PBT production for this period is 23,300 tons, a decrease of 400 tons compared to last week, with a decline rate of 1.69%. Capacity utilization rate is 54.84%, a decrease of 0.85% compared to the previous period. This week's average domestic PBT gross profit is -493 yuan/ton, down 26 yuan/ton compared to the previous week. 。

2. Spot Overview

Taking the East China region as the benchmark, the mainstream price of medium and low viscosity PBT resin today is 7,400-7,700 yuan/ton, unchanged from the previous working day. Today, the PBT market fluctuated within a range, the PTA market slightly declined, and the BDO market operated in a wait-and-see mode. The market fundamentals lack clear bullish or bearish signals, negotiations in the PBT market are subdued, and the sentiment of market participants is increasingly cautious. , According to Longzhong Information statistics, the price of low-viscosity PBT pure resin in the East China market is 7,400-7,700 yuan/ton.

3 Price Prediction

The PBT market is expected to remain in a wait-and-see mode. On the raw material side, the supply and demand of PTA remain tight, with the balance sheet continuously de-stocking. However, the terminal performance is lukewarm, with no new positive drivers in the market, and downstream lacks the momentum to chase the price increases. In the short term, the PTA spot market is expected to be weak and volatile. The fundamentals of BDO are mixed, with market participants maintaining a wait-and-see attitude. Downstream contract orders are following up, and holders are negotiating based on the market. The overall raw material fluctuations are minimal, and the focus of PBT negotiations is expected to continue to be in a tug-of-war, with limited market fluctuations. Therefore, Longzhong expects that tomorrow the East China market price for low to medium viscosity PBT resin will be around 7,400-7,700 RMB/ton.

PMMA Particle Daily Review: PMMA Particles Stable and Quiet

1 Today's Summary

①、 Today's PMMA particles Market prices are sluggish. 。

②. Today's domestic PMMA particle utilization rate is 65%.

2 Spot Overview

Today, PMMA particles in the East China region closed at 12,800 RMB/ton, stable compared to the previous working day, in line with the morning expectations. 。 The current raw material MMA is weak and declining, with a lack of cost support. Some manufacturers are lowering their quotations due to sales pressure. There is little demand follow-up, and the market negotiation atmosphere is lukewarm, with attention on low-priced goods in the market.

3 Price Prediction

Original The focus of the material shifts downward and falls back. The cost support has weakened, sporadic low prices have appeared in the market quotations from holders, and the demand side is following up sluggishly. The focus of the commercial talks may be on a lower level of consolidation.

POM: Lack of Fundamental Support and Weak Real Trading====

1. Today's Summary

The Hebi Longyu POM unit was shut down for maintenance on October 20th, and the restart date is yet to be determined.

The Tianjin Bohua POM unit was shut down for maintenance on July 7th, and the restart date is yet to be determined.

2 Spot Overview

Based on the Yuyao region, the price of Yun Tian Hua M90 is 10,600 yuan per ton today, remaining stable compared to the previous period. Today, the POM market is consolidating sideways. The fundamental support is limited, the inventory pressure of petrochemical plants is gradually increasing, and the market trend continues to be weak. Some quotations are struggling to close deals, with traders having an operating space of 100-200 RMB/ton. By the end of the trading day, the tax-inclusive price of domestic materials in the Yuyao market is 8100-11100 RMB/ton, and the cash price in the Dongguan market is 7300-10400 RMB/ton.

3. Price Forecast

Spot circulation is under pressure, petrochemical plant inventory pressure is increasing, and in the short term, the fundamentals lack positive news guidance. The overall sentiment of operators is poor, with some quotations continuing to negotiate sales, with a range of 100-200 yuan/ton. However, given that the current price is close to the cost line, the room for concessions is relatively limited. End users are mainly in a wait-and-see attitude, and actual transactions are sporadic. Longzhong expects that the domestic POM market will remain largely stable with minor fluctuations in the short term.

PA6: Cost support strengthens, PA6 market rises

1 Today's Summary

①、 Last week's settlement price for Sinopec caprolactam was 8,540 yuan per ton (six-month acceptance without interest).

②、 Sinopec has lowered the price of pure benzene by 200 yuan/ton at various refineries in East and South China, setting the new price at 5,450 yuan/ton, effective from October 21.

2 Spot Overview

Today, the market price of polyamide 6 has risen. The prices of raw materials continue to increase, strengthening cost support. Polymer companies have raised the ex-factory price of chips, but downstream buyers are becoming more cautious about replenishing high-priced chips. Overall market transactions are average, and actual transactions are negotiable. In East China, conventional spinning PA6 is priced at 9,000-9,150 yuan/ton for cash with short delivery, and high-speed spinning spot is priced at 9,100-9,300 yuan/ton with delivery upon acceptance. Chaohu is priced at 8,350-8,450 yuan/ton for cash self-pickup.

3 Price Forecast

From the cost perspective, the caprolactam market is operating firmly, increasing the cost pressure on chips. In terms of supply and demand, domestic supply is stable, and some polymerization enterprises are fulfilling previous orders. However, downstream buyers may remain cautious about purchasing high-priced chips, maintaining only essential demand. It is expected that the PA6 market will continue to operate firmly in the near future.

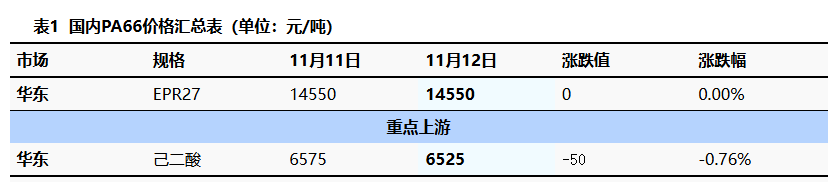

PA66: Cost Support Weakens, Market Operates Weakly

1 Today's Summary

①, November 11: The market expects the U.S. government shutdown to end soon, boosting demand expectations, coupled with persistent instability in geopolitical situations, leading to an increase in international oil prices. NYMEX crude oil futures for the December contract rose by $0.91/barrel to $61.04, a week-on-week increase of +1.51%; ICE Brent crude futures for the January contract rose by $1.10/barrel to $65.16, a week-on-week increase of +1.72%. China's INE crude oil futures for the 2601 contract fell by 0.8 to 461.8 yuan/barrel, and rose by 9.3 to 471.1 yuan/barrel in the night session.

Today, the domestic PA66 capacity utilization rate is 69%, with a daily output of approximately 2,700 tons. The capacity utilization rate of some enterprises is stable, downstream demand is average, new capacity is being gradually released, and the supply of goods in the domestic PA66 industry is sufficient.

2 Spot Overview

Based on the Yuyao market in the East China region, today's EPR27 market price is referenced at 14,500-14,600 yuan/ton, stable compared to the previous trading day. 。 The cost pressure is relatively high. The market supply is sufficient, and downstream purchases are mainly on-demand, with the market being weak. The trend is fluctuating, and the market is consolidating.

4 Price Forecast

Raw material prices are falling, the market lacks positive stimulus, and with ample spot supply, demand continues to be weak. It is expected that the domestic PA66 market will consolidate weakly in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

Progress on plastic reduction in packaging released by 16 fast-moving consumer goods brands including nestlé, pepsi, unilever, coca-cola, and mars

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

By 2030, Norway's New Sorting Facilities Will Process About 80% Of The Country's Plastic Packaging Waste

-

Building Partnerships Through the CIIE: Together on the Path to Win-Win Cooperation